albert Chan

What’s the Story?

In our monthly countdown to Singles’ Day, also known as the 11.11 Global Shopping Festival, we will help brands and retailers to prepare for the event and make the most of the huge opportunities it presents.

In this report, we present five actions that brands and retailers should take to set themselves up for success during this year’s shopping festival, covering marketing, sales targets, product portfolios and more.

Why It Matters

Singles’ Day, held annually on November 11, is the world’s largest online shopping event in terms of GMV. Brands and retailers need to prepare their logistics, marketing and inventory management strategies well in advance of the festival in order to ensure that they are well positioned to drive traffic and maximize sales—particularly this year, as the world continues to recover from the Covid-19 pandemic.

Four Months to Singles’ Day: In Detail

To effectively prepare for Singles’ Day 2021, brands and retailers should take five key actions as early as possible. We summarize these in Figure 1 and explore each in detail below.

Figure 1. Five Actions That Brands and Retailers Should Take To Prepare for Singles’ Day 2021 [caption id="attachment_129791" align="aligncenter" width="550"]

Source: Coresight Research[/caption]

1. Choose Multiple Sales Channels and Platforms

Source: Coresight Research[/caption]

1. Choose Multiple Sales Channels and Platforms

In addition to e-commerce platforms such as JD.com and Alibaba’s Tmall and Taobao, brands and retailers should consider using multiple social media sites to increase brand awareness in advance of Singles’ Day and boost sales during the event.

For example, for the 6.18 Shopping Festival this year, L’Oréal created 890 sponsored posts with KOLs (key opinion leaders) between April 1 and June 20 on Little Red Book—almost double the number of posts it published in the year-ago period. According data provider Qiangua, the each post achieved 774 engagements and 252,000 views, on average. The beauty company also leveraged its stores on Douyin, Weibo, as well as via its WeChat mini program, to extend its reach and maximize brand exposure.

[caption id="attachment_129792" align="aligncenter" width="300"] Source: L’Oréal’s stores on Weibo, Little Red Book, WeChat mini program and Douyin[/caption]

Source: L’Oréal’s stores on Weibo, Little Red Book, WeChat mini program and Douyin[/caption]

