albert Chan

Introduction: Uncertainty Remains the Biggest Challenge Facing the Apparel Industry

In this fast-changing world, apparel brands and retailers are facing an increasingly complex combination of new technologies, disruptions and consumer expectations. At the macro level, the rising trade barriers and geopolitical tensions—from the US-China trade tensions to social instability in Hong Kong and the US to the global Covid-19 pandemic—are forcing apparel companies to change their sourcing strategies and reconsider both short- and long-term supply chain strategies.

At the micro level, adopting new technologies and sustainability practices—from product design and manufacturing to distribution—requires elevated technology investment and cost-control schemes.

In this report, we outline five key trends in apparel sourcing—considering the current challenges and opportunities facing the apparel industry, how the sourcing landscape is likely to shift and how apparel firms and their suppliers can remain competitive in the evolving marketplace.

[caption id="attachment_112256" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

1. Apparel Companies Are Looking for New Sourcing Destinations To Achieve Greater Cost Control and Efficiency

For years, global apparel companies have profited from finding suppliers and manufacturers at low costs in countries such as China. However, the long-established perception of China as the world’s factory may be coming to an end due to rising labor costs, trade barriers and social instability in the nation. Apparel companies are now looking for new sourcing destinations, such as Bangladesh, Cambodia and Vietnam.

Labor Costs Increase Significantly in China

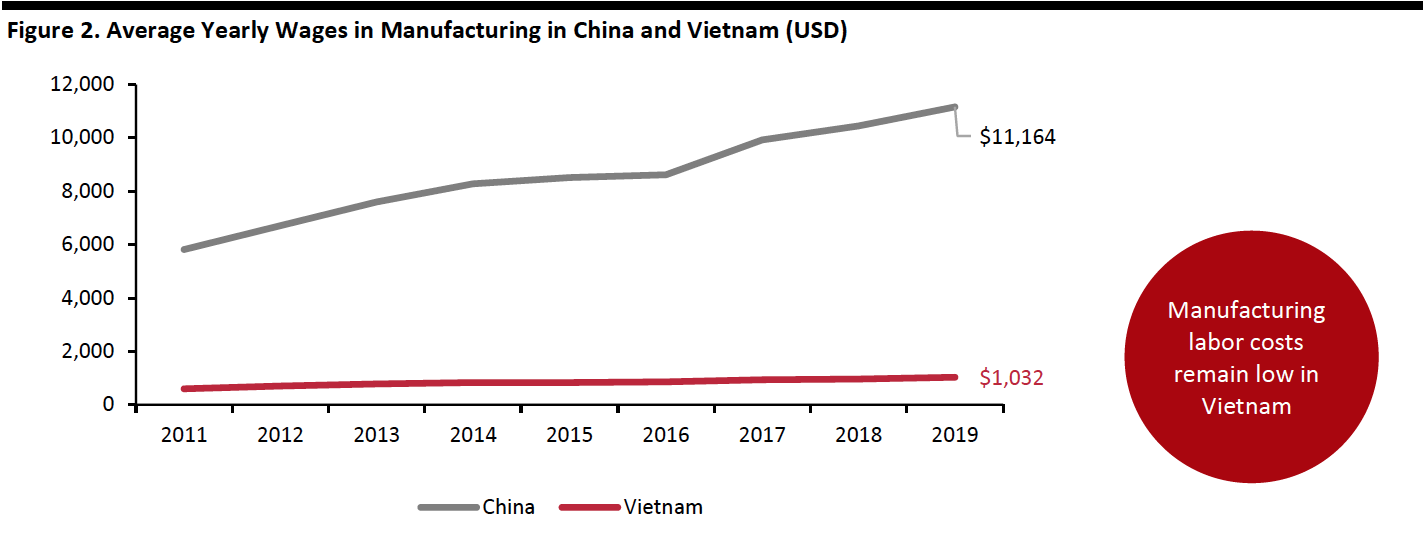

Rising labor costs in China’s manufacturing industry are pushing apparel retailers to consider relocating at least some of their production to lower-cost geographies, such as Vietnam. Wages in the sector doubled to ¥78,147 ($11,164 based on yearly average currency exchange rate) per year in 2019 from ¥30,700 ($5,820) per year in 2011, according to the National Bureau of Statistics of China.

