DIpil Das

Introduction

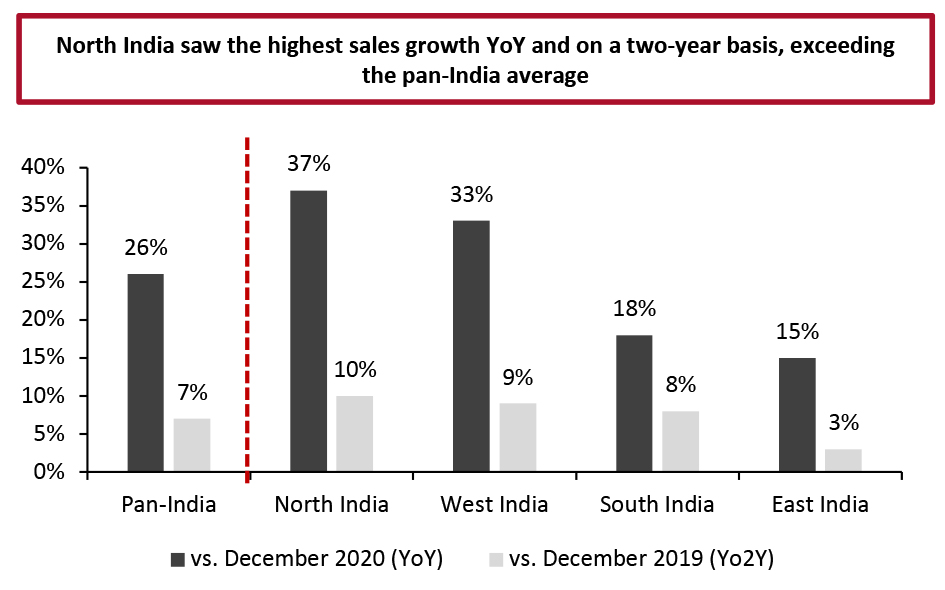

What’s the Story? The retail sector in India has witnessed a wave of change since the pandemic hit the country in March 2020. The pandemic-led shift in consumer behavior and shopping habits have forced most brands and retailers to adopt several long-term retail trends and innovations in a short timeframe: Retailers have quickly launched new business models and embraced technologies in their businesses that would otherwise have been considered long-term plans. At a time when India’s $800 billion retail sector is witnessing unprecedented growth—led by the surge in digital adoption, e-commerce and technological advancements to meet evolving consumer expectations—it is imperative that brands and retailers understand current trends and potential future opportunities to capitalize on this growth. We examine five key trends that are reshaping retail in India, covering data analytics, immersive technologies, digital payments, social shopping and alternative fulfillment. We discuss shifts in consumer behavior and examples of notable retailer initiatives across these trends. Why It Matters We estimate that India’s total consumer spending on core retail categories (food and non-alcoholic beverages; alcoholic beverages, tobacco and narcotics; clothing and footwear; furnishing, household equipment and routine household maintenance; recreation and culture; and personal effects) will increase by 9.9% year over year in fiscal 2023 (ending March 31, 2023; in India, the fiscal year runs from April 1 to March 31), to $898.5 billion. We expect steady growth in fiscal 2024, with spending set to total $1 trillion, based on data from the Ministry of Statistics and Programme Implementation. (All conversions to dollar figures are at constant 2021 exchange rates.) Furthermore, despite the impacts of the second wave of the pandemic between April and June 2021, India’s retail sector has since witnessed a strong resurgence in sales, according to the Retailers Association of India (RAI). Retail sales in India in December 2021 increased by 26%, year over year, and by 7% on a two-year basis (compared to pre-pandemic December 2019), according to the 23rd edition of the RAI Business Survey (see Figure 1). Going forward, we expect India’s retail sector to witness accelerated growth through the rapid implementation of long-term retail trends, beginning in fiscal 2023.Figure 1. India: Retail Sales Growth by Region, December 2021 (% Change) [caption id="attachment_143455" align="aligncenter" width="700"]

Source: RAI[/caption]

Source: RAI[/caption]

