albert Chan

On March 28, 2019, Foot Locker hosted its investor day. The company focused on its customer-connected strategic framework, strategic initiatives, international expansion plan, Power Store portfolio optimization and five-year financial outlook.

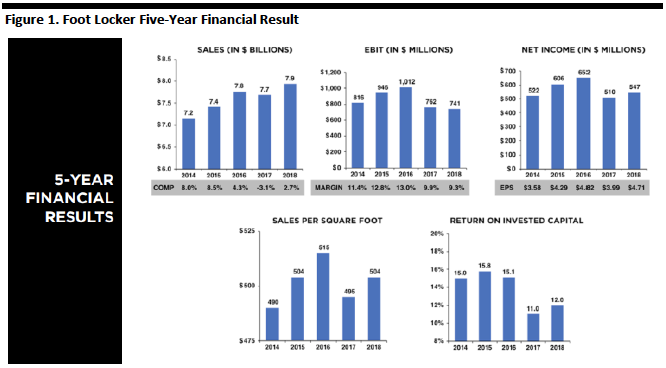

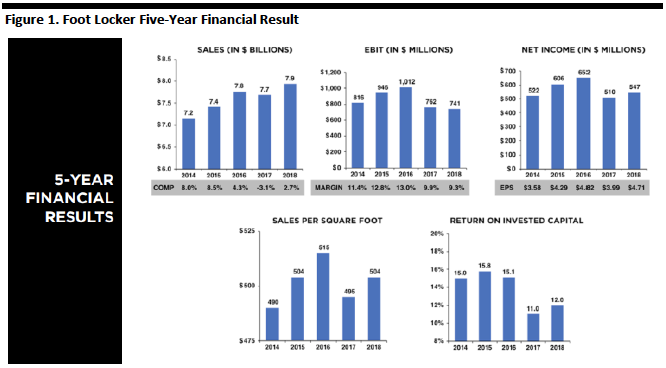

Foot Locker opened the day with progress against its 2015 long term strategies and financial results

Management opened the investor day with an overview and background of the overall Foot Locker market and the company’s progress against 2015 long-term strategies. The company’s seven strategies in 2015 were described as: “Core Business,” “Kids,” “European Expansion,” “Apparel,” Digital,” “Women’s” and “People.”

[caption id="attachment_82259" align="aligncenter" width="666"] Source: Company reports[/caption]

In 2015, Foot Locker set a long-term sales target of $10 billion; the company’s sales in 2018 were $7.9 billion. In 2015, Foot Locker set a long-term target of sales per gross square foot of $600; the company’s sales per square foot in 2018 were $504.

Foot Locker updates its purpose: “to inspire and empower youth culture”

Management highlighted that its mission is “to fuel a shared passion for self-expression.” Its vision is “to create unrivaled experiences for its consumers”. Its positioning is “to be at the heart of the sport and sneaker communities.”

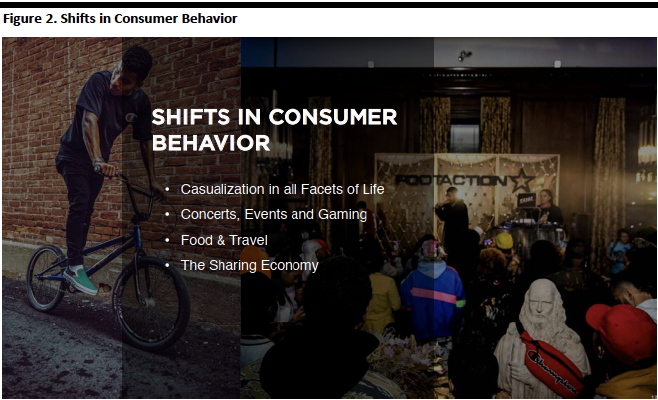

The consumer is changing, moving faster and using social media as social currency

The customer is changing, moving faster and is digitally connected. Management commented that technology is changing how today’s consumer interacts with the world and how they engage with brands. Customers demand authenticity and newness from brands – and at faster-than-ever speeds.

[caption id="attachment_82260" align="aligncenter" width="658"]

Source: Company reports[/caption]

In 2015, Foot Locker set a long-term sales target of $10 billion; the company’s sales in 2018 were $7.9 billion. In 2015, Foot Locker set a long-term target of sales per gross square foot of $600; the company’s sales per square foot in 2018 were $504.

Foot Locker updates its purpose: “to inspire and empower youth culture”

Management highlighted that its mission is “to fuel a shared passion for self-expression.” Its vision is “to create unrivaled experiences for its consumers”. Its positioning is “to be at the heart of the sport and sneaker communities.”