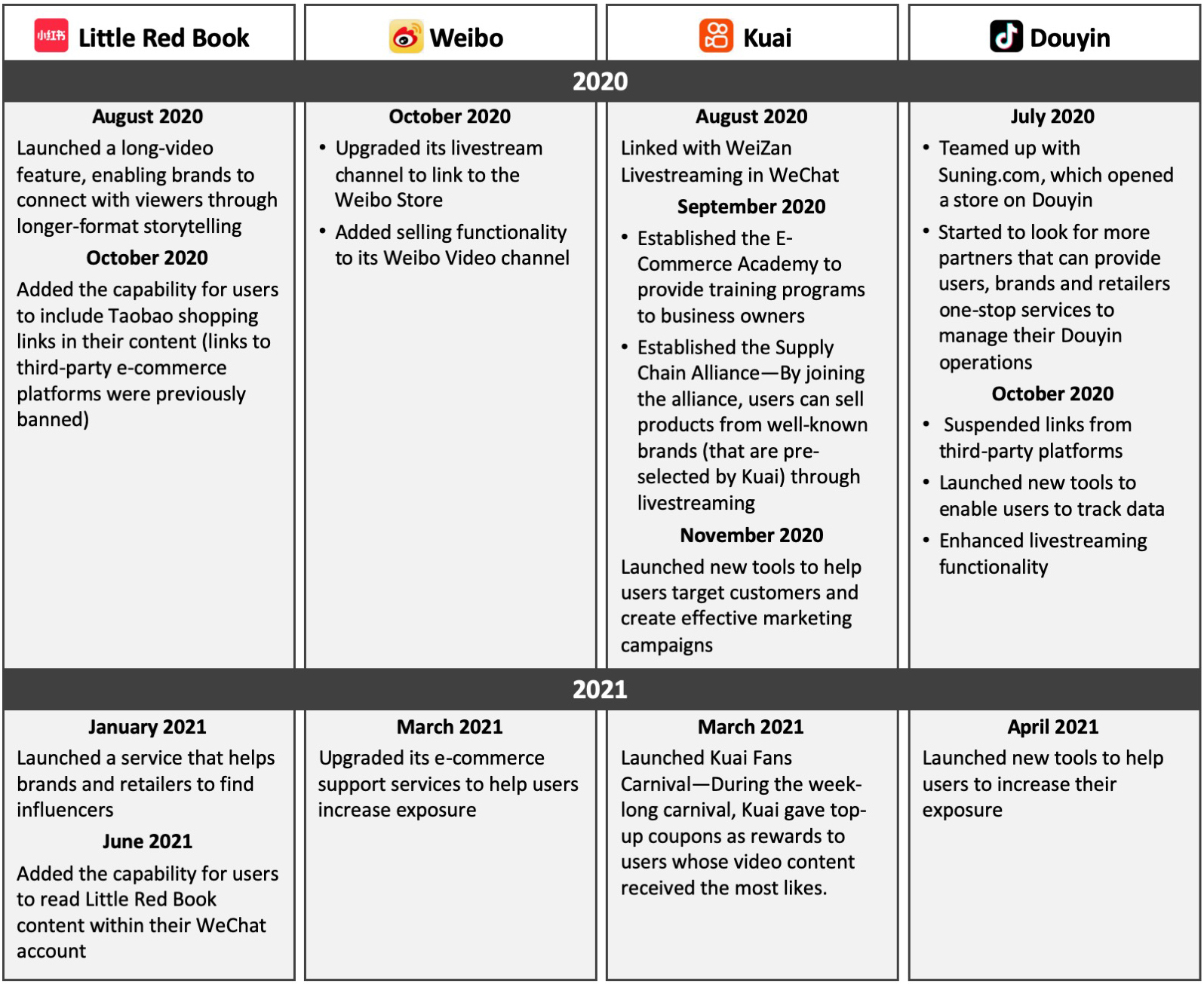

Social media platforms in China have been adding new tools to help their users sell more products through user-generated content. We summarize examples of such developments in Figure 2.

Figure 2. Recent Developments by Selected Social Media Platforms To Help Users, Brands and Retailers To Drive Traffic and Revenue Through Social Commerce [caption id="attachment_129793" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

- For more about popular marketing tools and notable platforms in China that brands and retailers can use to build brand awareness and drive sales during Singles’ Day, read our separate report on livestreaming and content marketing.

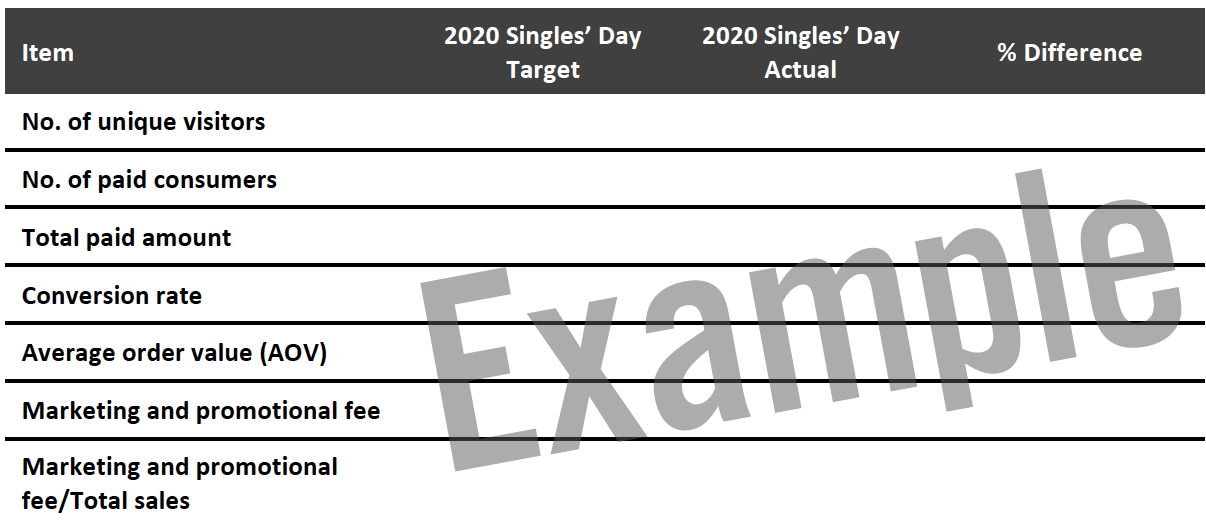

Brands and retailers need to set their Singles’ Day sales targets in order to calculate inventory levels, recruit a dedicated Singles’ Day project team and plan for marketing and promotional events.

In order to set and manage realistic sales targets, brands and retailers should work from their estimated and actual sales figures during Singles’ Day 2020, as well as their monthly sales performance since November 2020, to work out a reasonable rate of growth. Brands that are new to Singles’ Day should use other shopping festival results (such as 6.18) and monthly sales data as a baseline. We give an example template for sales target modelling in Figure 3.