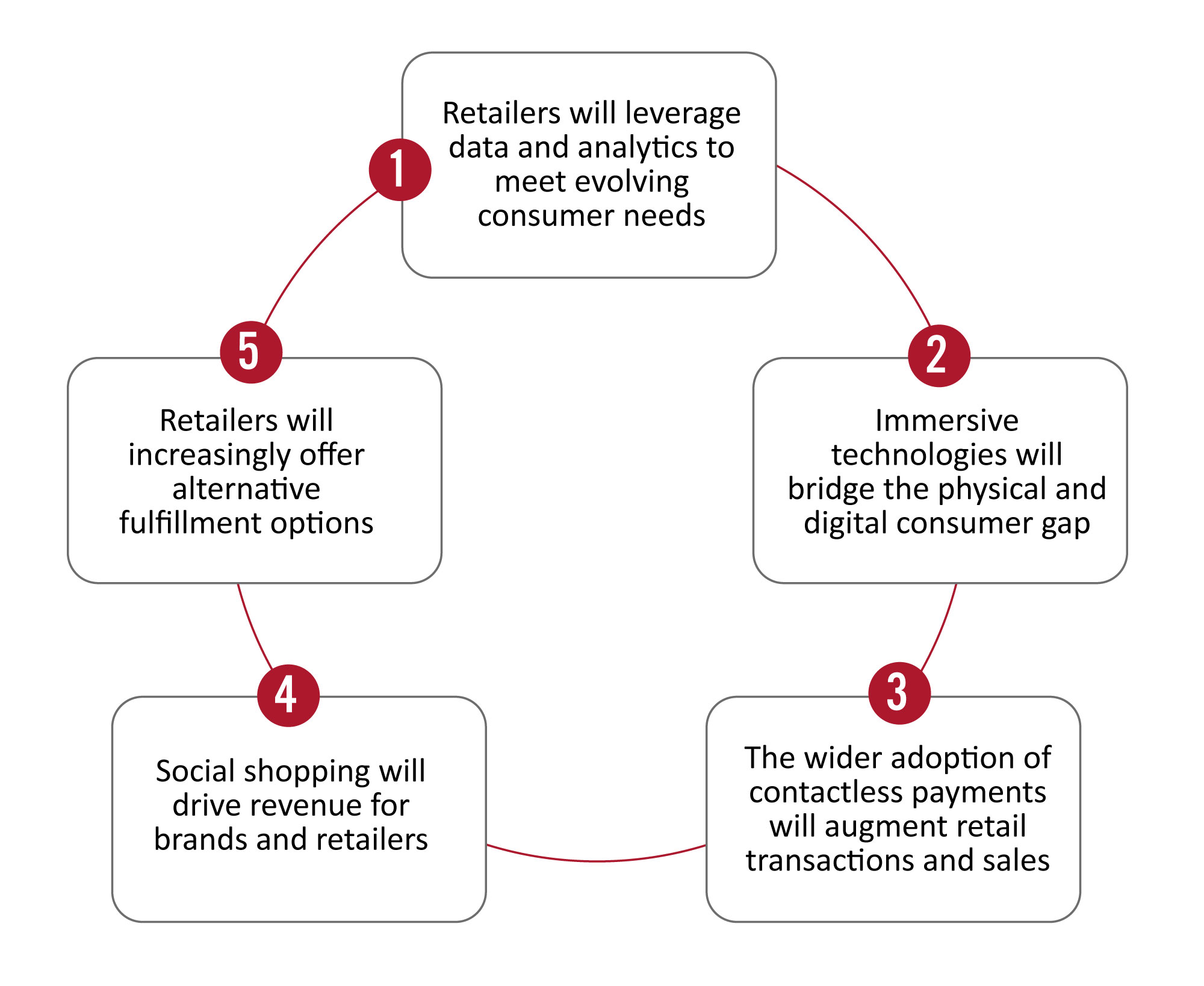

Five Trends Reshaping Online and Offline Retail: Coresight Research Analysis

In Figure 2, we present five key trends that will continue to reshape the retail sector in India in fiscal 2023 and beyond, and examine each in detail below.Figure 2. India: Trends Reshaping Online and Offline Retail [caption id="attachment_143468" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

1. Retailers Will Leverage Data and Analytics To Meet Evolving Consumer Needs

We expect brands and retailers in India to increasingly focus on the power of data to improve business performance. By adopting technologies that support the collection and analysis of consumer data, retailers can better understand shopper journeys and engagement levels—enabling them to more effectively forecast demand and purchasing behavior, determine product, pricing and promotional strategies, tailor their offerings and promote cross-selling opportunities.

