Nitheesh NH

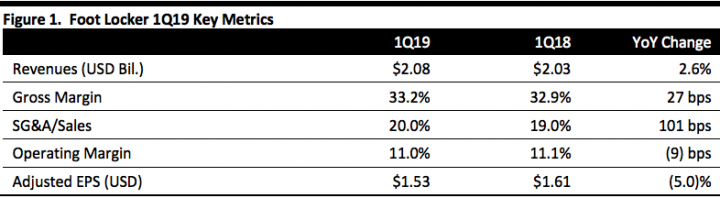

[caption id="attachment_89295" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

Foot Locker 1Q19 revenues were $2.08 billion, up 2.6% year over year, below the consensus estimate of $2.12 billion. The company reported 1Q19 adjusted EPS of $1.53, below the consensus estimate of $1.61, and 5% below last year.

Comparable sales increased 4.6% for the quarter, lower than the consensus estimate of 5.6%. By channel, store comps were up 2.9%, while the company’s direct-to-customer channel led performance with a 14.8% sales increase.

By division, North America Champs Sports led with low-double-digit comp gains. Foot Locker US and Foot Locker Canada each were up mid-single digits and each posted low single digit comp gains. Internationally, all divisions posted comparable sales gains, altough Foot Locker Pacific grew fastest with comparable sales up double-digits. Foot Locker Europe experienced mid single-digit increases — its third consecutive quarter of comp gains.

By category, footwear was the strongest category with mid-single-digit comp gains, while apparel was up low single digits. The company’s accessories business fashion bags were strong, but that was offset by a decline in socks and hats, which led to a double-digit decline. In footwear, the women's business posted a low-double digit increase, children's footwear was up high-single digits and men's increased mid single-digits.

Foot Locker reported average selling prices in footwear were flat in the quarter, while units were up high-single digits. By category, men's classic shoes posted strong double-digit gains, while men's running was up high-single digits. Trends and men's basketball improved during the quarter with comp sales down slightly. Overall, drivers were Nike, PUMA, Adidas, Fila, Vans and offerings from Michael Jordan’s collection.

Foot Locker ended the quarter with 3,201 stores. The company opened 14 new stores, including two power stores and one store in Asia, and it is remodeling 13 stores. The company closed 34 stores during the quarter.

Outlook

Management said it expects earnings per share growth in the high-single digits, compared to prior guidance for double-digit growth and the consensus estimate of a 10.1% increase.

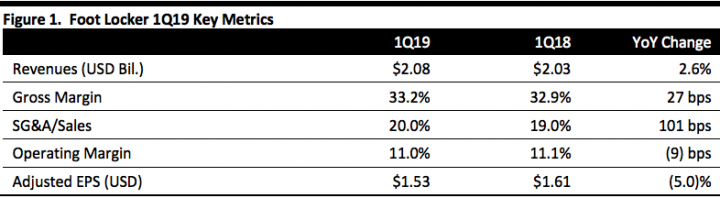

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Foot Locker 1Q19 revenues were $2.08 billion, up 2.6% year over year, below the consensus estimate of $2.12 billion. The company reported 1Q19 adjusted EPS of $1.53, below the consensus estimate of $1.61, and 5% below last year.

Comparable sales increased 4.6% for the quarter, lower than the consensus estimate of 5.6%. By channel, store comps were up 2.9%, while the company’s direct-to-customer channel led performance with a 14.8% sales increase.

By division, North America Champs Sports led with low-double-digit comp gains. Foot Locker US and Foot Locker Canada each were up mid-single digits and each posted low single digit comp gains. Internationally, all divisions posted comparable sales gains, altough Foot Locker Pacific grew fastest with comparable sales up double-digits. Foot Locker Europe experienced mid single-digit increases — its third consecutive quarter of comp gains.

By category, footwear was the strongest category with mid-single-digit comp gains, while apparel was up low single digits. The company’s accessories business fashion bags were strong, but that was offset by a decline in socks and hats, which led to a double-digit decline. In footwear, the women's business posted a low-double digit increase, children's footwear was up high-single digits and men's increased mid single-digits.

