Introduction

The used furniture market is about much more than antiques, although demand for vintage products has surely fueled the expansion of online platforms devoted to furniture resale. In this report, we look at the used furniture e-commerce (furniture re-commerce) market and explore its potential and some of the key players in the business. Readers can find our previous coverage of the US and global furniture markets

here.

Defining Re-Commerce

The Internet has opened up new ways for consumers to dispose of durable goods they no longer need by reselling them online. Apparel comprises the most significant re-commerce market, but there are many re-commerce platforms dedicated to other categories,including furniture.

The furniture re-commerce market has a number of facets, including:

1) Trade-in programs led by established retailers and brands: Some furniture retailers offer to pick up items that customers are replacing when they buy furniture from the retailer. IKEA, for example, has a trade-in program for mattresses in the US, whereby the company picks up customers’ old mattresses when delivering their new ones. In Japan, IKEA has a similar program that covers other types of furniture and housewares.

2) Online and mobile marketplaces: There are many online marketplaces devoted to the purchase and sale of used furniture and housewares.

3) Refurbished and repurposed furniture: Some marketplace platforms, such as Etsy and Amazon, feature furniture products that have been refurbished or re purposed.

4) Furniture-as-a-service providers: Websites such as Furnishare provide services that cover the entire process of buying and selling furniture, including shipping, pickup and cleaning.

Popularity of Secondhand Furniture

In the secondhand market, used furniture is the fourth-most popular item sold, after clothing, books and shoes. According to a 2017 Statista survey, nearly half of US consumers polled who had resold items in the past said that they had sold clothing, while only a quarter said that they had sold furniture, indicating furniture’s lower turnover in the secondhand market.

Base: 753 US adults surveyed in June 2017

Source: Statista

Base: 753 US adults surveyed in June 2017

Source: Statista

Furniture generally tends to be a big-ticket and infrequent purchase. For people who move frequently,taking time to carefully choose furniture and décor, and spending heavily on them, may not be on the agenda.But for others, these furnishings represent a long-term investment that is worth researching and paying for.

