albert Chan

Foot Locker, Inc.

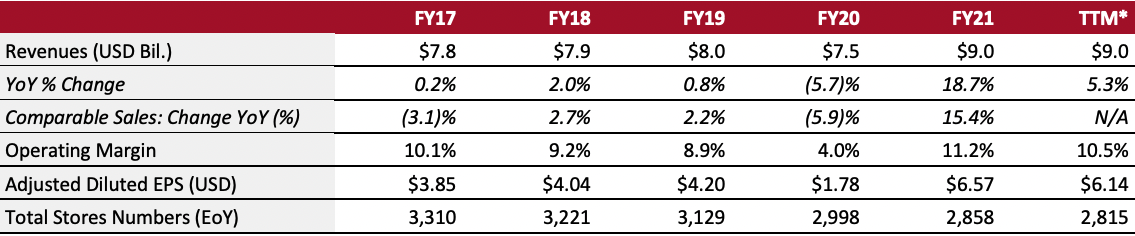

Sector: Apparel specialty retail Countries of operation: Australia, Canada, France, New Zealand, South Korea, the UK, the US and 21 other countries Key product categories: Apparel and footwear Annual Metrics [caption id="attachment_151099" align="aligncenter" width="700"] Fiscal year ends on January 30 of the following calendar year

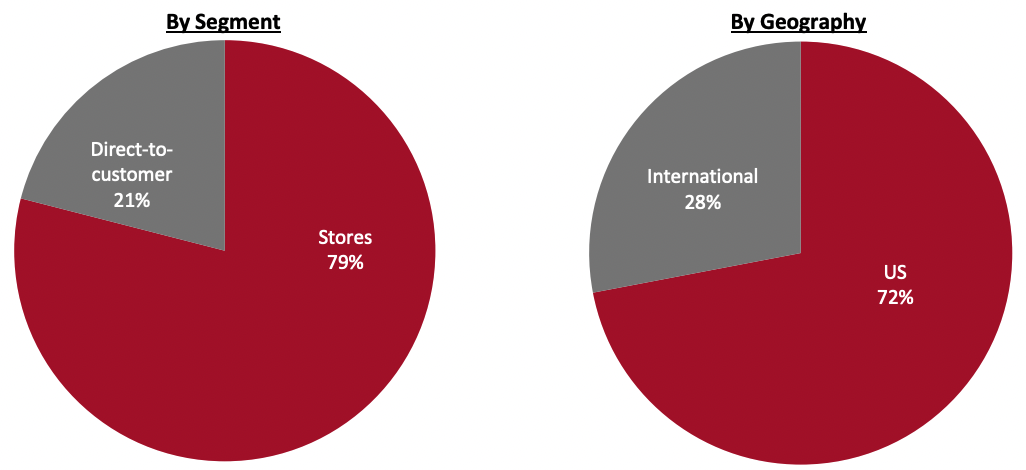

Fiscal year ends on January 30 of the following calendar year*Trailing 12 months ended April 30, 2022[/caption] Summary Founded in 1879 and headquartered in New York City, Foot Locker is a retailer of athletics-inspired shoes and apparel. The company operates through two channels: athletic stores and direct-to-consumer (DTC). The athletics store segment operates under various formats, including Champs Sports, Eastbay, Footaction, Foot Locker, Kids Foot Locker and Lady Foot Locker. The DTC segment sells through catalogs, mobile devices and websites. As of April 30, 2022, the company operates 2,815 stores in 28 countries in Asia, Australasia, Europe and North America, as well as 148 franchised Foot Locker stores in Asia and the Middle East. Company Analysis Coresight Research insight: Foot Locker continues to benefit from its product focus: athletic and active footwear. Both are seeing secular growth tailwinds, as consumers increasingly focus on health and fitness, as well as shifting to casual clothing and footwear. Foot Locker’s enormous scale allows it to invest in technology and customer experience, provide opportunities to stock emerging products from innovative brands, and drive key brand relationships, including NIKE. Furthermore, the company is witnessing strong comp growth from non-NIKE vendors: In the first quarter of fiscal 2022 (ended April 30, 2022), while overall comps were down 1.9%, comp growth from non-NIKE vendors, including Adidas, Converse Crocs, New Balance and PUMA, was in the high teens as the company continues its efforts to rebalance its assortment to promote vendor diversity. The company’s Power Store format remains an important differentiator. Power Stores are about 9,000 square feet in size—nearly four times as large as its mall store. We see these Power Stores as centers for sport and culture, which are able to replace several mall-based stores operating under different banners, and to capitalize on local culture (for example, by featuring products from local designers). In fiscal 2022, the company plans to open 40 new Power Stores.

