albert Chan

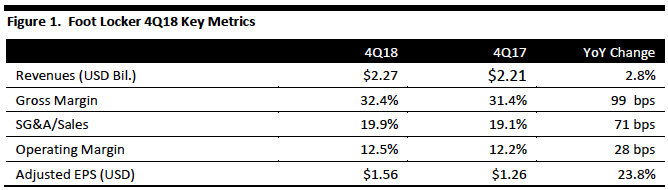

[caption id="attachment_79060" align="aligncenter" width="668"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

Foot Locker 4Q18 revenues were $2.27 billion, up 2.8% year over year, above the consensus estimate of $2.18 billion. The company reported 4Q18 adjusted EPS of $1.56, beating the consensus estimate of $1.40.

Annual revenues were $7.9 billion, up 2.0% from $7.8 billion in the year ago period.

Comparable sales increased 9.7% for the quarter, beating the consensus estimate of 4.5%. The company reported that comparable sales were positive throughout the quarter, with November up mid-single digits, December up double digits due to holiday excitement, and January comparable sales were up high single digits. Management commented that average selling prices were up double digits, with traffic down low single digits overall.

Stores posted 5.7% comparable sales increases and digital channels delivered a 29.7% comparable sales gain.

By division, the company said its North America divisions all posted positive sales results including Eastbay, Foot Locker US and Foot Locker Canada, each banner posting double-digit comp gains. Champs’ comps were up high-single digits, Kids Foot Locker was up mid-single digits and Footaction posted a low single digit comp gain.

Internationally, the company’s Foot Locker Pacific business generated double-digit sales gains. The Foot Locker Europe business was up high single digits, while Sidestep was down in the mid-single digits and Runners Point decreased double digits.

By category, footwear posted the strongest sales gain, up double digits overall in the quarter, with men’s and women’s footwear up double digits while kids climbed by high single-digits. Men’s running and classic styles posted double-digit gains, while men's basketball was down mid-single digits.

The company commented that its apparel business posted a mid-single digit increase, with gains driven by sales of branded tees and fleece from Champion, Nike and Jordan, and NBA apparel, led by Lakers apparel. The children's apparel business was up double digits, men's apparel posted a mid-single digit gain and women's apparel was down low single digits. Management said it continued to see the same trends in Q4 in its accessories business, with gains it its bags business more than offset by decreases in hats and socks resulting in double digit comp sales declines.

The company plans to close 165 stores in 2019 across all of its geographies, with the greatest concentration in Foot Locker and Lady Foot Locker in the United States, SIX:02, Foot Locker and Runners Point in Europe. As of February 2, 2019 there were 3,221 total Foot Locker brand stores. Over the year the company closed 134 stores, and opened 45 stores.

The company stated it plans to invest in its digital customer experience and supply chain capabilities including personalization, a reimagined membership program, a rollout of a global point of sales software platform in international markets and the upgrade of international websites to its new platform. Management commented that it expects depreciation and amortization expense to be approximately $185 million in 2019 for these investments.

Outlook

Management stated it expects mid-single digit comparable sales gains in each quarter, and a double digit percentage increase in its earnings per share.

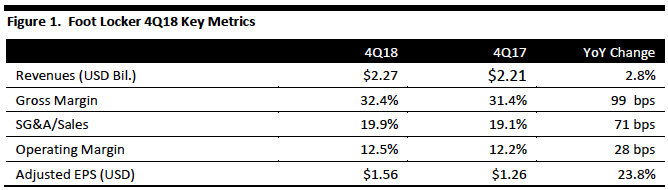

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Foot Locker 4Q18 revenues were $2.27 billion, up 2.8% year over year, above the consensus estimate of $2.18 billion. The company reported 4Q18 adjusted EPS of $1.56, beating the consensus estimate of $1.40.

Annual revenues were $7.9 billion, up 2.0% from $7.8 billion in the year ago period.

Comparable sales increased 9.7% for the quarter, beating the consensus estimate of 4.5%. The company reported that comparable sales were positive throughout the quarter, with November up mid-single digits, December up double digits due to holiday excitement, and January comparable sales were up high single digits. Management commented that average selling prices were up double digits, with traffic down low single digits overall.

Stores posted 5.7% comparable sales increases and digital channels delivered a 29.7% comparable sales gain.

By division, the company said its North America divisions all posted positive sales results including Eastbay, Foot Locker US and Foot Locker Canada, each banner posting double-digit comp gains. Champs’ comps were up high-single digits, Kids Foot Locker was up mid-single digits and Footaction posted a low single digit comp gain.

Internationally, the company’s Foot Locker Pacific business generated double-digit sales gains. The Foot Locker Europe business was up high single digits, while Sidestep was down in the mid-single digits and Runners Point decreased double digits.

By category, footwear posted the strongest sales gain, up double digits overall in the quarter, with men’s and women’s footwear up double digits while kids climbed by high single-digits. Men’s running and classic styles posted double-digit gains, while men's basketball was down mid-single digits.

The company commented that its apparel business posted a mid-single digit increase, with gains driven by sales of branded tees and fleece from Champion, Nike and Jordan, and NBA apparel, led by Lakers apparel. The children's apparel business was up double digits, men's apparel posted a mid-single digit gain and women's apparel was down low single digits. Management said it continued to see the same trends in Q4 in its accessories business, with gains it its bags business more than offset by decreases in hats and socks resulting in double digit comp sales declines.

The company plans to close 165 stores in 2019 across all of its geographies, with the greatest concentration in Foot Locker and Lady Foot Locker in the United States, SIX:02, Foot Locker and Runners Point in Europe. As of February 2, 2019 there were 3,221 total Foot Locker brand stores. Over the year the company closed 134 stores, and opened 45 stores.

