DIpil Das

[caption id="attachment_95266" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

2Q19 Results

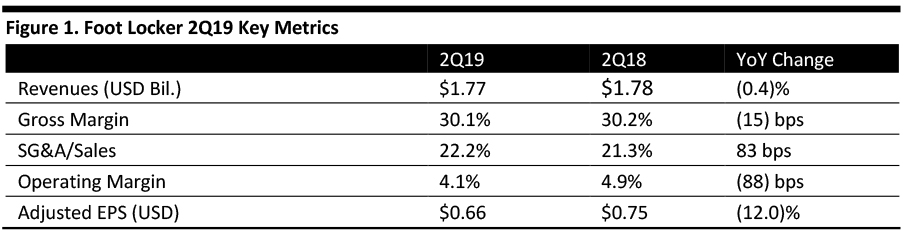

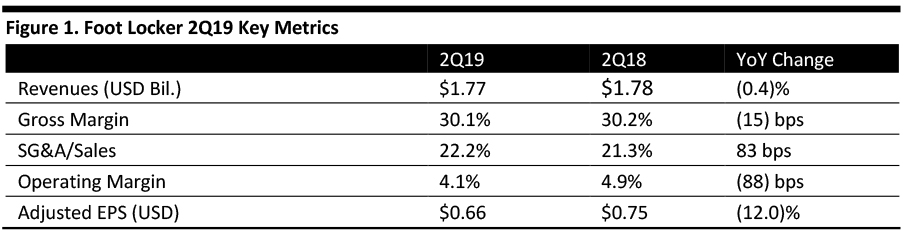

Foot Locker 2Q19 revenues were $1.77 billion, down 0.4% year over year and below the consensus estimate of $1.82 billion. The company reported 2Q19 adjusted EPS of $0.66, below the consensus estimate of $0.67, and 12% below last year.

Foot Locker reported the impact of weaker foreign currency compared to the year-ago period reduced sales by $22 million; additionally, traffic was down low single digits in all geographies.

Comparable sales increased 0.8% for the quarter, lower than the consensus estimate of 3.1%. By channel, store comps were down 0.1%, while the company’s direct-to-customer channel led performance with a 6.5% sales increase.

By category, footwear was the strongest category with low single-digit comp gains, while apparel was down mid single digits. In the company’s accessories business, fashion bags were strong, but that was offset by a decline in socks and hats, which led to a mid-single digit comp decline. Within footwear, women's and children’s each posted high single-digit comp gains while men's was down slightly due to the impact of launch shifts. By category, men's running was up low single digits, while court and casual styles produced a slight gain.

Management discussed its community-based Power Store strategic initiative, which creates hyper-local customer experiences. The company has opened its second Power Store in New York City’s Washington Heights, an important sneaker community. The Washington Heights Power Store is staffed by mostly local associates and serves as a location for local brands and artists.

The store includes footwear, apparel and accessories from a wide variety of top athletic brands, including Nike, Jordan, Converse, adidas, PUMA as well as localized products including exclusive and limited release apparel from brands such as Lyfestyle NYC and Triangulo Swag. The store also has dedicated women's and children’s spaces, digital lockers to pick up online orders, art work and an activation space for community events.

Customers can also get more accurate visibility into inventory at Power Stores through a strategic partnership with Nike via the Foot Locker mobile app and the Nike app. Through a feature called “Shoecase,” members can view sneaker releases on the app, while the “NikePlus Unlock Box” lets members unlock limited edition items through a digital vending machine.

The company said it plans to launch a new innovation hub called Greenhouse as a separate app next quarter. The app will include a community of brands across footwear, apparel, accessories, art and other categories. Greenhouse is a tool for collaborating with designers and artists on products and a way to connect with youth culture.

Inventory decreased by 2.2% year over year.

As of August 3, 2019 the company operated 3,174 stores in 27 countries across North America, Europe, Asia, Australia and New Zealand. The company reported it expects to open 65 stores including new Power Stores in Frankfurt and Melbourne, and to remodel or relocate 160 stores, slightly below the previous guidance of 190 store relocations or remodelings. Foot Locker expects to close 170 stores, slightly more than planned at the beginning of the year where the company planned to close 165 stores.

Outlook

Management affirmed its earnings per share guidance of growth in high-single digits, compared to the consensus estimate of 4.7%. Foot Locker expects SG&A to be up 10 to 30 basis points.

