Nitheesh NH

Introduction

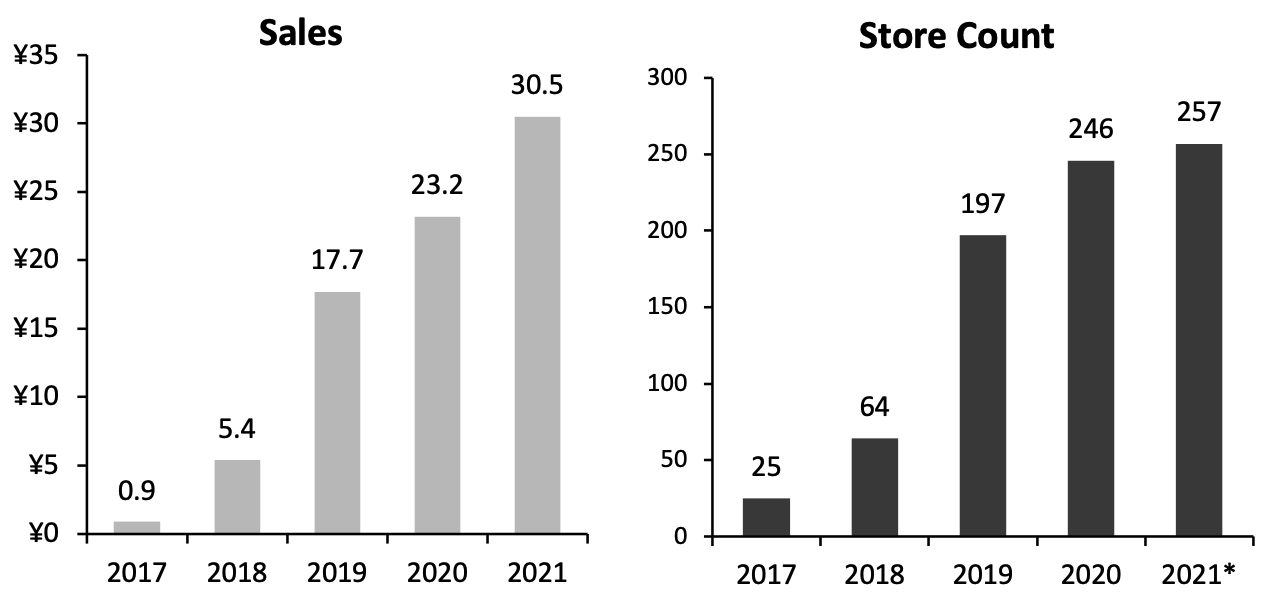

What’s the Story? Alibaba’s grocery chain Freshippo (formerly Hema) provides a one-stop shopping experience, integrating grocery shopping, e-commerce, dine-in services and takeaway food. In this report, we look at the strategies behind Freshippo’s success in China’s grocery market. Why It Matters Freshippo is a grocery chain launched as a part of Alibaba’s “New Retail” strategy. The term “New Retail” was coined by Alibaba’s founder Jack Ma in 2016, and refers to a model that integrates online retail, offline retail and logistics across a single value chain, powered by data and technology. Since its launch in 2016, Freshippo has brought grocery shopping into the digital era, with a mobile-first shopping experience, unmanned checkout kiosks, fast-running fulfillment conveyor belts, 30-minute delivery options and a vast selection of items, including live seafood that customers can even have cooked in-store. By combining online and in-store inventory under one roof and accelerating processes using digital technologies, it seeks to provide an improved customer experience while driving sales. Freshippo has expanded rapidly, with 246 stores as of December 31, 2020. Freshippo’s brick-and-mortar sales reached ¥30.5 billion ($4.8 billion) in 2021, growing at a three-year CAGR of 141.3%, according to estimates by Euromonitor.Figure 1. Freshippo: Estimated In-Store Sales (Left, RMB Bil.) and Store Count (Right) [caption id="attachment_140200" align="aligncenter" width="700"]

*As of March 2021

*As of March 2021Source: Company reports/Euromonitor International Limited 2022 © All rights reserved[/caption] Freshippo’s omnichannel approach exemplifies the digitalization trend in the grocery market. As retailers in Western countries plan post-pandemic strategies, Freshippo may provide a blueprint for reimagining their own stores and merging digital and in-store experiences.

