DIpil Das

The economic crisis resulting from the coronavirus pandemic will likely lead to a surge in trading down in nondiscretionary retailing—between categories, brands and possibly channels. This will present opportunities for private labels and store brands, but challenges for big consumer brands.

Trading Down in Type of Product

With widespread coronavirus-related furloughs and job losses, the personal finances of many consumers worldwide are taking a hit during this global crisis. We could see a new wave of trading down as value becomes the key priority—from pricier groceries to cheaper products, organic food to regular food, fresh food to prepackaged food and from premium brands to less-premium brands.

The trading-down trend was also observed during and after the Great Recession of 2007–2009. As the recession drove consumers to cut costs, their commitment to organic food was tested, and sales of this type of produce in the US fell by 31% year over year in March 2009, according to figures from consulting firm Kantar Worldpanel (formerly TNS Worldpanel). It would not be surprising to see organic produce become less popular again as the coronavirus crisis heads into an economic recession and consumer priorities shift.

The impacts of the Great Recession can be seen in the meat category too. Average weekly sales of beef loin at traditional supermarkets in the US declined by 1.5% to $2,403 for the year ending August 28, 2010 versus the prior year, according to data from market research firm The Perishables Group. Weekly sales of beef sirloin for the same period dropped 1.6% to $844. At the same time, sales of other meats increased: Average weekly sales of duck grew 4.2% to $15, for example. Although beef still led in terms of dollar share of sales, poultry registered higher dollar growth than beef.

During the coronavirus crisis—and following it, according to the trends of the Great Recession shown in the 2010 sales data—consumers may switch to cheaper cuts of meat and different types of meat—such as switching from steak to chicken.

An Opportunity for Private Labels

In the consumer-packaged goods sector, private labels could make gains at the expense of major brands as consumers look for value in times of recession. We also expect to see shoppers switch more permanently to the private labels of retailers that they view favorably coming out of the crisis.

Looking back to the Great Recession to exemplify this trend, Target reported that private-label penetration increased 300 basis points (bps) in 2007 from 15% to 18%. Walgreens saw a double-digit percentage jump in private-label sales during the last three months of 2008. BJ's and Costco both reported that private labels in food and health products gained market share in 2008. For CVS, private labels accounted for 15.5% of front-end sales in the third quarter of 2009, up 111 bps from a year earlier.

Benefits of the Trading Down Trend for Value-Focused Retailers

Mass merchandisers and warehouse clubs could see gains during the coronavirus pandemic, as they currently have an edge over other categories of retail: Stores remain open and are selling products that are considered essential, at low prices. For example, Costco, Target and Walmart offer cheaper personal-care products and groceries, and they each have a presence both online and offline.

Target has reportedly been experiencing unusually strong traffic and sales in its stores and same-day services, as stockpiling customers have turned to the retailer for essential items like food, medicine, cleaning products and pantry stock-up items. According to the company, its comparable sales increased 3.8% year over year in February and then by more than 20% as of March 25. Walmart has also seen massive sales growth during the coronavirus pandemic: Sales surged 20% in March, reported by the Wall Street Journal.

These sales trends have been driven by stockpiling, but mass merchandisers as well as warehouse clubs and dollar stores could also benefit from any trading down between channels—sustaining growth trends we had already seen pre-coronavirus.

