albert Chan

Introduction

What’s the Story?

In our monthly countdown to Singles’ Day, also known by Alibaba as the 11.11 Global Shopping Festival, we will help brands and retailers to prepare for the event.

In this report, we present four key strategies that brands and retailers should implement to set themselves up for success during this year’s shopping festival—covering marketing, public policy, e-commerce trends and more.

Why It Matters

Singles’ Day represents the most important opportunity of the year for e-commerce platforms and brands in China to generate a large portion of annual revenue and increase brand recognition among Chinese consumers. This year’s Singles’ Day falls at a tricky time when China has undergone persistent lockdowns and consumption patterns are shifting, so brands and retailers need to prepare early and take action to maximize potential gains.

Four Months to Singles’ Day: Coresight Research Analysis

1. Work with Influencers To Promote Your Brand and Products

Brand and retailers can leverage influencers and social media to build relationships with consumers and positively impact their purchasing decisions. Influencers can host livestreaming sessions, attend online and offline brand events, and promote products on their personal social media accounts.

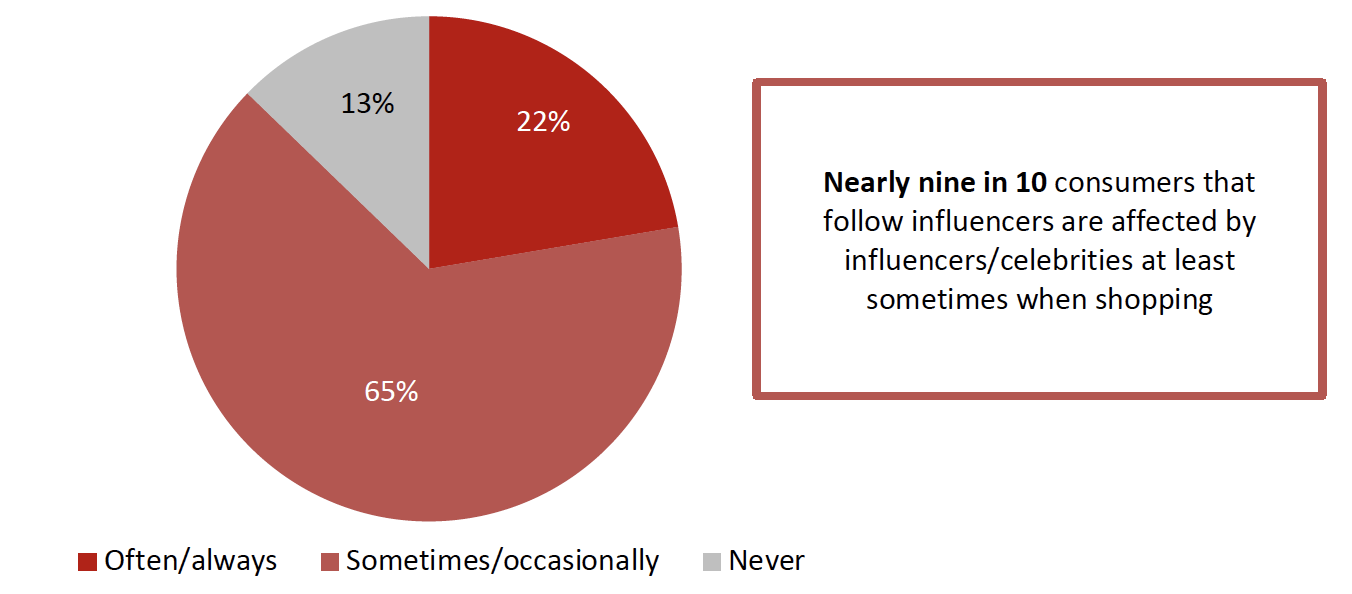

A May 2022 Coresight Research survey of Chinese consumers found that influencers/celebrities “often/always” affect the shopping decisions of more than one-fifth of respondents who follow influencers/celebrities on social media—and around two-thirds of the same group report being “sometimes/occasionally” influenced in their purchasing by the influencers/celebrities that they follow (see Figure 1).

By incorporating influencers into their marketing strategy, brands can therefore improve conversion to boost sales, in addition to tapping influencers’ existing networks of potential shoppers.

