Source: Company reports/Fung Global Retail & Technology

4Q16 Results

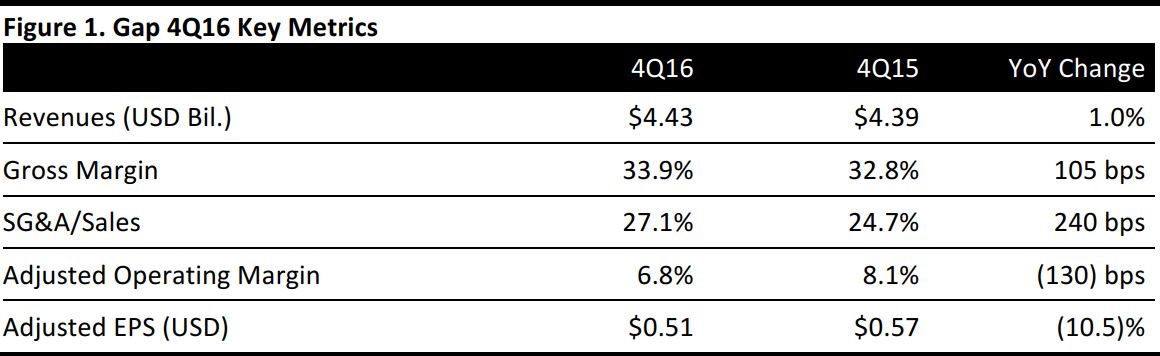

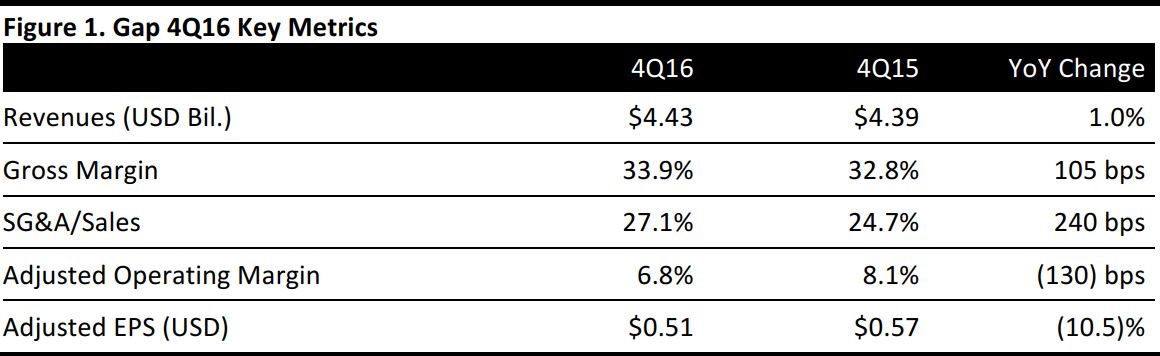

Gap reported revenue of $4.43 billion for 4Q16, up 1% from the year-ago period and above the $4.41 billion consensus estimate. Total company same-store sales increased by 2.0%, compared with a 7% decline in the year-ago quarter.

During the quarter, the Old Navy brand grew market share in key categories, including dresses, denim, and knits.

Merchandise inventories were down 2% year over year, to $1.83 billion, in line with the company’s previous guidance.

The company reported adjusted EPS of $0.51, slightly above the consensus estimate of $0.50 but down 10.5% from the year-ago quarter. EPS was adjusted for the following:

- Costs associated with store closures (a $0.03 negative impact)

- A noncash goodwill impairment charge related to Intermix (a $0.18 negative impact)

- A $0.11 benefit from insurance proceeds from the company’s Fishkill distribution center

- A nonrecurring tax benefit of about $0.15.

FY16 Results

For FY16, Gap reported that revenues decreased by 1.8%, to $15.5 billion, and that total company comps declined by 2% year over year. A comp increase of 1.0% for the Old Navy brand was offset by a 3% decrease for the Gap brand and a 7% decrease for the Banana Republic brand.

Gap reported full-year adjusted EPS of $2.17, down 10.7% from adjusted EPS of $2.43 the previous year.

Gap’s mobile point-of-sale function was expanded to about 20% of Gap’s US stores in FY16, enabling store associates to better serve their customers throughout the shopping experience.

Gap expanded its women’s performance lifestyle brand, Athleta, to 132 US stores by the end of FY16 and it is scheduled to open about 15 additional stores in FY17.

FY17 Outlook

For FY17, Gap expects EPS of $1.95–$2.05, including a $0.09 negative impact from foreign currency and exchange rates, versus consensus of $2.06. The company expects EPS in 1H17 to be down by a high-single-digit percentage compared with EPS from 1H16.

Same-store sales for the full year are expected to be flat to up slightly, versus the consensus estimate of a 0.5% increase. Net sales are expected to be slightly below this range, driven by an expected negative impact from foreign currency fluctuations.