Nitheesh NH

Introduction

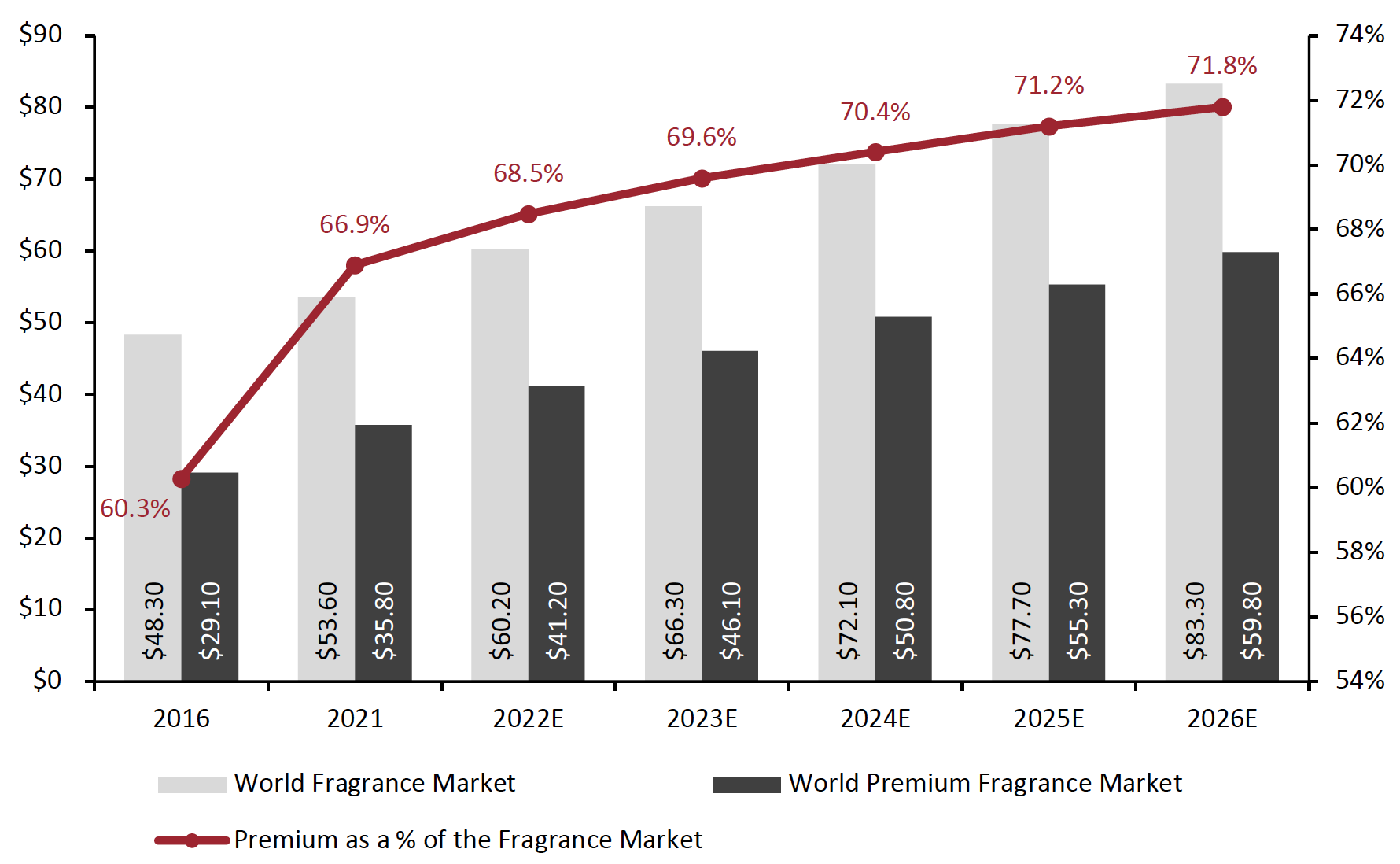

What’s the Story? Historically, outside of price point, the difference between mass and premium fragrances came from distribution. Drugstores and mass merchants carried mass perfumes, while exclusive department and specialty stores carried premium fragrances—however, the Internet and instant access to products erased these diving lines. Now, fragrance brands use ingredient transparency, stronger and cleaner formulations, rare and raw materials, and product efficacy to justify higher price points to consumers (premiumization). The global fragrance industry experienced considerable growth in 2021, driven by strong momentum in premium fragrances. Premium fragrances added 400 basis points (bps) of market share in 2021 alone, accounting for 66.9% of global fragrance industry sales. In this report, we examine the factors driving premiumization in the fragrance market and the resulting opportunities created for beauty, fashion and luxury brands. This report is sponsored by CEW—conversation leaders in the beauty industry and community. Why It Matters In 2021, fragrance became the fastest-growing category in the US beauty industry—up 41.9%—while worldwide fragrance sales rose 18.4%, with China and the US leading momentum. China continues to be a serious opportunity for the fragrance industry: while only 2% of the country’s population uses fragrances daily, they account for approximately 4% of the world’s fragrance sales, according to Euromonitor. Premiumization is driving double-digit sales growth within the fragrance category as consumers trade up to costlier products with greater concentrations, increase fragrance usage overall and extend fragrance use to their homes, adding a lifestyle element to the category. While the trend began before the pandemic, Covid-19 deepened consumer awareness of the emotionally restorative features of fragrance, leading to increased sales. In Figure 1 below, we chart the growth of the global premium fragrance market since 2016 and the estimated growth through 2026.Figure 1. Global Fragrance Market and Premium Fragrance Market (Left Axis; USD Bil.) and Premium Penetration (Right Axis; Premium as % of Total Fragrance Market) [caption id="attachment_151642" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research[/caption]

In 2021, global sales of premium fragrances rose 25.9% within the fragrance market’s overall 18.4% year-over-year growth, leading to a 400 bps market share gain for premium fragrances, according to Euromonitor data. Over the most recent five-year period, premium fragrance sales have grown proportionally to total fragrance sales, from 60.3% in 2016 to 66.9% in 2021. However, this varies by region, with premium fragrances accounting for more than 90% of the fragrance market in China, the UK and the US.

Recently, fragrance leader Puig announced a majority investment in Byredo, a niche Swedish beauty, fragrance and lifestyle brand, underscoring the premiumization trend. Byredo has approximately 30 fragrances at a variety of price points, as well as ancillary fragrance products, including cleaning gels, creams, lotions and perfume oils, providing customers with complete coverage.

Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research[/caption]

In 2021, global sales of premium fragrances rose 25.9% within the fragrance market’s overall 18.4% year-over-year growth, leading to a 400 bps market share gain for premium fragrances, according to Euromonitor data. Over the most recent five-year period, premium fragrance sales have grown proportionally to total fragrance sales, from 60.3% in 2016 to 66.9% in 2021. However, this varies by region, with premium fragrances accounting for more than 90% of the fragrance market in China, the UK and the US.

Recently, fragrance leader Puig announced a majority investment in Byredo, a niche Swedish beauty, fragrance and lifestyle brand, underscoring the premiumization trend. Byredo has approximately 30 fragrances at a variety of price points, as well as ancillary fragrance products, including cleaning gels, creams, lotions and perfume oils, providing customers with complete coverage.