The global retail analytics market is set to grow from $5.8 billion in 2021 to $18.3 billion in 2028 at a CAGR of 17.7% during the forecast period, according to estimates by India-based market research firm Fortune Business Insights.

Both online and brick-and-mortar brands and retailers can employ predictive analytics to make data-powered business decisions around demand forecasting and inventory management: E-commerce players should analyze abandoned carts, the online customer journey and shopper profiles; physical retailers should look at store-based merchandising decisions as well as product placement and promotion.

In Figure 3, we present examples of two notable retail brands that are currently using data analytics to drive sales, revenue and conversion.

Source: Coresight Research[/caption]

1. Retailers Will Leverage Data and Analytics To Meet Evolving Consumer Needs

We expect brands and retailers in India to increasingly focus on the power of data to improve business performance. By adopting technologies that support the collection and analysis of consumer data, retailers can better understand shopper journeys and engagement levels—enabling them to more effectively forecast demand and purchasing behavior, determine product, pricing and promotional strategies, tailor their offerings and promote cross-selling opportunities.

The global retail analytics market is set to grow from $5.8 billion in 2021 to $18.3 billion in 2028 at a CAGR of 17.7% during the forecast period, according to estimates by India-based market research firm Fortune Business Insights.

Both online and brick-and-mortar brands and retailers can employ predictive analytics to make data-powered business decisions around demand forecasting and inventory management: E-commerce players should analyze abandoned carts, the online customer journey and shopper profiles; physical retailers should look at store-based merchandising decisions as well as product placement and promotion.

In Figure 3, we present examples of two notable retail brands that are currently using data analytics to drive sales, revenue and conversion.

Figure 3. India: Retail Brands Leveraging Data Analytics To Drive Sales and Conversion [wpdatatable id=1812 table_view=regular]

Source: Company reports 2. Immersive Technologies Will Bridge the Physical and Digital Gap for Consumers With consumers’ increased inclination toward online shopping channels, brands and retailers are switching to immersive technologies such as conversational AI (artificial intelligence), augmented reality (AR) and 3D tools to bridge the physical and digital gap and replicate the in-store experience online. Many brands have rolled out virtual try-on offerings to help consumers with product discovery and improve their engagement levels with the brand.

- India-based beauty-tech retailer Boddess launched its AR-powered virtual try-on tool, “The Boddess Virtual Pro,” in March 2020. The tool allows customers to virtually try on makeup across different SKUs (stock-keeping units) in real time from the comfort of their homes. It also offers a skin-analyzer tool that assesses skin-related issues such as wrinkles, pores and dark spots, and recommends products for each skin type.

- Indian jewelry retailer Caratlane offers a virtual try-on feature with facial detection and 3D imaging technology that allows its users to virtually put on thousands of earrings from its product range and see a 3D virtual view of how it looks on them.

- Indian jewelry brand Tanishq from the house of Tata Group uses AR at airport kiosks in Bangalore and Delhi to let travelers try on jewelry virtually. Customers can select the jewelry they wish to try on from a screen and then turn to the AR mirror that shows them wearing the jewelry virtually. The jewelry also moves with the person, giving a realistic effect.

