Introduction

What’s the Story?

Traditional off-price retailers are witnessing increasing competition from other retail sectors as more companies launch compelling value options. The off-price sector is also shifting internally: Industry leaders are beginning to change their selling models and formats to introduce innovation, attract customers and boost growth.

Exploring these external pressures and internal shifts in detail, we identify five key trends in off-price retail and present examples of recent developments by major brands and retailers.

Why It Matters

The US off-price channel is a growing industry, totaling $47.1 billion in fiscal 2020 (FY20, ended January 31, 2021), Coresight Research calculates. In FY21, we estimate that the US off-price industry will total $71.6 billion, a 52.1% year-over-year increase and an 18.4% increase over FY19. Although it has traditionally been dominated by physical retail, we are seeing new formats, channels and players emerging in the US off-price sector—and traditional players will need to keep up with change to remain competitive in the increasingly cluttered off-price space.

Five Trends in US Off-Price Retail: Coresight Research Analysis

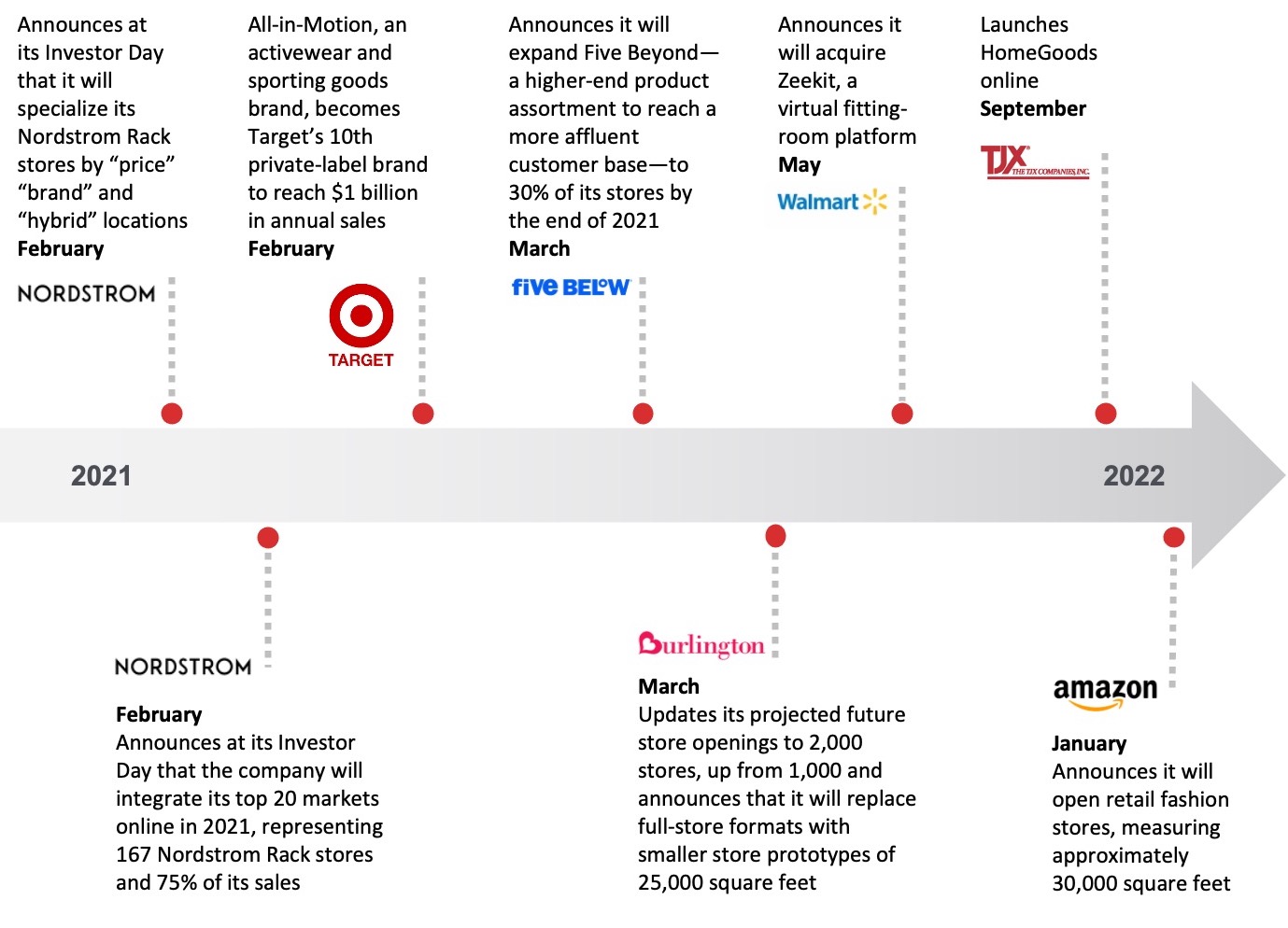

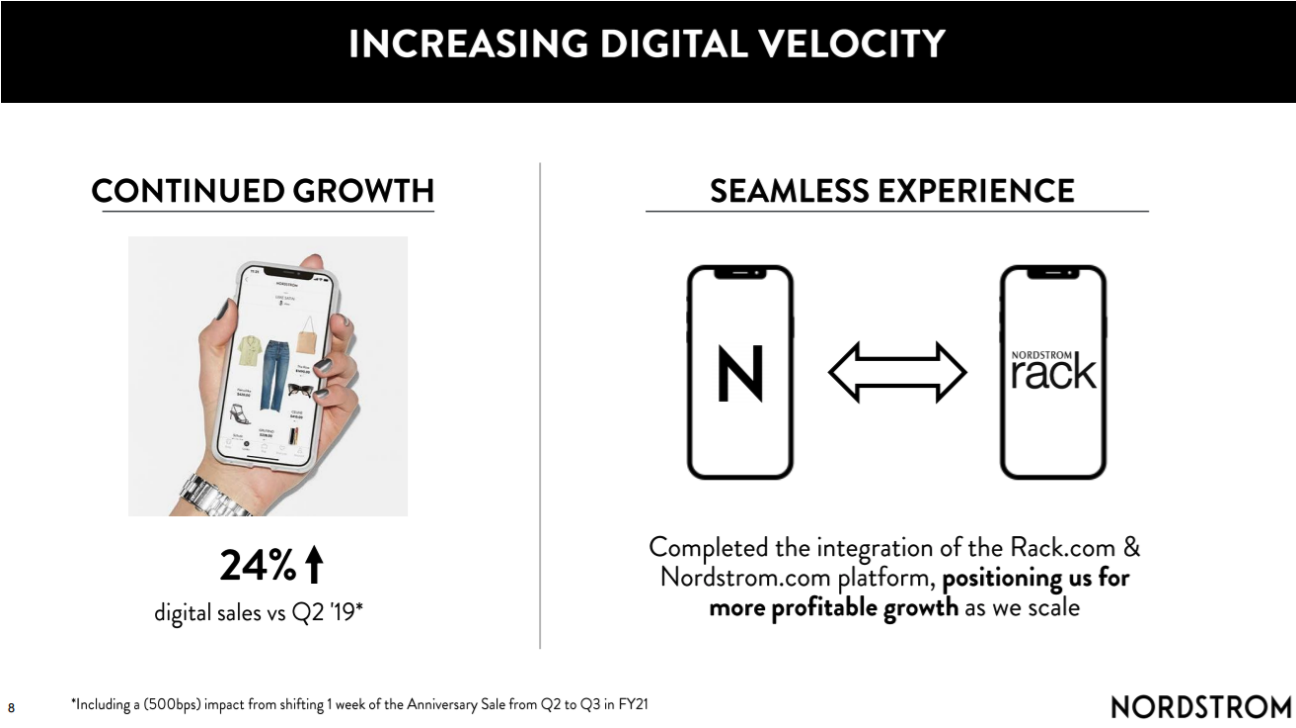

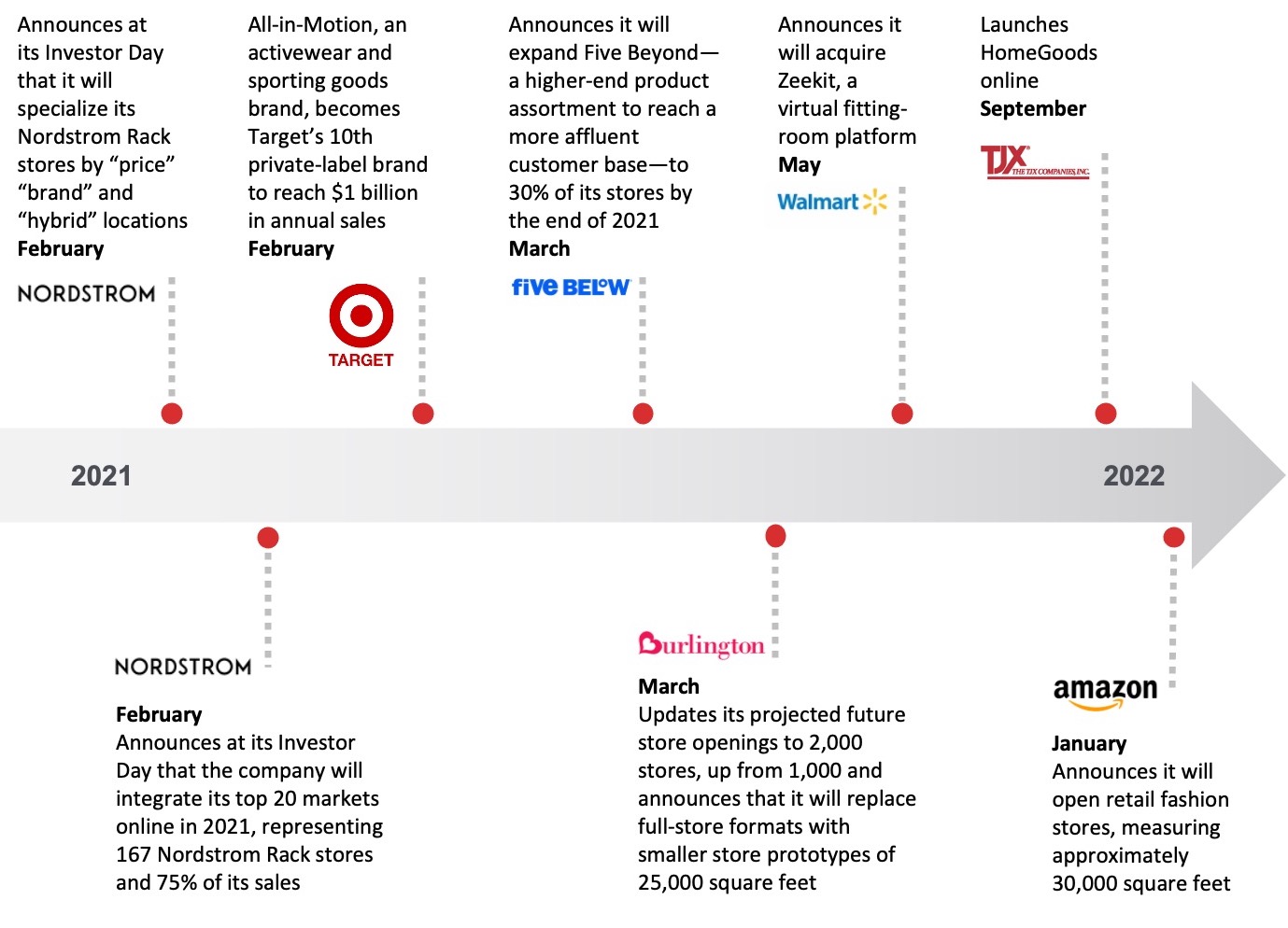

Informing the five trends we discuss in this report are the recent developments we have seen in the US off-price retail sector. We present a timeline of significant announcements in Figure 1, covering major off-price competitors, product categories and selling channels.

Figure 1. Timeline of Activity in the Off-Price Market

[caption id="attachment_141156" align="aligncenter" width="700"]

Source: Coresight Research

Source: Coresight Research[/caption]

- Note: For purposes of comparison in this report, we refer to FY20 as the year ended January 30, 2021. The TJX Companies refers to this year as FY21 in its reports.

1. The Off-Price Sector Is Becoming More Specialized

We are seeing major players in the sector focus on specialization—by store and by categories within stores—as they respond to evolving consumer demand and local trends.

