Web Developers

The US online grocery industry is estimated to be worth about $8.6 billion this year and is forecast to grow at a compound annual growth rate of 9.6% through 2019, according to market research firm IBISWorld. The US Census Bureau estimates that the online grocery market represents more than 1% of the $600-billion-plus US grocery market.

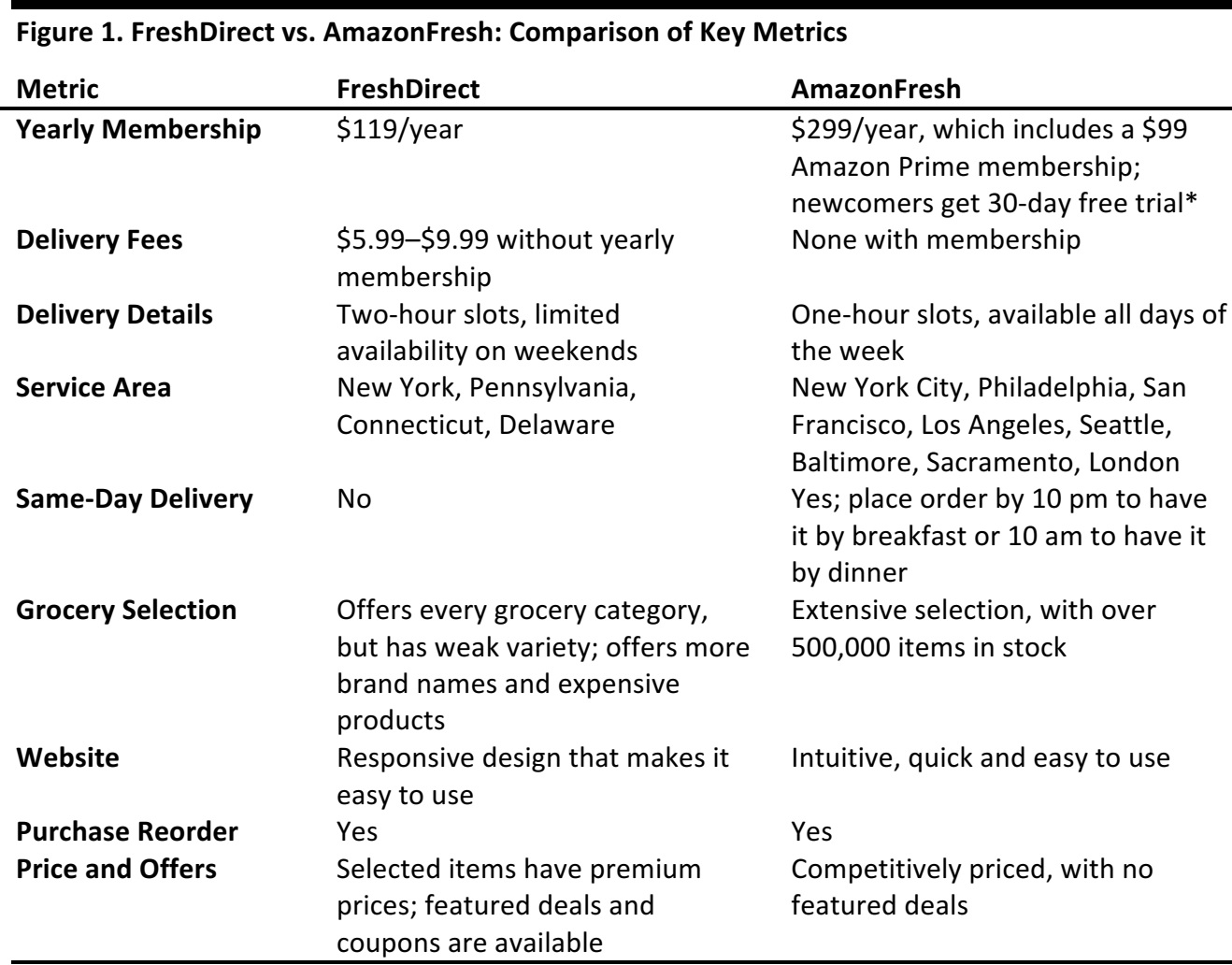

The largest players in the US online grocery market include AmazonFresh, Instacart, Google Express, Peapod and FreshDirect. Long Island–based FreshDirect has been delivering groceries straight from farms to homes in the New York tri-state area since 2002.

AmazonFresh boasts impressive delivery times and an extensive grocery selection. It offers service to customers in New York City, Philadelphia, San Francisco, Los Angeles, Baltimore, Sacramento and Seattle in the US, and recently added London to its service area.