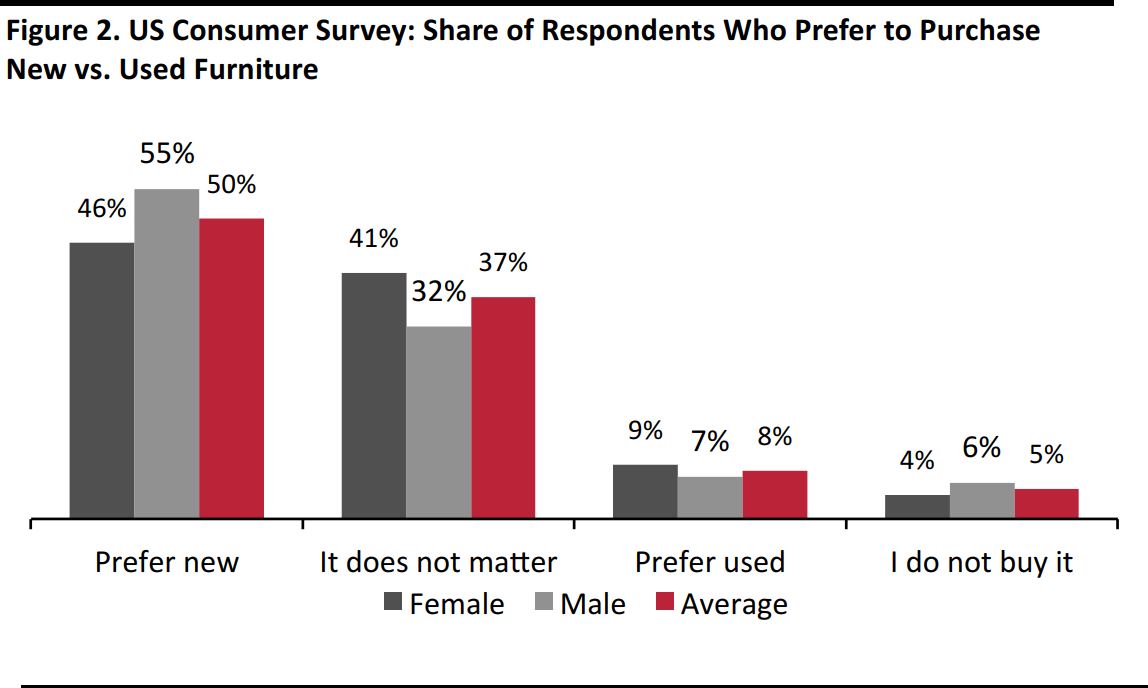

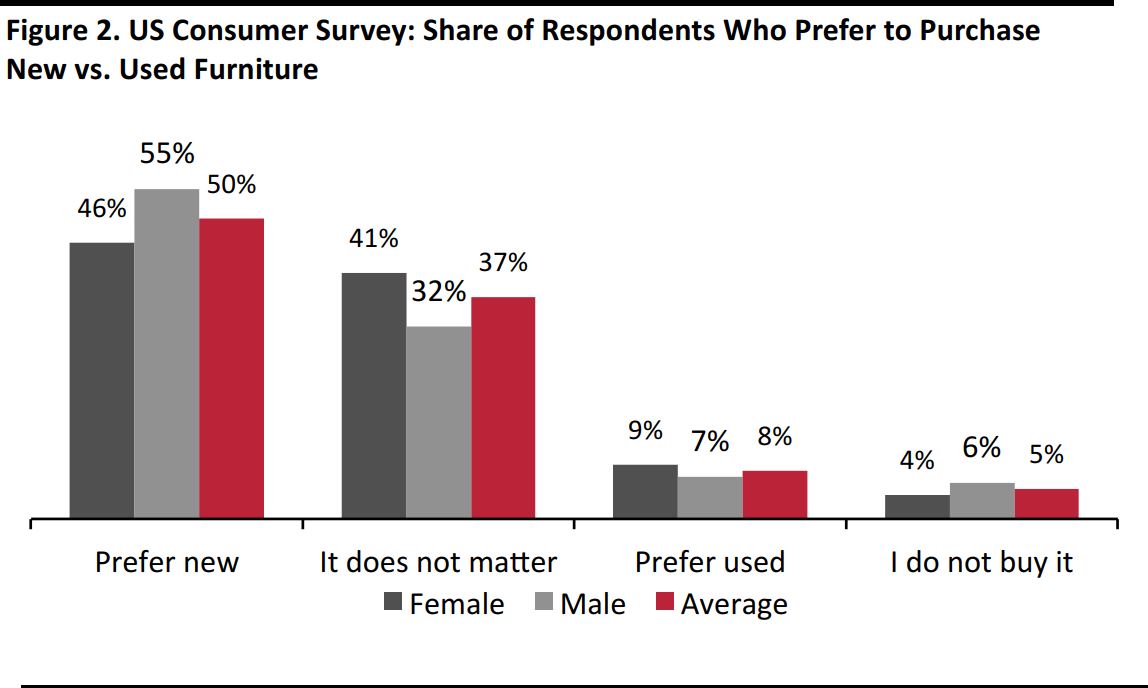

Statista’s 2017 survey found that about half of American consumers prefer to buy furniture that is new or unused. Some 37% of those surveyed said that it does not matter if a piece of furniture is new or used if they wish to purchase it. Meanwhile, only 8% of those polled indicated a preference for used furniture.

Demographic Profile and Decor Preferences of Secondhand Furniture Buyers

According to Statista’s survey, in the US, women are more likely to buy used furniture than men are. In addition, younger consumers are more enthusiastic than older people are about decorating their homes and, particularly,about furnishing them with used furniture.

Base: 753 US adults surveyed in June 2017

Source: Statista

Base: 753 US adults surveyed in June 2017

Source: Statista

A 2016 home decorating survey by home and décor website Apartment Therapy and Furniture Today magazine found that decorating is important to approximately 70% of American millennials. The survey also revealed some aspects of secondhand furniture buyers: about 70% of these consumers are under age 45 and about 60% have a household income of less than $75,000.In addition, about half live in an urban setting.