Figure 1. Chinese Respondents Who Follow Influencers/Celebrities on Social Media: How Often Influencers/Celebrities Affect Their Shopping Decisions (% of Respondents) [caption id="attachment_151141" align="aligncenter" width="550"]

Base: 1,683 Chinese respondents aged 18+ who follow influencers/celebrities, surveyed in May 2022

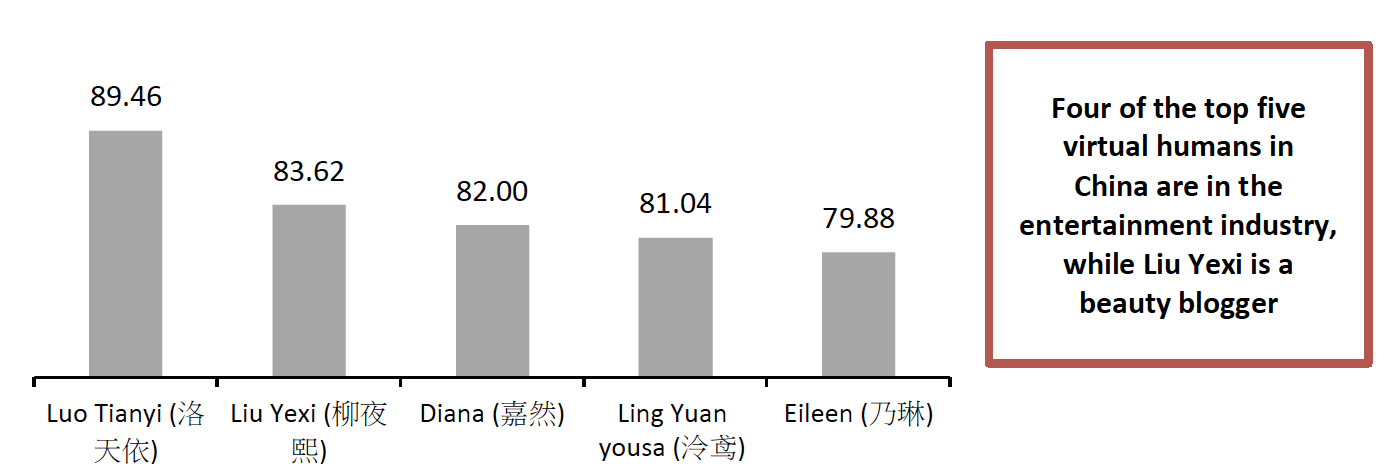

Base: 1,683 Chinese respondents aged 18+ who follow influencers/celebrities, surveyed in May 2022Source: Coresight Research[/caption] There are different types of influencers that brands can work with, and each offers different benefits. Brands and retailers should consider their goals and target audience when selecting influencers to partner with. We discuss four types of influencers below. Key Opinion Leaders (KOLs) KOLs are a popular choice to market products as they have a very large, established base of followers and may even have professional training. KOLs are typically categorized into three tiers based on their reach, with Tier 1 KOLs having at least 1 million followers. Brands can tap KOLs to promote hero products and gain brand exposure with engaged target audiences. For example, beauty brands and retailers can partner with KOLs that specifically create content about beauty products. However, KOLs are more expensive than other types of influencers. In addition, big-name KOLs have run into trouble in recent months, such as Viya, who was fined $210 million for tax evasion and has since had all online accounts shut down by authorities. Most recently, Austin Li (Li Jiaqi, known as the “Lipstick King”) abruptly disappeared during a livestreaming session at the beginning of the 6.18 Shopping Festival. His disappearance caused brands to scramble as they were counting on generating a large portion of total sales from his promotions. Brands may need to consider the increasing PR risks in working with KOLs. Key Opinion Consumers (KOCs) KOCs are appealing to consumers as they are perceived to be more authentic and relatable than KOLs—giving their honest opinions about products and brands rather than simply producing sponsored posts for products they may not have used. KOCs are also a lower-cost option for brands. However, KOCs have smaller follower bases than KOLs, meaning that there is a smaller potential reach that brands can achieve through a marketing campaign involving these influencers. Virtual Humans Virtual humans are becoming increasingly popular for brand marketing, appearing at brand events and participating in livestreaming campaigns. Virtual influencers provide more opportunities for brands to engage in the metaverse and other new tech-forward experiences compared to other influencers. They also present less PR risk to a brand compared to real humans. According to an iiMedia report, the most influential virtual people in China as of April 2022 were Luo Tianyi, Liu Yexi, Diana, Ling Yuan yousa and Eileen (see Figure 2). Four of these are in the entertainment industry, demonstrating the expansion of celebrity culture into the virtual world: Diana and Eileen are both members of A-SOUL, a virtual idol girl group with five members; and Luo Tianyi and Ling Yuan yousa are singers. Just like real-life celebrities, virtual idols can be used as livestream hosts to boost a brand’s exposure. Luo Tianyi has co-hosted livestream e-commerce campaigns with KOL Austin Li. [caption id="attachment_151142" align="aligncenter" width="350"]

Diana (left) and Eileen (right) who are both part of A-SOUL, a virtual idol group

Diana (left) and Eileen (right) who are both part of A-SOUL, a virtual idol groupSource: YouTube[/caption] [caption id="attachment_151143" align="aligncenter" width="250"]