| Tailwinds | Headwinds |

|

|

- Accelerate its shift to bigger box off-mall format

- Work with strategic partners and brand owners to deliver compelling and unique products

- Promote vendor diversity by adding more non-NIKE brands

- Continue to roll out its Power Store format and expand the women’s category through community activation, enhanced space and elevated assortments

- Broaden its customer base through acquisitions of new banners to strengthen its portfolio of retail brands

- Diversify its product mix across brands and categories. Expand its apparel category, through the launch of private labels, new third-party brands and strategic collaborations

- Continue to expand its FLX reward program

- Extend the company-owned distribution across channels and banners

- Add third-party distribution centers, which enable local product sourcing and more efficient operations

- Invest in its multi-channel capabilities: add flexibility and convenience to the checkout experience, and offer new digital payment options, including Apple Pay, Google Pay and Klarna.

- Accelerate its rollout of drop ship across vendors, banners and regions through 2022

- Adopt a disciplined approach to capital allocation to improve operating efficiency. In February 2022, the company launched a new cost savings program, which is expected to generate savings of about $200 million on an annualized basis.

- Use data analytics and machine learning to provide improved product searches and offer consumers personalized experiences.

- Upgrade point-of-sale systems, including adding a contactless payment system.

Company Developments

Company Developments

| Date | Development |

| June 1, 2022 | Foot Locker appoints Neil Bansal as Executive Vice President and Chief Strategy and Transformation Officer, effective immediately. Bansal joined Foot locker from Constellation Brands, where he served as Senior Vice President–Strategy, Insights and Analytics. |

| May 5, 2022 | Foot Locker announces a long-term strategic partnership with apparel and footwear brand owner Adidas. Including all Foot Locker banners in Asia-Pacific, Europe, the Middle East and Africa (EMEA), and North America, the new strategic collaboration targets more than $2 billion in retail sales by 2025, almost tripling levels from 2021. |

| April 19, 2022 | Foot Locker Foundation awards $560,000 in annual scholarships to 20 high school seniors and 30 Foot Locker team members. |

| April 18, 2022 | Foot Locker’s Champs Sports unveils new retail concept—Champs Sports Homefield in Pembroke Pines, Florida. The location, with an area of over 35,000 square feet, is Champs Sports’ first iteration of its new Homefield concept and the largest of any Foot Locker’s subsidiary. |

| March 24, 2022 | Foot Locker unveils its goal to achieve net zero greenhouse gas (GHG) emissions by 2050. |

| March 21, 2022 | Foot Locker announces the appointment of Samantha Lomow as President, Global Brands, effective March 18, 2022. Lomow joined Foot Locker from toy retail company Hasbro Inc., where she served as President, Branded Entertainment, bringing more than 25 years of experiences of brand innovation and business transformation across consumer products. |

| March 8, 2022 | Foot Locker teams up with Bottomless Closet, a non-profit organization empowering woman to enter workforce, to support women to integrate their personal style in their everyday workplace attire. |

| February 17, 2022 | Foot Locker enters into a partnership with brand management company Authentic Brands Group for exclusively carrying select Reebok footwear models in Foot Locker’s US stores and its e-commerce website. |

| January 31, 2021 | Foot Locker appoints Robert Higginbotham as Vice President, Investor Relations. Higginbotham has about 20 years of experience on Wall Street as an equity research analyst and portfolio manager. |

| December 13, 2021 | Foot Locker launches its first private-label womenswear brand, Cozi, following the launch of its apparel line LCKR in October 2021. |

| December 9, 2021 | Foot Locker announces that its Community Empowerment Program, in collaboration with Laureus Sport for Good Foundation, will invest $750,000 in organizations supporting underserved youth across Canada and Europe. |

| November 18, 2021 | Foot Locker announces organizational changes. Franklin Bracken, current EVP and CEO–North America, is promoted to COO; Susan Kuhn, currently working as SVP and General Manager–Europe, is promoted to President–EMEA, while retaining her responsibilities as General Manager–Europe; and the responsibilities of Andrew Gray, current EVP and Chief Commercial Officer, in leading the organization’s commercial area has been expanded. |

