Source: Company reports

2Q16 RESULTS

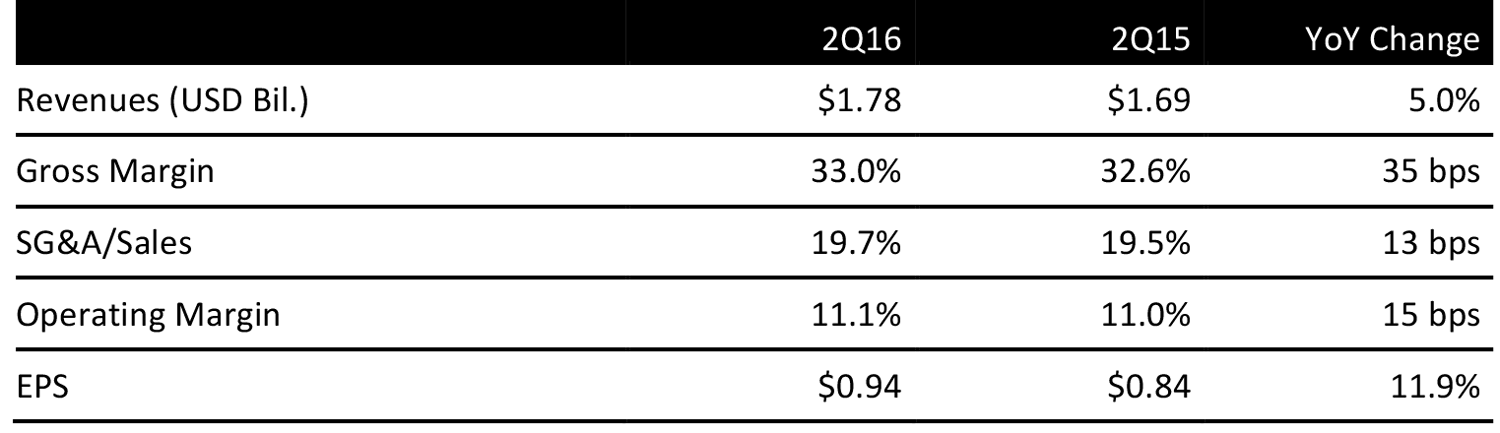

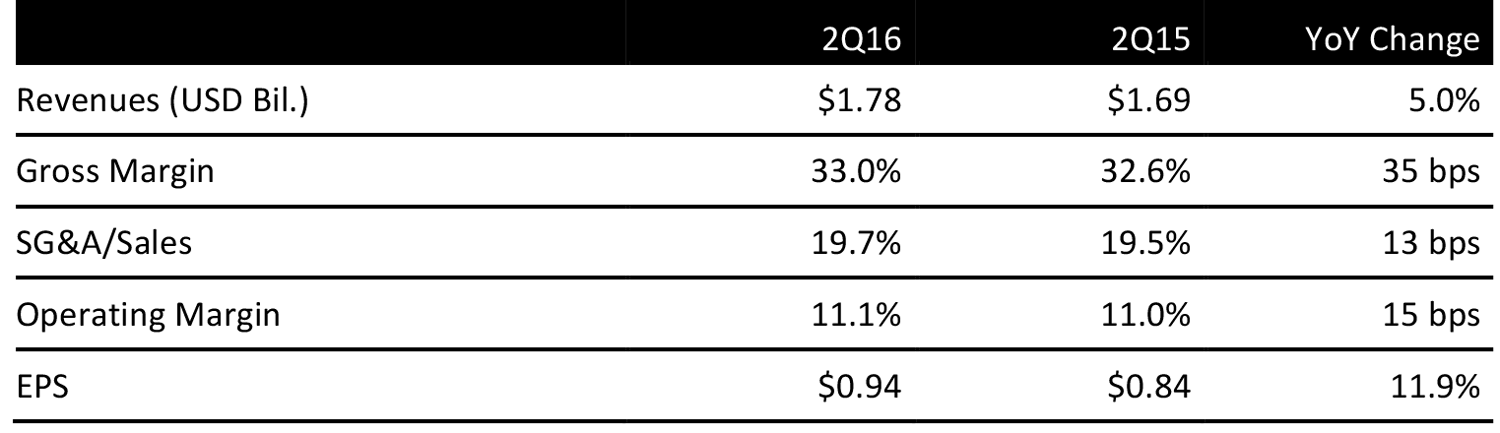

Foot Locker’s 2Q16 revenues were $1.78 billion, up 5% from the year-ago quarter and above the consensus estimate. Excluding the effect of foreign currency, sales increased 5.4% for the quarter. Same-store sales rose 4.7% and topped expectations of 3.9%.

Gross margin was 33% in 2Q16, up 35 basis points from the year-ago quarter. The gains were driven by lower markdowns in stores, partially offset by a decline in the merchandise margin from its direct-to-customer business.

The SG&A expense rate increased to 19.7% from 19.5% last year. Foot Locker spent more to drive traffic to its website. Overall, management was pleased with expense control during the quarter, especially store wages.

Direct-to-consumer comps were up 7.1%, driven by digital sales in the US, Europe and Canada.

Inventory was up 1.7% year over year and inventory turned almost three times in the quarter.

Foot Locker reported 2Q16 EPS of $0.94, and beat the consensus estimate of $0.90, up 11.9% year over year.

Business Divisions

- Foot Locker Canada led comp growth, followed closely by Champs Sports, both with low double-digit comp gains driven by footwear, apparel and accessories.

- Foot Locker US posted mid-single-digit comp gains, despite a negative 100 basis point impact from its NY flagship store being closed for renovations during the quarter.

- Foot Locker Europe and Asia Pacific comps were up mid-single-digits, on top of double-digit gains in the year-ago quarter. Footwear, specifically running, is the leading category in each geographic.

- The Kids Foot Locker contributed positive comps, up low single-digits in the second quarter. With the net addition of 26 stores, total sales were up almost 10%.

- Lady Foot Locker comps lagged, and were down low to mid-single digits.

Product Categories

- Footwear continues its strong growth, up in the high to mid-single-digit range. Within footwear, basketball was up mid-single-digits, driven by Jordan Retros, Nike Foamposites and certain basketball signature shoes, such as Kyrie Irving from Nike and Stephen Curry from Under Armour. Running footwear was up mid-single-digits, driven by Roche from Nike and nomad and Ultra Boost from Adidas.

- Apparel business was up mid-single-digits, led by men’s and kids apparel, partially offset by women’s and accessories. Men’s apparel, the largest piece of Foot Locker’s apparel business, was up mid-single-digits, following by kid’s apparel up double-digits. Accessories were down double-digits, negatively impacted by the sock business.

Outlook

The company maintained fiscal 2016 guidance of EPS up double-digits, in line with the consensus of +10% or $4.72. Comps are expected up mid-single-digits versus the consensus of +4%.

For 3Q16, management expects comps up mid-single-digits compared to the consensus of +4.7%. EPS is expected to increase “close to” double-digits versus the consensus of +12% or $1.12.