DIpil Das

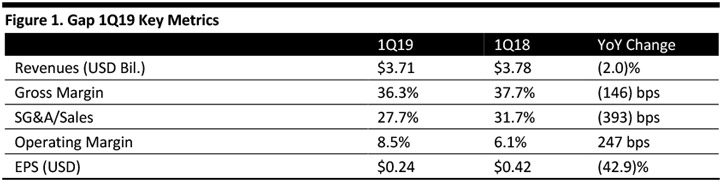

[caption id="attachment_89709" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

Gap reported fiscal 1Q19 revenues of $3.71 billion, down 2.0% year over year and below the consensus estimate of $3.77 billion. EPS was $0.24, down 42.9% from the year-ago period, and lower than the consensus estimate of $0.32.

Comparable sales were down 4.0% compared with the consensus estimate of (1.5)%, and down from the year-ago period of a 1% increase. By brand, Old Navy comparable sales were (1)% compared to 3% last year and versus the 0.6% consensus. Gap comparable sales were down 10% compared with (4)% last year and the consensus estimate of (4.2)%. Banana Republic comparable sales were (3)% compared to 3% in the year-ago period and versus the consensus estimate of (2.5)%.

Management reiterated its intent to split into two companies in 2020, Old Navy and a company tentatively called NewCo. The company said the needs of specialty and value customers are diverging, and the planned separation will enable each brand to move more efficiently and align investments to meet unique business needs.

During the first quarter, Old Navy did not meet expectations, according to management. Old Navy's traffic was in line with the industry for the quarter, and the company reported modest market share gains in the brand. The company opened six new Old Navy stores in Q1 and plans to open 20 in the second quarter, with a total of 70 forecast for the year. Old Navy’s, e-commerce is expanding with double-digit comps in traffic and conversion.

The Gap brand is focusing on regaining profitability through operational improvements in inventory, product assortment and expense reduction. Management reported that it is on track to rationalize the fleet with its aggressive store closure plan; the company announced that it would close 230 underperforming Gap stores (mostly in North America) over the next two years. The company highlighted that the brand is reinvesting in marketing in its kids and baby business with a back-to-school campaign this year.

The company reported that Banana Republic was affected by merchandise misses that were attributable to unseasonably cold weather in February and March; management commented that the brand’s performance and quality is improving, and is getting back on track.

Athleta, the company’s athletic brand, outpaced the market by a factor of two, according to management. Athleta celebrated its first year as a B Corp by announcing progress against its sustainability goals, including 60% of materials are made from sustainable fibers. In 2019, the company is plans to open 25 new stores versus its historical average of 15 to 20 openings per year.

Management commented that its smaller brands, Intermix and its new digitally native men’s active brand, Hill City, are progressing positively.

The company reported that three years ago, approximately 25% of its product was manufactured in China. In the company’s most recent disclosure, that proportion decreased to 21%. Management reported that it has been migrating sourcing out of China for the past several years. The current guidance incorporates the impact of “List 3” goods (which includes tariffs that took effect in September 2018), but does not include the proposed List 4 changes (which is a tariff of up to 25% on Chinese imports).

The company ended the quarter with 3,335 company-operated stores.

Outlook

For the full fiscal year, the company lowered its earnings per share guidance to be in the range of $2.04 to $2.14, down from $2.40-2.55. The company lowered its comparable sales for fiscal year 2019 and expects comps to be down in the low single digits compared to its previous guidance of flat to up slightly and versus the consensus estimate of 0.2%.

The company expects 30 net store closures for the year.

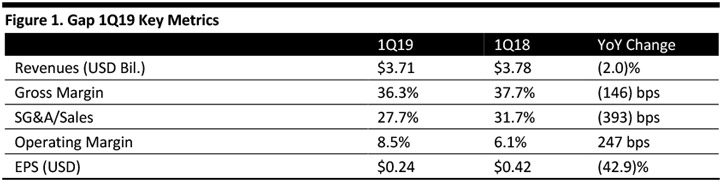

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Gap reported fiscal 1Q19 revenues of $3.71 billion, down 2.0% year over year and below the consensus estimate of $3.77 billion. EPS was $0.24, down 42.9% from the year-ago period, and lower than the consensus estimate of $0.32.