Freshippo in China—Redefining Grocery Retail with Innovation: Coresight Research Analysis

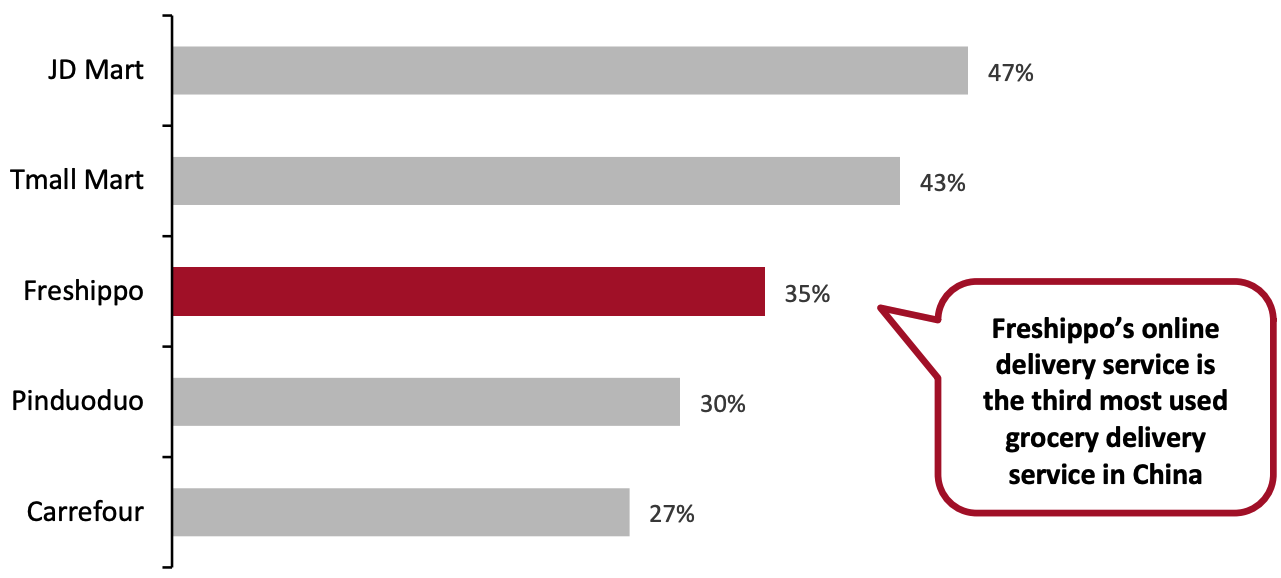

Freshippo offers a retail experience that integrates online and offline retail by leveraging its proprietary in-store technology, smart supply chain systems, consumer insights and mobile platform. We discuss below Freshippo’s key points of difference from traditional grocery retailers: 30-minute online delivery: Freshippo stores are designed to serve as both grocery stores and fulfillment centers, enabling rapid delivery of online orders. The inventory on the Freshippo app is continuously refreshed to reflect the inventory available the user’s local store. Freshippo staff fulfill online orders by scanning products and putting them on a conveyor belt, which carries orders to delivery riders at the back of the warehouse—thus the entire process takes place without disrupting foot traffic inside the store. Freshippo’s delivery riders then deliver orders to consumers in a three-kilometer (1.9 miles) radius of the store within 30 minutes. According to a November survey by Statista, Freshippo’s online delivery service is the third-most popular grocery delivery service in China, with 35% of respondents ordering groceries, beverages or meal kits from the grocery chain in the past 12 months.Figure 2. China: Top Five Most Used Grocery Delivery Services (% of Respondents) [caption id="attachment_140201" align="aligncenter" width="700"]

Source: Statista Consumer Survey[/caption]

In-store experience: The in-store experience is designed to make the overall shopping process more appealing:

Source: Statista Consumer Survey[/caption]

In-store experience: The in-store experience is designed to make the overall shopping process more appealing:

- Fresh food: Freshippo leverages nationwide cold-chain networks and logistics capabilities to deliver fresh food to its customers. Highlighting this, fresh food is marked with the day of the week it arrived in store.