The consumer is changing, moving faster and using social media as social currency

The customer is changing, moving faster and is digitally connected. Management commented that technology is changing how today’s consumer interacts with the world and how they engage with brands. Customers demand authenticity and newness from brands – and at faster-than-ever speeds.

[caption id="attachment_82260" align="aligncenter" width="658"] Source: Company reports[/caption]

Social media has become a source of social currency for customers as they seek to share moments and their personal style from concerts, festivals and culinary experiences. The Foot Locker customer uses sneaker choices and clothing choices to tell a story about who they are.

Youth culture is at the forefront of changing customer dynamics

Management commented that youth culture is at the forefront of changing trends, brands and product – accelerated by technology. This change is helping the company to think about Foot Locker in new ways, “as a place to inspire and empower youth culture.”

[caption id="attachment_82261" align="aligncenter" width="662"]

Source: Company reports[/caption]

Social media has become a source of social currency for customers as they seek to share moments and their personal style from concerts, festivals and culinary experiences. The Foot Locker customer uses sneaker choices and clothing choices to tell a story about who they are.

Youth culture is at the forefront of changing customer dynamics

Management commented that youth culture is at the forefront of changing trends, brands and product – accelerated by technology. This change is helping the company to think about Foot Locker in new ways, “as a place to inspire and empower youth culture.”

[caption id="attachment_82261" align="aligncenter" width="662"] Source: Company reports[/caption]

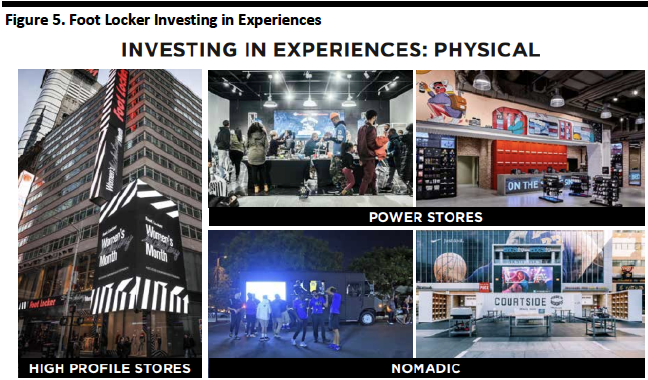

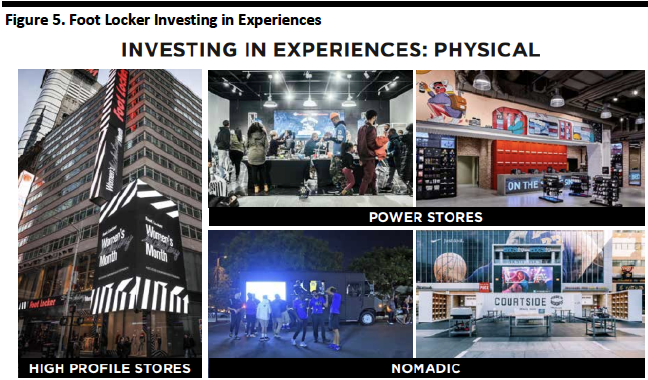

Foot Locker outlined its customer-connected strategic framework including collections, content, community, connectivity, and convenience

Foot Locker outlined its customer-connected strategic framework which the company created to focus the Foot Locker team on the customer.

[caption id="attachment_82262" align="aligncenter" width="662"]

Source: Company reports[/caption]

Foot Locker outlined its customer-connected strategic framework including collections, content, community, connectivity, and convenience

Foot Locker outlined its customer-connected strategic framework which the company created to focus the Foot Locker team on the customer.

[caption id="attachment_82262" align="aligncenter" width="662"] Source: Company reports[/caption]

Source: Company reports[/caption]

Source: Company reports[/caption]

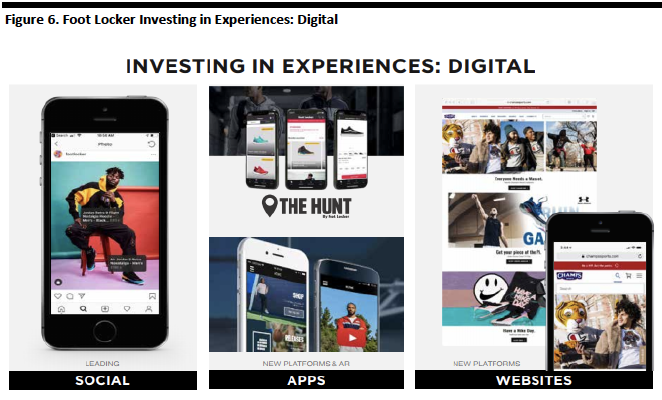

Foot Locker is investing in digital experiences: On average, over 80% of web traffic originates from mobile devices or apps. The company is investing in re-platforming its North American websites to make them responsive to different form factors and mobile devices, and the new platform has improved navigation and increased page load speeds, which drives higher conversion rates. In 2019, the technology team will take the platform to Europe and Asia Pacific.