Comparable sales were down 4.0% compared with the consensus estimate of (1.5)%, and down from the year-ago period of a 1% increase. By brand, Old Navy comparable sales were (1)% compared to 3% last year and versus the 0.6% consensus. Gap comparable sales were down 10% compared with (4)% last year and the consensus estimate of (4.2)%. Banana Republic comparable sales were (3)% compared to 3% in the year-ago period and versus the consensus estimate of (2.5)%.

Management reiterated its intent to split into two companies in 2020, Old Navy and a company tentatively called NewCo. The company said the needs of specialty and value customers are diverging, and the planned separation will enable each brand to move more efficiently and align investments to meet unique business needs.

During the first quarter, Old Navy did not meet expectations, according to management. Old Navy's traffic was in line with the industry for the quarter, and the company reported modest market share gains in the brand. The company opened six new Old Navy stores in Q1 and plans to open 20 in the second quarter, with a total of 70 forecast for the year. Old Navy’s, e-commerce is expanding with double-digit comps in traffic and conversion.

The Gap brand is focusing on regaining profitability through operational improvements in inventory, product assortment and expense reduction. Management reported that it is on track to rationalize the fleet with its aggressive store closure plan; the company announced that it would close 230 underperforming Gap stores (mostly in North America) over the next two years. The company highlighted that the brand is reinvesting in marketing in its kids and baby business with a back-to-school campaign this year.

The company reported that Banana Republic was affected by merchandise misses that were attributable to unseasonably cold weather in February and March; management commented that the brand’s performance and quality is improving, and is getting back on track.

Athleta, the company’s athletic brand, outpaced the market by a factor of two, according to management. Athleta celebrated its first year as a B Corp by announcing progress against its sustainability goals, including 60% of materials are made from sustainable fibers. In 2019, the company is plans to open 25 new stores versus its historical average of 15 to 20 openings per year.

Management commented that its smaller brands, Intermix and its new digitally native men’s active brand, Hill City, are progressing positively.

The company reported that three years ago, approximately 25% of its product was manufactured in China. In the company’s most recent disclosure, that proportion decreased to 21%. Management reported that it has been migrating sourcing out of China for the past several years. The current guidance incorporates the impact of “List 3” goods (which includes tariffs that took effect in September 2018), but does not include the proposed List 4 changes (which is a tariff of up to 25% on Chinese imports).

The company ended the quarter with 3,335 company-operated stores.

Outlook

For the full fiscal year, the company lowered its earnings per share guidance to be in the range of $2.04 to $2.14, down from $2.40-2.55. The company lowered its comparable sales for fiscal year 2019 and expects comps to be down in the low single digits compared to its previous guidance of flat to up slightly and versus the consensus estimate of 0.2%.

The company expects 30 net store closures for the year.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Gap reported fiscal 1Q19 revenues of $3.71 billion, down 2.0% year over year and below the consensus estimate of $3.77 billion. EPS was $0.24, down 42.9% from the year-ago period, and lower than the consensus estimate of $0.32.

Comparable sales were down 4.0% compared with the consensus estimate of (1.5)%, and down from the year-ago period of a 1% increase. By brand, Old Navy comparable sales were (1)% compared to 3% last year and versus the 0.6% consensus. Gap comparable sales were down 10% compared with (4)% last year and the consensus estimate of (4.2)%. Banana Republic comparable sales were (3)% compared to 3% in the year-ago period and versus the consensus estimate of (2.5)%.

Management reiterated its intent to split into two companies in 2020, Old Navy and a company tentatively called NewCo. The company said the needs of specialty and value customers are diverging, and the planned separation will enable each brand to move more efficiently and align investments to meet unique business needs.

During the first quarter, Old Navy did not meet expectations, according to management. Old Navy's traffic was in line with the industry for the quarter, and the company reported modest market share gains in the brand. The company opened six new Old Navy stores in Q1 and plans to open 20 in the second quarter, with a total of 70 forecast for the year. Old Navy’s, e-commerce is expanding with double-digit comps in traffic and conversion.

The Gap brand is focusing on regaining profitability through operational improvements in inventory, product assortment and expense reduction. Management reported that it is on track to rationalize the fleet with its aggressive store closure plan; the company announced that it would close 230 underperforming Gap stores (mostly in North America) over the next two years. The company highlighted that the brand is reinvesting in marketing in its kids and baby business with a back-to-school campaign this year.

