DIpil Das

Forever 21 announced it had filed for Chapter 11 protection to “reorganize and reposition the business,” according to Linda Chang, Executive Vice President of Forever 21. To facilitate the restructuring, Forever 21 has obtained $275 million in financing from existing lenders as well as $75 million in new capital from TPG Sixth Street Partners.

Forever 21 intends to use the Chapter 11 protection and the new financing for a global restructuring to focus on core profitable parts of its operations. The company plans to exit most international locations in Asia and Europe, but will continue operations in the US, Mexico and Latin America. With the additional funding, Forever 21 plans to continue operating business as usual, will maintain all company policies and will continue to honor gift cards, accept returns, exchanges and offer refunds. The company states on its website that it plans to keep many stores open, and will close some through the bankruptcy process, but media reports indicate the company may close 178 stores in the US and up to 350 stores in total, but Coresight Research has not been able to independently verify this.

To date in 2019, there have been 35 major US bankruptcy announcements as tracked by S&P Capital IQ, of which 69% have been retailers, meaning the companies operate in consumer packaged goods, apparel, accessories and footwear. This is on par with the same period in 2018 (through September 30), during which there were 34 bankruptcy announcements, 64% of which were in retail.

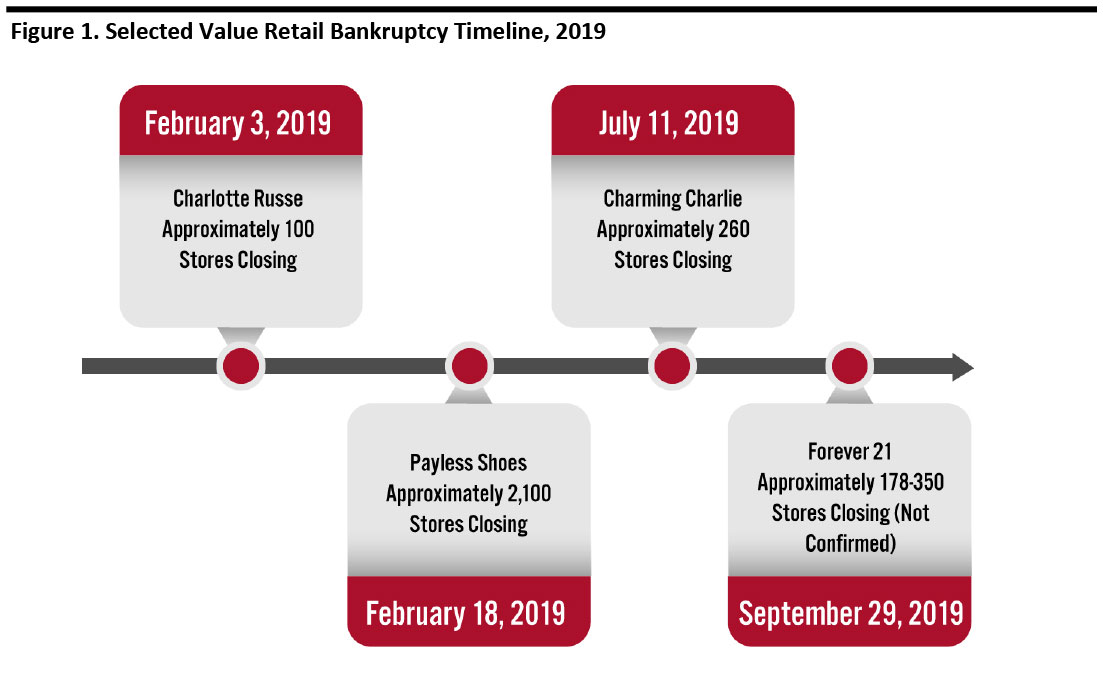

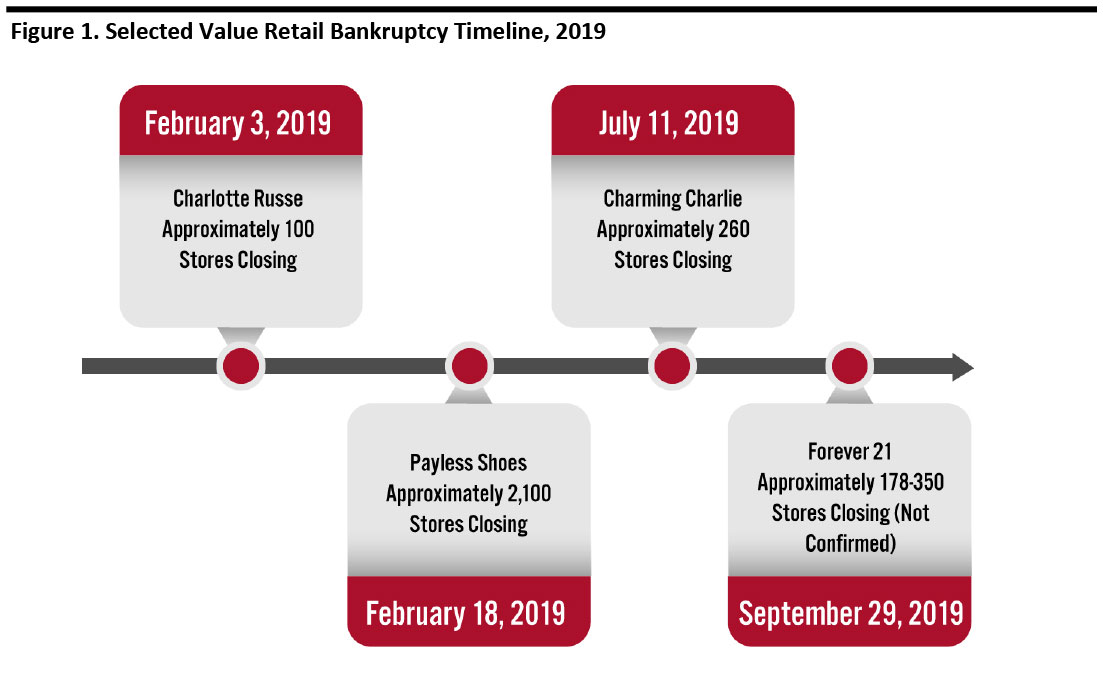