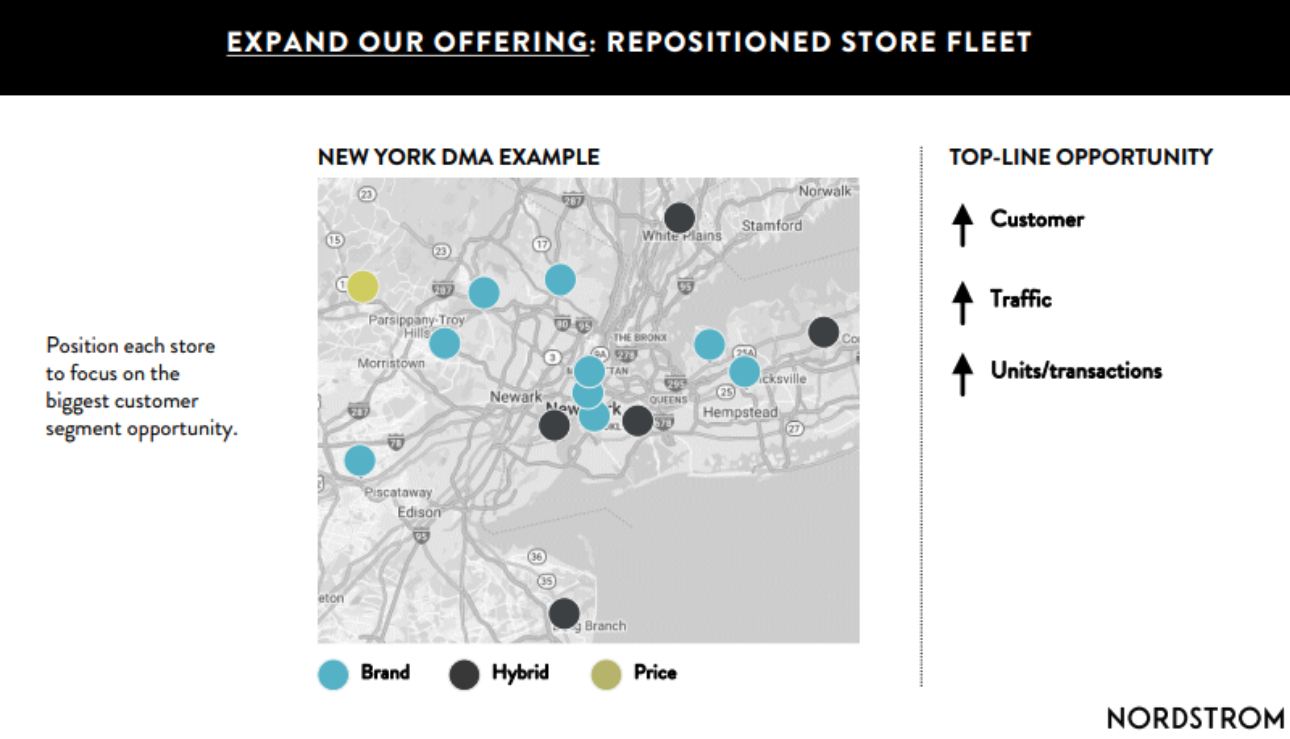

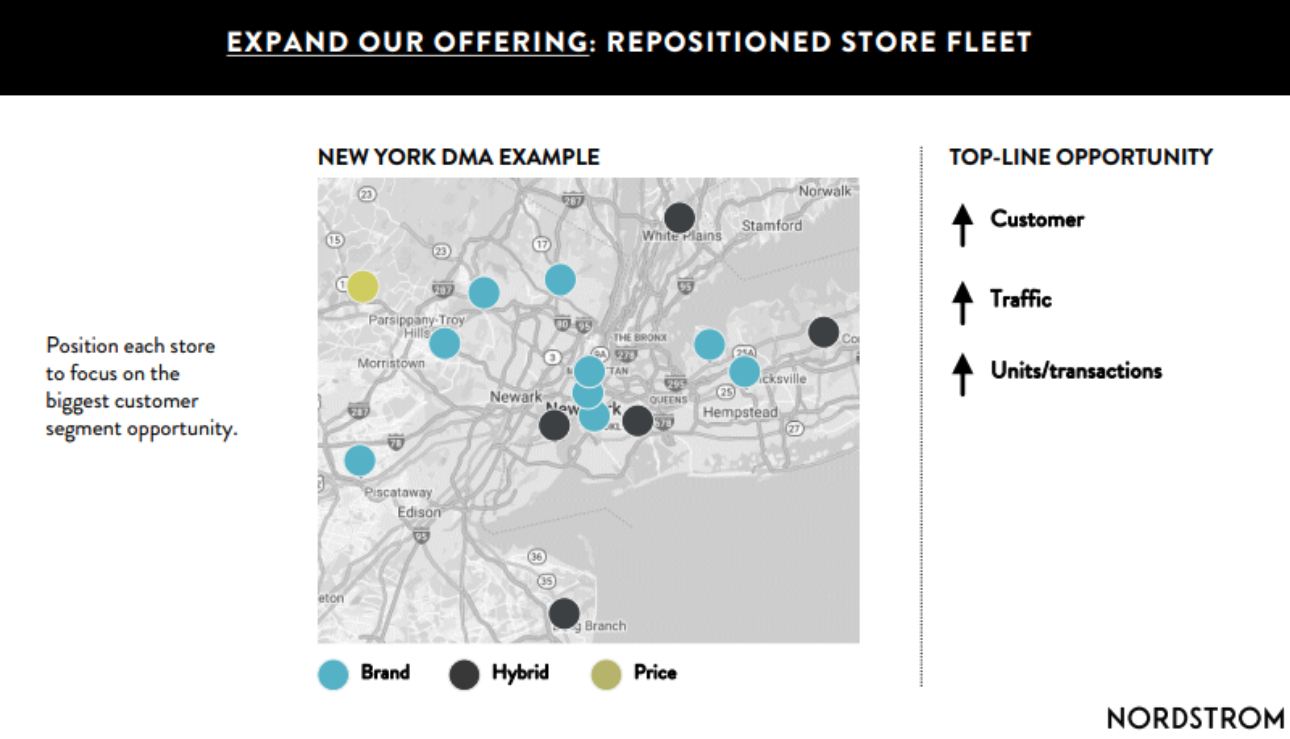

Nordstrom reported at its Investor Day in February 2021 that it would segment its Nordstrom Rack stores based on local consumer needs, with each store focusing on price, brand or a hybrid of the two to better serve its customers (see the image below an example of the fleet’s repositioning in New York). The “price” stores will be more sensitive to the prices that the store offers; the “brand” stores will be more attuned to fashion-conscious customers seeking trends; and a “hybrid” store will focus on a mix of both brands and price, similar to Rack stores previously. In its earnings report for the second quarter of FY21 (2Q21, released in August 2021), Nordstrom stated that for the 70 Rack stores that had been repositioned for a price-oriented offering, “new-to-Nordstrom” customers had increased by 16% over 2019 levels.

