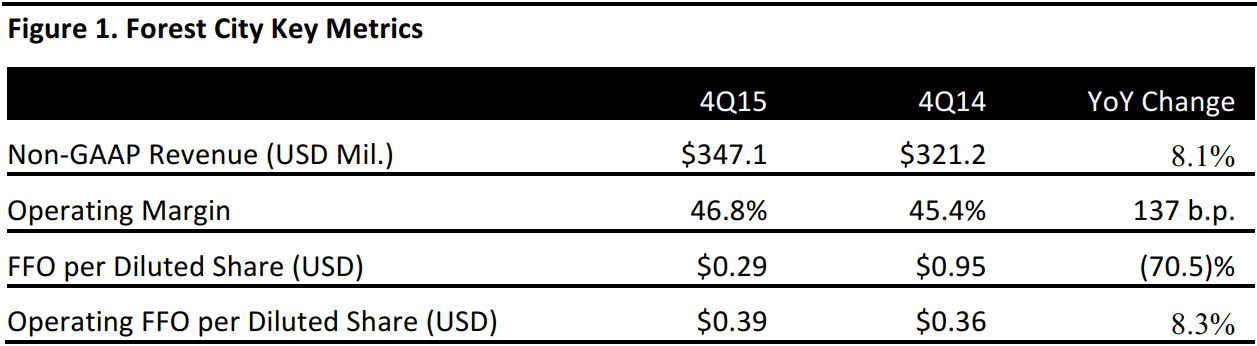

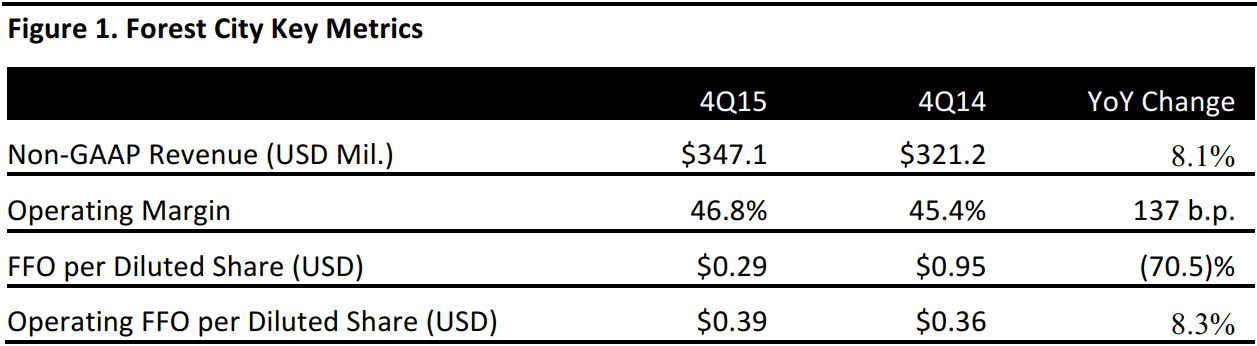

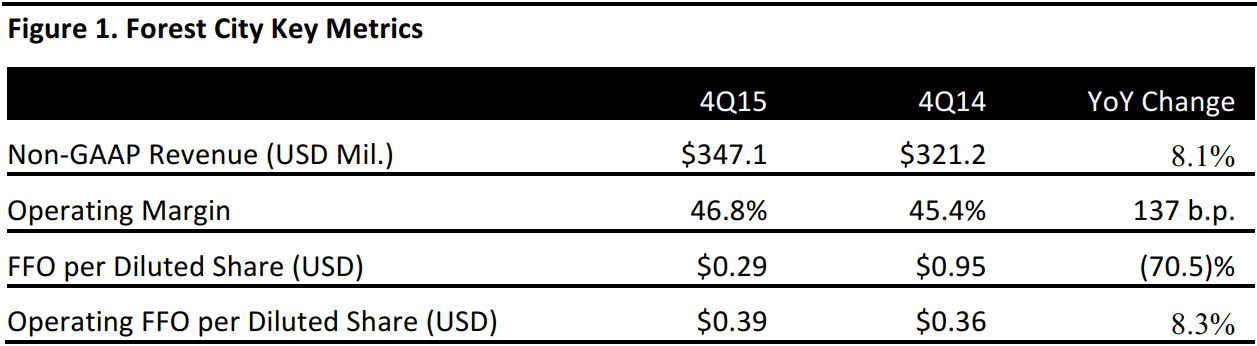

Source: Company reports

Forest City reported Q4 adjusted revenues of $347.1 million, up 11.1% from the year-ago quarter. The acquisition in June 2015 of seven life science office properties and two parking facilities in Cambridge, MA, added to revenues.

Fourth-quarter comparable NOI increased by 5.9% year over year, led by increases of 7.6% in office, 5.6% in apartments and 4.2% in retail.

Office results were particularly strong, driven by additional occupancy and rent revenues in key markets, particularly Brooklyn. The NOI increase from apartments was attributed to new supply in markets. Retail was driven by the impact of strong, same-space leasing spreads at “our” regional malls as a result of renovation, expansion and re-merchandising programs.

For the full year, total comparable NOI was up 4.9%, with increases of 5.1% in retail, 4.9% in office and 4.7% in apartments, compared with 2014. In the retail portfolio, comparable retail occupancies increased to 94%, up from 92.5% in FY14. Sales in the company’s regional malls averaged $558 per square foot, up from $537 per square foot in the prior year. For FY15, new, same-space leases in regional malls increased by 26.3% over prior rents. Comparable office occupancies increased to 95.4% from 94.9% in FY14. Rent per square foot in new office same-space leases increased by 2.2% over prior rents. In the residential portfolio, average monthly rents per unit for the company’s total comp apartments rose by 3.1%, to $1,423. Comparable occupancies for the

year were 94.9%, flat compared with FY14.

For FY15, adjusted revenue was $1.3 billion, up 3.3% year over year. Operating diluted FFO per share was up 16%, to $1.36, compared with $1.17 per share in 2014. Full-year FFO was positively impacted by the acquisition of University Park at MIT.

The company did not provide 1Q16 or FY16 guidance.