Forever 21 focuses on value prices and fast fashion, and is not the first value retailer to file for bankruptcy this year: Charlotte Russe, a mall-based retailer focused on value apparel and accessories for teens, filed for bankruptcy in February; Payless, a value shoe retailer, filed for bankruptcy on February 18, 2019; and, Charming Charlie, a company offering trendy apparel and accessories for the younger consumer at value prices, filed for bankruptcy on July 11, 2019. Please see the timeline below of selected value and fast-fashion retailers that filed for bankruptcy in 2019 with the estimated store closures per announced bankruptcy.

[caption id="attachment_97345" align="aligncenter" width="700"] Source: Company reports[/caption]

Competition is increasing both in store and online with numerous stylish, value options available. Consumers are able to search for exactly what they are seeking and in most cases, for the price they are willing to pay. Some long-standing value chains are faltering in the face of such competition.

Source: Company reports[/caption]

Competition is increasing both in store and online with numerous stylish, value options available. Consumers are able to search for exactly what they are seeking and in most cases, for the price they are willing to pay. Some long-standing value chains are faltering in the face of such competition.

Source: Company reports[/caption]

Competition is increasing both in store and online with numerous stylish, value options available. Consumers are able to search for exactly what they are seeking and in most cases, for the price they are willing to pay. Some long-standing value chains are faltering in the face of such competition.

Source: Company reports[/caption]

Competition is increasing both in store and online with numerous stylish, value options available. Consumers are able to search for exactly what they are seeking and in most cases, for the price they are willing to pay. Some long-standing value chains are faltering in the face of such competition.