Luo Tianyi appears on Austin Li’s livestreaming session

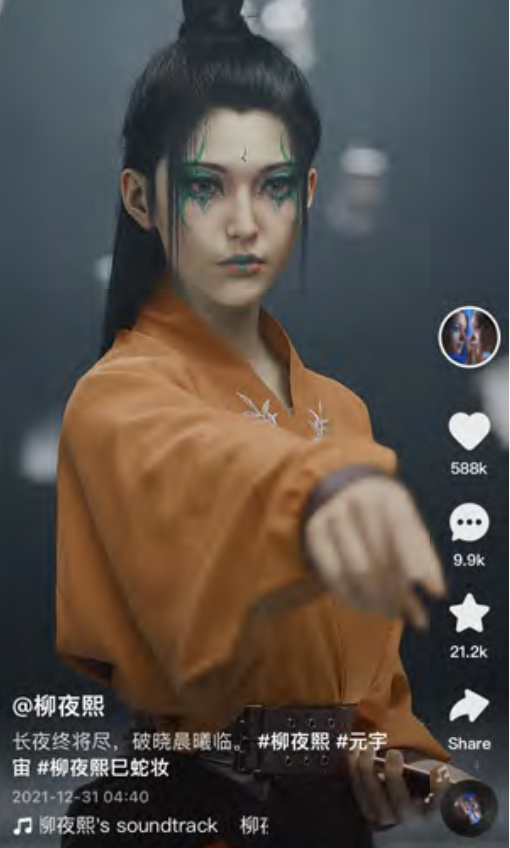

Luo Tianyi appears on Austin Li’s livestreaming sessionSource: Bilibili[/caption] Rounding out the top five virtual humans in China is Liu Yexi, a beauty blogger. Liu Yexi first appeared on short-video platform Douyin in November 2021, attracting 2.3 million followers in three days. Earlier this year, Liu Yexi appeared in a viral short drama episode as part of a marketing campaign by XPeng, an electric vehicle manufacturer, which generated over 80 million views. [caption id="attachment_151146" align="aligncenter" width="250"]

Liu Yexi debuts on Douyin

Liu Yexi debuts on DouyinSource: Douyin[/caption]

Figure 2. Top Five Virtual Humans in China, Ranked by iiMedia’s Gold List Index [caption id="attachment_151147" align="aligncenter" width="550"]

iiMedia’s Gold List Index is a 0–100 scoring model that uses big data analytics for score calculations, based on industry interviews and market research

iiMedia’s Gold List Index is a 0–100 scoring model that uses big data analytics for score calculations, based on industry interviews and market researchSource: iiMedia[/caption] Virtual humans have gained a lot of attention through Chinese social media platforms such as Xiaohongshu and Douyin, driving traffic for brands that may be viewed as more tech-forward and embracing of the metaverse for partnering with virtual influencers.

- Read more about meta humans and virtual idols in our separate Metaverse Latest report.

2. Seize Localized Marketing Opportunities Offered by Major Platforms

International brands should look to leverage the cross-border tools of major e-commerce platforms, which are continuing to develop capabilities for brands to easily and efficiently set up online international stores and market products in China.

- The JD-Shopify partnership, which was announced in January 2022, is a new gateway for US merchants and independent brands looking to expand into the e-commerce market in China. Through the partnership, JD.com offered special benefits to US merchants during the 6.18 Shopping Festival, including special promotional activities and participation in JD Worldwide’s (JD.com’s platform for imported products) “Overseas Direct Purchase Campaign,” in which items identified as potential bestsellers were listed in the “select product pool” for additional exposure.

- US cosmetics brand ColourPop, which sells its products through its Shopify site and Ulta.com, recently launched its brand on JD.com through the JD-Shopify partnership and announced prior to 6.18 that it had already experienced a month-over-month growth rate of 550%. Special coupons and newcomer rights were also offered to first-time shoppers at Shopify merchants.

- In 2018, Alibaba reported how TMIC had helped L'Oréal’s SkinCeuticals brand identify that its customers in China were actually in the 19–30 age group, rather than above-35 age group as is the case in the US and Europe. TMIC went on to help SkinCeuticals redesign its online flagship store to appeal to the younger target consumer and suggested the brand alter the packaging of one of its bestselling products. Following these changes, average spending per transaction on the SkinCeuticals online flagship store doubled, according to Alibaba.

- JD.com launched its “Green Impact Initiative” on May 31, featuring around 1 million products as green-labeled items on its marketplace, from global consumer brands such as Abbott, CHERY, JOMOO, L’Oréal, Nestlé, Panasonic, Procter & Gamble (P&G) and PurCotton. Through the newly established green account system integrated into JD.com’s app, shoppers can collect green credits that they can redeem for green products, which may use reduced packaging or sustainable materials, or may be delivered via low-carbon transportation, for example. Green products include sustainable fashion and furnishing products as well as energy-efficient appliances.