Fragrance Premiumization: Coresight Research Analysis

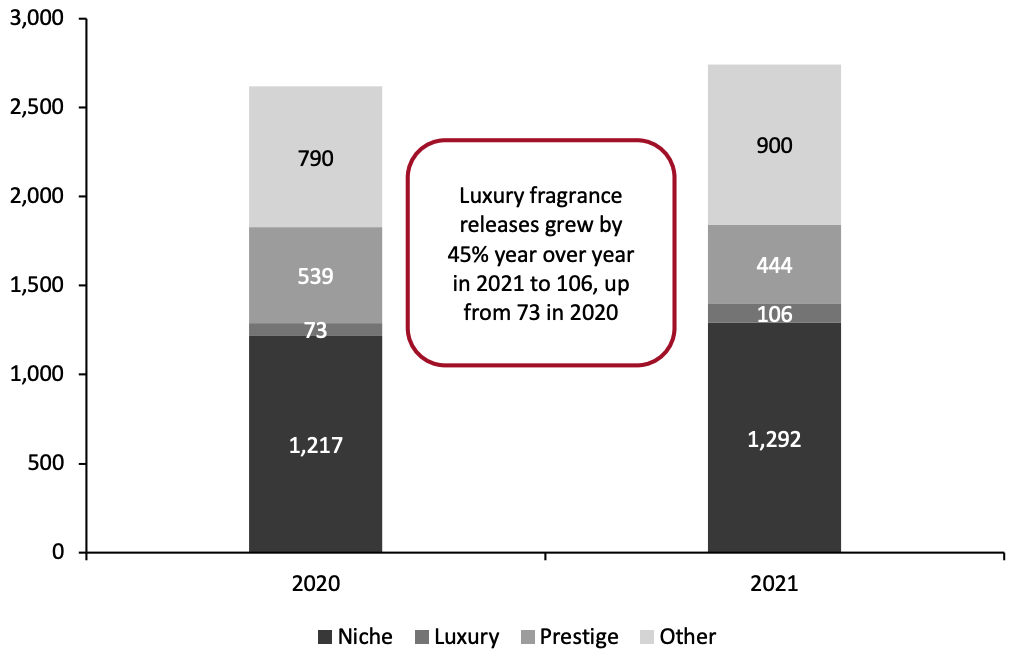

1. Premium Fragrances Have Become a Part of Consumers’ Lifestyles Across the beauty industry, premiumization is a prevailing strategy to engage with customers and educate them regarding product ingredients and efficacies, while also justifying price increases. Typically, in beauty categories such as skincare and haircare, premiumization relies on showing results in a tactile and perceivable way. Fragrance, on the other hand, benefits from increased knowledge of the benefits of fragrance. For instance, smells can significantly affect human emotions due to the connection of the olfactory bulb, which handles smells, and the limbic system, the part of the brain that deals with emotions and memories, according to neuroscientists at the Harvard Brain Science Initiative. Fragrance took on new meaning during the Covid-19 pandemic, as beauty marketers amplified messaging about fragrance’s physical and mental wellbeing benefits, including enhancing one’s home with scents during lockdowns and alleviating pandemic-related stress. In the October–December 2020 issue of Fragrances of the World Quarterly Insights, Michael Edwards, a world-renowned fragrance expert, wrote that retailers observed increased fragrance sales from shoppers “wanting to indulge in small luxuries to help cope with living in lockdown,” coining it “comfort smelling.” Candle and potpourri enjoyed sales lifts as well, likely driven by similar consumer desires. According to Fragrances of the World, fragrance launches in 2019 (pre-pandemic) numbered 3,727, dropping 29.7% to 2,619 in 2020. While launches were up 5.4% year over year in 2021 to 2,742, the total was still 985 launches short of 2019’s total. Still, more than two-thirds (67.2%) of new launches in 2021 were premium.Figure 2. Total World Fragrance Released in 2020 and 2021 (By Segment) [caption id="attachment_149269" align="aligncenter" width="550"]

Source: Fragrances of the World Quarterly Insights, April 2022 issue[/caption]

According to both company reports and industry participants, the growing acceptance of fragrance’s role in self-expression, health and wellness will support the premiumization trend and the increased use of fragrance in the post-pandemic world. Beauty company financial reports issued in the first quarter of calendar 2022 that speak to this continued strong momentum include:

Source: Fragrances of the World Quarterly Insights, April 2022 issue[/caption]

According to both company reports and industry participants, the growing acceptance of fragrance’s role in self-expression, health and wellness will support the premiumization trend and the increased use of fragrance in the post-pandemic world. Beauty company financial reports issued in the first quarter of calendar 2022 that speak to this continued strong momentum include:

Figure 3. Reported Calendar 1Q22 Fragrance Sales Growth for Selected Beauty Companies [wpdatatable id=2050]

Source: Company reports

