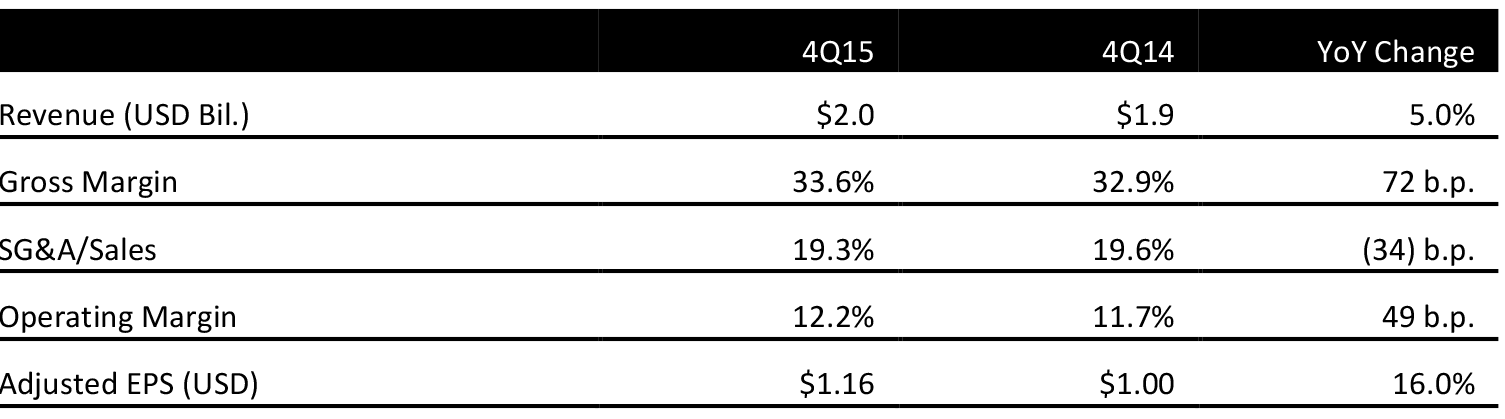

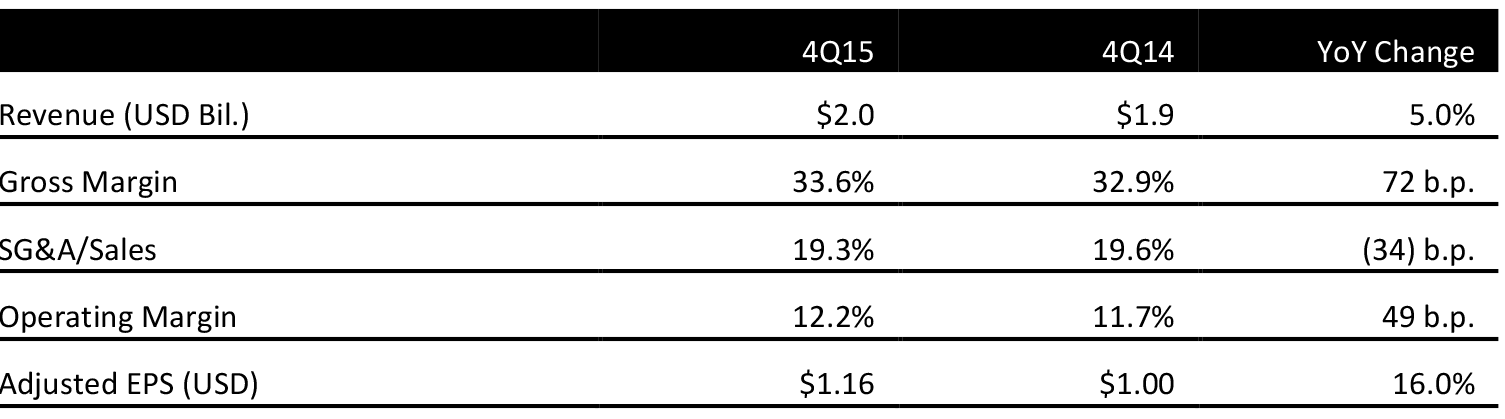

Source: Company reports

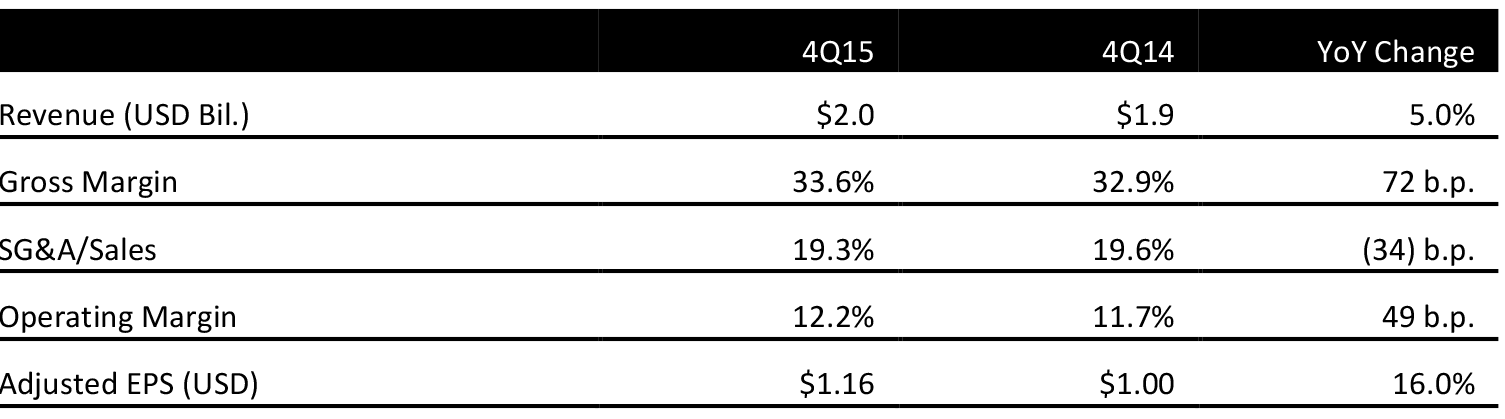

Foot Locker reported strong 4Q15 total sales of $2.0 billion, up 5.0% year over year and in line with the consensus estimate. On a constant-currency basis, sales increased by 8.8%. Net income totaled $158 million, or $1.16 per diluted share, an 8.2% gain over the year-ago quarter.

Results by Segment

Footwear drove sales gains, with double-digit growth in the quarter. Men’s footwear increased at a high-single-digit rate, while women’s and kids’ footwear were both up by double digits. Nike, Under Armour and other activewear brands have driven sales amid the ongoing athleisure trend.

By category, the running business recorded mid-teen gains in comps in the quarter, with double-digit gains in every region, driven by Nike and adidas. Basketball saw gains in the lower end of the mid-single digit range, thanks to strong growth of the Jordan brand (especially in North America), as well as Nike and Stephen Curry for Under Armour. These gains were partially offset by low-single-digit declines in apparel and accessories.

Results by Division

Total sales in the international division increased by more than 10% in local currency in each of the regions, led by Foot Locker Asia-Pacific’s mid-teens comparable sales gain. Foot Locker Europe increased in the teens and Foot Locker Canada saw double-digit comp growth.

The direct-to-customer division turned in another strong performance, with an overall comparable sales gain of 9.6%. Domestic store banner e-commerce businesses collectively increased by 20%, with even faster growth outside the US. This was partially offset by Eastbay sales, which experienced a low-single-digit decrease in the quarter.

The domestic divisions posted solid sales, with Kids Foot Locker leading the way with a high-single-digit comparable sales gain and a double-digit revenue increase. Champs Sports and Lady Foot Locker each had mid-single-digit comp increases, while Footaction saw a low-single-digit increase compared to the year-ago quarter. The Runners Point and Sidestep banners saw mid-single-digit decreases in comps.

2015 Results

For 2015, Foot Locker reported that total sales increased by 3.6%, to $7.4 billion. Adjusted EPS was $4.29, up 20% compared to 2014. Comparable-store sales increased by 8.5% in the year.

Guidance

For 2016, Foot Locker expects mid-single-digit comp growth, in line with the consensus estimate of 4.7%. EPS is projected to grow by double digits versus analysts’ expectations of a 10.8% increase, to $4.75. The consensus estimate calls for sales to increase by 5.1% to $7.8 billion. The company did not provide sales guidance for 2016.