Source: Company reports

1Q16 RESULTS

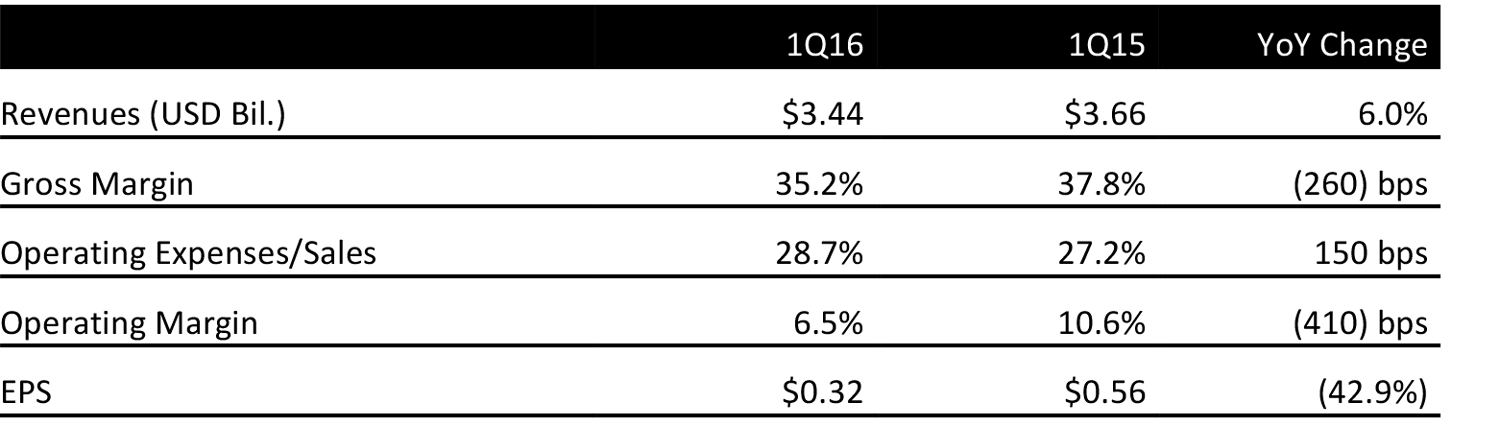

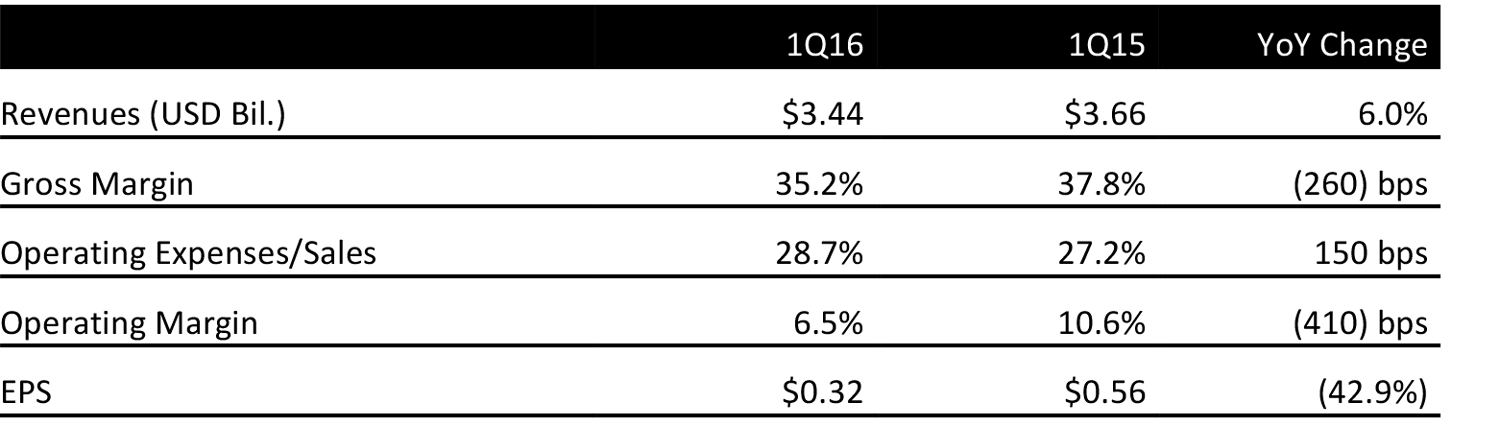

Gap Inc. reported 1Q EPS of $0.32, in line with consensus and the updated guidance provided on May 9th. Currency fluctuation negatively impacted EPS by $0.02.

As previously reported, total revenues were $3.44 billion. Comps were down 5%. By brand, Gap comps were down 3%, Banana Republic comps were down 11% and Old Navy comps were down 6%.

Inventory ended the period down 2.6% year over year as compared to the 6% decline in sales during the quarter.

POSITIONING THE COMPANY FOR LONG TERM GROWTH

The company also provided an update on previously announced initiatives to streamline its operating model and sharpen its focus on geographies with the most potential.

The company outlined the specific initiatives described below, which are expected to generate savings of about $275 million on a pre-tax basis, annually, and representing an operating margin improvement of almost 200 bps. The company estimates an annualized sales loss of about $250 million associated with the store closures and expects to record restructuring costs in fiscal 2016 of about $300 million pre-tax, of which about $100 million is non-cash, from the store closures and streamlining measures.

- Focus on geographies with the greatest potential. Old Navy will close its 53 stores in Japan and focus on markets with more-favorable growth for the brand. Near term, the brand will be focused on North America as well as China and it franchises globally. In addition, the company will close certain Banana Republic locations, mostly internationally this year, totaling 75 stores.

- Streamline its operating model. The company will take steps to create a more efficient global brand structure, enabling its brands to more fully leverage its scale and move even faster in anticipating and responding to the environment and needs of customers.

2016 OUTLOOK

Management is not reaffirming its-full year EPS guidance. The company noted that the current consensus of $1.92 “falls within a reasonable range of potential outcomes.” The company also noted that trends in the apparel retail environment would need to improve from 1Q for EPS to get to $1.92.