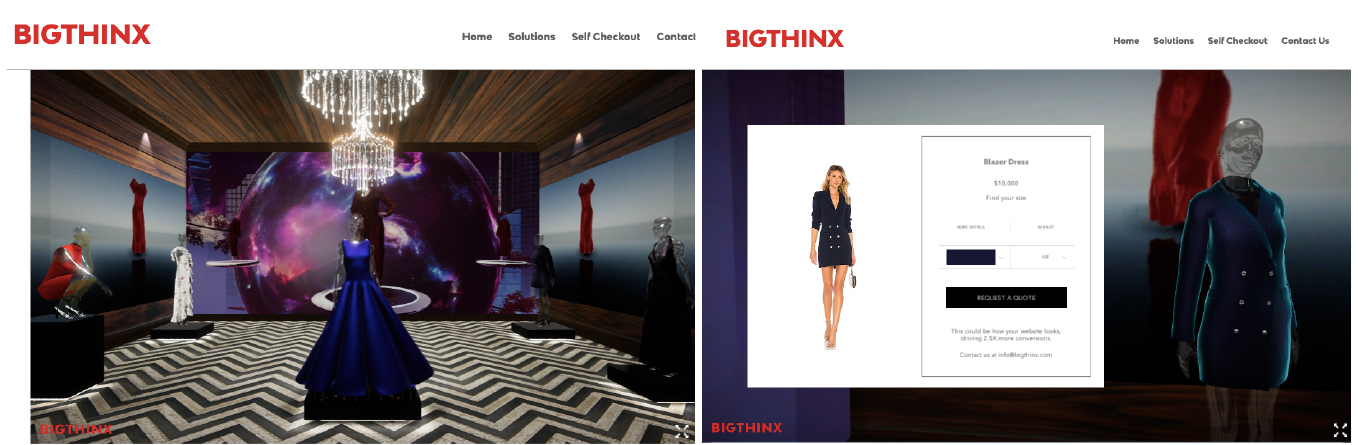

- BigThinx is an Indian fashion-tech company that uses AI and computer vision to create a personalized 3D virtual avatar from 2D images for fashion brands and their customers. Its AI visualization platform, “Lyflike,” enables fashion brands to digitize human avatars for virtual fashion shows, photo shoots, and online and in-store shopping. The tool renders 3D body scans and body measurements from 2D images to accurately predict sizes for mass customization and made-to-measure fashion. It also helps fashion brands to create virtual showrooms with digital clothing.

BigThinx’s virtual showroom for brands and retailers (left) and product description using virtual models (right)

BigThinx’s virtual showroom for brands and retailers (left) and product description using virtual models (right) Source: Company website [/caption]

- Swirl is an Indian live-video commerce SaaS (software-as-a-service) solution that offers virtual shopping experiences that replicate real-life moments. It offers one-to-one shopping, enabling consumers to connect and interact with brands and store associates for a personalized shopping experience with video and chat support. The solution also provides one-to-many shopping features with live video shopping, and real-time consumer interaction and feedback.