Figure 3: Sales Target Modeling Template

[caption id="attachment_129794" align="aligncenter" width="550"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Furthermore, brands and retailers can use scenario planning. The best-case scenario is normally based on the strategic sales growth target, while the worst-case scenario is based on the sales forecast, given the sales performance from the previous year’s Singles’ Day. Brands and retailers also need to set a base sales goal. Using these scenarios, brands and retailers can plan their inventory and logistics to strive toward the targets under the best-case scenario.

3. Allocate the Marketing BudgetIt is crucial for brands and retailers to effectively allocate and manage their marketing budget while executing a dedicated Singles’ Day marketing plan. Although there is no rule of thumb on how much to spend on marketing during the shopping festival, new brands typically need to spend more than well-established brands, for whom raising brand awareness is not a priority. For example, if a new brand’s sales from Singles’ Day are expected to account for 40% of total annual sales, its marketing budget for the event could comprise as much as 60% of its annual marketing budget. On the other hand, for a well-known brand that sees 30% of annual sales generated through the shopping festival, 30% of its annual marketing budget could be allocated to Singles’ Day.

To estimate how much will be spent on marketing, brands and retailers should take several factors into consideration, including retail category—FMCG companies typically spend more on marketing, while the automobiles sector spends less—sales targets under the base-case scenario, inventory levels, average daily marketing expenses and marketing strategies. Brands and retailers should track their in-channel (through Tmall and Taobao) and out-channel (via other platforms) marketing expenses, total sales and return on investment during the previous Singles’ Day festival. Brands that are new to Singles’ Day can use recent sales data and leverage third-party data providers, such as Qianniu and Sheng Yi Can Mou, to find out how their peers allocate marketing expenses.

4. Develop Plans for Inventory, Logistics and Product PortfoliosProducts have different production cycles, and for brands and retailers that are selling imported products, it takes time for inventory to be allocated and for the products to be shipped and clear customs. It is therefore important that brands and retailers develop inventory and logistics plans as early as possible to ensure they have stock available for Singles’ Day sales.

When identifying their focus products for the shopping festival, brands and retailers need to find a balance between hero products—those that have high margins and generate the majority of sales—and traffic-driving products, which are typically loss leaders that have the sole purpose of attracting consumers to the store. Traffic-driving products have a low average order value, positive reviews, high conversion rates and typically zero, sometimes even negative, profit margin. Brands and retailers also need to identify alternative offerings to their hero products to give consumers additional options when hero products sell out. Having complementary products to hero products helps brands to increase total sales and average order value.

5. Build a Dedicated Customer Service TeamA great customer-service interaction solidifies customer loyalty and has huge potential for driving sales. This is particularly crucial during Singles’ Day, when the number of inquiries could be 10 times more than on an average day. Brands and retailer need to build a dedicated customer service team for the shopping festival. When headcount planning for the team, companies should review their best-case sales target, average daily sales and average daily inquiries and total inquires during the previous Singles’ Day.

Brands and retailers can leverage artificial intelligence (AI)-based technologies, such as chatbots, to handle repetitive pre-sales inquiries. For example, in 2015, Alibaba launched Alime Shop Assistance, an AI chatbot that can provide assistance to both merchants and consumers. According to Alibaba, the chatbot analyzes consumer sentiment and sends alerts to human customer service representatives for priority cases. During Singles’ Day 2020, Alime handled 2.1 billion queries. With the help of an AI-based chatbot, customer service teams can focus on more complex aftersales inquiries, including handling complaints and dealing with returns.

What We Think

To set themselves up for success during this year’s Singles’ Day shopping festival, brands and retailers need to start planning early. We recommend that they promote their brands, products and promotions through multiple social commerce platforms, set reasonable and best-case sales targets, allocate the marketing budget, develop plans for product portfolios and build a dedicated customer service team.

Implications for Brands/Retailers

- With the increasing popularity of social commerce among consumers in China, brands and retailers should take a multichannel/platform approach to launching Singles’ Day campaigns in order to maximize brand exposure—including platforms such as Douyin, Little Red Book and WeChat mini programs.

- Brands and retailers should use their own data, such as monthly sales, average order value and customer interactions to help them with marketing and sales planning. They should also leverage data from third-party data providers to track their performance and targets against peers.

- Brands and retailers can use technologies such as AI-powered chatbots, to improve efficiency during the largest and busiest shopping festival in the calendar.