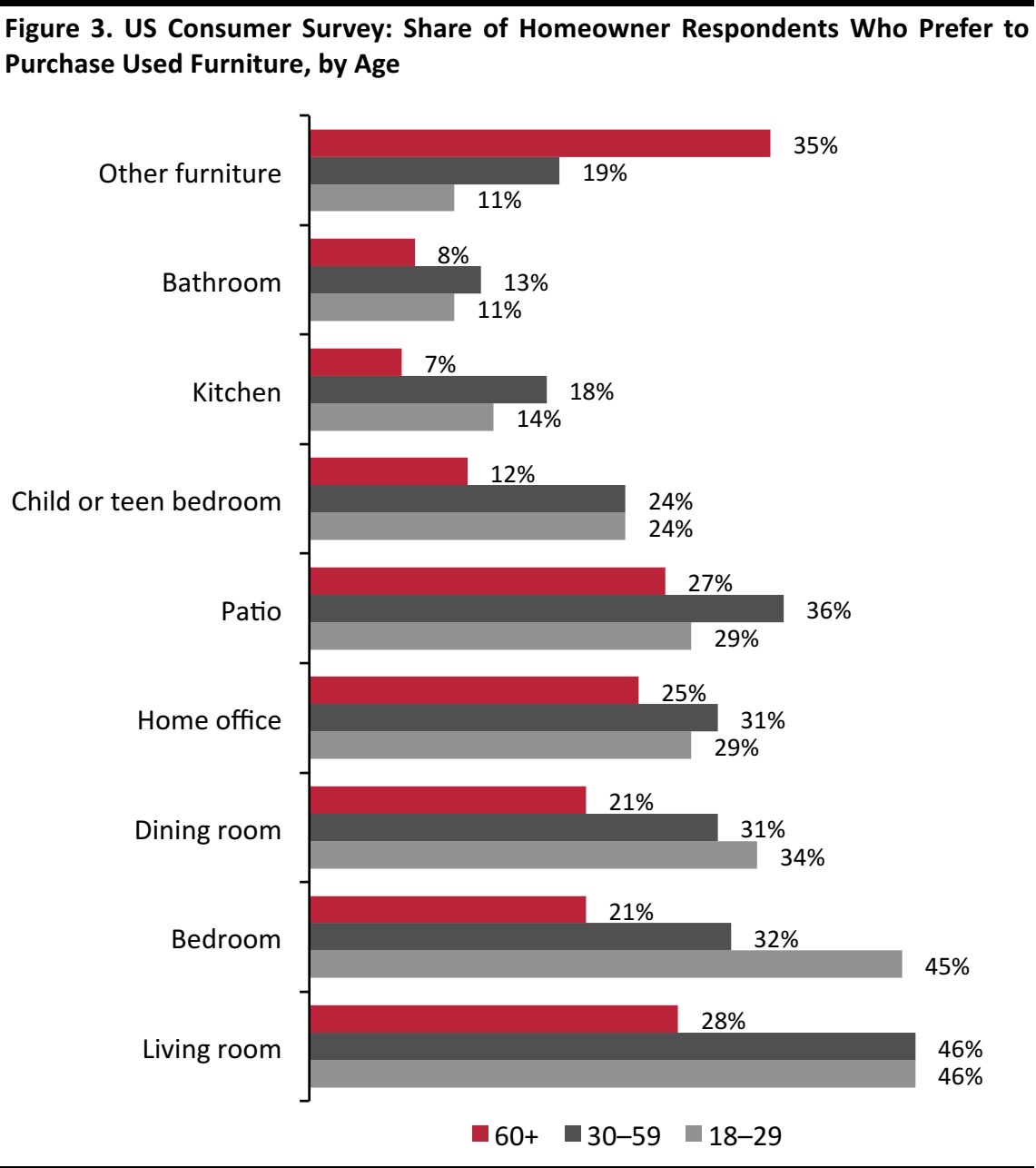

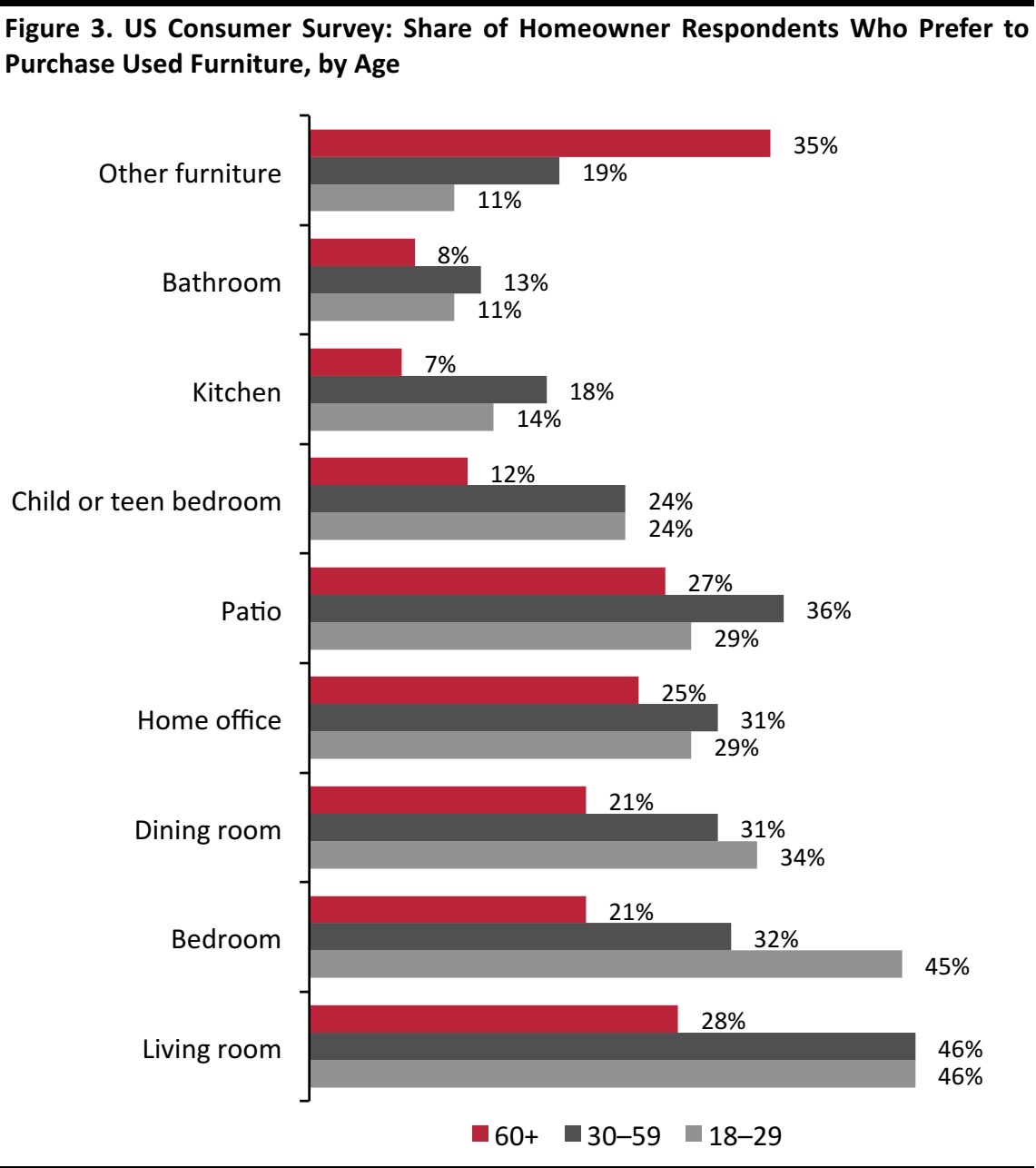

An earlier survey by Statista, which was conducted in 2016,showed a similar trend of younger consumers being more willing than older ones to purchase used furniture for the main areas of their home, such as the living room, bedroom and dining room.However, young adults surveyed were less likely than older consumers to buy used furniture for their home office or patio. This is probably because younger adults tend to have lower incomes and fewer assets, so are likely to live in smaller homes that do not contain such areas.

An October 2015 survey of 1,610 US female homeowners by Better Homes and Gardens magazine revealed similar findings. Almost two-thirds of millennial respondents said that having a home customized to their tastes and needs was a top priority. And while 44% of those polled said that they were willing to spend significantly to get the features and quality they want, 60% indicated that they were willing to compromise on their wants in order to save money, which could imply an openness to buying second hand furniture.