The FreshDirect basket had a total cost of $167.90 versus the AmazonFresh basket’s total cost of $125.48, a difference of $42.42, or 25%. The combination of FreshDirect’s delivery fee and overall higher prices makes it a more expensive online grocery service than AmazonFresh. In all the grocery categories we looked at, AmazonFresh consistently offers cheaper prices than FreshDirect does. Out of all of the products we researched, only grass-fed beef and whole wheat bread were more expensive at AmazonFresh than at FreshDirect.

The FreshDirect basket had a total cost of $167.90 versus the AmazonFresh basket’s total cost of $125.48, a difference of $42.42, or 25%. The combination of FreshDirect’s delivery fee and overall higher prices makes it a more expensive online grocery service than AmazonFresh. In all the grocery categories we looked at, AmazonFresh consistently offers cheaper prices than FreshDirect does. Out of all of the products we researched, only grass-fed beef and whole wheat bread were more expensive at AmazonFresh than at FreshDirect.

For those who frequently order food, AmazonFresh’s annual membership fee of$299 eventually balances out, given the major grocery savings it offers versus FreshDirect. AmazonFresh customers have to spend only $1,200 on groceries to offset their annual fee ($299 divided by 25%) and start enjoying savings, so the service appears to be a good investment, since the average American household spends $3,971 on groceries per year, according to the US Bureau of Labor Statistics. However, FreshDirect appeals to consumers who enjoy more expensive, brand-name products and exotic meal offerings.

For those who frequently order food, AmazonFresh’s annual membership fee of$299 eventually balances out, given the major grocery savings it offers versus FreshDirect. AmazonFresh customers have to spend only $1,200 on groceries to offset their annual fee ($299 divided by 25%) and start enjoying savings, so the service appears to be a good investment, since the average American household spends $3,971 on groceries per year, according to the US Bureau of Labor Statistics. However, FreshDirect appeals to consumers who enjoy more expensive, brand-name products and exotic meal offerings.

In 2001, grocery delivery startup Webvan filed for bankruptcy after being valued at $1.2 billion just a few months before. Webvan’s marketing strategy was to offer the quality and selection of Whole Foods, but at the affordable prices of Safeway. One of Webvan’s first mistakes was pricing its luxury goods at least 30% too low and this did not appeal to high-end customers. Its low-price strategy did not offset the high capital expenditures that were necessary to create a complex infrastructure of expensive technology and distribution centers. Another mistake was expanding too quickly. The company’s 26-city expansion plan and $1-billion Bechtel contract to build new warehouses caused a liquidity shortage.

Home delivery services such as FreshDirect and AmazonFresh have learned to target the proper audience and build the appropriate infrastructure to go with their offerings. Most importantly, they have learned from Webvan that they must expand at an appropriate pace.

Please click here to read our May 2015 report Global Grocery Retailing.

Please click here to read our September 2015 report Target to Pilot Test Grocery Delivery with Instacart

Please click here to read our April 2016 report How Millennials Disrupt Industries Grocery Shopping: New Priorities, New Preferences Millennials and Grocery

In 2001, grocery delivery startup Webvan filed for bankruptcy after being valued at $1.2 billion just a few months before. Webvan’s marketing strategy was to offer the quality and selection of Whole Foods, but at the affordable prices of Safeway. One of Webvan’s first mistakes was pricing its luxury goods at least 30% too low and this did not appeal to high-end customers. Its low-price strategy did not offset the high capital expenditures that were necessary to create a complex infrastructure of expensive technology and distribution centers. Another mistake was expanding too quickly. The company’s 26-city expansion plan and $1-billion Bechtel contract to build new warehouses caused a liquidity shortage.

Home delivery services such as FreshDirect and AmazonFresh have learned to target the proper audience and build the appropriate infrastructure to go with their offerings. Most importantly, they have learned from Webvan that they must expand at an appropriate pace.

Please click here to read our May 2015 report Global Grocery Retailing.

