Nitheesh NH

What’s the Story?

The Covid-19 pandemic has seen a rapid shift to e-commerce in retail, but recent digitalization in the grocery sector has not been limited to the online channel. Grocery retailers have been increasingly deploying in-store technologies amid heightened consumer demand for convenience, safety and efficiency. Smart checkout technologies in particular are transforming the shopping journey in the grocery sector. In this report, we explore three such in-store technologies: automated checkout, smart carts and scan-and-go.Why It Matters

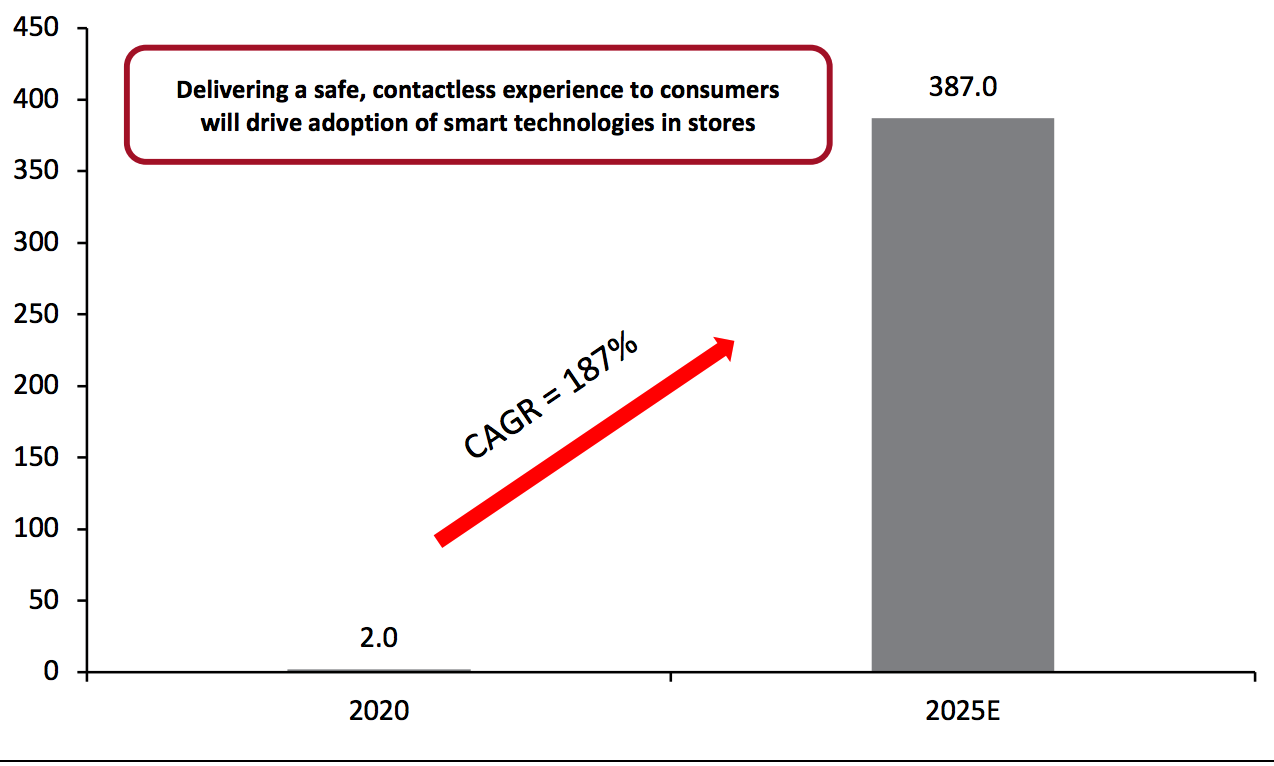

The brick-and-mortar channel is where the majority of consumers typically shop for groceries. Prior to Covid-19, traditional retailers were reluctant to deploy in-store technology, as such investments can be hard to justify in a low-margin business, especially when it is not clear if customers would download smartphone apps or embrace innovation. However, 2020 saw shoppers of all ages become more willing than ever to turn to technology in seeking out ways to avoid queues or interactions with cashiers and other customers. We are seeing traditional retailers increasingly invest in in-store technology to improve the shopping experience for their customers and better compete with major e-commerce players. The deployment of tech-based solutions that promote safety and efficiency is becoming table stakes for grocers. Smart checkout technologies enable retailers to offer safe, contactless shopping experiences in physical stores. These include all forms of checkout infrastructure that automate or remove elements of the payment process. According to Juniper Research, the total value of transactions processed by smart checkout technologies will reach $387 billion in 2025, up from just $2 billion in 2020. Figure 1. Transactions Processed by Smart Checkout Technologies Globally (USD Bil.) [caption id="attachment_123315" align="aligncenter" width="600"] Source: Juniper Research[/caption]

Source: Juniper Research[/caption]