[caption id="attachment_82264" align="aligncenter" width="662"]

Source: Company reports[/caption]

Foot Locker is investing in digital experiences: On average, over 80% of web traffic originates from mobile devices or apps. The company is investing in re-platforming its North American websites to make them responsive to different form factors and mobile devices, and the new platform has improved navigation and increased page load speeds, which drives higher conversion rates. In 2019, the technology team will take the platform to Europe and Asia Pacific.

[caption id="attachment_82264" align="aligncenter" width="662"] Source: Company reports[/caption]

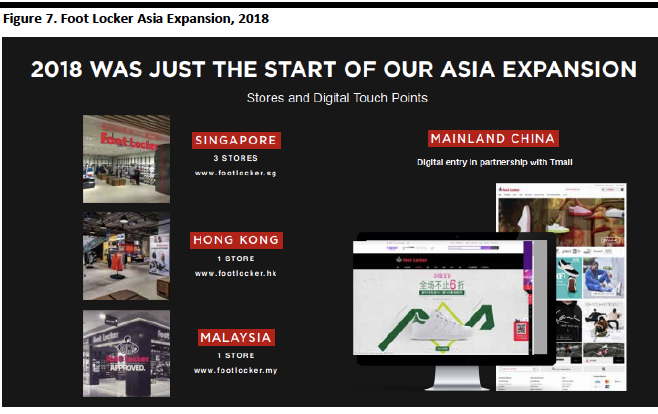

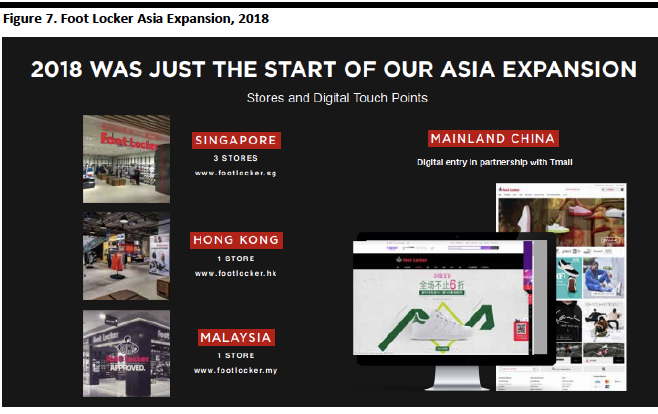

Foot Locker will continue to expand into Asia

In 2018, Foot Locker began expanding across Asia with an omnichannel activation strategy. The company finished 2018 with three stores and an ecommerce site in Singapore, one store in Malaysia, and one Power Store in Hong Kong. In China, the company also entered into a partnership with Tmall in to understand the Chinese consumer.

[caption id="attachment_82265" align="aligncenter" width="658"]

Source: Company reports[/caption]

Foot Locker will continue to expand into Asia

In 2018, Foot Locker began expanding across Asia with an omnichannel activation strategy. The company finished 2018 with three stores and an ecommerce site in Singapore, one store in Malaysia, and one Power Store in Hong Kong. In China, the company also entered into a partnership with Tmall in to understand the Chinese consumer.

[caption id="attachment_82265" align="aligncenter" width="658"] Source: Company reports[/caption]

Management reported Foot Locker will evaluate the company’s opportunities in these targeted countries and begin to expand in metro areas and cities, leveraging its leadership teams in Asia.