- Product traceability: Consumers can scan each product via the app for provenance information, ingredients and preparation suggestions.

- In-store dining: Consumers can purchase fresh food from the supermarket and have it cooked at the dining area. This can induce the purchase of fresh products and also attracts more offline traffic to the stores. Some locations also feature concept restaurants with robot waiters. Customers can use the app to book a table and identify their spot in the restaurant. Once seated, consumers can scan the QR code at the table and place their order. The kitchen receives the order and when it is ready, it is delivered by robot waiters, relying on RFID chips and multiple sensors to find the right path.

- Convenient checkout: Consumers can scan the products and use QR codes or facial recognition to pay at self-checkout terminals.

Figure 3. Freshippo’s Retail Store Formats [wpdatatable id=1643]

Source: Company reports

2. Deep Supply Chain Integration To Drive Speed and Savings Freshippo has leveraged its growing purchasing scale and Alibaba’s wealth of consumption data to strengthen its supply chain system. The large amount of consumer behavior data held enables Freshippo to predict consumer demand and adjust its inventory balance to reduce out-of-stocks and minimize wastage from unsold inventory. In the area of fresh food, Freshippo has established warehouses in cities at the point of production and cities at the point of sale to improve the efficiency of goods circulation. Freshippo has built more than 500 direct supply centers and established 136 Freshippo villages. Freshippo Villages grow agricultural products for Freshippo only, according to specific orders and for delivery directly to brick-and-mortar locations. The company plans to increase the number of Freshippo villages to 1,000 by 2025, covering 19 provinces. At present, Freshippo’s supply chain also includes 41 normal and cold temperature warehouses and 16 processing centers. In July 2021, Freshippo announced the rollout of new innovative distribution centers in China, incorporating indoor holding facilities for live seafood, cold-storage rooms, food-processing equipment and centralized kitchens. This network of distribution centers will allow safe and speedy handling of fresh produce as it is transported across the country. Its stores are mainly located in top-tier cities where demand for imported food is high among middle-class consumers. By leveraging its supply chain capabilities, Freshippo imports fresh products from more than 100 countries and regions; imported products account for roughly 40% of the grocery chain’s total goods, according to Alibaba. With deep supply chain integration of cold-chain networks and logistics capabilities, Freshippo can deliver imported and perishable items—especially fruit and seafood—from procurement to sale in short timeframes, while keeping its quality and freshness intact. Instead of relying on third-party delivery services, Freshippo has built its own last-mile system that guarantees free 30-minute delivery within a three-kilometer miles radius. 3. Technology Integration Boosts Sales and Efficiency and Improves In-Store Experience Freshippo’s ReXOS retail operating system, released in 2018, covers store-ERP (enterprise resource planning) systems, distribution and sales systems, and online app systems. Using blockchain, IoT, artificial intelligence, big data, cloud computing and other technologies, ReXOS gives Freshippo a powerful advantage across several areas. To improve the consumer experience, Freshippo uses AI and big data to personalize product recommendations on its app and to plan the most efficient delivery routes. Each store has different merchandise assortments, based on geographic consumer data. AI also helps manage store inventory: For example, Freshippo’s system detects fresh goods that have shorter shelf lives and automatically put them on sale when necessary. To provide a high level of transparency and gain consumer trust, Freshippo also uses blockchain technology, provided by Alibaba Cloud, so shoppers can easily track the farm-to-shelf journey of their food products. The information includes the distributor’s business license and food-safety certificates. In addition, through location-based services, Freshippo encourages customers living in close proximity to form social groups, leveraging user-generated content to drive sales. Its app has incubated over 7,000 key opinion leader consumers, boosting sales of top products by up to 30%. Technology and data also help optimize labor and improve cost and operational efficiency. Freshippo uses product barcodes, smart electronic price tags and self-checkout stations in stores, and the company claims the following:- Its AI-powered loss prevention system reduces store shrinkage by 40%.

- Its IoT energy-management system lowers store energy costs by 5%.

- Its flexible staffing system decreases labor costs by 20% compared to using full-time staff.

- Its real-time visualization of labor efficiency improves warehouse labor productivity by 40%.