The company reported that Banana Republic was affected by merchandise misses that were attributable to unseasonably cold weather in February and March; management commented that the brand’s performance and quality is improving, and is getting back on track.

Athleta, the company’s athletic brand, outpaced the market by a factor of two, according to management. Athleta celebrated its first year as a B Corp by announcing progress against its sustainability goals, including 60% of materials are made from sustainable fibers. In 2019, the company is plans to open 25 new stores versus its historical average of 15 to 20 openings per year.

Management commented that its smaller brands, Intermix and its new digitally native men’s active brand, Hill City, are progressing positively.

The company reported that three years ago, approximately 25% of its product was manufactured in China. In the company’s most recent disclosure, that proportion decreased to 21%. Management reported that it has been migrating sourcing out of China for the past several years. The current guidance incorporates the impact of “List 3” goods (which includes tariffs that took effect in September 2018), but does not include the proposed List 4 changes (which is a tariff of up to 25% on Chinese imports).

The company ended the quarter with 3,335 company-operated stores.

Outlook

For the full fiscal year, the company lowered its earnings per share guidance to be in the range of $2.04 to $2.14, down from $2.40-2.55. The company lowered its comparable sales for fiscal year 2019 and expects comps to be down in the low single digits compared to its previous guidance of flat to up slightly and versus the consensus estimate of 0.2%.

The company expects 30 net store closures for the year.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Gap reported fiscal 1Q19 revenues of $3.71 billion, down 2.0% year over year and below the consensus estimate of $3.77 billion. EPS was $0.24, down 42.9% from the year-ago period, and lower than the consensus estimate of $0.32.

Comparable sales were down 4.0% compared with the consensus estimate of (1.5)%, and down from the year-ago period of a 1% increase. By brand, Old Navy comparable sales were (1)% compared to 3% last year and versus the 0.6% consensus. Gap comparable sales were down 10% compared with (4)% last year and the consensus estimate of (4.2)%. Banana Republic comparable sales were (3)% compared to 3% in the year-ago period and versus the consensus estimate of (2.5)%.

Management reiterated its intent to split into two companies in 2020, Old Navy and a company tentatively called NewCo. The company said the needs of specialty and value customers are diverging, and the planned separation will enable each brand to move more efficiently and align investments to meet unique business needs.

During the first quarter, Old Navy did not meet expectations, according to management. Old Navy's traffic was in line with the industry for the quarter, and the company reported modest market share gains in the brand. The company opened six new Old Navy stores in Q1 and plans to open 20 in the second quarter, with a total of 70 forecast for the year. Old Navy’s, e-commerce is expanding with double-digit comps in traffic and conversion.

The Gap brand is focusing on regaining profitability through operational improvements in inventory, product assortment and expense reduction. Management reported that it is on track to rationalize the fleet with its aggressive store closure plan; the company announced that it would close 230 underperforming Gap stores (mostly in North America) over the next two years. The company highlighted that the brand is reinvesting in marketing in its kids and baby business with a back-to-school campaign this year.

The company reported that Banana Republic was affected by merchandise misses that were attributable to unseasonably cold weather in February and March; management commented that the brand’s performance and quality is improving, and is getting back on track.

Athleta, the company’s athletic brand, outpaced the market by a factor of two, according to management. Athleta celebrated its first year as a B Corp by announcing progress against its sustainability goals, including 60% of materials are made from sustainable fibers. In 2019, the company is plans to open 25 new stores versus its historical average of 15 to 20 openings per year.

Management commented that its smaller brands, Intermix and its new digitally native men’s active brand, Hill City, are progressing positively.

The company reported that three years ago, approximately 25% of its product was manufactured in China. In the company’s most recent disclosure, that proportion decreased to 21%. Management reported that it has been migrating sourcing out of China for the past several years. The current guidance incorporates the impact of “List 3” goods (which includes tariffs that took effect in September 2018), but does not include the proposed List 4 changes (which is a tariff of up to 25% on Chinese imports).

The company ended the quarter with 3,335 company-operated stores.

Outlook

For the full fiscal year, the company lowered its earnings per share guidance to be in the range of $2.04 to $2.14, down from $2.40-2.55. The company lowered its comparable sales for fiscal year 2019 and expects comps to be down in the low single digits compared to its previous guidance of flat to up slightly and versus the consensus estimate of 0.2%.

The company expects 30 net store closures for the year.