Shoppers Struggling

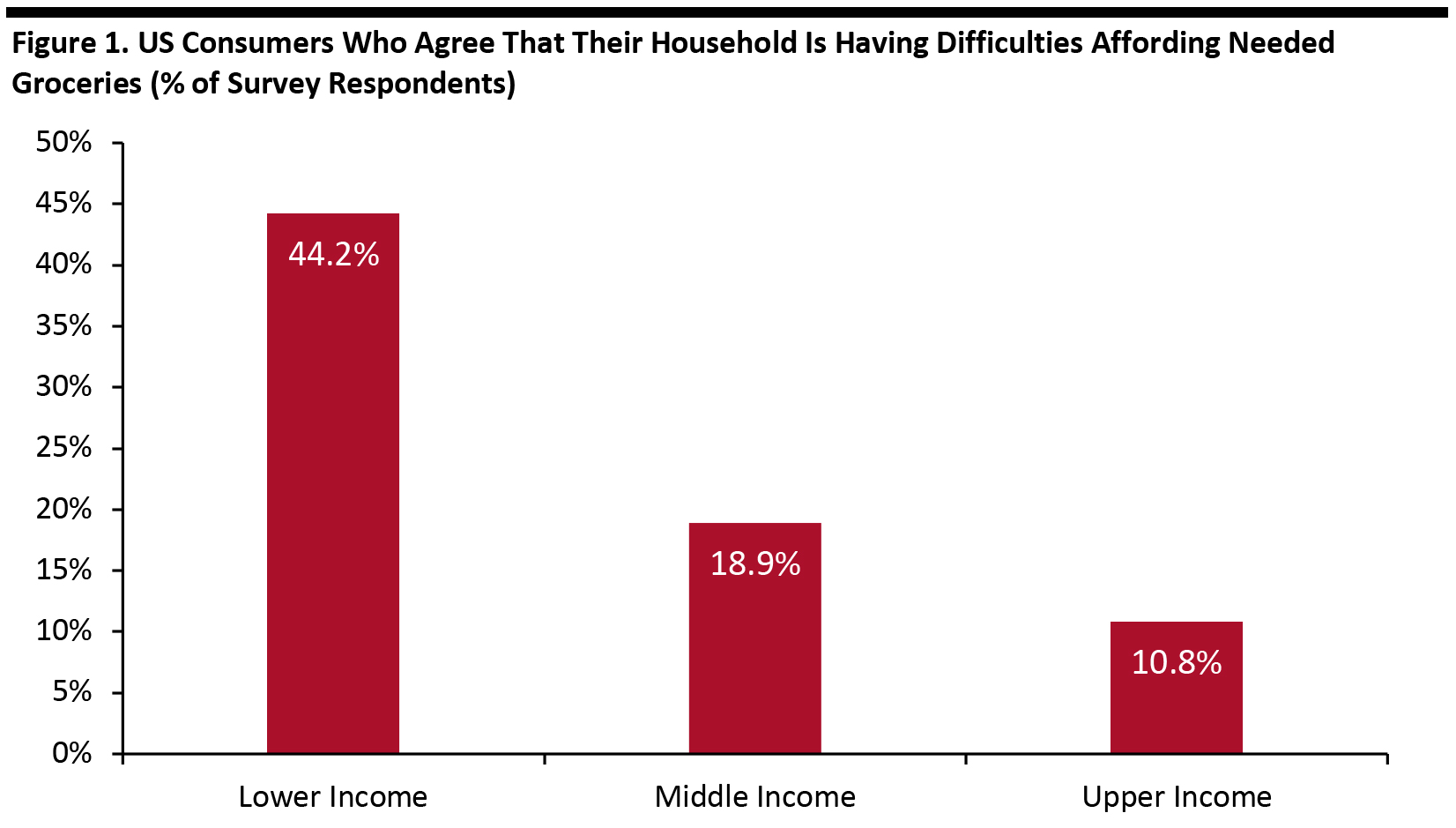

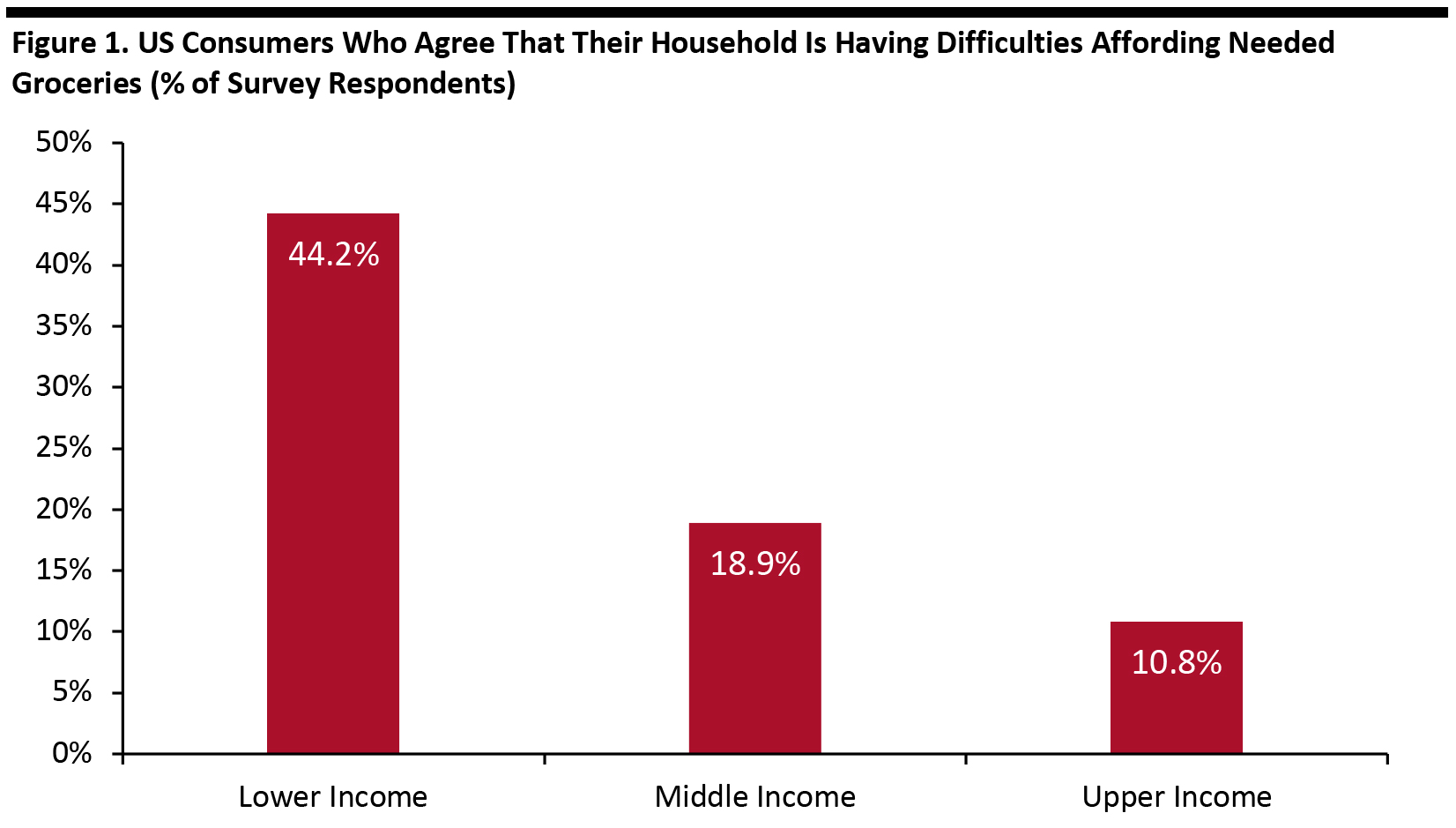

According to a late-March 2020 survey by data analytics provider IRI, many lower-income consumers in the US are struggling to buy needed groceries during the crisis (shown in Figure 1).

[caption id="attachment_108252" align="aligncenter" width="700"] Base: 963 US consumers in total, among which 244 are in lower-income tier, 369 are in middle-income tier and 350 are in upper-income tier

Base: 963 US consumers in total, among which 244 are in lower-income tier, 369 are in middle-income tier and 350 are in upper-income tier

Source: IRI [/caption] A Boost to Grocery Retail as the Food-Service Sector Experiences a Downturn Restaurants in the US have been forced to close and consumers are confined to their homes during widespread lockdowns, billions of dollars in food spend is set to migrate to grocery retailers amid the coronavirus pandemic. Although cooking and eating at home is an example of trading down from dining out, this trend could boost grocery retail and partially offset trading down in regular grocery purchases, as shoppers may look for more premium products to recreate restaurant experiences. See our US Grocery Retail Poised for a Double-Digit Upswing report for more information on consumer spending in grocery. Key Insights and Implications for Retailers Amid the ongoing coronavirus crisis, we are seeing a shift in the purchasing behaviors of US consumers, with value becoming the key priority. Shoppers are seeking cheaper options as they look to mitigate the impact of economic uncertainty. This trading down trend is seeing consumers switch from food service to food retail, from national brands to private labels, from organic food to regular food and from fresh food to frozen food. We expect mass merchandisers and warehouse clubs will be the biggest winners.

Base: 963 US consumers in total, among which 244 are in lower-income tier, 369 are in middle-income tier and 350 are in upper-income tier

Base: 963 US consumers in total, among which 244 are in lower-income tier, 369 are in middle-income tier and 350 are in upper-income tier Source: IRI [/caption] A Boost to Grocery Retail as the Food-Service Sector Experiences a Downturn Restaurants in the US have been forced to close and consumers are confined to their homes during widespread lockdowns, billions of dollars in food spend is set to migrate to grocery retailers amid the coronavirus pandemic. Although cooking and eating at home is an example of trading down from dining out, this trend could boost grocery retail and partially offset trading down in regular grocery purchases, as shoppers may look for more premium products to recreate restaurant experiences. See our US Grocery Retail Poised for a Double-Digit Upswing report for more information on consumer spending in grocery. Key Insights and Implications for Retailers Amid the ongoing coronavirus crisis, we are seeing a shift in the purchasing behaviors of US consumers, with value becoming the key priority. Shoppers are seeking cheaper options as they look to mitigate the impact of economic uncertainty. This trading down trend is seeing consumers switch from food service to food retail, from national brands to private labels, from organic food to regular food and from fresh food to frozen food. We expect mass merchandisers and warehouse clubs will be the biggest winners.