[caption id="attachment_141157" align="aligncenter" width="700"]

Nordstrom’s repositioning of its Rack store fleet: New York example

Nordstrom’s repositioning of its Rack store fleet: New York example

Source: Company reports[/caption]

Nordstrom also reported at its Investor Day that it is going to specialize more on trending categories within its Rack stores, including home, beauty, kids and activewear. In FY20, these categories totaled 20% of sales, according to the company; Nordstrom plans to increase this proportion to 33%. In its earnings report for 2Q21, the company reported that it was encouraged by the early results of its merchandise repositioning efforts—with price-oriented offerings in active, home and kids—which delivered a combined double-digit sales increase in the categories for the quarter.

TJX was an early mover of store specialization with the launch of two home category-focused banners: HomeGoods in 1992 and Homesense in 2001—with the latter initially in Canada before expanding into Europe in 2008 and the US in 2017. TJX has recently taken HomeGoods online (in 3Q21), as discussed later in this report.

TJX has recently focused its store openings on HomeGoods and Homesense, with these banners accounting for nearly 60% of the company’s store openings since FY17 (read our separate report,

US Off-Price Retail: Strategies in the Physical and Digital Channels, for more on this)— showing its commitment to specialization. The company’s most recent results, for 3Q21, show comparable sales growth of 34% for the US HomeGoods banner, compared to the company’s overall comparable sales growth of 14%.