Foot Locker reported average selling prices in footwear were flat in the quarter, while units were up high-single digits. By category, men's classic shoes posted strong double-digit gains, while men's running was up high-single digits. Trends and men's basketball improved during the quarter with comp sales down slightly. Overall, drivers were Nike, PUMA, Adidas, Fila, Vans and offerings from Michael Jordan’s collection.

Foot Locker ended the quarter with 3,201 stores. The company opened 14 new stores, including two power stores and one store in Asia, and it is remodeling 13 stores. The company closed 34 stores during the quarter.

Outlook

Management said it expects earnings per share growth in the high-single digits, compared to prior guidance for double-digit growth and the consensus estimate of a 10.1% increase.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Foot Locker 1Q19 revenues were $2.08 billion, up 2.6% year over year, below the consensus estimate of $2.12 billion. The company reported 1Q19 adjusted EPS of $1.53, below the consensus estimate of $1.61, and 5% below last year.

Comparable sales increased 4.6% for the quarter, lower than the consensus estimate of 5.6%. By channel, store comps were up 2.9%, while the company’s direct-to-customer channel led performance with a 14.8% sales increase.

By division, North America Champs Sports led with low-double-digit comp gains. Foot Locker US and Foot Locker Canada each were up mid-single digits and each posted low single digit comp gains. Internationally, all divisions posted comparable sales gains, altough Foot Locker Pacific grew fastest with comparable sales up double-digits. Foot Locker Europe experienced mid single-digit increases — its third consecutive quarter of comp gains.

By category, footwear was the strongest category with mid-single-digit comp gains, while apparel was up low single digits. The company’s accessories business fashion bags were strong, but that was offset by a decline in socks and hats, which led to a double-digit decline. In footwear, the women's business posted a low-double digit increase, children's footwear was up high-single digits and men's increased mid single-digits.

Foot Locker reported average selling prices in footwear were flat in the quarter, while units were up high-single digits. By category, men's classic shoes posted strong double-digit gains, while men's running was up high-single digits. Trends and men's basketball improved during the quarter with comp sales down slightly. Overall, drivers were Nike, PUMA, Adidas, Fila, Vans and offerings from Michael Jordan’s collection.

Foot Locker ended the quarter with 3,201 stores. The company opened 14 new stores, including two power stores and one store in Asia, and it is remodeling 13 stores. The company closed 34 stores during the quarter.

Outlook

Management said it expects earnings per share growth in the high-single digits, compared to prior guidance for double-digit growth and the consensus estimate of a 10.1% increase.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Foot Locker 1Q19 revenues were $2.08 billion, up 2.6% year over year, below the consensus estimate of $2.12 billion. The company reported 1Q19 adjusted EPS of $1.53, below the consensus estimate of $1.61, and 5% below last year.

Comparable sales increased 4.6% for the quarter, lower than the consensus estimate of 5.6%. By channel, store comps were up 2.9%, while the company’s direct-to-customer channel led performance with a 14.8% sales increase.

By division, North America Champs Sports led with low-double-digit comp gains. Foot Locker US and Foot Locker Canada each were up mid-single digits and each posted low single digit comp gains. Internationally, all divisions posted comparable sales gains, altough Foot Locker Pacific grew fastest with comparable sales up double-digits. Foot Locker Europe experienced mid single-digit increases — its third consecutive quarter of comp gains.

By category, footwear was the strongest category with mid-single-digit comp gains, while apparel was up low single digits. The company’s accessories business fashion bags were strong, but that was offset by a decline in socks and hats, which led to a double-digit decline. In footwear, the women's business posted a low-double digit increase, children's footwear was up high-single digits and men's increased mid single-digits.

Foot Locker reported average selling prices in footwear were flat in the quarter, while units were up high-single digits. By category, men's classic shoes posted strong double-digit gains, while men's running was up high-single digits. Trends and men's basketball improved during the quarter with comp sales down slightly. Overall, drivers were Nike, PUMA, Adidas, Fila, Vans and offerings from Michael Jordan’s collection.

Foot Locker ended the quarter with 3,201 stores. The company opened 14 new stores, including two power stores and one store in Asia, and it is remodeling 13 stores. The company closed 34 stores during the quarter.

Outlook

Management said it expects earnings per share growth in the high-single digits, compared to prior guidance for double-digit growth and the consensus estimate of a 10.1% increase.