Source: Company reports

2Q16 RESULTS

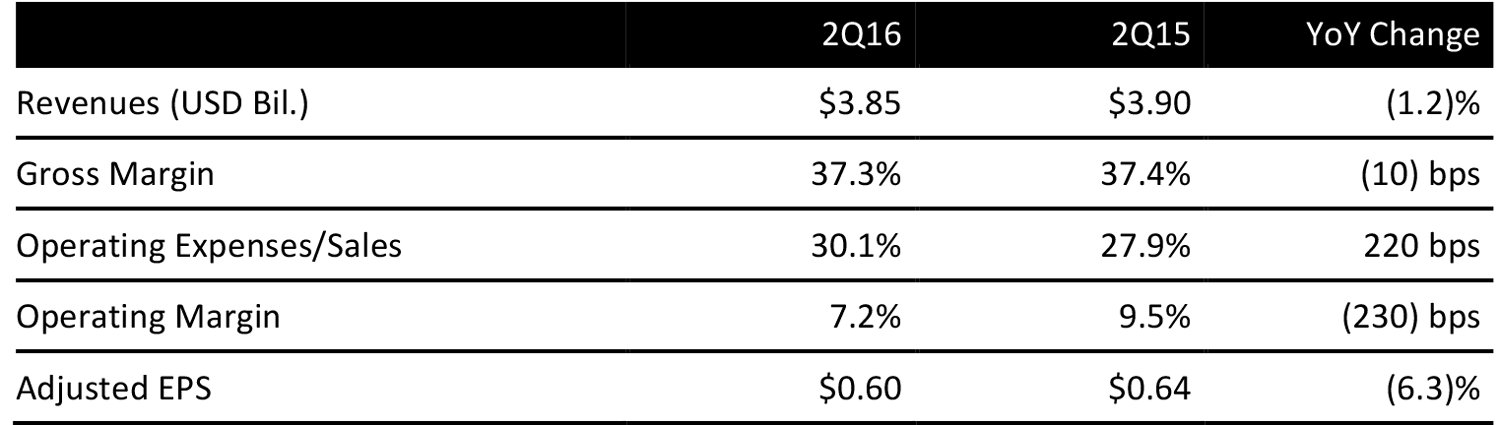

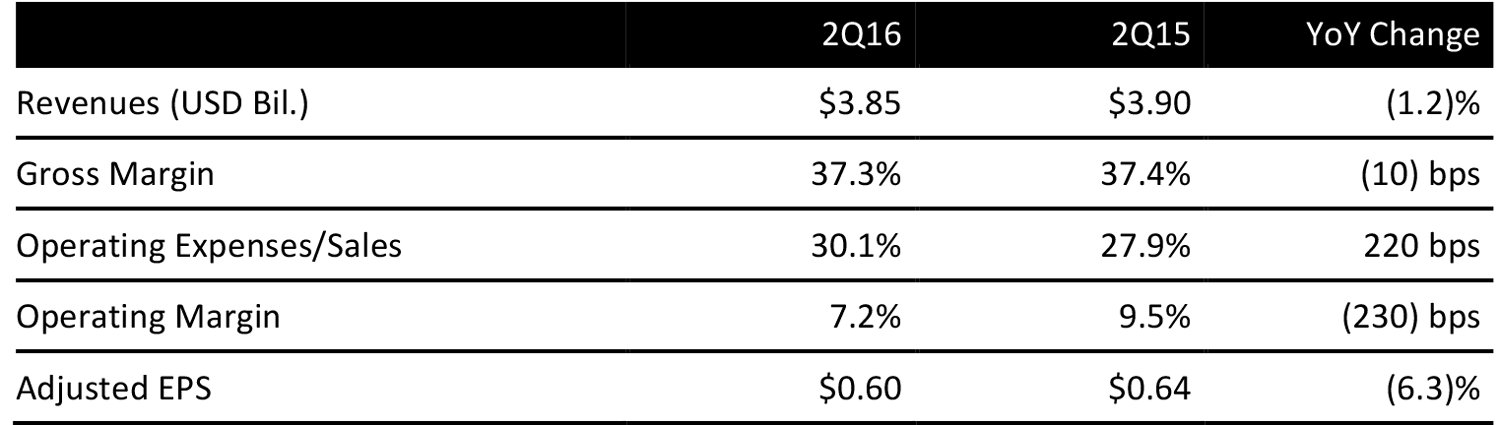

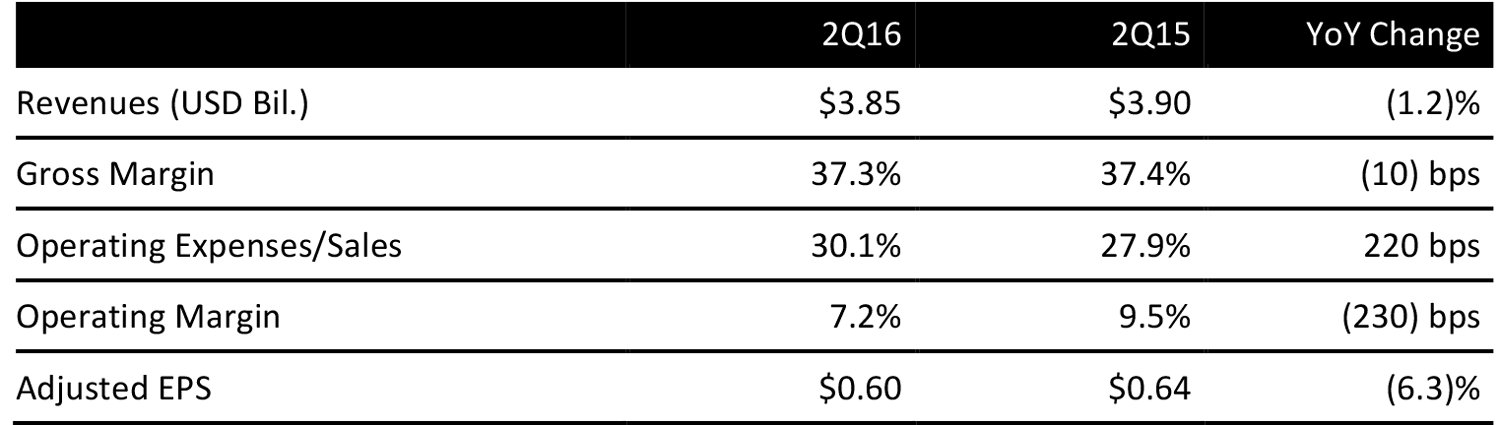

Gap reported 2Q16 adjusted diluted EPS of $0.60 versus consensus of $0.59 and guidance of $0.58–$0.59.

The company reported total revenues of $3.85 billion, down 1.2% from $3.90 billion in the year-ago quarter. Total comps were down 2%, as had been reported on August 8. By brand, Gap comps were down 3%, Banana Republic comps were down 9% and Old Navy comps were flat.

Inventory ended the period down 3%, in line with guidance. Management expects total inventory dollars to be down by low single digits, year over year, by the end of the third quarter.

In the second quarter, the US accounted for 77% of Gap o sales, while Asia accounted for 10%, Canada for 7%, Europe for 5% and other regions for 1%.

Gap has undertaken a restructuring plan to build a more efficient global brand model with greater potential for growth.

During the quarter, Gap opened 19 stores and closed 22 stores. Square footage was down 1% compared with the year-ago period. Gap expects to close 50 more stores during the remainder of 2016 and to reduce square footage by approximately 2% year over year.

2016 OUTLOOK

Management updated its full-year diluted EPS guidance to $1.37–$1.47. Excluding an expected $0.45–$0.50 negative impact from restructuring costs, the company expects its full-year adjusted diluted EPS to be $1.87–$1.92. The company now expects its adjusted operating income to be about 8.5% in 2016.