2. Aspirational and International Consumers Will Drive Premium Fragrance Growth Currently, China is the greatest opportunity market for the fragrance category, given the low penetration usage in the country. Additionally, while usage penetration might be low in China, it appears that Chinese consumers prefer premium fragrances. In the last five years, the proportion of premium to total fragrance sales in China increased 21.1 percentage points, from 72.0% to 93.1%. Meanwhile, in the US, the proportion increased 5.5 percentage points to 91.2%, and in the UK, it only increased 3.6 percentage points to 90.8%. We project that fragrance will continue to make inroads into China due to its low usage penetration and its large segment of young, aspirational consumers, which is also driving overall luxury growth in the country. While China may have a large population of young, wealthy consumers, demand from aspirational shoppers worldwide will drive the continued premiumization of fragrance. For aspirational consumers worldwide, design houses with broad appeal, such as Chanel and Dior, produce widely distributed fragrances at relatively high price points as entry points into the fragrance market. For instance, Les Exclusifs de Chanel is a line of 16 eau de parfums that start at $250 and are available to anyone through Chanel’s website and boutiques, as well as select department stores, including Bloomingdale’s, Bergdorf Goodman and Le Bon Marché. Similarly, Chloé introduced Atelier des Fleurs in 2019, a project in which six perfumers created nine scents intended to be worn solo or layered, potentially increasing the average purchase amount. Price points for Atelier des Fleurs begin at $230, and, like Les Exclusifs de Chanel, the line is available at department stores, the Chloé boutique in Paris and online at chloé.com. These fragrance houses have also introduced more exclusive, higher-priced lines in their premiumization strategies, addressing the increasing demand for premium and niche fragrances. For example, Maison Francis Kurkdjian, which LVMH acquired a majority share of in 2017, produces both premium fragrances—one of which, Baccarat Rouge 540 (beginning at $132), has become a cult hit—as well as expensive scents over $1,000 and even personal fragrances for individual clients. At the very high end of the market, fine fragrances not only include scents created for individual clients but also expensive, limited-edition releases that come in diamond-encrusted flacons, crystal bottles and other over-the-top vessels. These fine fragrances, from brands like Amaffi, Clive Christian and Viktor&Rolf, can range from four to six figures in price. The Coresight Research team visited the Amaffi perfume house in New York City, where available fragrance price points begin at $2,800. While demand for these expensive fragrances has not grown greatly, they do set the tone for the premium fragrance segment. [caption id="attachment_149270" align="aligncenter" width="700"] Amaffi 57th Street, NYC Flagship display (left); Power for Women flacon (right)