| November 15, 2021 | Foot Locker merges its Champs Sports and Eastbay brands–the combined brand is named as Champs Sports x Eastbay. |

| November 8, 2021 | Foot Locker launches All City by Just Don – a lifestyle brand created in collaboration with the American streetwear designer Don C. |

| October 18, 2021 | Foot Locker launches its new apparel line LCKR by Foot Locker. |

| August 2, 2021 | Foot Locker enters into an agreement to acquire Eurostar (WSS), a US-based athletic footwear retailer, for $750 million. |

| August 2, 2021 | Foot Locker enters into an agreement to acquire Japan-based digitally-led footwear retailer Text Trading Company, K.K. (atmos), for $360 million. |

| May 26, 2021 | Foot Locker launches an exclusive basketball-inspired apparel capsule collection, designed by Melody Ehsani, the retailer’s new Creative Director of its women’s business. |

| April 27, 2021 | Foot Locker launches a $3 million, multi-city program to empower youth in Black, Indigenous and people of color (BIPOC) communities, in collaboration with the Local Initiatives Support Corporation (LISC). |

| April 27, 2021 | Foot Locker collaborates with Puma and Diadora, launching two new sneakers to raise awareness for autism. |

| April 12, 2021 | Foot Locker selects payment service provider FreedomPay to implement digital wallets and new a touchless payment system across its more than 2,000 stores in the US. |

| April 8, 2021 | Foot Locker releases its 2019–20 Impact Report that highlights environment, social and governance (ESG) priorities, including the company’s commitment to invest $200 million over five years to support the retailer’s Black workforce and communities. |

| March 25, 2021 | Foot Locker appoints Andrew Page as EVP and CFO, effective April 12, 2021. Prior to joining Foot Locker, Page worked at Advance Auto Parts, Inc. as SVP, Chief Accounting Officer and Controller. |

| March 5, 2021 | Foot Locker appoints renowned designer Melody Ehsani as Creative Director of its company’s women’s business. In the role, Ehsani will design quarterly apparel capsule collections, with the first capsule to launch in Summer 2021. Furthermore, Ehsani will curate an on-going selection of NIKE and Jordan products. |

| February 17, 2021 | Foot Locker announces that its Board of Directors has approved a $275 million capital expenditure program for 2021, compared to $155 million spent in 2020. A substantial portion of 2021 funds will be invested into expanding its digital capabilities and infrastructure, as well as streamlining its global supply chain. |

| December 14, 2020 | Foot Locker appoints Himanshu Parikh as SVP and Chief Information Officer. Parikh has over 25 years of experience in organizational development, strategic planning and business solutions. Most recently, he served as SVP and CTO at The Michaels Companies. Prior to joining Michaels, Parikh held several executive roles with Ross Stores. |

| November 30, 2020 | Foot Locker announces the planned retirement of Lauren Peters, CFO and EVP, effective April 2021. The company expects to consider both internal and external candidates to find Peters’ successor. |

| July 23, 2020 | Foot Locker announces a new organizational structure. Andy Gray is promoted to EVP and Chief Commercial Officer, Frank Bracken to EVP and CEO of North America, and Scott Martin to EVP and CEO of Asia Pacific. Lew Kimble, current EVP and CEO, Asia-Pacific, retires at the end of August 2020, following a more than 40-year career at the company; while Jake Jacobs, EVP and CEO, North America, retires, effective at the end of August 2020, following more than 20 years at Foot Locker. |

| February 4, 2020 | Foot Locker launches FLX, the company’s new membership program unifying all Foot Locker brands. The program has three membership tiers, each providing additional benefits. |

| September 25, 2019 | Foot Locker announces a $13 million investment in NTWRK, a youth culture e-commerce and content platform. With this investment, Foot Locker looks to release exclusive products and original content. |

| February 7, 2019 | Foot Locker announces a $100 million strategic minority investment in Goat Group, a marketplace for second-hand, accessories, apparel and footwear. |

- Richard Johnson—Chairman, President and CEO

- Andrew Page—EVP and CFO

- Franklin Bracken—EVP and COO

- Neil Bansal—EVP and Chief Strategy and Transformation Officer

- Andrew Gray—EVP and Chief Commercial Officer

- Giovanna Cipriano—SVP and Chief Accounting Officer

- Himanshu Parikh—SVP and Chief Information Officer

Source: Company reports/S&P Capital IQ