- Read about China’s latest five-year plan (for the period 2021 – 2025) in our separate report.

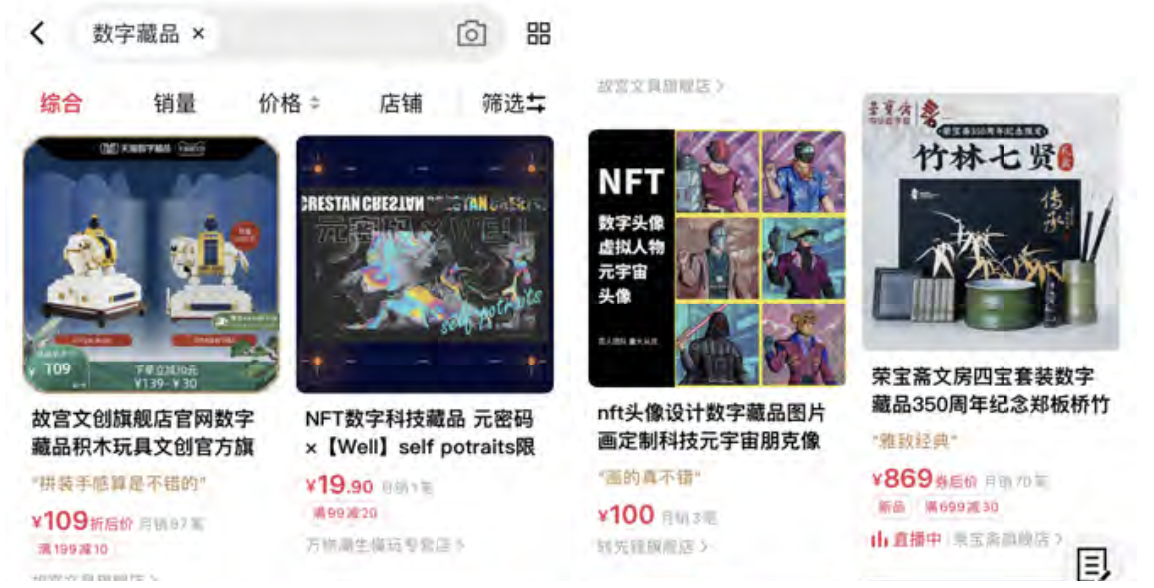

- During 6.18, huge brands such as Adidas, Chow Tai Fook and Jordan began launching limited-edition digital collectibles. Shuanghui, a large Chinese food company, partnered with TheOne.art to launch its own digital collectibles for the first time. Shuanghui generated huge traffic, topping the list of popular food brands on Tmall during the festival.

- On June 30, 2022, Tmall established a “digital collections” page, launching 50 digital collections of 40 brands, including international brands such as Breitling, Burberry, Puma and Versace. These digital collectibles are available as digital gifts with purchases of physical goods from Tmall.

Digital collectibles on Tmall

Digital collectibles on TmallSource: Tmall[/caption] Another current trend in China e-commerce is brand partnerships in short drama series as part of promotional campaigns. According to Endata, as of March 2022, short drama series on Douyin increased by 53% compared to six months prior. Moreover, in the first quarter of 2022, the average number of brand partnerships in online series increased year over year while those in TV series decreased.

- In addition to the XPeng x Liu Yexi series mentioned earlier in this report, other popular short series include the 20-episode Night Shift Diary, which was posted through February and March by Shiqi Jiang, a content creator primarily on Douyin and Kuaishou with a combined follower count of 46.5 million. Two episodes of the series were released in collaboration with Mars Wrigley; in episode 19, the characters display chewing gum on screen several times and the Mars Wrigley slogan appears.

Mars Wrigley marketing scene from episode 19 of Night Shift Diary

Mars Wrigley marketing scene from episode 19 of Night Shift DiarySource: Douyin[/caption]

What We Think

Given trends in the Chinese economy and shifting consumption patterns this year, Singles’ Day 2022 is likely to present new challenges for retailers. Brands will need to utilize new marketing tools and strategies to successfully win over the evolving Chinese consumer. Implications for Brands/Retailers- Brand and retailers can leverage influencers and social media to reach wider audiences, build relationships with consumers and positively impact their purchasing decisions. Brands should consider the benefits of working with different types of influencers, including key opinion leaders, key opinion consumers, virtual humans and in-house sales staff.

- Brands can utilize tools and opportunities available through major e-commerce platforms that are well equipped to offer easier and secure China market entry and help brands implement better localized marketing strategies.

- Brands should stay up to date with evolving Chinese public policy and align their initiatives accordingly, such as by promoting sustainable products.

- Brands should tap new marketing methods that provide fresh opportunities to engage Chinese consumers. Digital collectibles and short drama series are current e-commerce trends that brands can look to participate in to interact with engaged consumers during Singles’ Day promotions.