Amaffi 57th Street, NYC Flagship display (left); Power for Women flacon (right)Source: Coresight Research[/caption] 3. Increased Demand Will Bring New Players More recently, mass retailers such as Kohl’s, Sephora, Target, Ulta Beauty and Walmart have also joined the premiumization trend, elevating beauty at mass in the US. One of the benefits afforded to essential retailers during the pandemic was the influx of new customers who could only shop at their stores because of store closures. Now, they are looking to keep those customers by offering a wider variety of fragrances, strengthening the premiumization trend and increasing the number of premium fragrances sold overall. We averaged the price of the 39 “best new fragrance drops” of 2021, according to Cosmopolitan, a popular fashion, beauty and entertainment magazine, for a total average of $156, with a range of $20 to $440 (see Figure 4 below). Almost all the fragrances are available from mass retailers, namely Sephora and Ulta Beauty. Only 31% are priced in the double digits, while 69% sell at over $100 a bottle. Of those over $100, 15 (38%) are priced between $100 and $200, eight (21%) between $200 and $300, four (10%) between $300 and $400 and only one, NoMad Bond No.9 New York, is priced over $400.

Figure 4. “Best” New Fragrance Drops 2021 [wpdatatable id=2051]

*Two or more varieties of the fragrance were sold or the scent was sold at multiple price points depending on retailer; the price listed is the average of all price points, sizes (excluding travel sizes) and varieties sold Source: Cosmopolitan/Coresight Research

Increased demand for premium fragrances will also lead to new brands and designers entering the category. For instance, in April 2022, Virgil Abloh’s brand, Off-White, made its foray into fragrance with a line of four genderless scents called Solution. Each product in the line costs $185, and they are available to customers worldwide from multiple websites. While we see mass, non-premium fragrance moderately losing market share in the industry, we envision sales growth, which will benefit the beauty industry overall. In the US, Victoria’s Secret Beauty holds the leading industry share of the mass fragrance, with more than a quarter of the segment, thanks to the power of the brand and its 800+ US stores. Victoria’s Secret Beauty just launched on Amazon, which we believe will likely increase its share of the US fragrance market. Victoria’s Secret has also targeted international markets, including China, in its growth plans, and so we believe it will likely capture global share as well.What We Think

We project that the premiumization of fragrance, new fragrance launches and increased penetration and usage will drive industry growth for the next five years, with premium fragrance brands outpacing mass fragrance brands and capturing a growing portion of the global fragrance market. As a result of increased demand for premium fragrances, new designers, brands and retailers will also be attracted to the category, further strengthening the market share of premium fragrances. Implications for Brands/Retailers- Fragrance is increasingly used for self-expression and wellness, both in and outside the home. This provides the market with emotional potency and opportunities for consumer engagement and loyalty. Fragrance can be additive to brands’ go-to-market proposition and should be considered part of their product portfolio.

- With the premiumization of fragrance, fashion brands have the ability to change consumers' perception of them, transitioning from fashion to luxury.

- Digitally native and specialty apparel brands can use premium fragrances as an add-on or impulse purchase, increasing various retail metrics, including units per transaction and average transaction value.

Source for all Euromonitor data: Euromonitor International Limited 2022 © All rights reserved