The company stated it plans to invest in its digital customer experience and supply chain capabilities including personalization, a reimagined membership program, a rollout of a global point of sales software platform in international markets and the upgrade of international websites to its new platform. Management commented that it expects depreciation and amortization expense to be approximately $185 million in 2019 for these investments.

Outlook

Management stated it expects mid-single digit comparable sales gains in each quarter, and a double digit percentage increase in its earnings per share.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Foot Locker 4Q18 revenues were $2.27 billion, up 2.8% year over year, above the consensus estimate of $2.18 billion. The company reported 4Q18 adjusted EPS of $1.56, beating the consensus estimate of $1.40.

Annual revenues were $7.9 billion, up 2.0% from $7.8 billion in the year ago period.

Comparable sales increased 9.7% for the quarter, beating the consensus estimate of 4.5%. The company reported that comparable sales were positive throughout the quarter, with November up mid-single digits, December up double digits due to holiday excitement, and January comparable sales were up high single digits. Management commented that average selling prices were up double digits, with traffic down low single digits overall.

Stores posted 5.7% comparable sales increases and digital channels delivered a 29.7% comparable sales gain.

By division, the company said its North America divisions all posted positive sales results including Eastbay, Foot Locker US and Foot Locker Canada, each banner posting double-digit comp gains. Champs’ comps were up high-single digits, Kids Foot Locker was up mid-single digits and Footaction posted a low single digit comp gain.

Internationally, the company’s Foot Locker Pacific business generated double-digit sales gains. The Foot Locker Europe business was up high single digits, while Sidestep was down in the mid-single digits and Runners Point decreased double digits.

By category, footwear posted the strongest sales gain, up double digits overall in the quarter, with men’s and women’s footwear up double digits while kids climbed by high single-digits. Men’s running and classic styles posted double-digit gains, while men's basketball was down mid-single digits.

The company commented that its apparel business posted a mid-single digit increase, with gains driven by sales of branded tees and fleece from Champion, Nike and Jordan, and NBA apparel, led by Lakers apparel. The children's apparel business was up double digits, men's apparel posted a mid-single digit gain and women's apparel was down low single digits. Management said it continued to see the same trends in Q4 in its accessories business, with gains it its bags business more than offset by decreases in hats and socks resulting in double digit comp sales declines.

The company plans to close 165 stores in 2019 across all of its geographies, with the greatest concentration in Foot Locker and Lady Foot Locker in the United States, SIX:02, Foot Locker and Runners Point in Europe. As of February 2, 2019 there were 3,221 total Foot Locker brand stores. Over the year the company closed 134 stores, and opened 45 stores.

The company stated it plans to invest in its digital customer experience and supply chain capabilities including personalization, a reimagined membership program, a rollout of a global point of sales software platform in international markets and the upgrade of international websites to its new platform. Management commented that it expects depreciation and amortization expense to be approximately $185 million in 2019 for these investments.

Outlook

Management stated it expects mid-single digit comparable sales gains in each quarter, and a double digit percentage increase in its earnings per share.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Foot Locker 4Q18 revenues were $2.27 billion, up 2.8% year over year, above the consensus estimate of $2.18 billion. The company reported 4Q18 adjusted EPS of $1.56, beating the consensus estimate of $1.40.

Annual revenues were $7.9 billion, up 2.0% from $7.8 billion in the year ago period.

Comparable sales increased 9.7% for the quarter, beating the consensus estimate of 4.5%. The company reported that comparable sales were positive throughout the quarter, with November up mid-single digits, December up double digits due to holiday excitement, and January comparable sales were up high single digits. Management commented that average selling prices were up double digits, with traffic down low single digits overall.

Stores posted 5.7% comparable sales increases and digital channels delivered a 29.7% comparable sales gain.

By division, the company said its North America divisions all posted positive sales results including Eastbay, Foot Locker US and Foot Locker Canada, each banner posting double-digit comp gains. Champs’ comps were up high-single digits, Kids Foot Locker was up mid-single digits and Footaction posted a low single digit comp gain.

Internationally, the company’s Foot Locker Pacific business generated double-digit sales gains. The Foot Locker Europe business was up high single digits, while Sidestep was down in the mid-single digits and Runners Point decreased double digits.

By category, footwear posted the strongest sales gain, up double digits overall in the quarter, with men’s and women’s footwear up double digits while kids climbed by high single-digits. Men’s running and classic styles posted double-digit gains, while men's basketball was down mid-single digits.

The company commented that its apparel business posted a mid-single digit increase, with gains driven by sales of branded tees and fleece from Champion, Nike and Jordan, and NBA apparel, led by Lakers apparel. The children's apparel business was up double digits, men's apparel posted a mid-single digit gain and women's apparel was down low single digits. Management said it continued to see the same trends in Q4 in its accessories business, with gains it its bags business more than offset by decreases in hats and socks resulting in double digit comp sales declines.

The company plans to close 165 stores in 2019 across all of its geographies, with the greatest concentration in Foot Locker and Lady Foot Locker in the United States, SIX:02, Foot Locker and Runners Point in Europe. As of February 2, 2019 there were 3,221 total Foot Locker brand stores. Over the year the company closed 134 stores, and opened 45 stores.

The company stated it plans to invest in its digital customer experience and supply chain capabilities including personalization, a reimagined membership program, a rollout of a global point of sales software platform in international markets and the upgrade of international websites to its new platform. Management commented that it expects depreciation and amortization expense to be approximately $185 million in 2019 for these investments.

Outlook

Management stated it expects mid-single digit comparable sales gains in each quarter, and a double digit percentage increase in its earnings per share.