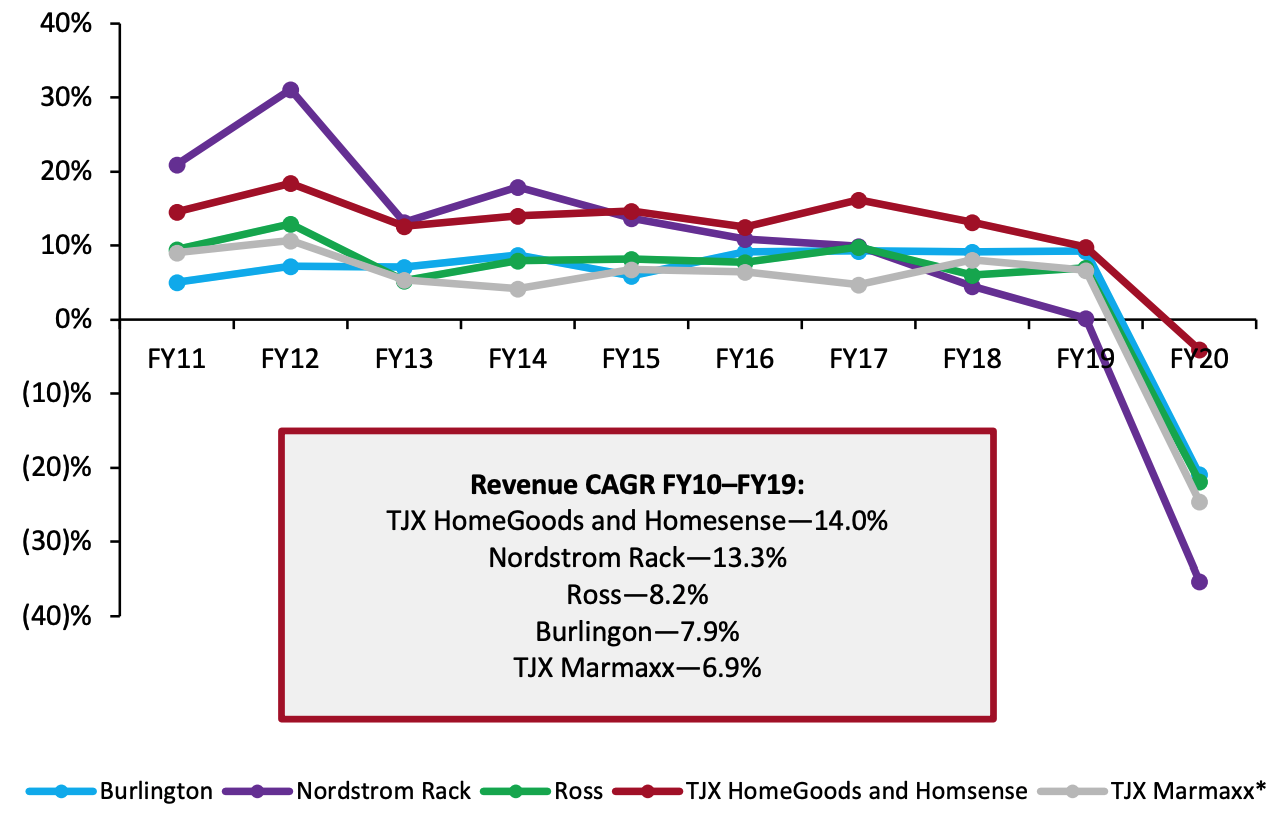

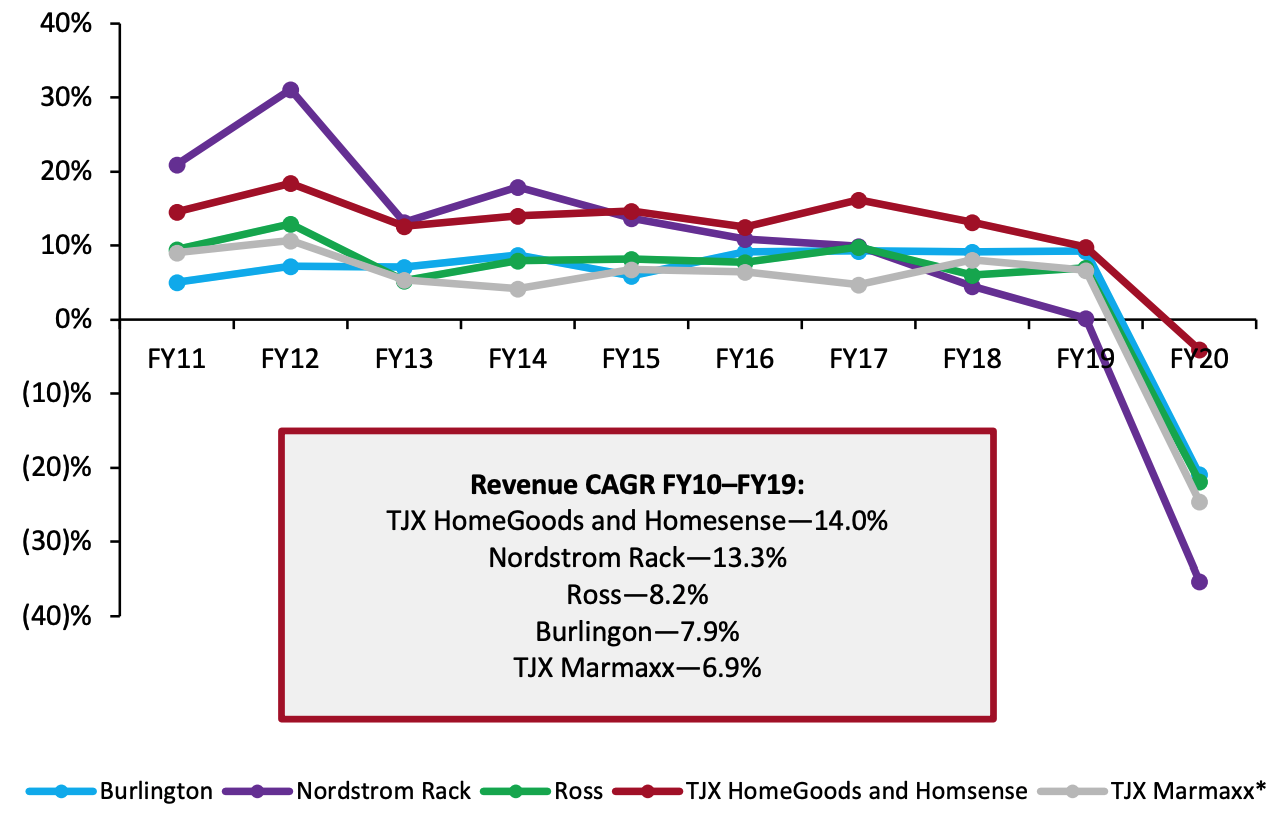

The company’s home banners have outperformed all other leading off-price retailers in terms of revenue growth from FY10 to FY19 (pre-pandemic), with a CAGR of 14.0%, demonstrating the success of store specialization. The TJX HomeGoods and Homesense banners were also most resilient during the Covid-19 pandemic in FY20, with revenue declining by only 4.1%. We break down major off-price retailers’ revenue growth by fiscal year and banner in Figure 2.

Figure 2. Major US Off-Price Retailers: Revenue Growth by Banner (YoY %)

[caption id="attachment_141158" align="aligncenter" width="700"]

*TJX Marmaxx banners includes Marshalls, T.J. Maxx and Sierra

*TJX Marmaxx banners includes Marshalls, T.J. Maxx and Sierra

Source: Company reports[/caption]

Discount retailers

Discount retailers are expanding their customer reach by creating shop-in-shops and new specialized stores around specific categories, creating competition for the off-price market, particularly in the beauty, home, gifting and small technology categories. As we discuss later in this report, Dollar General and Five Below are both expanding: Their growth is centered around the specialization trend.

