Source: Company reports/Coresight Research

4Q17 Results

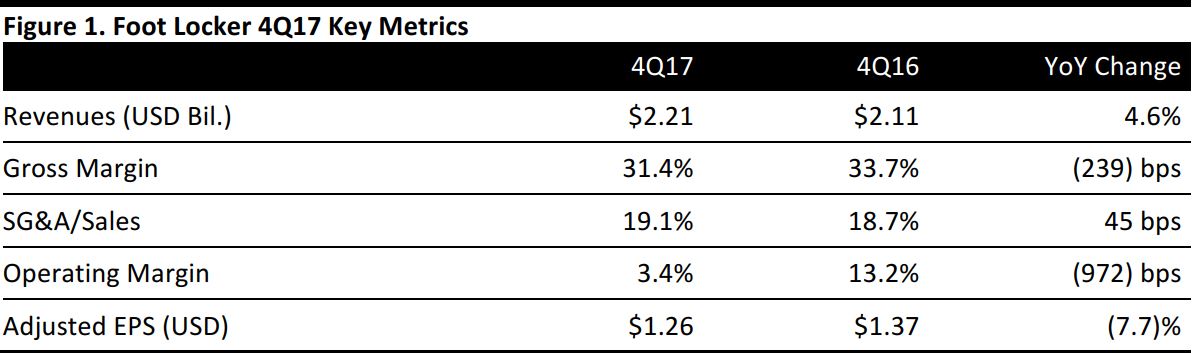

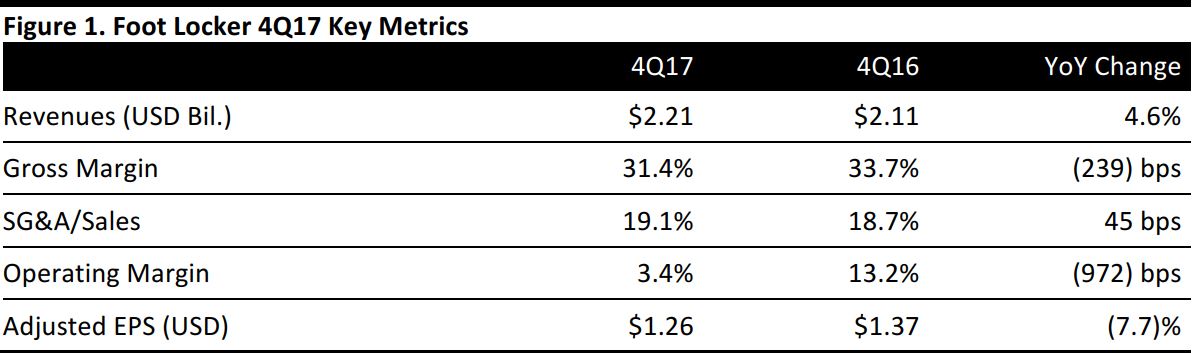

Foot Locker reported 4Q17 sales of $2.21 billion, up 4.6% year over year and slightly below the $2.22 billion consensus estimate. Non-GAAP sales, which exclude the 53rd week of the year, were $2.12 billion.

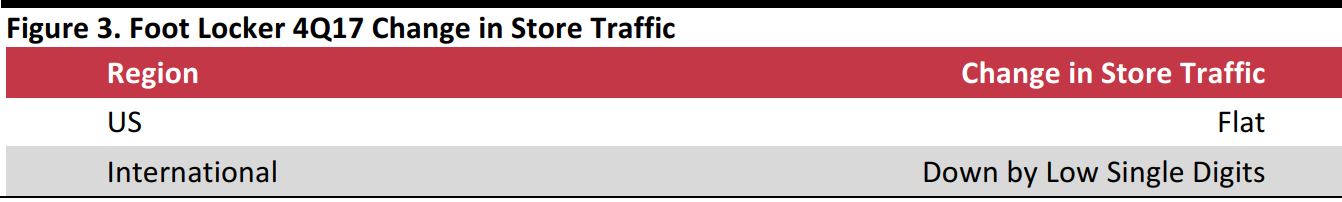

Comps decreased by 3.7%, missing the consensus estimate of a 2.4% decline.

Operating expenses included $46 million of depreciation and amortization and $148 million of litigation and other charges. Excluding the litigation charges, the operating margin would have been 10.1%.

Adjusted EPS was $1.26, compared with $1.37 in the year-ago quarter and above the $1.25 consensus estimate. GAAP EPS was $(0.40), compared with $1.42 in the year-ago quarter. Litigation and other charges accounted for $0.76 of the difference, while US tax reform accounted for $0.81, a tax valuation allowance for $0.07 and a French tax rate change for $0.02.

FY17 Results

Full-year revenues were $7.78 billion, up 0.2% from the prior year.

Full-year comps decreased by 3.1% and were down 0.5% excluding currency effects.

Full-year adjusted EPS was $3.99, down 17.3% from $4.82 in the prior year. Full-year GAAP EPS was $2.22, down 54.8% from $4.91 in the prior year.

As of the end of the fiscal year, the company operated a total of 3,310 stores, a decrease of 53 stores from the prior year.

Details from the Quarter

- Direct-to-consumer sales increased, accounting for 16.1% of total sales in the quarter, up from 15.3% in the year-ago quarter.

- Apparel delivered its seventh consecutive quarter of positive comp growth, with comps growing by high mid-single digits, driven by branded fleece and big logo T-shirts.

- Footwear remained challenging, declining by mid-single digits. Footwear comps were down by low single digits in men’s, by mid-single digits in kids and by double digits in women’s. Men’s running was again the strongest component of footwear, posting a high-single-digit comp, while men’s basketball comps were down by high single digits.

Source: Company reports

Source: Company reports

Outlook

The company provided the following expectations for FY18:

- Comps: flat to up by low single digits (versus the consensus estimate of 1.0%).

- Gross margin: to recover from 2017’s 31.6%.

- SG&A: one percentage point higher (from 19.3% in 2017).