Grocery Digitalization: In Detail

Below, we discuss three smart checkout technologies that are being widely implemented by grocery retailers. 1. Automated Checkouts We have seen grocery retailers launch pilot programs with artificial intelligence (AI) technology vendors to install automated checkout systems in stores. These systems enable customers to purchase items without the need to scan each product or interact with a payment terminal. Automated checkouts use ceiling-mounted cameras and AI-powered computer-vision technology to track products as a shopper selects them and digitally add the items to a virtual shopping cart. The customer is then charged via the app when they scan a code on their smartphone before exiting the store. Such technology resembles the Amazon Go concept, but there is a key difference. Unlike Amazon Go, these automated checkout systems retrofit into existing stores and can coexist with traditional checkout lanes, allowing retailers to incorporate the tech in stores without adversely impacting operations. Below, we highlight a couple of recent automated-checkout programs in the grocery sector:- In August 2020, convenience store chain Circle K announced that it would install automated checkouts at select US stores in partnership with tech solutions provider Standard Cognition. The system will first be launched as a pilot in Phoenix, Arizona, before being expanded to additional Circle K locations in the US. The first autonomous checkout equipped store is set to go live in early 2021, according to the retailer.

- In September 2020, supermarket chain Giant Eagle, in partnership with checkout-free shopping technology provider Grabango, rolled out a smart checkout system at its 3,000-square-foot GetGo store in Pittsburgh, Pennsylvania. The grocery retailer noted that customer response to the first deployment exceeded expectations: Almost 75% of customers who tried the service used it again within 30 days, and of that group, almost two-thirds used it nearly five times, according to Giant Eagle. The company has reported plans to install the technology at a second location by early 2021 and at nearly 400 additional stores in the near future.

- In May 2020, frictionless checkout technology provider Shopic raised $7.6 million to help bring its frictionless technology to medium and large grocers.

- In December 2020, Israel-based startup Trigo Vision raised $60 million with the help of venture capital firm Red Dot Capital Partners and UK supermarket chain Tesco.

- Amazon has set the stage in the US by deploying smart shopping carts known as “Dash Carts” at eight Amazon Fresh stores in 2020.

- Kroger introduced a line of “KroGo” shopping carts, developed by Caper, at one of its stores in Cincinnati in January 2021. Caper’s smart carts include a digital scale feature that can weigh produce in the cart.

Smart cart by Caper

Smart cart by CaperSource: Caper[/caption] 3. Scan-and-Go Scan-and-go has been on the rise over the past few years, offering retailers the key benefits of lower labor costs and enhanced customer experience, as well as arming them with more data to analyze in-store shopper behavior. Scan-and-go technology was pushed to the fore with the outbreak of Covid-19, as brick-and-mortar retailers shifted their focus to getting customers in and out quickly while minimizing contact and reducing time spent standing in queues. In the more sophisticated versions of this technology, shoppers download the retailer’s scan-and-go app on their smartphones and link it with their preferred payment card in advance of visiting the store. Inside the store, customers can scan items using their smartphones, which adds each scanned item to their virtual shopping cart. They can then make the required payment within the app and exit the store—eliminating the need to use a physical checkout terminal. Scan-and-go systems can also incorporate augmented reality technology and targeted advertising based on consumer data, to personalize and enhance the shopping experience. Amid the pandemic, several grocery retailers have launched or expanded their scan-and-go systems. Three notable examples are as follows:

- Kroger, which had not provided any updates on its “Scan, Bag & Go” system in the two years prior to the pandemic, announced in its earnings call for the fiscal quarter ended May 23, 2020 that it is expanding and making improvements to this service. Customers can now scan items through their smartphones, place them in their bags and pay via the app at the register. Previously, shoppers had to use store-provided handheld devices to scan items.

- Sam’s Club, which had introduced scan-and-go technology in 2016, noted that its dedicated “Scan & Go” app added 700,000 new members in the quarter ended April 30, 2020. In September 2020, Sam’s Club announced that it will roll out Scan & Go to all 518 of its fuel stations by the end of the year.

- Wegmans, which piloted “SCAN” technology in April 2019, revised the plan to implement it sooner and rolled out the program to 45 locations as of April 2020.

What We Think

In-store smart checkout technologies are poised to make a big impact on the way people shop in the grocery sector by eliminating lines, minimizing contact and increasing efficiency in the shopping process. Although these benefits have driven the development of smart checkout tech since its inception, the Covid-19 pandemic has expedited the implementation of scan-and-go, automated checkouts and smart carts to meet increased consumer demand for safety. At the same time, innovations from newer rivals—notably, Amazon with Amazon Go stores and Dash Carts—will further encourage incumbent grocery retailers to introduce frictionless technologies. Implications for Retailers- Due to the pandemic, shoppers are more ready now than ever before to embrace technologies that can help them shop safer and smarter in brick-and-mortar stores. Solutions that are aimed at reducing physical interactions and wait times will be a staple for shoppers as the world recovers from the pandemic, and beyond. Grocery retailers must carefully choose from the range of available technologies that can improve the checkout experience and deliver a quick return on investments.

- Grocery retailers operate on notoriously low margins and may hesitate to make investments if the in-store modifications increase long-term costs or create more work for them. Technology vendors should make cost savings central to their pitch and ensure that their solutions generate an appealing return on investment in a timely manner.