Base: 1,001 US adults surveyed in September 2016

Source: Statista

Base: 1,001 US adults surveyed in September 2016

Source: Statista

Factors Driving the Trade of Used Goods

A majority of consumers prefer to purchase new goods, but the market for used items is nonetheless considerable. Below, we explore some of the reasons consumers buy used goods.

1) Vintage and antique furniture holds appeal: Vintage and antique products are a long-standing element of the used furniture market, as many people appreciate the quality or traditional styles offered by such pieces. Some 57% of American consumers prefer to buy vintage home furnishings, according to the 2016 survey by Apartment Therapy and

Furniture Today. Among age groups, 63% of millennials surveyed said that they favor vintage home products, while 52% of Gen Xers and 53% of baby boomers noted the same (the survey asked respondents about vintage items specifically, not antiques).

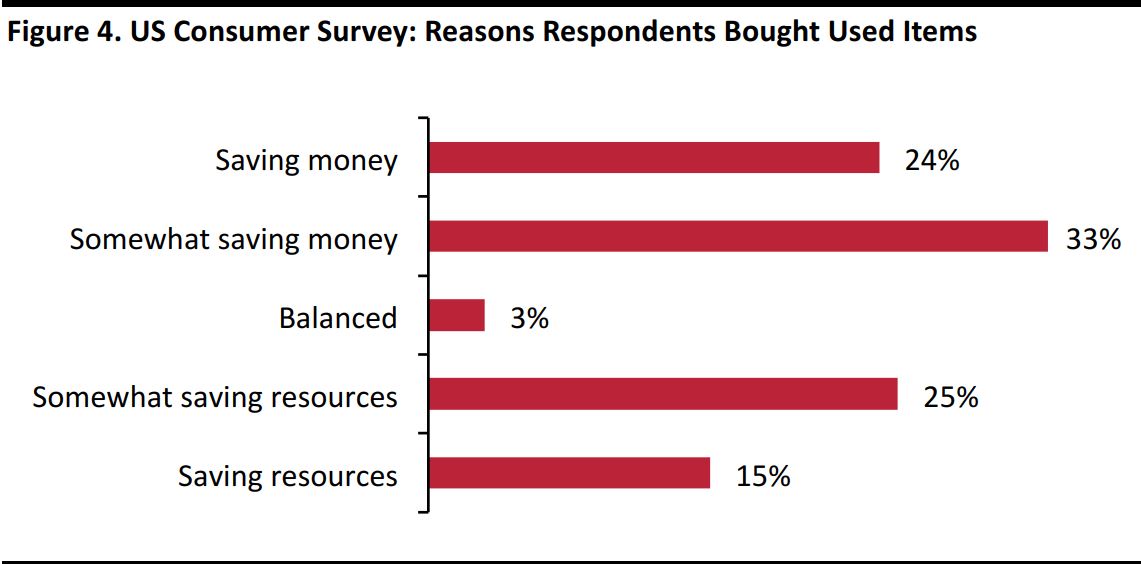

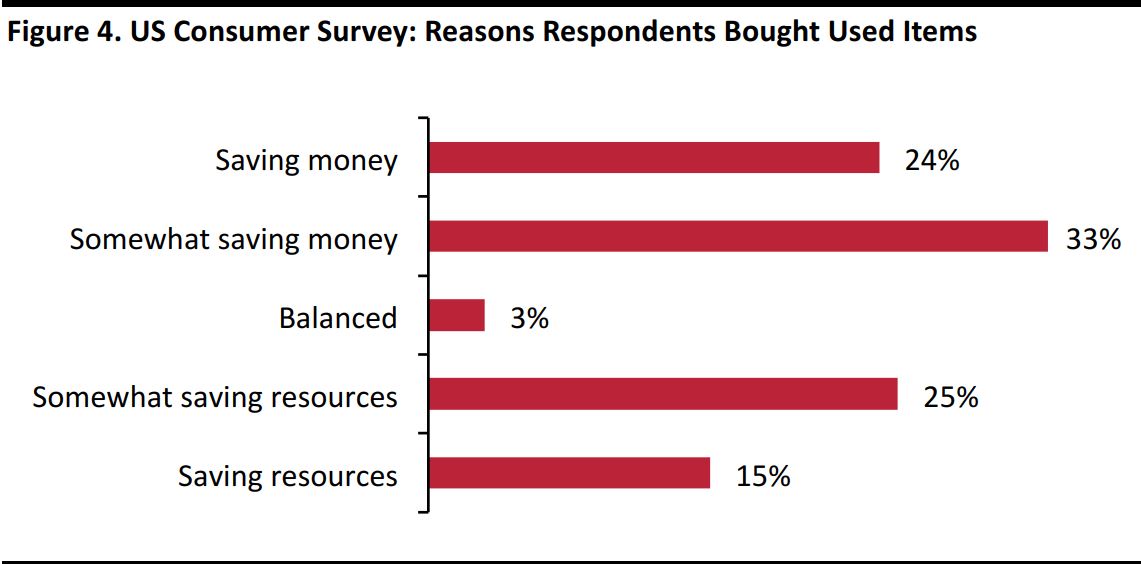

2) Many consumers are looking to save money and resources: While many consumers buy used items to save money, that is not always their only goal. The 2017 Statista survey found that 25% of Americans believe that buying used items is one way to save resources and that 15% of Americans actually do buy used items in order to save resources.

Base: 978 US adults surveyed in June 2017

Source: Statista

Base: 978 US adults surveyed in June 2017

Source: Statista

3) Consumers like to own collectibles and memorabilia: Objects owned or used by celebrities are sought after by collectors and fans alike, and limited-edition products are appealing to collectors because they are in short supply. Globally, consumers spend approximately $200 billion each year on collectibles and memorabilia, according to HobbyDB.com, a collectibles database and marketplace.