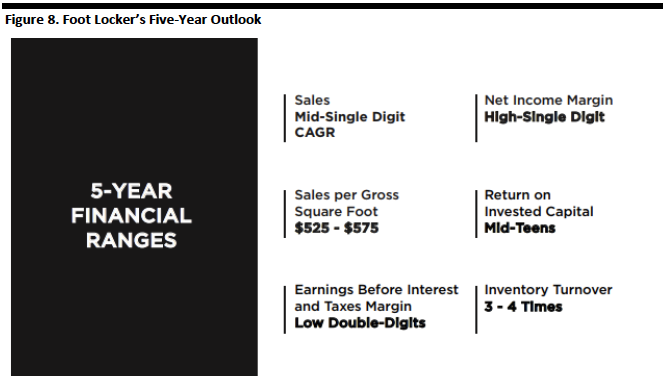

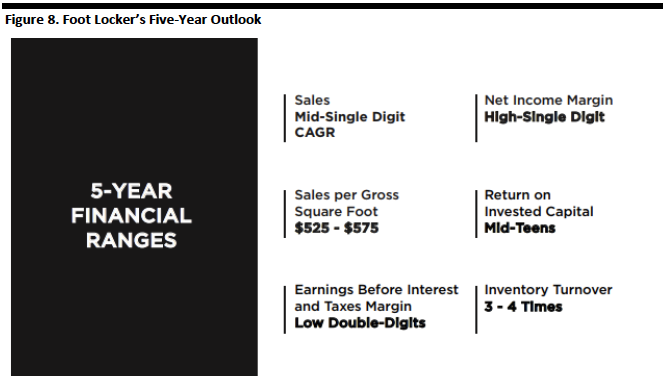

Foot Locker expects five-year growth ranges of sales in mid-single digits and sales per gross square foot of $525-575

Foot Locker reiterated its guidance for the full year, calling for mid-single-digit comp gains and further indicated that the company expects mid-single-digit comps quarterly. The company reiterated full year EPS growth in the double digits.

Source: Company reports[/caption]

Management reported Foot Locker will evaluate the company’s opportunities in these targeted countries and begin to expand in metro areas and cities, leveraging its leadership teams in Asia.

Foot Locker expects five-year growth ranges of sales in mid-single digits and sales per gross square foot of $525-575

Foot Locker reiterated its guidance for the full year, calling for mid-single-digit comp gains and further indicated that the company expects mid-single-digit comps quarterly. The company reiterated full year EPS growth in the double digits.

Source: Company reports[/caption]

Source: Company reports[/caption]

Source: Company reports[/caption]

In 2015, Foot Locker set a long-term sales target of $10 billion; the company’s sales in 2018 were $7.9 billion. In 2015, Foot Locker set a long-term target of sales per gross square foot of $600; the company’s sales per square foot in 2018 were $504.

Foot Locker updates its purpose: “to inspire and empower youth culture”

Management highlighted that its mission is “to fuel a shared passion for self-expression.” Its vision is “to create unrivaled experiences for its consumers”. Its positioning is “to be at the heart of the sport and sneaker communities.”

The consumer is changing, moving faster and using social media as social currency

The customer is changing, moving faster and is digitally connected. Management commented that technology is changing how today’s consumer interacts with the world and how they engage with brands. Customers demand authenticity and newness from brands – and at faster-than-ever speeds.

[caption id="attachment_82260" align="aligncenter" width="658"]

Source: Company reports[/caption]

In 2015, Foot Locker set a long-term sales target of $10 billion; the company’s sales in 2018 were $7.9 billion. In 2015, Foot Locker set a long-term target of sales per gross square foot of $600; the company’s sales per square foot in 2018 were $504.

Foot Locker updates its purpose: “to inspire and empower youth culture”

Management highlighted that its mission is “to fuel a shared passion for self-expression.” Its vision is “to create unrivaled experiences for its consumers”. Its positioning is “to be at the heart of the sport and sneaker communities.”

The consumer is changing, moving faster and using social media as social currency

The customer is changing, moving faster and is digitally connected. Management commented that technology is changing how today’s consumer interacts with the world and how they engage with brands. Customers demand authenticity and newness from brands – and at faster-than-ever speeds.

[caption id="attachment_82260" align="aligncenter" width="658"] Source: Company reports[/caption]

Social media has become a source of social currency for customers as they seek to share moments and their personal style from concerts, festivals and culinary experiences. The Foot Locker customer uses sneaker choices and clothing choices to tell a story about who they are.

Youth culture is at the forefront of changing customer dynamics

Management commented that youth culture is at the forefront of changing trends, brands and product – accelerated by technology. This change is helping the company to think about Foot Locker in new ways, “as a place to inspire and empower youth culture.”

[caption id="attachment_82261" align="aligncenter" width="662"]

Source: Company reports[/caption]

Social media has become a source of social currency for customers as they seek to share moments and their personal style from concerts, festivals and culinary experiences. The Foot Locker customer uses sneaker choices and clothing choices to tell a story about who they are.

Youth culture is at the forefront of changing customer dynamics

Management commented that youth culture is at the forefront of changing trends, brands and product – accelerated by technology. This change is helping the company to think about Foot Locker in new ways, “as a place to inspire and empower youth culture.”

[caption id="attachment_82261" align="aligncenter" width="662"] Source: Company reports[/caption]

Foot Locker outlined its customer-connected strategic framework including collections, content, community, connectivity, and convenience

Foot Locker outlined its customer-connected strategic framework which the company created to focus the Foot Locker team on the customer.