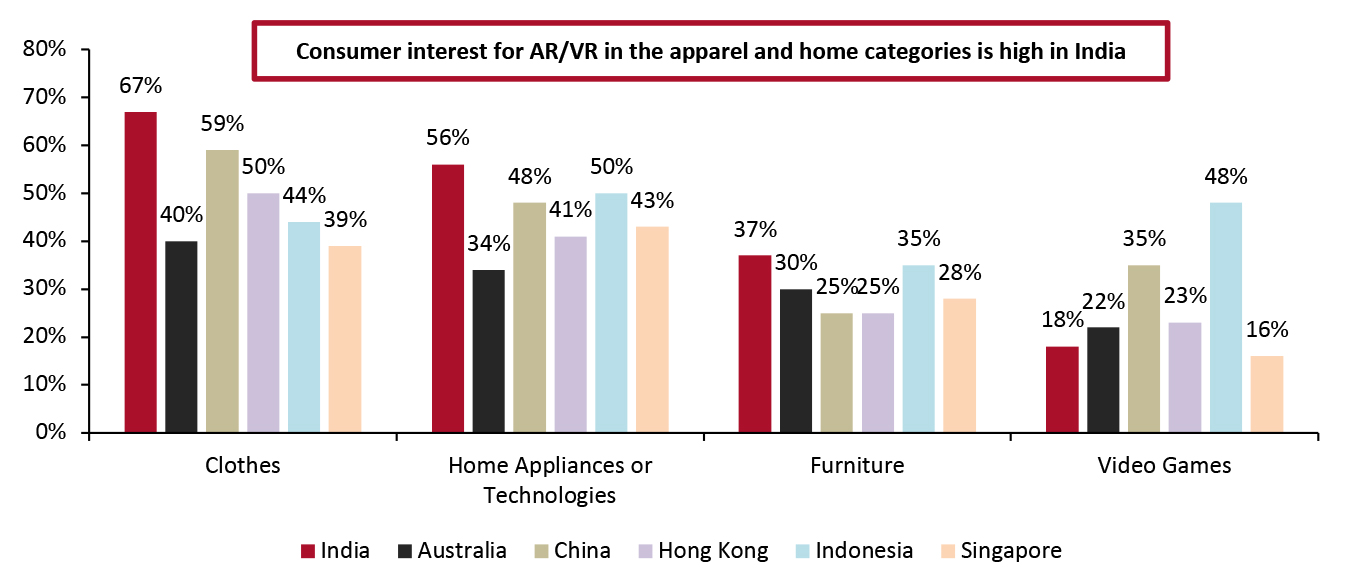

Figure 4. Asia-Pacific Region: Consumer Interest in AR/VR Across Categories, by Country (% of Respondents) [caption id="attachment_143458" align="aligncenter" width="700"]

Categories as published in the survey

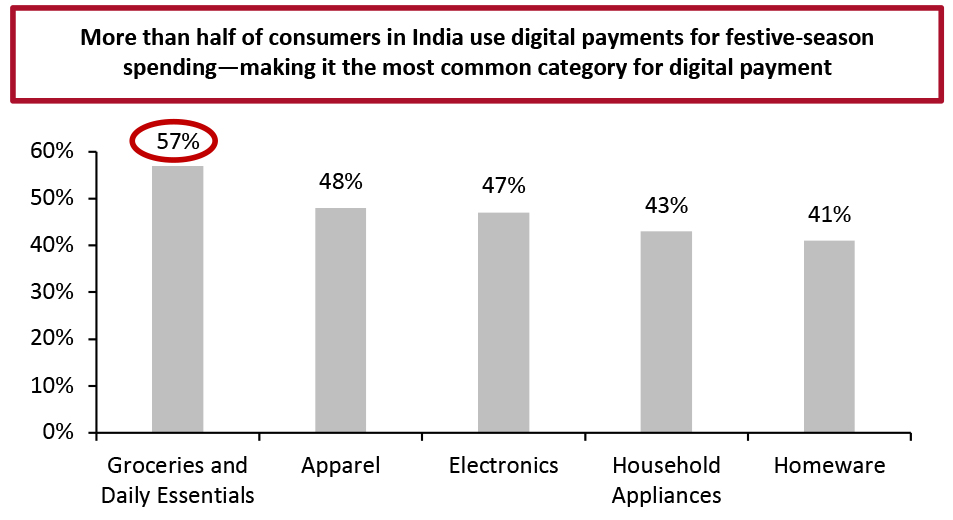

Categories as published in the survey Base: 1,000+ consumers per country (except Hong Kong, with 504 consumers), surveyed January–February 2021 Source: YouGov [/caption] Consumers crave a “human connection” while shopping—such as personalized recommendations—which is a key element that attracts them to physical retail stores. As online retailers can now bring in that personal connection through virtual shopping technologies, physical retail stores must look to adopt digitalization and immersive technologies to stay competitive with their online counterparts. 3. The Wider Adoption of Contactless Payments Will Augment Retail Transactions and Sales The pandemic-led consumer shift to digital payments from cash-on-delivery and in-store cash transactions is set to stick, as consumers have come to recognize and appreciate the convenience, speed, security, contactless nature and ease of doing transactions that digital payment options provide. Unified Payments Interface (UPI)—a fast and real-time payment system that enables inter-bank transactions between people and businesses—has become the most popular digital payment method in India. As of January 2022, UPI transactions account for about 4.6 billion in volume and ₹8.3 trillion ($110.6 billion) in value, registering a year-over-year increase of 101% in volume and 93% in value, according to National Payments Corporation of India, a specialized division under the Reserve Bank of India (RBI). UPI seamlessly integrates with payment forms such as “scan and pay” at offline stores, peer-to-peer and peer-to-merchant transactions, as well as online payments, facilitating easy retail transactions. Digital payments are the preferred payment mode among 41% of Indian consumers for festive-season spending, ahead of cash (26%) and debit and credit card payments (23%), according to an October 2021 online survey of Indian consumers conducted by YouGov and digital payment software and solutions provider ACI Worldwide. The survey also revealed that among all retail categories, the highest proportion of Indian consumers use digital payment for grocery purchases (see Figure 5).