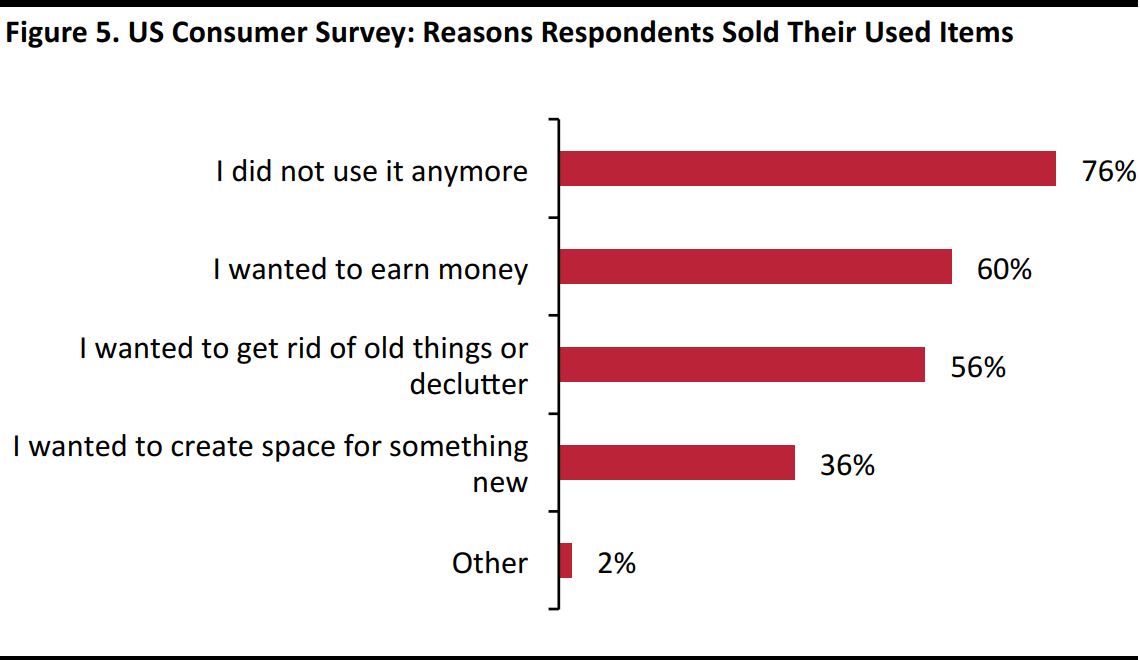

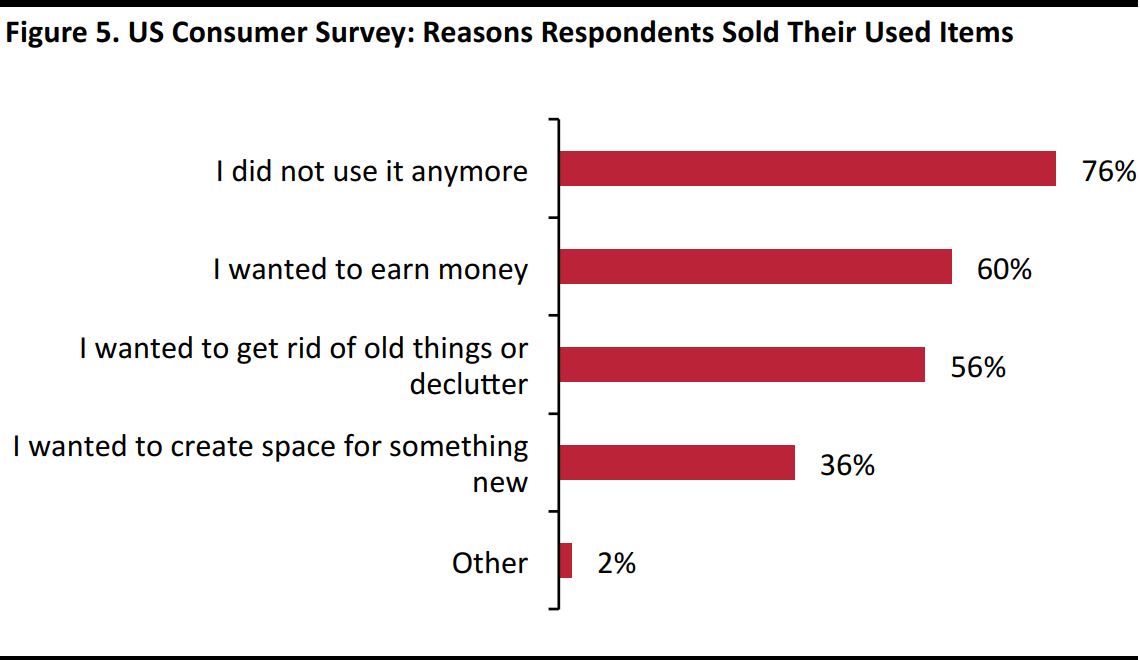

Many consumers are also keen to sell items they own. In 2017, around 77% of Americans sold at least one thing they no longer used, according to the 2017 Statista survey cited earlier.Among survey respondents who had sold items they had previously owned, the top three reasons cited for selling them were:

- Not using the product anymore.

- To earn money.

- To declutter.