Wages in manufacturing in Vietnam also increased substantially to $1,032 per year in 2019 from $600 per year in 2011, an increase of 72%, according to the Statistics Office of Vietnam. However, these costs remain relatively low in comparison to China (see Figure 2).

[caption id="attachment_112257" align="aligncenter" width="700"] Currencies converted to USD based on yearly average currency exchange rates

Currencies converted to USD based on yearly average currency exchange ratesSource: Statistics Office of Vietnam/National Bureau of Statistics of China[/caption]

Consumer Sentiment Toward Sourcing from China Changes in the Wake of the Coronavirus Crisis

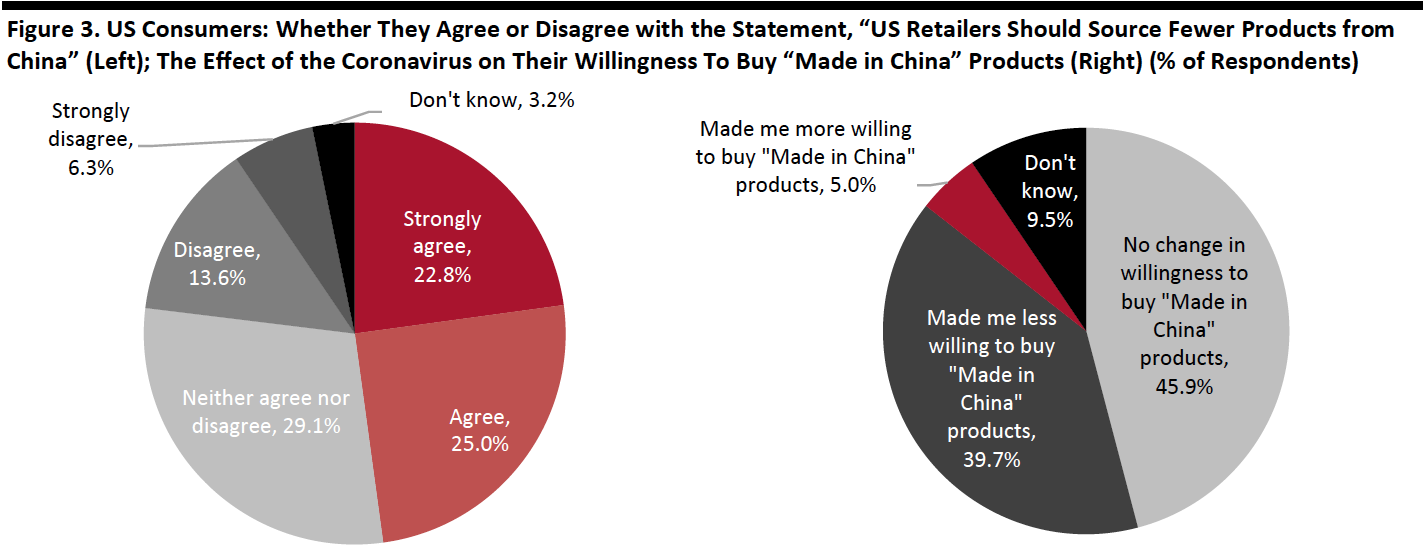

Following the global coronavirus pandemic, US retailers should review the extent of their reliance on China as a manufacturing hub—and whether that is evident to their customers, According to a Coresight Research proprietary survey of US consumers conducted on June 3, some 47.8% of respondents agree or strongly agree that US retailers should source fewer products from China. Furthermore, 39.7% reported that the pandemic has made them less willing to buy “Made in China” products, suggesting a sizeable consumer backlash in the wake of the coronavirus.