Figure 5. Indian Consumers: Use of Digital Payments for Festive-Season Spending, by Category (% of Respondents) [caption id="attachment_143459" align="aligncenter" width="700"]

Categories as published in the survey

Categories as published in the survey Base: 1,001 Indian consumers aged 18+, surveyed in October 2021

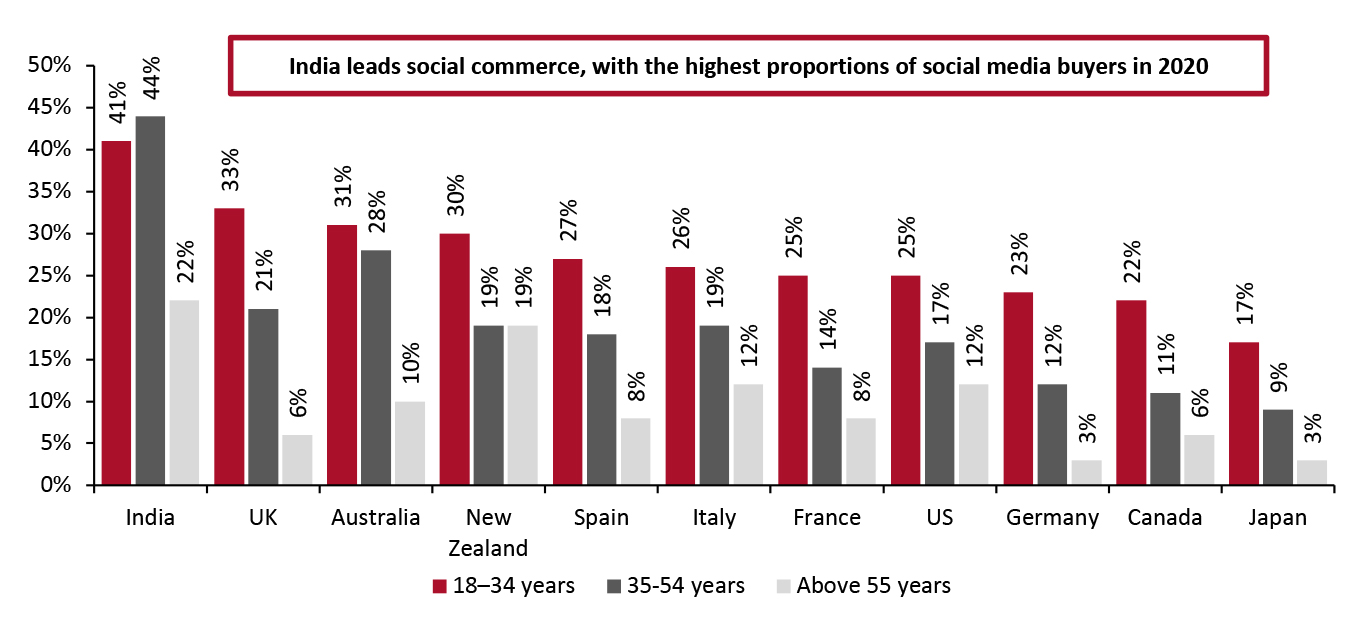

Source: ACI Worldwide/YouGov [/caption] With the pandemic still lingering around in terms of new variants, consumers are likely to continue avoiding cash or card payments in favor of contactless, digital payment methods. In October 2021, the RBI announced plans to roll out retail digital payments in the offline channel to further the reach and adoption of digital payments in low/no-Internet connectivity areas across the country. Prior to that, the RBI conducted three pilot projects to check the acceptance of offline digital payments (QR code-based) among consumers and retailers between September 2020 and June 2021. The pilot projects generated 241,000 transactions in volume, worth ₹11.6 million ($0.2 million), according to the company, indicating successful acceptance among the retailers and consumers. 4. Social Shopping Will Become Mainstream, Helping Brands and Retailers To Drive Sales and Revenue Consumers are increasingly using social media for product discovery and purchases, fueled by the pandemic-led digital switch. India has 157 million social commerce shoppers as of 2021—53% of total online shoppers in the country—and this number is likely to grow to 228 million in 2022, at a year-over-year growth rate of 45%, according to Recogn, the research division of India-based digital marketing agency WATConsult. Brands and retailers can therefore use social media to gain access to a wider consumer base and drive sales. On top of creating interactive and shareable product content for their social media pages, brands have started integrating shoppable features to offer engaging ways for consumers to shop through these pages. As such, social media is thus evolving from a place for people to connect to an e-commerce channel. Social commerce is set to grow at a CAGR of 55%–60% to $16–20 billion in GMV by fiscal 2025, from $1.5–2.0 billion fiscal 202, according to Bain & Company. Coresight Research estimates that