Base: 753 US adults surveyed in June 2017

Source: Statista

Base: 753 US adults surveyed in June 2017

Source: Statista

That final reason—decluttering—has evolved into a trend, and we covered it in detail in our report

Decluttering: Anatomy of a Consumer Trend and How Retailers Can Win. Declutteringis simply the process of organizing one’s belongings and getting rid of things one does not use. Author Marie Kondo created a specific decluttering technique that she described in her book

The Life-Changing Magic of Tidying Up: The Japanese Art of Decluttering and Organizing, which sold millions of copies and helped popularize the trend of holding on to only those possessions that “spark joy.”

In an environment of rising home prices,the cost of accumulating belongings is high, so paring down is appealing to many consumers. In our earlier report, we shared that housing pressure and Google Search interest in major urban areas globally indicates that people living in cities with higher housing pressure tend to be more interested in decluttering. The ability to conveniently sell furniture and home décor itemsonline complements this trend.

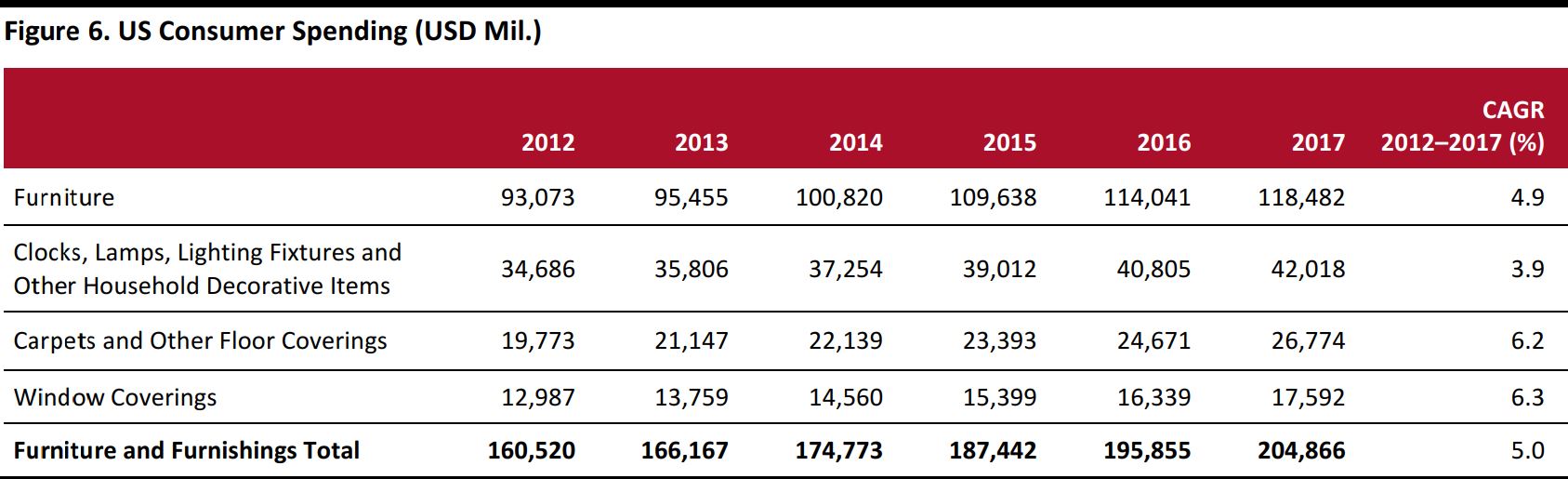

How Much US Consumers Are Spending on Furniture and Used Goods

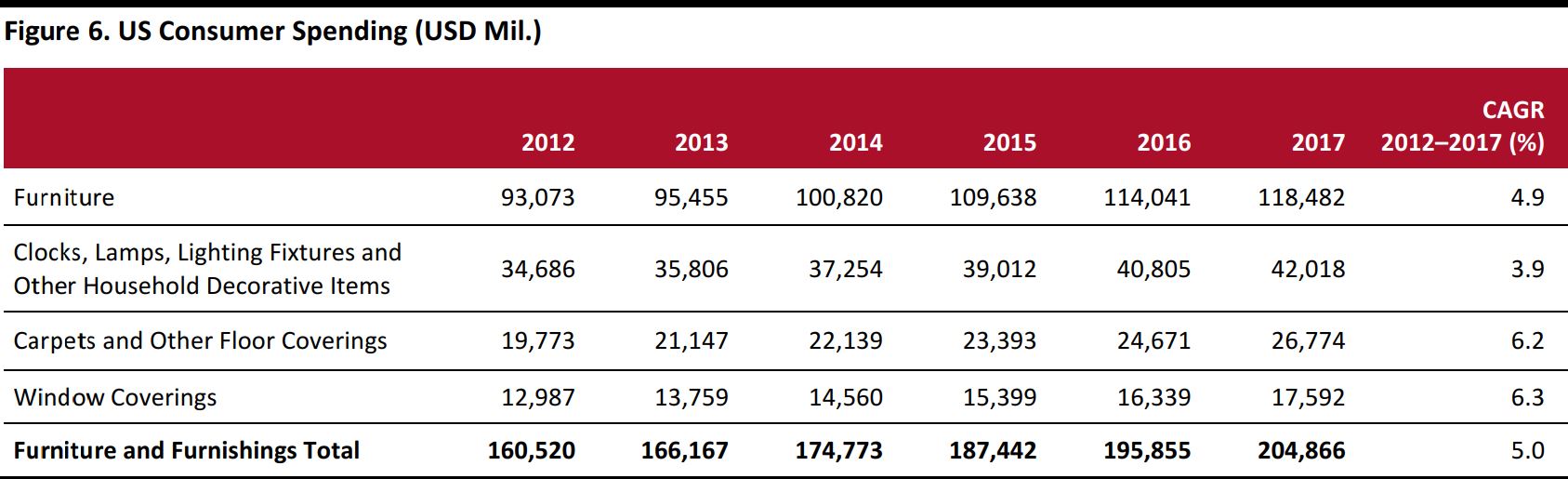

As furniture re-commerce is a relatively new segment in online retail, definitive figures on the size of the market are not yet available. We do, however, have numbers for US sales of furniture and used merchandise as well asfor nonstore retail sales. In 2017, US consumers spentapproximately $205 billion,or 1.5% of their personal consumption expenditure, on furniture and furnishings, according to the US Bureau of Economic Analysis.