[caption id="attachment_82262" align="aligncenter" width="662"]

Source: Company reports[/caption]

Foot Locker outlined its customer-connected strategic framework including collections, content, community, connectivity, and convenience

Foot Locker outlined its customer-connected strategic framework which the company created to focus the Foot Locker team on the customer.

[caption id="attachment_82262" align="aligncenter" width="662"] Source: Company reports[/caption]

Source: Company reports[/caption]

- “Collections” leverage vendor partnerships, internal talent and capabilities and external investments to create unique and powerful assortments that elevate the sneaker business.

- “Content” storytells around the product and builds an emotional connection with consumers across multiple channels. Foot Locker is using key influencers, celebrities and new initiatives to drive excitement and build shareable moments.

- “Community” taps into consumers’ passions and interests, and delivers innovative experiences around them. The goal is to build authentic relationships with the customer at the local level.

- “Connectivity” enables today’s consumer to connect outside the physical store. Consumers do not distinguish between a physical and a digital experience. The company is leveraging data analytics, digital technology and a team of people to empower the customer with ways to participate, share and engage.

- “Convenience” helps meet expectations around speed, product, content and experiences – delivered on the consumers’ terms.

Source: Company reports[/caption]

Foot Locker is investing in digital experiences: On average, over 80% of web traffic originates from mobile devices or apps. The company is investing in re-platforming its North American websites to make them responsive to different form factors and mobile devices, and the new platform has improved navigation and increased page load speeds, which drives higher conversion rates. In 2019, the technology team will take the platform to Europe and Asia Pacific.

[caption id="attachment_82264" align="aligncenter" width="662"]

Source: Company reports[/caption]

Foot Locker is investing in digital experiences: On average, over 80% of web traffic originates from mobile devices or apps. The company is investing in re-platforming its North American websites to make them responsive to different form factors and mobile devices, and the new platform has improved navigation and increased page load speeds, which drives higher conversion rates. In 2019, the technology team will take the platform to Europe and Asia Pacific.

[caption id="attachment_82264" align="aligncenter" width="662"] Source: Company reports[/caption]

Foot Locker will continue to expand into Asia

In 2018, Foot Locker began expanding across Asia with an omnichannel activation strategy. The company finished 2018 with three stores and an ecommerce site in Singapore, one store in Malaysia, and one Power Store in Hong Kong. In China, the company also entered into a partnership with Tmall in to understand the Chinese consumer.

[caption id="attachment_82265" align="aligncenter" width="658"]

Source: Company reports[/caption]

Foot Locker will continue to expand into Asia

In 2018, Foot Locker began expanding across Asia with an omnichannel activation strategy. The company finished 2018 with three stores and an ecommerce site in Singapore, one store in Malaysia, and one Power Store in Hong Kong. In China, the company also entered into a partnership with Tmall in to understand the Chinese consumer.

[caption id="attachment_82265" align="aligncenter" width="658"] Source: Company reports[/caption]

Management reported Foot Locker will evaluate the company’s opportunities in these targeted countries and begin to expand in metro areas and cities, leveraging its leadership teams in Asia.

Foot Locker expects five-year growth ranges of sales in mid-single digits and sales per gross square foot of $525-575

Foot Locker reiterated its guidance for the full year, calling for mid-single-digit comp gains and further indicated that the company expects mid-single-digit comps quarterly. The company reiterated full year EPS growth in the double digits.

Source: Company reports[/caption]

Management reported Foot Locker will evaluate the company’s opportunities in these targeted countries and begin to expand in metro areas and cities, leveraging its leadership teams in Asia.

Foot Locker expects five-year growth ranges of sales in mid-single digits and sales per gross square foot of $525-575

Foot Locker reiterated its guidance for the full year, calling for mid-single-digit comp gains and further indicated that the company expects mid-single-digit comps quarterly. The company reiterated full year EPS growth in the double digits.

- For the company’s five-year outlook, it projects sales at a compound annual growth rate in the mid-single digits. The company’s CAGR from 2014 to 2018 was 1.9%.

- The company projects its sales per gross square feet to be $525-$575 for its five-year outlook. In 2018, the company reported sales per square feet of $504.

- The company projects EBIT to be in the low double digits; in 2018, the company reported EBIT of 9.4%.

- The company projects net income margin to be in high single digits; in 2018, the company reported net income margin of 0.6%.

- The company projects its return on invested capital to be in the mid-teens; in 2018, the company reported a return on invested capital of 12%.

Source: Company reports[/caption]

Source: Company reports[/caption]