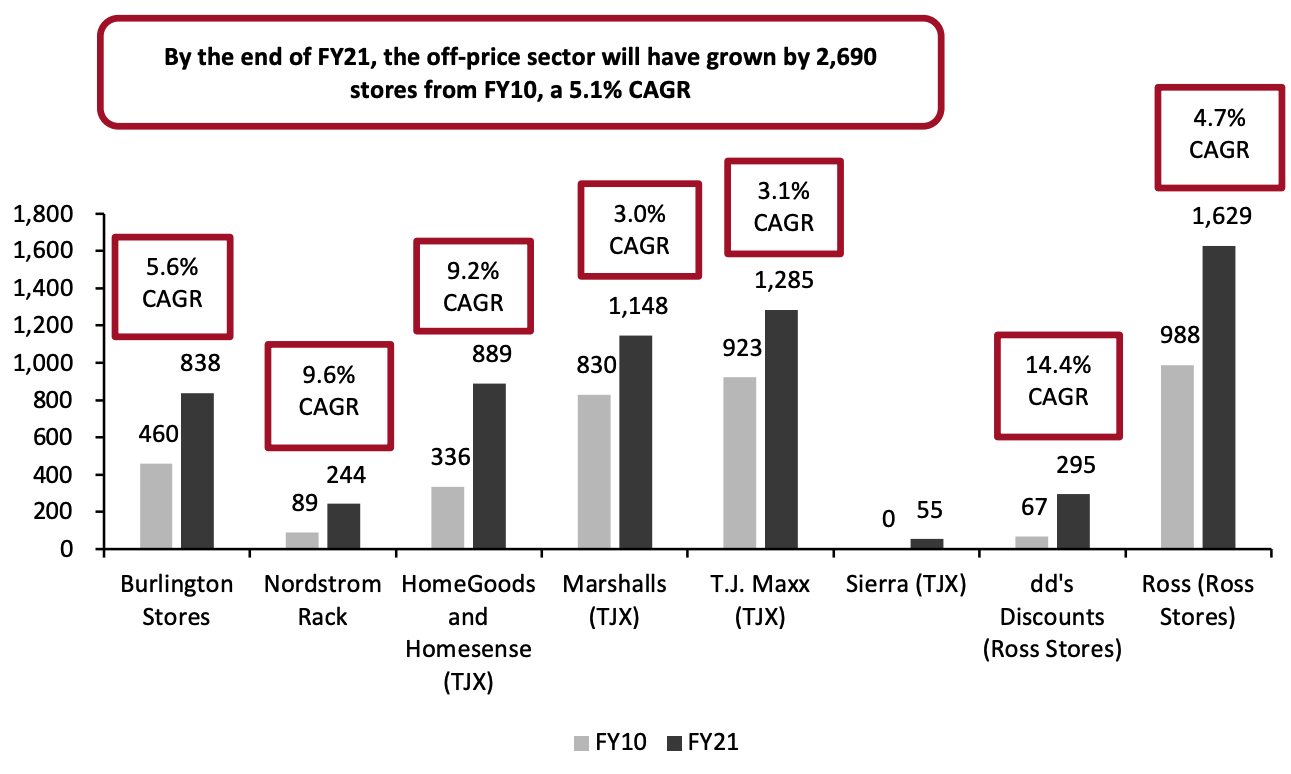

2. Physical Store Expansion Continues, but with a Smaller Format Gaining Traction

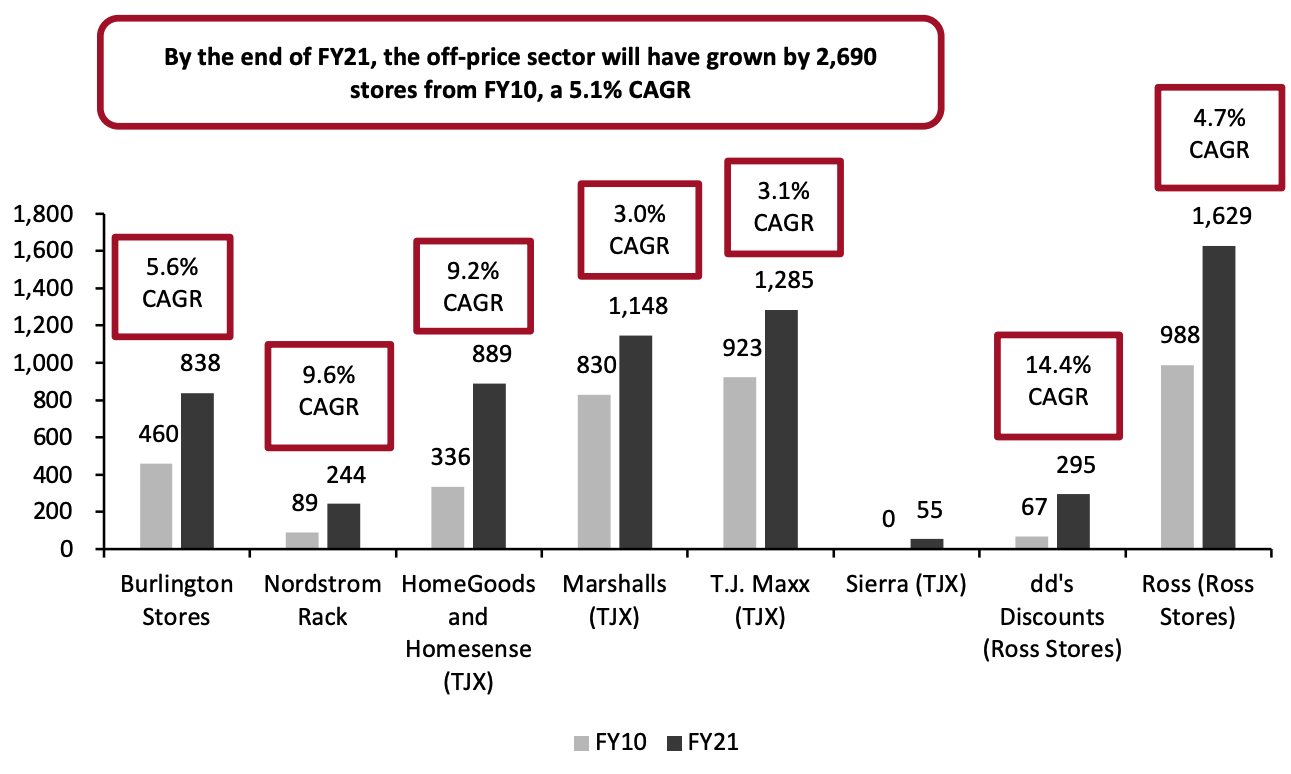

Off-price retail is heavily invested in physical stores and has defied the retail industry trend by remaining nearly an “all physical” retail channel, with over 95% of retail sales from physical stores and growth of an average 245 stores every year from FY10 to FY21, we calculate (see Figure 3).

Figure 3. US Off-Price Retailers: Stores by Banner

[caption id="attachment_141159" align="aligncenter" width="700"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

As the sector continues to expand its brick-and-mortar footprint, we are seeing leading players announce new, smaller store formats (see detail on Burlington below), as well as external competition launch into the sector through small physical stores, such as

Dollar General’s PopShelf concept store.

As part of the Burlington 2.0 improvement plan—announced by Burlington management announced during its earnings call for FY21 in March 2021—the company plans to double its long-term store goal from 1,000 stores to 2,000 stores in conjunction with the opening of smaller-footprint stores (approximately 25,000 square feet compared to the traditional store model of 40,000 square feet). Michael O’Sullivan, CEO at Burlington, said that a key enabler of the smaller format will be operating with leaner inventory levels, reduced resources, a heightened focus on trend-right products and opportunistic buys.

On its earnings call for 2Q21 on August 26, 2021, management said that it was very pleased with the initial rollout of its initial small store format. The retailer had opened 16 new stores in the spring that measured 30,000 square feet or smaller, with “very encouraging results.” Burlington said that the stores are running ahead of their targets.

On its 3Q21 earnings call on November 23, 2021, management reported that over the next five years, more than 75% of its new stores will be smaller than 30,000 square feet.

3. The Off-Price Retail Sector Faces Heightened Competition from External Players

The distinction between off-price and value is becoming blurry, as discount retailers, big-box retailers and e-commerce giant Amazon launch new strategies.