Source: US Bureau of Economic Analysis/Coresight Research

Source: US Bureau of Economic Analysis/Coresight Research

In 2017, furniture and home furnishings specialty stores generated some$116 billion in sales,equivalent to 6.6% of total non grocery and non drug retail trade, according to our analysis of US Census Bureau data. In the same year, outlets selling used merchandise (in all categories)accounted for $19.1 billion,or 1.1%, of total non grocery and non drug retail sales.

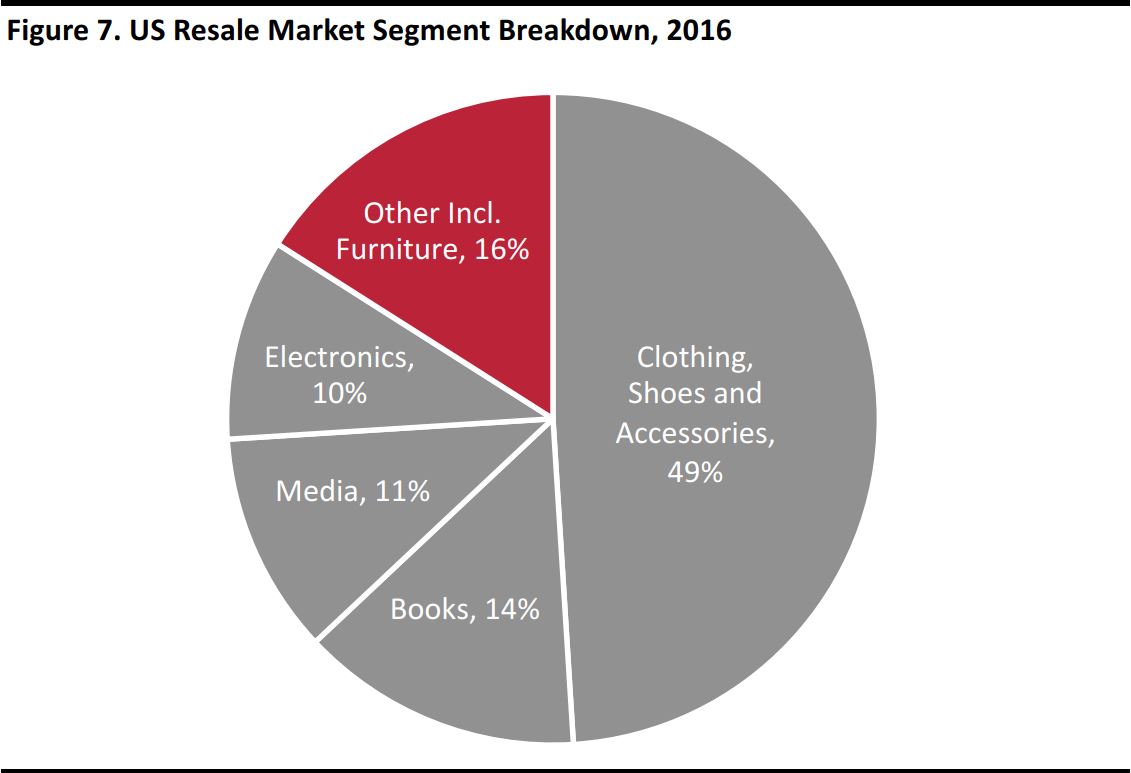

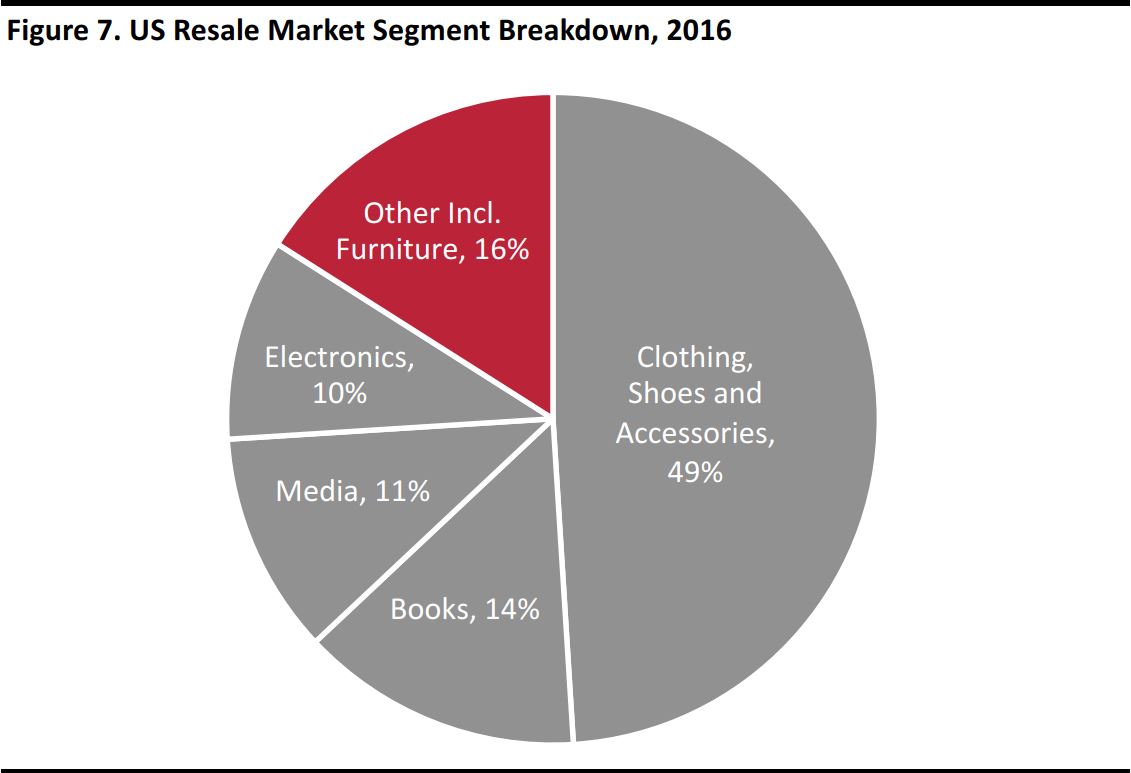

ThredUp, one of the biggest fashion resale websites in the US, publishes a yearly report with estimates for the total resale market,divided by segment. In its

Annual Resale Report 2017, ThredUp estimated that the online and offline resale market for apparel was worth $18 billion in 2016 and that apparel accounted for 49% of the total resale market that year.Furniture would be included within the “Other” category of ThredUp’s market breakdown, which is shown below. If we assume furniture accounts for a ballpark 12.5% of the total resale market and extrapolate from apparel being valued at $18 billion for 49%, that suggests that the total value of the in-store and online furniture resale market was $4.6 billion in 2016.

Source: ThredUp

Source: ThredUp

Popular Furniture Re-Commerce Platforms

Online retail has provided opportunities to tap into markets that were previously difficult to reach.E-commerce has sparked innovative business models that facilitate convenience and transparency in transactions and connect sellers of all types and sizes with interested buyers.

Craigslist is a well-established local classifieds platform that connects individual buyers and sellers of all kinds of goods. Among the larger retailers, Amazon and IKEA have offered buying and selling options for used furniture,but several other platforms specialize in used furniture, including 1stdibs, Chairish, Furnishare and AptDeco.

1stdibs

- 1stdibs is a high-end online marketplace connecting dealers, shops and galleries with individual customers.

- Shoppers can buy antique furniture and housewares, art, jewelry, fashion and other vintage items on the site, and they have the option of negotiating a price with a seller.

- The company was founded in 2001 and is based in New York.Global shipping options are available through the site.

- 1stdibs has received total funding of approximately$167–$177 million, according to Fortune magazine, which reported that the company had raised $50–$60 million in funding from Insight Venture Partners. Alibaba had invested $15 million previously, according to startup database Crunchbase.com.

Chairish

- San Francisco–based Chairish was formed in 2013.The company describes its site as an “online marketplace for design lovers to buy and sell chic vintage decor, furniture and art.”