[caption id="attachment_112258" align="aligncenter" width="700"] Base: US Internet users aged 18+

Base: US Internet users aged 18+Source: Coresight Research[/caption]

Apparel Retailers Target New Sourcing Destinations

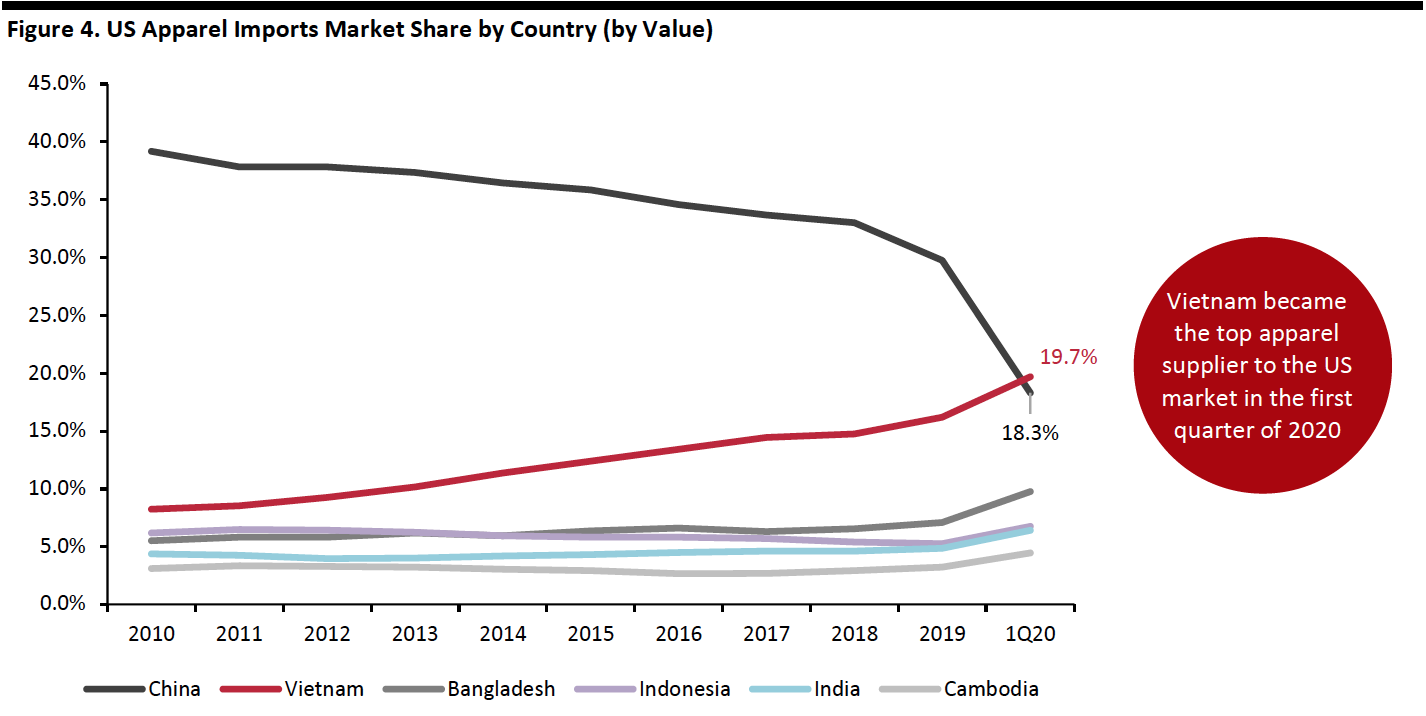

Vietnam surpassed China to become the top apparel supplier to the US market in the first quarter of 2020, according to the latest statistics from the Office of Textiles and Apparel (OTEXA). China’s market share in the US apparel import market dropped to 18.3% in the first quarter of 2020 (from 30% in 2019).

China has lost share to other Asian countries, particularly Vietnam (19.7% in the first quarter of 2020 vs. 16.2% in 2019), Bangladesh (9.8% in the first quarter of 2020 vs. 7.1% in 2019), Indonesia (6.7% in the first quarter of 2020 vs. 5.2% in 2019) and India (6.4% in the first quarter of 2020 vs. 4.8% in 2019). Cambodia is also becoming an important country for apparel sourcing (with 4.4% share in the first quarter of 2020 vs. 3.2% in 2019).