Foot Locker is actively discussing the recently announced tariffs on imports from China with vendor partners in an effort to limit their impact. The current guidance does not take tariff impacts into account.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Foot Locker 2Q19 revenues were $1.77 billion, down 0.4% year over year and below the consensus estimate of $1.82 billion. The company reported 2Q19 adjusted EPS of $0.66, below the consensus estimate of $0.67, and 12% below last year.

Foot Locker reported the impact of weaker foreign currency compared to the year-ago period reduced sales by $22 million; additionally, traffic was down low single digits in all geographies.

Comparable sales increased 0.8% for the quarter, lower than the consensus estimate of 3.1%. By channel, store comps were down 0.1%, while the company’s direct-to-customer channel led performance with a 6.5% sales increase.

By category, footwear was the strongest category with low single-digit comp gains, while apparel was down mid single digits. In the company’s accessories business, fashion bags were strong, but that was offset by a decline in socks and hats, which led to a mid-single digit comp decline. Within footwear, women's and children’s each posted high single-digit comp gains while men's was down slightly due to the impact of launch shifts. By category, men's running was up low single digits, while court and casual styles produced a slight gain.

Management discussed its community-based Power Store strategic initiative, which creates hyper-local customer experiences. The company has opened its second Power Store in New York City’s Washington Heights, an important sneaker community. The Washington Heights Power Store is staffed by mostly local associates and serves as a location for local brands and artists.

The store includes footwear, apparel and accessories from a wide variety of top athletic brands, including Nike, Jordan, Converse, adidas, PUMA as well as localized products including exclusive and limited release apparel from brands such as Lyfestyle NYC and Triangulo Swag. The store also has dedicated women's and children’s spaces, digital lockers to pick up online orders, art work and an activation space for community events.

Customers can also get more accurate visibility into inventory at Power Stores through a strategic partnership with Nike via the Foot Locker mobile app and the Nike app. Through a feature called “Shoecase,” members can view sneaker releases on the app, while the “NikePlus Unlock Box” lets members unlock limited edition items through a digital vending machine.

The company said it plans to launch a new innovation hub called Greenhouse as a separate app next quarter. The app will include a community of brands across footwear, apparel, accessories, art and other categories. Greenhouse is a tool for collaborating with designers and artists on products and a way to connect with youth culture.

Inventory decreased by 2.2% year over year.

As of August 3, 2019 the company operated 3,174 stores in 27 countries across North America, Europe, Asia, Australia and New Zealand. The company reported it expects to open 65 stores including new Power Stores in Frankfurt and Melbourne, and to remodel or relocate 160 stores, slightly below the previous guidance of 190 store relocations or remodelings. Foot Locker expects to close 170 stores, slightly more than planned at the beginning of the year where the company planned to close 165 stores.

Outlook

Management affirmed its earnings per share guidance of growth in high-single digits, compared to the consensus estimate of 4.7%. Foot Locker expects SG&A to be up 10 to 30 basis points.

Foot Locker is actively discussing the recently announced tariffs on imports from China with vendor partners in an effort to limit their impact. The current guidance does not take tariff impacts into account.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Foot Locker 2Q19 revenues were $1.77 billion, down 0.4% year over year and below the consensus estimate of $1.82 billion. The company reported 2Q19 adjusted EPS of $0.66, below the consensus estimate of $0.67, and 12% below last year.

Foot Locker reported the impact of weaker foreign currency compared to the year-ago period reduced sales by $22 million; additionally, traffic was down low single digits in all geographies.

Comparable sales increased 0.8% for the quarter, lower than the consensus estimate of 3.1%. By channel, store comps were down 0.1%, while the company’s direct-to-customer channel led performance with a 6.5% sales increase.

By category, footwear was the strongest category with low single-digit comp gains, while apparel was down mid single digits. In the company’s accessories business, fashion bags were strong, but that was offset by a decline in socks and hats, which led to a mid-single digit comp decline. Within footwear, women's and children’s each posted high single-digit comp gains while men's was down slightly due to the impact of launch shifts. By category, men's running was up low single digits, while court and casual styles produced a slight gain.

Management discussed its community-based Power Store strategic initiative, which creates hyper-local customer experiences. The company has opened its second Power Store in New York City’s Washington Heights, an important sneaker community. The Washington Heights Power Store is staffed by mostly local associates and serves as a location for local brands and artists.

The store includes footwear, apparel and accessories from a wide variety of top athletic brands, including Nike, Jordan, Converse, adidas, PUMA as well as localized products including exclusive and limited release apparel from brands such as Lyfestyle NYC and Triangulo Swag. The store also has dedicated women's and children’s spaces, digital lockers to pick up online orders, art work and an activation space for community events.