Please click here to read our September 2015 report Target to Pilot Test Grocery Delivery with Instacart

Please click here to read our April 2016 report How Millennials Disrupt Industries Grocery Shopping: New Priorities, New Preferences Millennials and Grocery

*Amazon offers a prorated refund of Prime fees for AmazonFresh subscribers after the 30-day trial period. Source: Company websites

Price Comparison

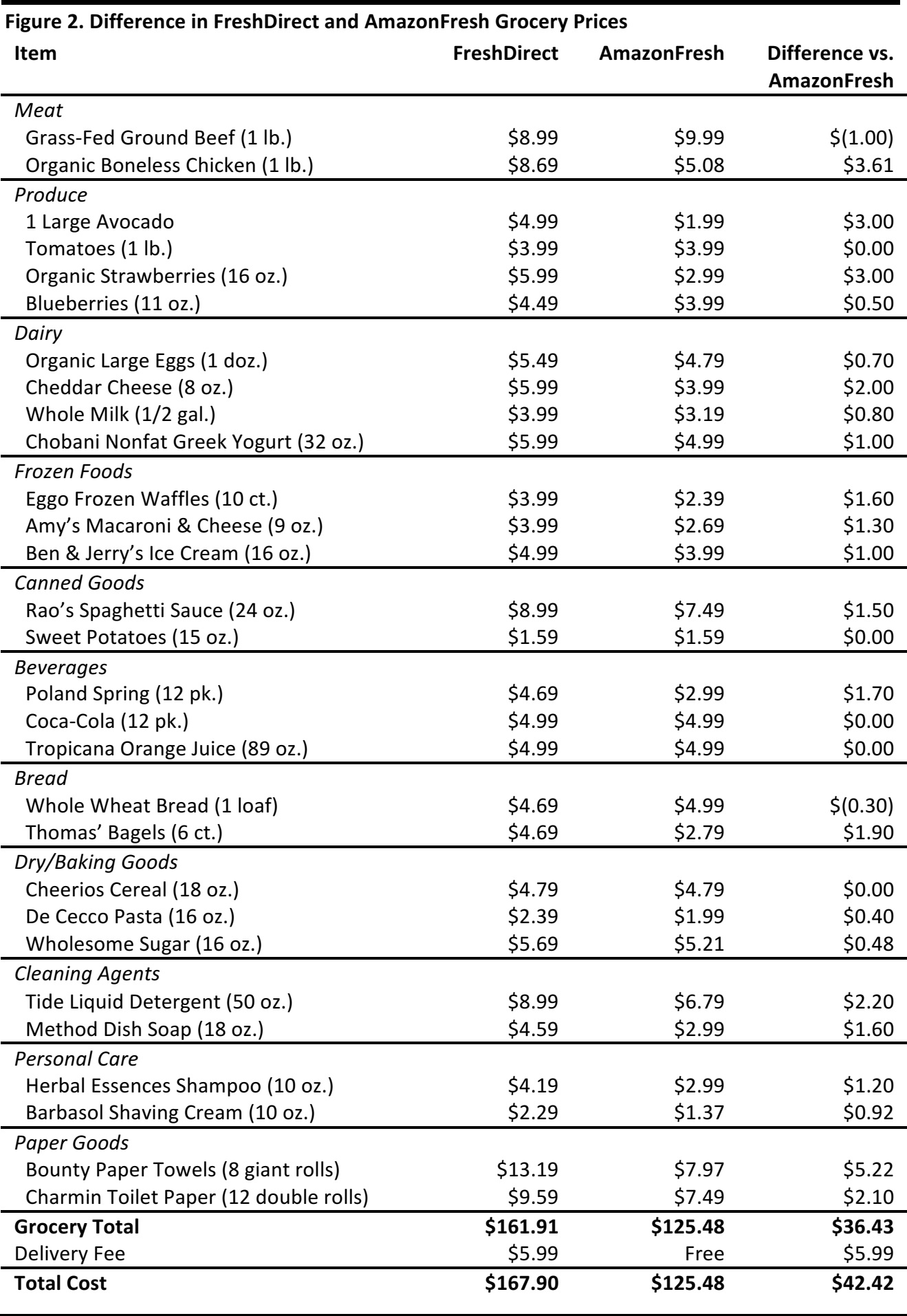

To further evaluate the value of the services offered by FreshDirect and AmazonFresh, we have assembled a sample basket to compare the prices of selected products that are sold by both online grocers.

Source: Company websites

The FreshDirect basket had a total cost of $167.90 versus the AmazonFresh basket’s total cost of $125.48, a difference of $42.42, or 25%. The combination of FreshDirect’s delivery fee and overall higher prices makes it a more expensive online grocery service than AmazonFresh. In all the grocery categories we looked at, AmazonFresh consistently offers cheaper prices than FreshDirect does. Out of all of the products we researched, only grass-fed beef and whole wheat bread were more expensive at AmazonFresh than at FreshDirect.

The FreshDirect basket had a total cost of $167.90 versus the AmazonFresh basket’s total cost of $125.48, a difference of $42.42, or 25%. The combination of FreshDirect’s delivery fee and overall higher prices makes it a more expensive online grocery service than AmazonFresh. In all the grocery categories we looked at, AmazonFresh consistently offers cheaper prices than FreshDirect does. Out of all of the products we researched, only grass-fed beef and whole wheat bread were more expensive at AmazonFresh than at FreshDirect.

