Source: Company reports/Fung Global Retail & Technology

1Q17 Results

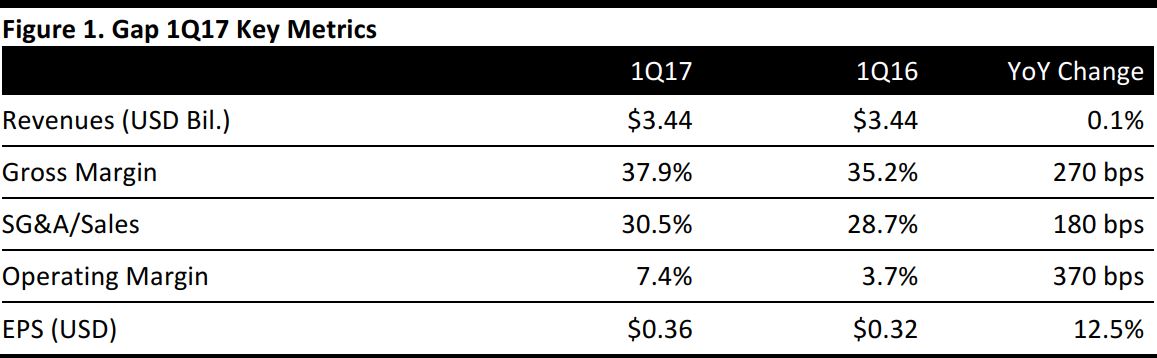

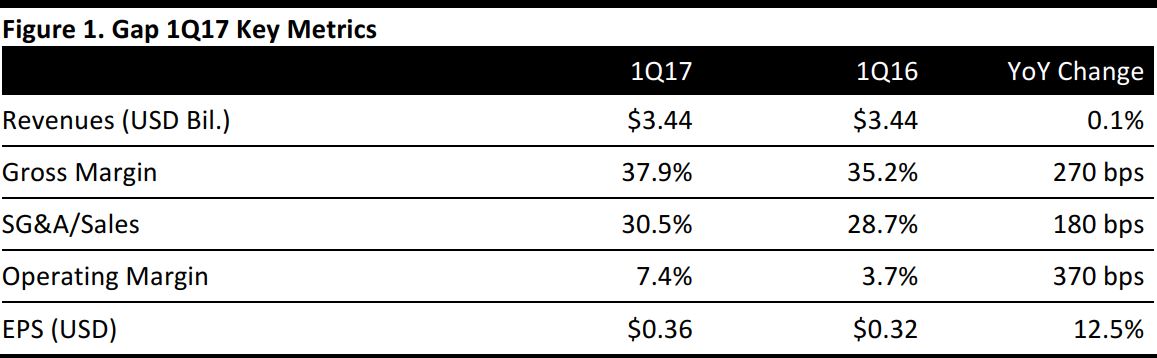

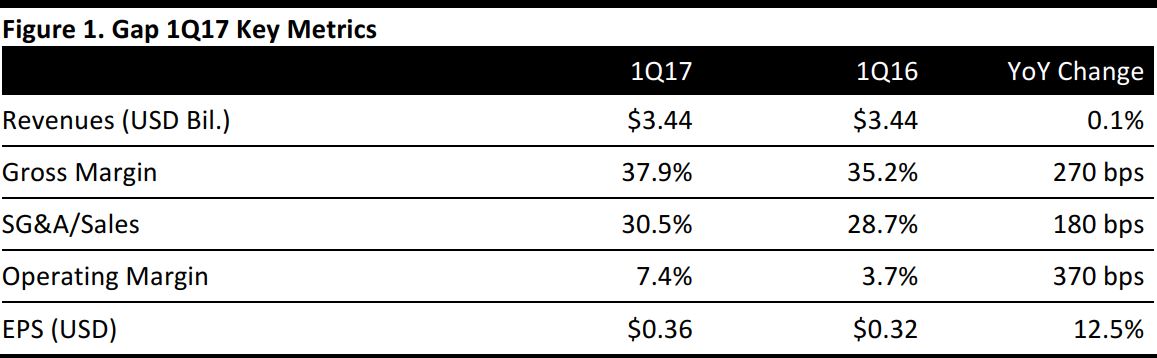

Gap reported 1Q17 EPS of $0.36, up from $0.32 in the year-ago quarter and above the $0.29 consensus estimate. Foreign currency negatively impacted EPS by an estimated $0.03, or about 9%. Total revenues were $3.44 billion, roughly flat year over year.

Total comps reversed their negative trend from last year and were up 2% in 1Q17 versus (5)% in the year-ago quarter. Old Navy comps were up 8% year over year, while Gap comps were down 4% and Banana Republic comps were down 4%. Inventory was about flat year over year at the end of the quarter.

Management commented that it was pleased with the positive comps and earnings in the quarter. The company noted that improvements in quality and fit contributed to the positive results.

FY17 Outlook

The company reaffirmed its FY17 EPS guidance of $1.95–$2.05. The company also raised its EPS guidance for 1H17; it now expects a mid-single-digit decline in the first half versus a high-single-digit decline previously.

Gap continues to expect FY17 comparable sales to be flat to up slightly. Net sales are expected to be slightly below this range, driven by an expected negative impact from foreign currency.

Gap expects $625 million in capital expenditures, excluding an estimated $200 million associated with the rebuilding of one of the company’s distribution centers and related supply-chain spending.

The company updated its guidance on store openings to flat, down from the previously stated 40 net store openings.