Source: Company reports

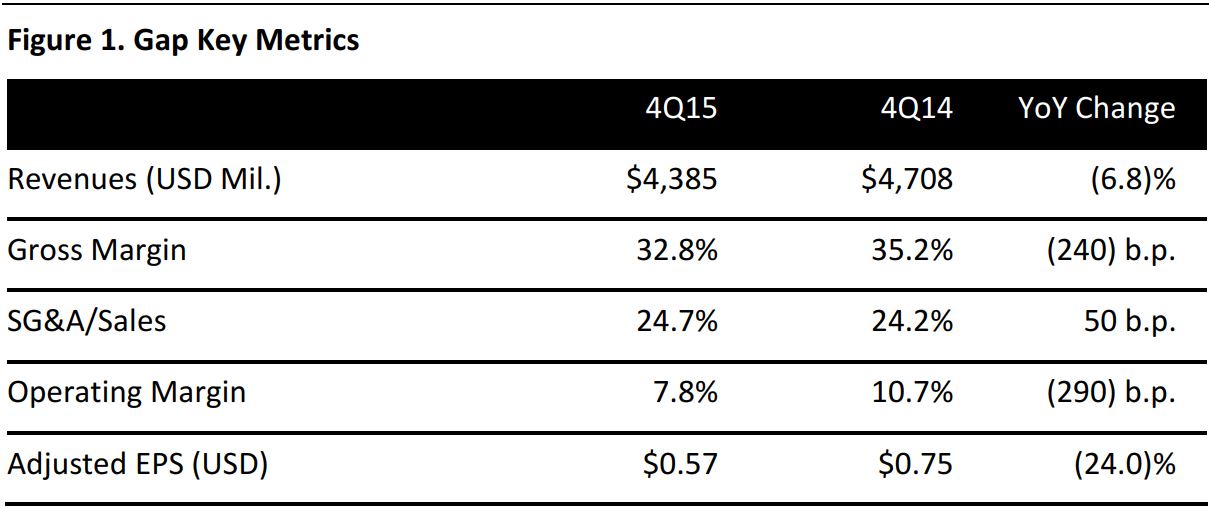

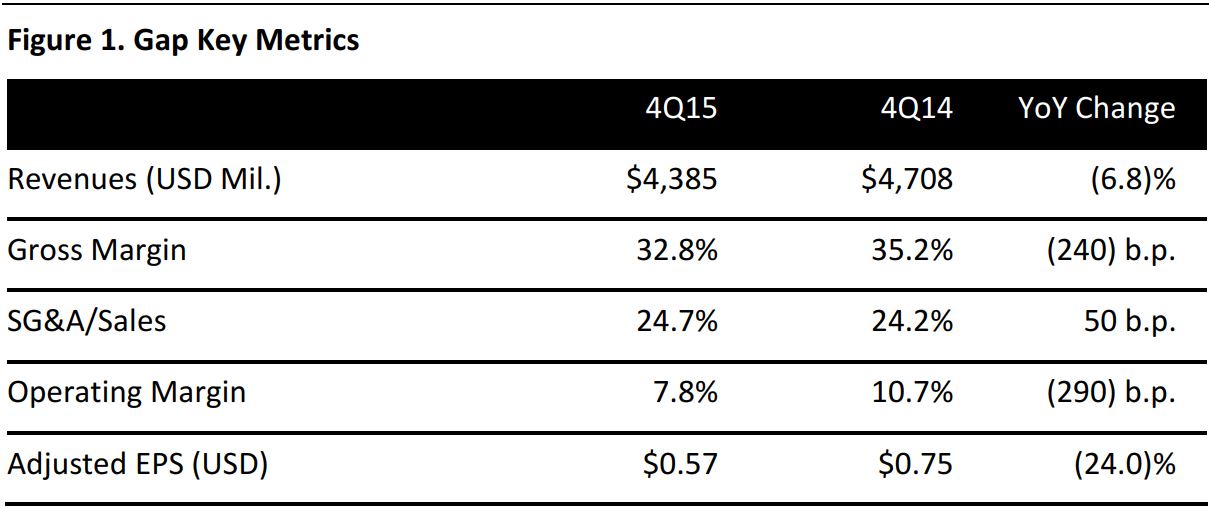

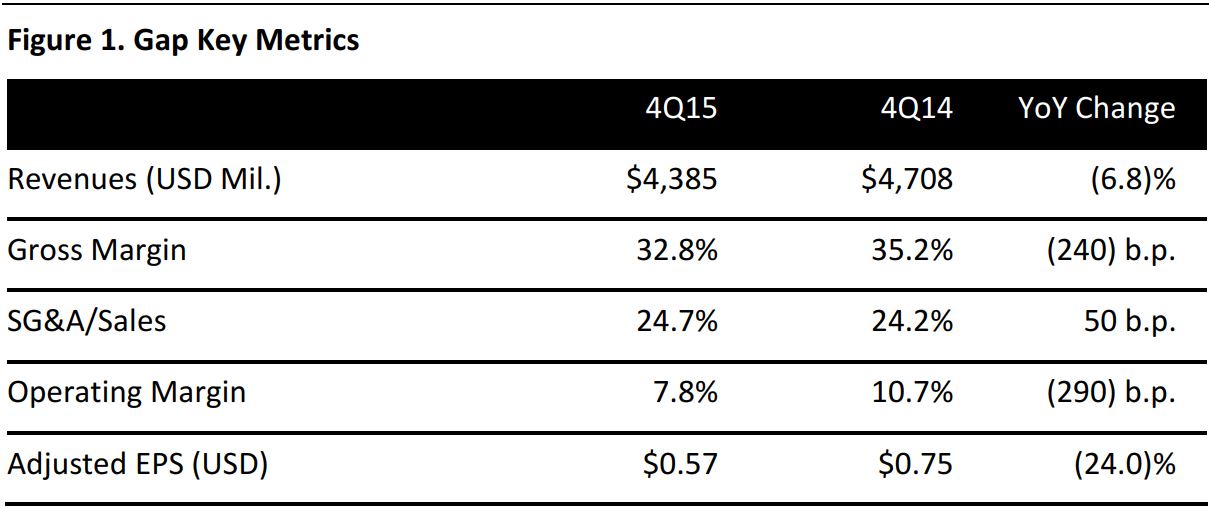

Gap reported 4Q15 EPS of $0.57 versus the consensus estimate of $0.56. On February 8, management updated its quarterly earnings guidance to $0.56–$0.57.

As reported on February 8, quarterly comps were down 7% and total sales were down 6.8%, to $4.39 billion. By brand, Gap comps were down 3%, Banana Republic comps were down 14% and Old Navy comps were down 8%.

Inventories were down 0.8% year over year at the end of the period, compared to a 6.8% decline in sales during the quarter.

FY16 guidance calls for EPS of $2.20–$2.25, which includes a negative impact of $0.19 due to foreign currency fluctuations at current exchange rates. Gap expects operating margins for the year to be about 9.5%, down 10 basis points from 9.6% in 2015.

In the year, the company expects to open 40 company-operated stores, net of closures and repositions that are focused on China, global outlet stores and Athleta.