For those who frequently order food, AmazonFresh’s annual membership fee of$299 eventually balances out, given the major grocery savings it offers versus FreshDirect. AmazonFresh customers have to spend only $1,200 on groceries to offset their annual fee ($299 divided by 25%) and start enjoying savings, so the service appears to be a good investment, since the average American household spends $3,971 on groceries per year, according to the US Bureau of Labor Statistics. However, FreshDirect appeals to consumers who enjoy more expensive, brand-name products and exotic meal offerings.

For those who frequently order food, AmazonFresh’s annual membership fee of$299 eventually balances out, given the major grocery savings it offers versus FreshDirect. AmazonFresh customers have to spend only $1,200 on groceries to offset their annual fee ($299 divided by 25%) and start enjoying savings, so the service appears to be a good investment, since the average American household spends $3,971 on groceries per year, according to the US Bureau of Labor Statistics. However, FreshDirect appeals to consumers who enjoy more expensive, brand-name products and exotic meal offerings.

Other Grocery Delivery Services

There are other companies engaged in local grocery delivery. Founded in 1989, Peapod is the leading online grocer and it has delivered more than 23 million orders across the country. The company also offers an impressive selection of more than 12,000 products to its customers. For those who need groceries immediately, Amazon Pantry is available for Prime members who want to shop for groceries and household items in everyday packages and Instacart partners with freelance personal shoppers to deliver groceries in as little as one hour to its customers in 18 states. Target partnered with Instacart in 2015 to offer same-day delivery to its customers in selected cities in the US. Safeway is another promising grocery option, offering same-day delivery on orders placed before 8:30 am. The company makes online grocery shopping easy by allowing its customers to shop by their past purchasing history. Blue Apron is a cooking delivery service that provides its customers with both fresh ingredients and recipes on a weekly basis. The preportioned ingredients allow customers anywhere in the US to prepare convenient meals. Walmart is keeping up with the growing e-commerce industry by offering its customers the option to order groceries online and have their car loaded with the items free of charge at the closest Walmart store. In 2014, Walmart debuted a click-and-collect service through which customers can order online and then drive up to kiosks to alert employees that they are ready to pick up their groceries.Lessons Learned from Failed Grocery Delivery Services

In 2001, grocery delivery startup Webvan filed for bankruptcy after being valued at $1.2 billion just a few months before. Webvan’s marketing strategy was to offer the quality and selection of Whole Foods, but at the affordable prices of Safeway. One of Webvan’s first mistakes was pricing its luxury goods at least 30% too low and this did not appeal to high-end customers. Its low-price strategy did not offset the high capital expenditures that were necessary to create a complex infrastructure of expensive technology and distribution centers. Another mistake was expanding too quickly. The company’s 26-city expansion plan and $1-billion Bechtel contract to build new warehouses caused a liquidity shortage.

Home delivery services such as FreshDirect and AmazonFresh have learned to target the proper audience and build the appropriate infrastructure to go with their offerings. Most importantly, they have learned from Webvan that they must expand at an appropriate pace.

Please click here to read our May 2015 report Global Grocery Retailing.

Please click here to read our September 2015 report Target to Pilot Test Grocery Delivery with Instacart

Please click here to read our April 2016 report How Millennials Disrupt Industries Grocery Shopping: New Priorities, New Preferences Millennials and Grocery

In 2001, grocery delivery startup Webvan filed for bankruptcy after being valued at $1.2 billion just a few months before. Webvan’s marketing strategy was to offer the quality and selection of Whole Foods, but at the affordable prices of Safeway. One of Webvan’s first mistakes was pricing its luxury goods at least 30% too low and this did not appeal to high-end customers. Its low-price strategy did not offset the high capital expenditures that were necessary to create a complex infrastructure of expensive technology and distribution centers. Another mistake was expanding too quickly. The company’s 26-city expansion plan and $1-billion Bechtel contract to build new warehouses caused a liquidity shortage.

Home delivery services such as FreshDirect and AmazonFresh have learned to target the proper audience and build the appropriate infrastructure to go with their offerings. Most importantly, they have learned from Webvan that they must expand at an appropriate pace.

Please click here to read our May 2015 report Global Grocery Retailing.

Please click here to read our September 2015 report Target to Pilot Test Grocery Delivery with Instacart

Please click here to read our April 2016 report How Millennials Disrupt Industries Grocery Shopping: New Priorities, New Preferences Millennials and Grocery