[caption id="attachment_112259" align="aligncenter" width="700"] Source: OTEXA[/caption]

Source: OTEXA[/caption]

A number of major US apparel retailers have reduced their sourcing or manufacturing exposure to China in 2019 and 2020:

- Abercrombie & Fitch reduced its dependence on suppliers in China in 2019 by more than 40% compared to in 2018

- Lululemon moved part of its production out of China to places like Cambodia and Vietnam

- Uniqlo is moving its production out of China to Indonesia.

Source: Company reports[/caption]

Source: Company reports[/caption]

2. Apparel Companies Are Adding Onshoring or Nearshoring to Their Sourcing Mix

In recent years, big domestic companies such as Brooks Brothers and Walmart have brought some of their operations back to the US, and more retailers are now considering onshoring or nearshoring.

Retailers Adopt Advanced Technologies and Onshoring and Nearshoring Strategies

Following the coronavirus outbreak, retailers are recognizing the value of a flexible supply chain and are therefore rethinking whether to bring some manufacturing back to the US. “Made in the US” represents a competitive edge for some retailers as consumers increasingly value domestic products. According to a recent survey conducted by Thomas, a product sourcing and supplier network, 64% of retailers, manufacturers and suppliers reported that they are “likely to extremely likely” to bring sourcing or production back to the US after the Covid-19 crisis. Business of Fashion also forecasts that over 20% of US fashion companies’ sourcing volume could come from nearshore sources by 2025, due to the rising adoption of automation technologies and consumers’ increasing demand for products to come to market quickly.

- Opie Way, a brand focused on quality leather shoes in the US, is bringing shoe-making operations and jobs back to the US in 2020, specifically to Western North Carolina.

- Walmart has committed to increase its US purchases by $50 billion annually by January 2023.

- Hickory Brands, a North Carolina-based shoelace manufacturer, also reported that bringing its supply chain back to the US from China would yield greater efficiency due to increased proximity.

- Denim producer Levi Strauss is reshoring part of its jeans manufacturing process back to the US and leveraging automation to cut lead times and better respond to shoppers’ demands. In partnership with technology firm Jeanologica, the retailer is testing a laser technology that automates the finishing phase that gives the “worn-in” look to jeans. This program, labeled by the company as Project F.L.X. (Future-Led Execution), will significantly reduce lead times due to faster finishing, enabling Levi Strauss to deliver products to market quickly and providing the flexibility to respond to changing consumer demand. The company built a large finishing facility at its Sky Harbor distribution center near Las Vegas to prepare for full-scale adoption of the technology in 2020. The laser finishing process is also more environmentally friendly, as it dramatically reduces the use of chemicals compared to the traditional denim-finishing process.

We believe that retailers and manufacturers will increasingly adopt automation technologies to become more data-driven, enabling and encouraging greater onshoring or nearshoring of production in industries such as apparel.

3. Technology Will Be Key to the Future of Apparel Sourcing

The global apparel sourcing market is rapidly evolving. The coronavirus pandemic made apparel retailers realize the importance of digitalization in driving speed, consistent quality and transparency through the supply chain. While technologies such as 3D, blockchain and sewing automation are not new, their applications in the apparel industry are becoming innovative and prevalent.