social commerce will account for around 12% of e-commerce sales in fiscal 2025. Millennials and Gen Zers are likely to actively use social media for shopping in the future. In India, 41% of younger online shoppers (18–34 years old) and 44% of middle-aged shoppers (35–54) made purchases using social media between March and August 2020—much higher than the proportions in other countries, including the US and the UK—according to Shopify’s “Future of Commerce 2021” survey findings.

Figure 6. Selected Countries: Proportion of Consumers That Have Made a Purchase on Social Media Between March and August 2020 (% of Respondents) [caption id="attachment_143460" align="aligncenter" width="700"]

Base: 10,000+ consumers aged 18 and above from 11 countries, surveyed in September 2020

Base: 10,000+ consumers aged 18 and above from 11 countries, surveyed in September 2020 Source: Shopify [/caption] Social media influencers can play a prominent role in guiding millennial and Gen Zers’ shopping choices. Brands should integrate influencers into their marketing strategy and share promotional content along with shoppable features via their social channels to resonate with this audience and so generate revenue. Leveraging video content for product discovery and conveying product information to consumers in a fun, engaging and memorable way will also help brands and retailers drive sales among social media users. 5. Retailers Will Increasingly Offer Alternative Fulfillment Options BOPIS (buy online, pick up in-store) and curbside pickup have gained popularity in India since the onset of the pandemic, as retailers offered these alternative fulfillment services to meet consumer demand for convenience and contact-light fulfillment. According to the Shopify “Future of Commerce 2021” report, more than half of surveyed retailers provided alternative pickup and delivery options more often during March–August 2020 than before the pandemic. Furthermore, 69% of Indian consumers used BOPIS or curbside-pickup options more frequently than before the pandemic. We expect demand for these services to remain heightened moving forward, as consumers have come to expect an easy and frictionless shopping journey. Below, we examine some of the retail brands in India that offer BOPIS and curbside pickup.