- Chairish offers shipping services from sellers to buyers, but also allows buyers to pick up purchases in person.

- Sellers can upload pictures of the items they want to sell, which are then approved or rejected by the Chairish team. Sellers receive 80% of the sale price of approved items.

- Buyers are allowed to return items within 48 hours if they do not like what they ordered, and sellers are paid only after this window has closed. Chairish claims that its return rate is less than 2%.

- The company has received $16.7 million in total funding, according to Crunchbase.com.

Furnishare

- New York–based Furnishare was founded in 2014 and offers a complete turnkey solution for buying and selling used furniture.

- Furnishare offers to pick up furniture from sellers and then clean, inspect and put it online for sale. It also offers delivery and furniture assembly services to buyers.

- The company has received seed funding of $2 million, according to Crunchbase.com.

AptDeco

- AptDeco is an online marketplace for pre owned furniture, where sellers can list items ranging from sofas to mattresses to rugs to décor.

- The company’s website allows shoppers to browse by product, collection and brand.

- AptDeco offers pickup and delivery services for items being sold or purchased.

- The company’s AptDeco for Designers program offers special deals for interior designers, stage prop designers and others. If buyers cannot find what they are looking for, AptDeco will specially source it for them through this program.

- AptDeco is based in New York and was founded in 2012.The company has raised $2.5 million in funding, according to Crunchbase.com.

What We Think

The online furniture resale market appears to be small, but it has substantial potential for growth. Unlike with categories such as apparel, shipping remains a costly barrier for furniture resale. As a result, a number of specialized furniture resale websites cater to local communities, but this limits customer numbers. By growing scale, online marketplaces may be able to democratize the availability of pre owned furniture and drive growth in this segment.

Base: 753 US adults surveyed in June 2017

Source: Statista

Base: 753 US adults surveyed in June 2017

Source: Statista Base: 753 US adults surveyed in June 2017

Source: Statista

Base: 753 US adults surveyed in June 2017

Source: Statista Base: 1,001 US adults surveyed in September 2016

Source: Statista

Base: 1,001 US adults surveyed in September 2016

Source: Statista Base: 978 US adults surveyed in June 2017

Source: Statista

Base: 978 US adults surveyed in June 2017

Source: Statista Base: 753 US adults surveyed in June 2017

Source: Statista

Base: 753 US adults surveyed in June 2017

Source: Statista Source: US Bureau of Economic Analysis/Coresight Research

Source: US Bureau of Economic Analysis/Coresight Research Source: ThredUp

Source: ThredUp