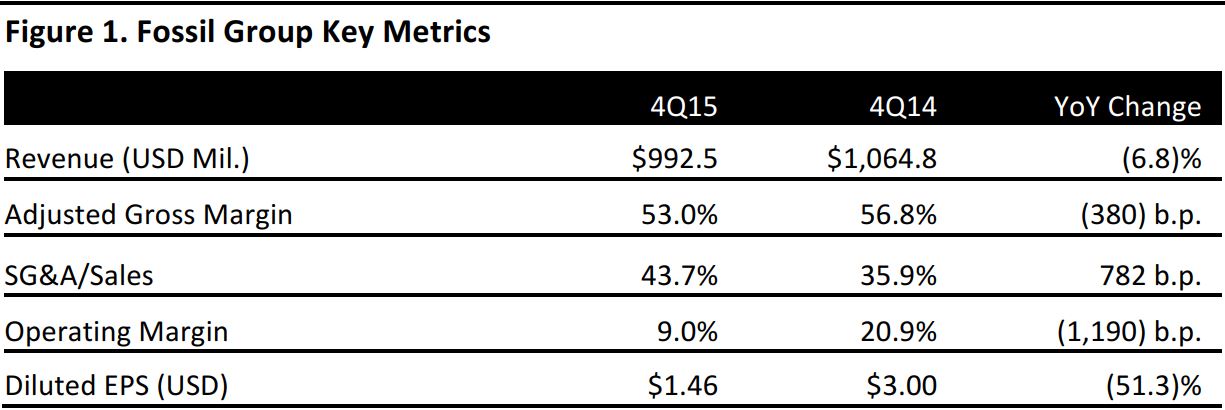

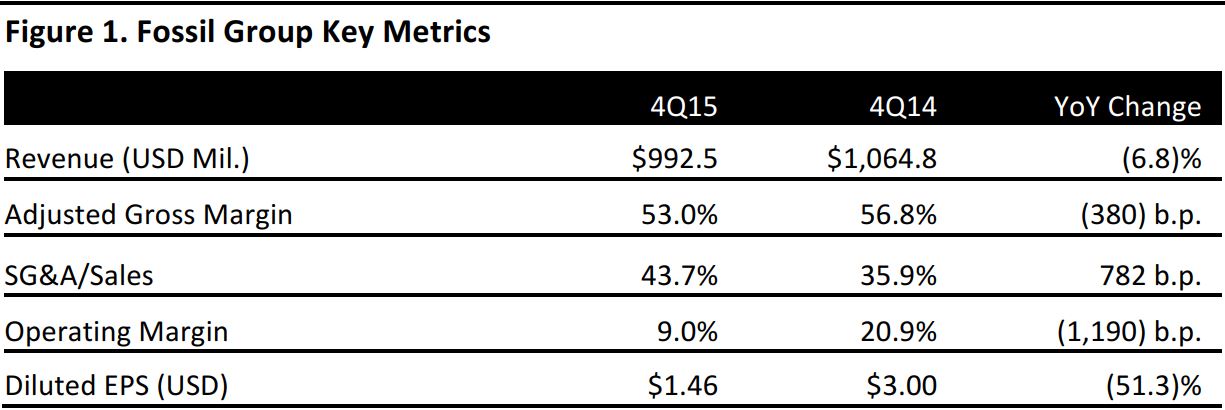

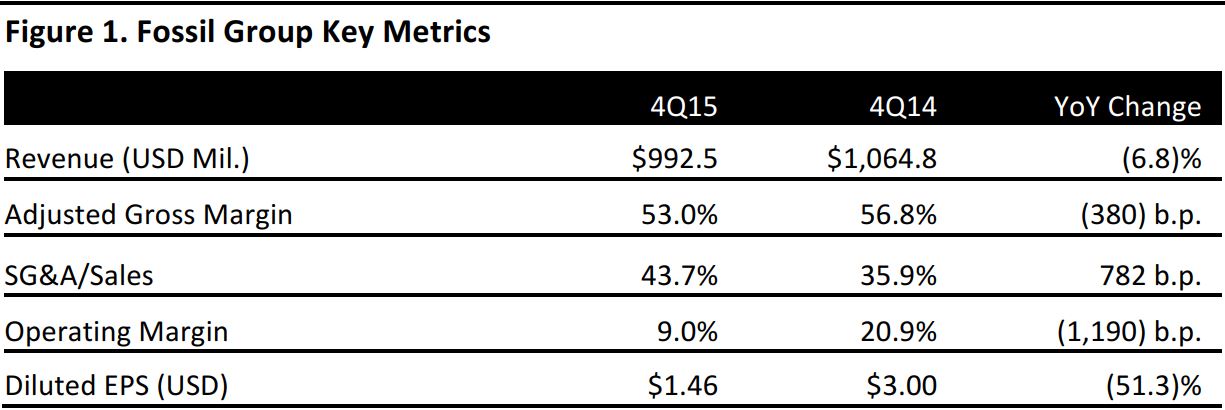

Source: Company reports

Fossil reported better-than-expected 4Q15 results despite recording declines in sales and earnings in the face of currency headwinds. Total revenue was $992.5 million, a decrease of 2% on a constant currency basis. The addition of the Kate Spade New York and Chaps brands helped Fossil’s licensed business, while growth in its Skagen and Fossil brands boosted results. The company improved its digital capabilities with the launch of a new website, which helped drive double-digit growth in its e-commerce channel. Revenue growth was offset by a decline in the company’s licensed watch portfolio and by the negative impact of changes in foreign currency.

Across product categories, a modest, 4% increase in leather was partially offset by a 2% decrease in watches and flat sales of jewelry compared to the year-ago quarter.

Global retail comps for 4Q15 increased by 1% over 4Q14. A solid comparable sales increase in Europe was partially offset by a modest decline in the Americas and flat comps in Asia.

On a constant currency basis, net sales in Europe increased by 3% year over year, with modest increases in watches, leather and jewelry. Within the region, strong growth in France was partially offset by a decline in distributor markets.

Net sales in the Americas decreased by 3% year over year, with single-digit growth in leather offset by a decline in watches and jewelry. Flat sales in the region’s retail channel were offset by a decline in the US wholesale channel.

Net sales in Asia declined by 9%, with an increase in leather offsetting declines in watches and jewelry. Within the region, continued growth in India and a return to growth in

South Korea were offset by declines in most markets, including Japan, Hong Kong and China.

For FY15, Fossil reported net income of $220.6 million, or $4.51 per diluted share. The company reported revenue of $3.23 billion, down 7% from the previous year. The strong dollar hurt net sales by $207.5 million and reduced diluted EPS by $1.12. On a constant currency basis, net sales decreased by 1% compared to FY14.

Guidance

Fossil expects its recent, $260-million acquisition of wearable watch company Misfit to offer many future growth opportunities, thanks to the convergence of fashion and technology the acquisition presents. Foreign currency translation costs related to the acquisition and the absence of a 2015 foreign tax credit benefit are expected to continue to negatively impact diluted EPS in FY16.

For FY16, the company expects diluted EPS of $2.80–$3.60, in line with the consensus estimate of $3.12. Net sales are projected to be in the range of (3.5)%–1.0%, compared to the consensus of a 4% sales decline.

For the current quarter, the company expects sales to decline by 7%–10%, with diluted EPS of $0.05–$0.20. The consensus estimate of $0.42 per diluted share includes the expectation that sales will fall by 9%.