The Use of IoT and Robotics in Apparel Sourcing Remain Low Compared to Analytics

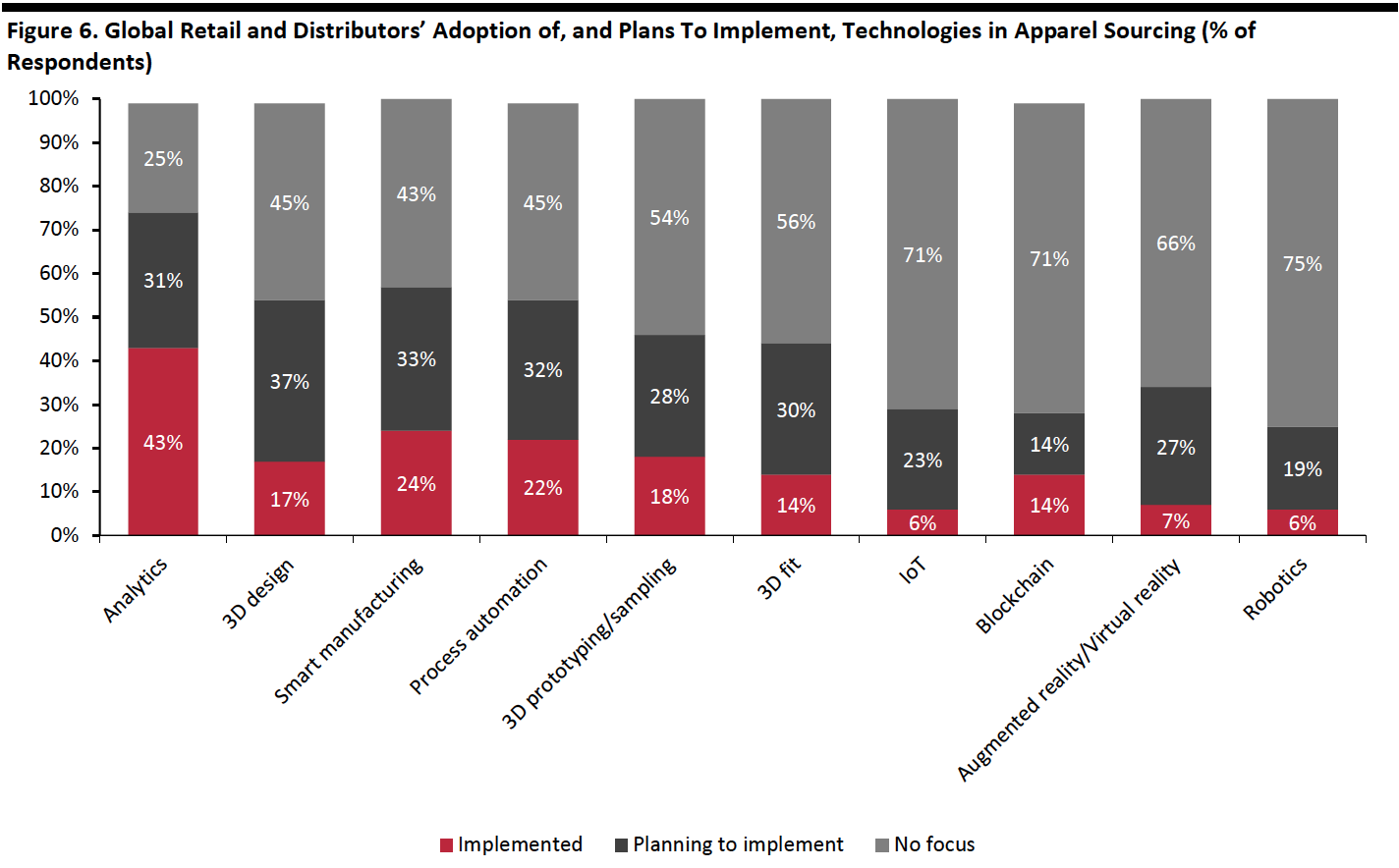

We expect to see a wave of apparel retailers leverage technologies to gain a competitive advantage in this challenging marketplace. According to Apparel Magazine’s 13th Annual Apparel Research Study published in August 2019, 43% of apparel retailers and distributors were already implementing analytics in the sourcing process, but few have adopted emerging technologies such as robotics and IoT. Some 37% of respondents said they plan to implement 3D design in the sourcing process, showing retailers’ intent to invest in transformative technologies.

[caption id="attachment_112261" align="aligncenter" width="700"] Base: 233 responses (46% were C-suite or executive-level management) from 181 global retailers and distributors, August 2019

Base: 233 responses (46% were C-suite or executive-level management) from 181 global retailers and distributors, August 2019Source: Apparel Magazine/Kurt Salmon[/caption]

Below, we highlight some key technologies and offer examples in retail of players that are embracing such capabilities to improve their operational performance.

Robotics: Robotics manufacturing can digitalize the production process, save costs and shorten the lead time to market. Softwear Automation is a US tech firm that developed Sewbot, a fully autonomous workline that can complete a T-shirt in half the time required by manual sewing—cutting workforce requirements by 90%, according to the company’s website. Li & Fung is collaborating with Softwear to develop a fully digitized apparel and textile supply chain, the sourcing firm announced in May 2018. The partnership between Li & Fung and Softwear Automation will initially focus on T-shirt production but expand to other categories in the future.