Customers can also get more accurate visibility into inventory at Power Stores through a strategic partnership with Nike via the Foot Locker mobile app and the Nike app. Through a feature called “Shoecase,” members can view sneaker releases on the app, while the “NikePlus Unlock Box” lets members unlock limited edition items through a digital vending machine.

The company said it plans to launch a new innovation hub called Greenhouse as a separate app next quarter. The app will include a community of brands across footwear, apparel, accessories, art and other categories. Greenhouse is a tool for collaborating with designers and artists on products and a way to connect with youth culture.

Inventory decreased by 2.2% year over year.

As of August 3, 2019 the company operated 3,174 stores in 27 countries across North America, Europe, Asia, Australia and New Zealand. The company reported it expects to open 65 stores including new Power Stores in Frankfurt and Melbourne, and to remodel or relocate 160 stores, slightly below the previous guidance of 190 store relocations or remodelings. Foot Locker expects to close 170 stores, slightly more than planned at the beginning of the year where the company planned to close 165 stores.

Outlook

Management affirmed its earnings per share guidance of growth in high-single digits, compared to the consensus estimate of 4.7%. Foot Locker expects SG&A to be up 10 to 30 basis points.

Foot Locker is actively discussing the recently announced tariffs on imports from China with vendor partners in an effort to limit their impact. The current guidance does not take tariff impacts into account.

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Foot Locker 2Q19 revenues were $1.77 billion, down 0.4% year over year and below the consensus estimate of $1.82 billion. The company reported 2Q19 adjusted EPS of $0.66, below the consensus estimate of $0.67, and 12% below last year.

Foot Locker reported the impact of weaker foreign currency compared to the year-ago period reduced sales by $22 million; additionally, traffic was down low single digits in all geographies.

Comparable sales increased 0.8% for the quarter, lower than the consensus estimate of 3.1%. By channel, store comps were down 0.1%, while the company’s direct-to-customer channel led performance with a 6.5% sales increase.

By category, footwear was the strongest category with low single-digit comp gains, while apparel was down mid single digits. In the company’s accessories business, fashion bags were strong, but that was offset by a decline in socks and hats, which led to a mid-single digit comp decline. Within footwear, women's and children’s each posted high single-digit comp gains while men's was down slightly due to the impact of launch shifts. By category, men's running was up low single digits, while court and casual styles produced a slight gain.

Management discussed its community-based Power Store strategic initiative, which creates hyper-local customer experiences. The company has opened its second Power Store in New York City’s Washington Heights, an important sneaker community. The Washington Heights Power Store is staffed by mostly local associates and serves as a location for local brands and artists.

The store includes footwear, apparel and accessories from a wide variety of top athletic brands, including Nike, Jordan, Converse, adidas, PUMA as well as localized products including exclusive and limited release apparel from brands such as Lyfestyle NYC and Triangulo Swag. The store also has dedicated women's and children’s spaces, digital lockers to pick up online orders, art work and an activation space for community events.

Customers can also get more accurate visibility into inventory at Power Stores through a strategic partnership with Nike via the Foot Locker mobile app and the Nike app. Through a feature called “Shoecase,” members can view sneaker releases on the app, while the “NikePlus Unlock Box” lets members unlock limited edition items through a digital vending machine.

The company said it plans to launch a new innovation hub called Greenhouse as a separate app next quarter. The app will include a community of brands across footwear, apparel, accessories, art and other categories. Greenhouse is a tool for collaborating with designers and artists on products and a way to connect with youth culture.

Inventory decreased by 2.2% year over year.

As of August 3, 2019 the company operated 3,174 stores in 27 countries across North America, Europe, Asia, Australia and New Zealand. The company reported it expects to open 65 stores including new Power Stores in Frankfurt and Melbourne, and to remodel or relocate 160 stores, slightly below the previous guidance of 190 store relocations or remodelings. Foot Locker expects to close 170 stores, slightly more than planned at the beginning of the year where the company planned to close 165 stores.

Outlook

Management affirmed its earnings per share guidance of growth in high-single digits, compared to the consensus estimate of 4.7%. Foot Locker expects SG&A to be up 10 to 30 basis points.

Foot Locker is actively discussing the recently announced tariffs on imports from China with vendor partners in an effort to limit their impact. The current guidance does not take tariff impacts into account.