Source: Company reports/Fung Global Retail & Technology

3Q16 RESULTS

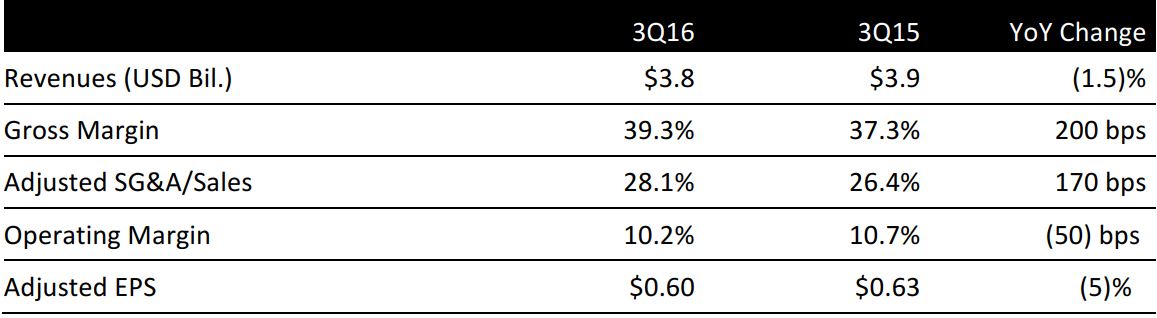

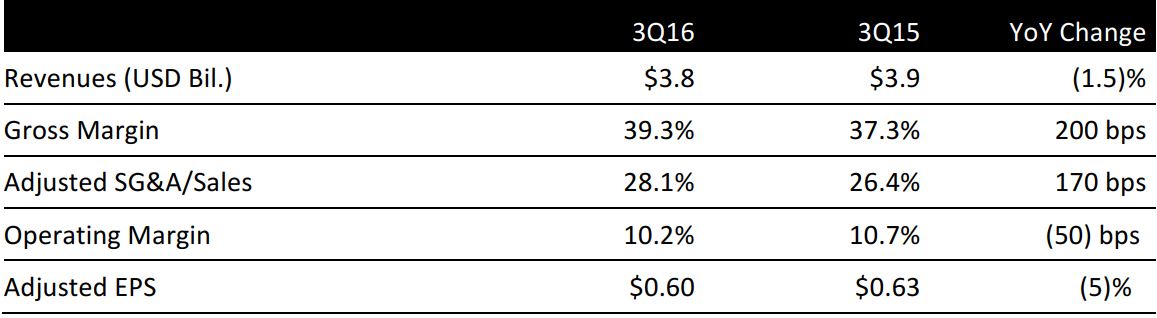

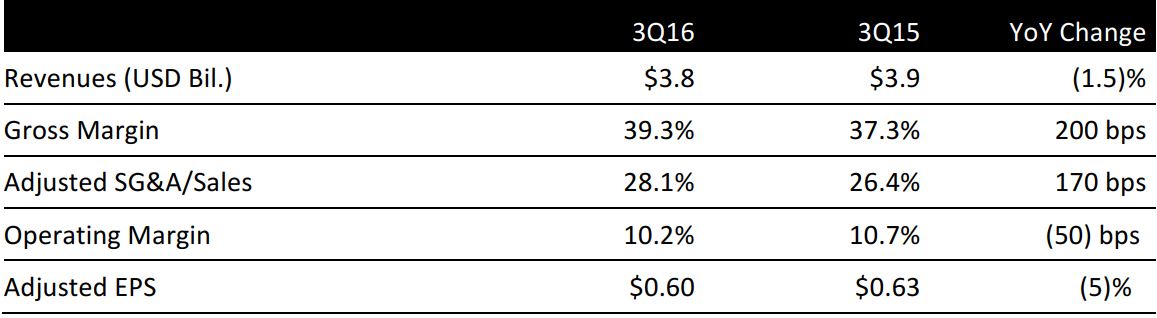

Gap reported 3Q16 revenues of $3.80 billion, down 1.5% year over year and slightly below the consensus estimate of $3.86 billion. Total comp sales for the quarter were down 3%, including a negative impact from a fire at the company’s distribution center in Fishkill, New York.

Adjusted EPS was $0.60, excluding a $0.09 impact from restructuring costs, and was in line with the consensus estimate but down 5% from the year-ago period.

The overall merchandise margin improved by 220 basis points year over year, driven by Old Navy. Management said it was pleased to see some improvement in products and margins across the business, despite recent challenging traffic trends. Inventory was down 4% year over year for the quarter.

BY BUSINESS SEGMENT

Gap Global reported a comp decline of 8%, including a 4% negative impact from a fire at the company’s Fishkill, New York, distribution center. The comp result was lower than the consensus estimate, which had called for a 3.7% decline, and lower than last year’s 4% decline for the same quarter. The brand is continuing on its path to transform its product-to-market strategy. It is engaging consumers across TV, digital and social media.

Banana Republic Global reported an 8% comp decline, including a 2% negative impact from the fire. The result missed the consensus estimate of a 4% decline, but represented an improvement from the year-ago quarter’s 12% decline.

Old Navy reported 3% growth for the quarter, including a 1% negative impact from the fire, missing the 4.8% consensus estimate and down from last year’s 4% growth in the same quarter. The brand recently announced its holiday strategy, which focuses on in-store experiences and the company’s Instant Happy sweepstakes.

The company’s Athleta brand continues to grow and drive product innovation. By the end of 3Q16, there were 130 Athleta stores in operation. The brand recently launched Sculptek, which is a new stretch fiber that sculpts and supports.

OUTLOOK

Gap expects full-year adjusted EPS of $1.87–$1.92, excluding the negative impact of restructuring costs, which is now expected to be $0.42–$0.46. The company expects total inventory to be down in the low single digits year over year.

Gap expects net closures of about 65 stores in fiscal year 2016 and a 3% year-over-year reduction in square footage.