Softwear Automation also collaborated with Chinese apparel manufacturer Tianyun Garments (which supplies sportswear giant Adidas) in 2018. The company set up an automated T-shirt production factory in Little Rock, Arkansas, using Softwear Automation’s technology. The facility has a production capacity of 800,000 T-shirts per day. According to Tianyun Garments, the labor cost per item is about $0.33, making the facility cost competitive with even the cheapest sourcing markets.

We also discussed tech firm Grabit in a previous tech-focused insight report.

IoT: The IoT will enable apparel companies to identify operational problems immediately, making sourcing more efficient and cost effective overall. Target worked with technology firm Inspectorio in 2017 to increase transparency in its supply chain. The tech company has developed a platform that allows retailers, brands, vendors and factories to digitalize key tasks in supply-chain management—such as quality control and compliance-monitoring processes. This digitalization solution leverages artificial intelligence and machine learning to improve supply-chain efficiency, visibility and productivity.

Inspectorio is expanding the platform’s capabilities by integrating IoT technology to facilitate production tracking and the verification of manufacturing locations and responsible sourcing. The technology enables the real-time monitoring of performance, quality standards and sustainability criteria.

3D design: A challenge for the apparel industry is that designing garments is a time-consuming process, typically taking several weeks, as discussed in our recent report on the consumerization and digitalization of product design. Designers must sometimes restart work on a design to correct miscalculations, and mailing product samples back and forth between manufacturers and brands/retailers can cause delays. To overcome these hurdles, many companies are digitalizing their supply chains, which speeds up the process of product creation. One of the most effective ways to achieve this is to utilize 3D technology for design and sampling.

Players in the fashion industry that have been using 3D technology to achieve speed and intelligence in product design and development include Theory, Tommy Hilfiger and Xcel Brands.

4. Sustainable Sourcing Will Become the Norm

Sustainability in sourcing encompasses processes, logistics and technologies, and how they interact to address demands for environmental and social responsibility. We are seeing consumers become increasingly sustainability conscious. According to a Coresight Research survey conducted in February 2020, 23% of US consumers try to buy from brands or retailers that have a good record on environmental issues, and 20% are willing to pay more for clothing produced in an environmentally friendly way. Companies that have sustainable supply chains can therefore build positive recognition among consumers while minimizing their impact on the environment and improving long-term profitability.

Despite the significant economic impacts of the coronavirus crisis, we believe that consumer focus on environmental issues will continue, driving sustainable sourcing to a higher level.

In 2020 and beyond, we expect sustainable apparel sourcing to be realized through four key drivers, which we discuss below.

Blockchain: Next-Level Transparency in a Sustainable Sourcing Future

For apparel retailers, blockchain can help to ensure that the fabrics sourced are truly sustainable and that the clothes ordered from a specific factory are not actually poorer-quality items sourced from elsewhere.

- Fashion for Good, PVH Corp, C&A Foundation and Organic Cotton Accelerator, and Zalando have successfully collaborated with Bext360, an agricultural blockchain startup, on a blockchain pilot project that traces organic cotton from farm to consumer, which began in November 2019. Organic cotton is a key fiber in the sustainability strategies of fashion brands worldwide; it promotes healthy soils, healthy ecosystems, healthy people and thriving farming communities.

- Walmart is using blockchain technology in the supply chain to reduce waste, cut tracking times and improve contamination management and transparency. We believe that blockchain technology has the potential to improve all processes of digitalization in the supply chain and retail operations that currently use centralized systems.

Saving Costs through 3D Design

Benefits of 3D design include lower labor costs (saving 68% of costs, according to Li & Fung), reduced wastage (saving 55% of environmental waste), higher precision and streamlined communication among teams. Additionally, in a post-coronavirus world, 3D design will become increasingly important in the context of social distancing measures, with virtual showrooms set to represent the new normal in retail.

