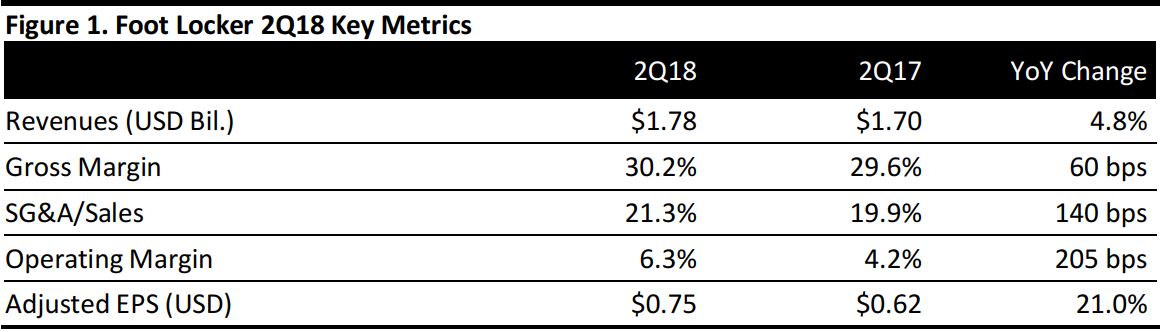

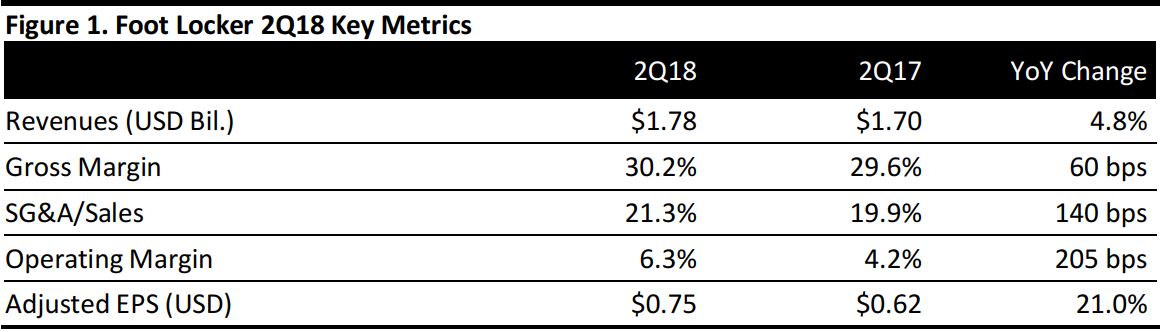

Source: Company reports/Coresight Research

Note: SG&A/Sales and Operating Margin exclude litigation expense

2Q18 Results

Foot Locker reported 2Q18 adjusted EPS of $0.75, up from $0.62 a year ago and ahead of the $0.70 consensus estimate. Revenues were $1.78 billion, up 4.8% year over year and above the $1.76 billion consensus estimate.

Store traffic was down in the low single digits, and US banners experienced flat traffic while internationally traffic declined by high single digits.

Comps increased by 0.5%, in-line with company guidance but below the 0.7% consensus estimate. By channel, comp sales at stores declined by 0.8%, more than offset by a 9.3% increase in online comps. Online sales accounted for 13.5% of total company sales, up from 12.7% in the year-ago quarter.

Apparel continued a solid performance, with comps up by double digits, its eighth consensus quarter of positive comp sales. Apparel comps were driven by higher average selling prices and total units sold. Apparel was led by Nike, Jordan, Champion, Nike Air Max and Vans, with strong sales in tees, shorts, fleece and windwear.

The footwear business posted a slight comp decline, with average selling prices up, offset by total units declining. Men’s footwear was down by low single digits, while women’s and kids increased by low single digits. Footwear was led by Nike Air Force Ones, Vans, Easy and Slides. Accessories were down double digits, led by declines in hats and socks.

Kids Foot Locker in the US and Eastbay reported low single digit and high single digit comp increases, respectively. Champs Sports increased by mid-single digits while both Foot Locker US and Foot Locker Canada had slight gains. Foot Locker Europe and Asia Pacific were each down by low single digits. Sidestep was down mid single digits, while Runners Point reported comps down double digits.

The gross margin was 30.2% in the first quarter, up 60 basis points, reflecting a 30 basis-point decline in the merchandise margin rate plus 30 basis points of deleveraging its occupancy and buyer’s compensation. The higher merchandise rate was primarily due to lower markdowns.

SG&A expense rose by 140 basis points to 21.3% of sales, reflecting ongoing investments in digital operations and higher wages.

Foot Locker opened 13 stores during the quarter while closing 21. Management commented that the flow of premium product continues to improve, with increasing breadth and depth in the most-sought-after styles from its key vendors.

Outlook

Management did not update guidance; however, commented that it expects comps to turn positive during the year.

Prior guidance is as follows:

- Comps flat to up by low single digits, versus the consensus estimate of 1.0%.

- Gross margin of 31.6%, up between 30 and 40 basis points from 2017.

- SG&A: One percentage point higher (from 19.3% in 2017), driven by ongoing investments in digital operations.

- For the year, the company expects to open 45 new stores and close 120.