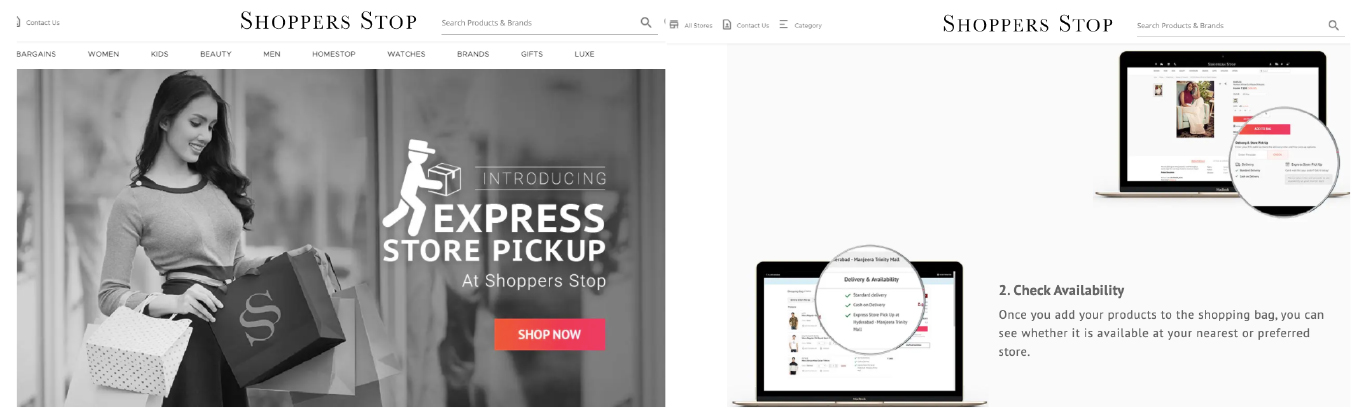

- Indian department store chain Shoppers Stop launched “Express Store Pick Up” in 2021, a free self-pickup service wherein consumers can browse products online, check availability of stock in their nearest/preferred store, and collect their online order from the brick-and-mortar store.

Source: Company website[/caption]

Source: Company website[/caption]

- IKEA India launched a click-and-collect feature in its Hyderabad store in May 2020. Customers can order products on the company’s website, pay online and select the click-and-collect option during checkout. IKEA’s delivery team will prepare the order and the store team will notify the customer by text or email about the pickup time. Customers can then collect their purchase from the collection station in the store’s parking area.

What We Think

To remain competitive in the future, we expect brands and retailers to increasingly integrate consumer data to curate tailormade products that meet consumer’s needs and expectations. We believe that the future for brands and retailers lies in offering virtual shopping experiences—combining technologies and human connections to stay agile and achieve sustained growth. The growing popularity and acceptance of UPI and digital payments among consumers and retailers alike—with the potential for kirana stores to adopt digital payment methods on a widespread scale in the offline channel—will further augment the growth of online and offline retail, as well as social commerce. We expect social and video-based shopping to gain traction even in India’s lower-tier markets, further driving the growth of social commerce and revenue prospects for brands and retailers. Alternative fulfillment services such as BOPIS and curbside pickup will see greater adoption among retailers moving forward, fueled by increasing consumer demand. Alternative fulfillment options offer a win-win situation: Retailers benefit from opportunities to attract in-store traffic and increase the likelihood of additional conversion/revenue, as well as reduced delivery costs, minimal return volumes and improved customer satisfaction; consumers benefit from the convenience, flexibility and safety (contact-light options) provided by BOPIS and curbside pickup. Implications for Brands/Retailers- Brands and retailers should invest in robust data-processing algorithms and partner with organizations providing AI, machine learning and computer vision capabilities to process huge volumes of consumer data and generate meaningful business insights.

- Brands can look at strategic partnerships with banks and financial institutions to digitally empower their retailers and distributors through UPI-based payment solutions and point-of-sale terminals.

- Partnerships with digital payment solutions providers can help brands and retailers to increase convenience for shoppers as well as roll out deals and promotions.

- The wider adoption of social commerce, even among consumers in lower-tier Indian cities, offers alternative revenue streams for brands and retailers. Companies should look to integrate livestreaming and immersive shoppable features into their social media channels.

- To boost their alternative fulfillment offerings, brands and retailers should streamline their back-end operations with technology-powered solutions.

- Small and medium retail businesses are increasingly looking to build a digital storefront. Software-as-a-service companies that offer end-to-end solutions for digital transformation can look to establish partnerships with these retailers.

- India has a thriving startup ecosystem that can capitalize on opportunities to provide platforms and software solutions for brands and retailers.