The Rising Use of Sustainable Fiber

More retailers and suppliers are creating garments using sustainable fabrics, and we expect to see this trend continue through 2020 and beyond. According to a 2020 survey by Sourcing Journal, 68% of chief procurement officers believe that it is somewhat or highly likely that there will be a sustainable share of recycled fibers in every new garment produced from 2025. Sustainable fabrics—including recycled cotton, organic hemp, organic linen and other innovative fabrics such as Tencel—are also biodegradable and less likely to cause skin irritation.

- Levi Strauss has spun recycled plastic bottles into its iconic denim jeans and has worked with other countries to launch the Better Cotton Initiative.

- Eileen Fisher is an apparel brand that uses organic cotton and sustainable fibers, specifically the tree-based fiber Tencel. The fiber is made from sustainably harvested trees and processed using solvents that are low in toxicity.

- Everlane teamed up with Millefili mill in Prato, Italy, (which specializes in upcycling cashmere wool and other clothing materials) to make sweaters using a blend of recycled cashmere and virgin wool.

Improving Labor Conditions

Baptist World Aid’s 2019 Ethical Fashion Report showed that 48% of fashion companies had already started to develop a living-wage (minimum income necessary for a worker to meet basic needs) methodology for the regions they source from, and 24% of fashion companies had published a level of commitment to pay their workers a living wage—demonstrating their willingness to demonstrate social and community responsibility.

It is also important for retailers and suppliers to properly inform employees about potential hazards of their job—such as in a factory—and adequately train them on how to perform their work safely.

5. Retailer-Supplier Collaboration Represents More Win-Win Opportunities

Retailer-supplier Collaboration efforts aim to reduce costs and streamline inventory through better forecasting, faster order fulfillment, or the use of joint warehouses. During the coronavirus pandemic, we have seen a growing number of retailers working closely with suppliers by being transparent and frequently communicating about the evolving challenges. We believe more retailers and suppliers will be mutually supportive throughout 2020.

Retailer-Supplier Collaboration in Challenging Times

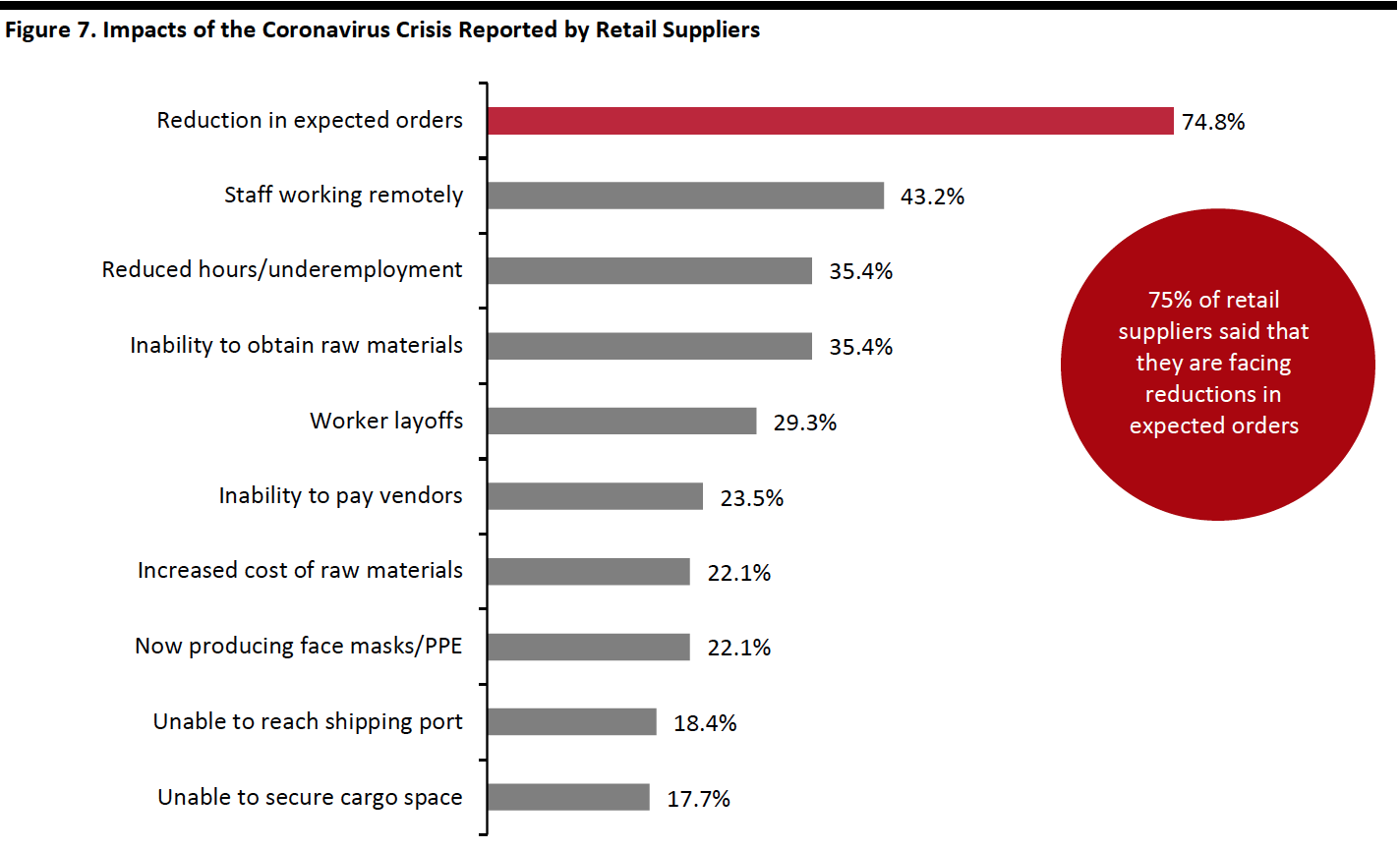

Some 35% of retail suppliers reported an inability to obtain raw materials for existing orders due the coronavirus crisis, while 22% reported that those materials were available but at a higher cost, according to a survey conducted in March 2020 by Better Buying, an online ratings platform that encourages buyers to adhere to their contractual agreements. The survey also found that 75% of retail suppliers reported to be facing a reduction in expected orders.

[caption id="attachment_112262" align="aligncenter" width="700"] Base: 294 retail suppliers from 39 countries, March 18–31, 2020

Base: 294 retail suppliers from 39 countries, March 18–31, 2020Source: Better Buying[/caption]

Apparel retailers and brands such as Gap, H&M and Marks and Spencer reportedly canceled shipments of summer orders and halted fall production due to the impacts of the coronavirus pandemic.

However, there are a number of other companies who made commitments to continue accepting orders and collaborate with sourcing suppliers to adjust inventory and minimize lost sales—including Inditex, NIKE, PVH Corp., Target and VF Corp. Ralph Lauren prioritized payments to suppliers that were at risk of going out of business during the pandemic. Ross Stores worked with suppliers to rationalize current assortment plans and reconfigure orders to continue producing viable products. According to Better Buying’s survey, several suppliers indicated that their buyers are willing to collaborate with them “to find out the best way to solve the problem.”

We believe that such retailer-supplier collaboration will be important to the future of the apparel industry, as it will support suppliers’ capacity to resume operations and efficiently deliver quality items post pandemic. Enhanced communication with suppliers could also promote sustainability through the supply chain, as well as improving inventory management for retailers.

Key Insights

We are seeing a potential wave of apparel retailers moving sourcing and production out of China due to ongoing trade tensions and rising labor costs in the country. The Covid-19 pandemic has also affected consumer sentiment toward “Made in China” products, which could further prompt companies to relocate sourcing.

Companies are also adding onshoring to their sourcing mix as part of efforts to shorten the lead time of products going to market.

More apparel retailers and brands are adopting technologies such as 3D design, blockchain and sewing automation to stay competitive and save costs in the supply chain. The integration of blockchain technology could play an important role in sustainability and transparency across businesses. We have seen a growing number of retailers working closely with suppliers by frequently communicating about the evolving challenges during the coronavirus crisis. We believe that retailers and suppliers should continue to support each other to gain mutual benefits through the remainder of 2020 and beyond.