- Discount retailers are expanding price points, allowing them to offer a broader range of products across the home, pet products, small electronics and beauty categories. While discount retailers offer very limited competition in the apparel space, the retailers are providing competition for off-price retailers across other categories including home and beauty. Discount retailers are also offering consumers online options and partnering with Instacart for at home delivery, a competitive advantage over off-price retail as the majority do not have an online presence.

- Amazon, Target and Walmart are presenting competition to the off-price sector as they gain share of wallet across various categories by offering convenience and value to consumers. Amazon, in particular, allows shoppers to access major brands and less-well-known names, often at lower-than-retail prices. These companies have also been launching private-label brands and exclusive brand collaborations that are challenging off-price in the home and furnishings, apparel, and beauty categories.

In order to remain competitive moving forward, off-price retailers must be aware of new competitors and developments by existing players in the market, and strategize effectively to differentiate their brands and offerings, both online and offline.

- Read our separate report, US Off-Pricers Face Heightened Competition, for an in-depth discussion of this trend, including details of how discount retailers (Five Below and Dollar General), big-box retailers (Target and Walmart) and Amazon are disrupting the off-price space.

4. Off-Price Is Going Online

For the off-price sector, launching online has been a hurdle that most retailers have decided not to undertake for three main reasons:

- First, the economics of off-price are not conducive for online shopping, where average unit retail is between $10 and $12, as reported by both Burlington and Ross management.

- Second, due to the multitude of SKUs (stock-keeping units), inventory management is challenging.

- Finally, recreating the customer experience of in-store shopping is challenging. The “treasure hunt” in-store shopping style in off-price involves consumers sifting through racks to discover items, but by limitation of the channel, a website condenses this experience to the items a consumer filters or searches and shows selected items on a webpage.

Burlington Stores and Ross do not operate in the digital channel. However, Nordstrom Rack and TJX are pursuing online opportunities as a point of differentiation and a way to gain market share among their off-price competitors, which we discuss below.

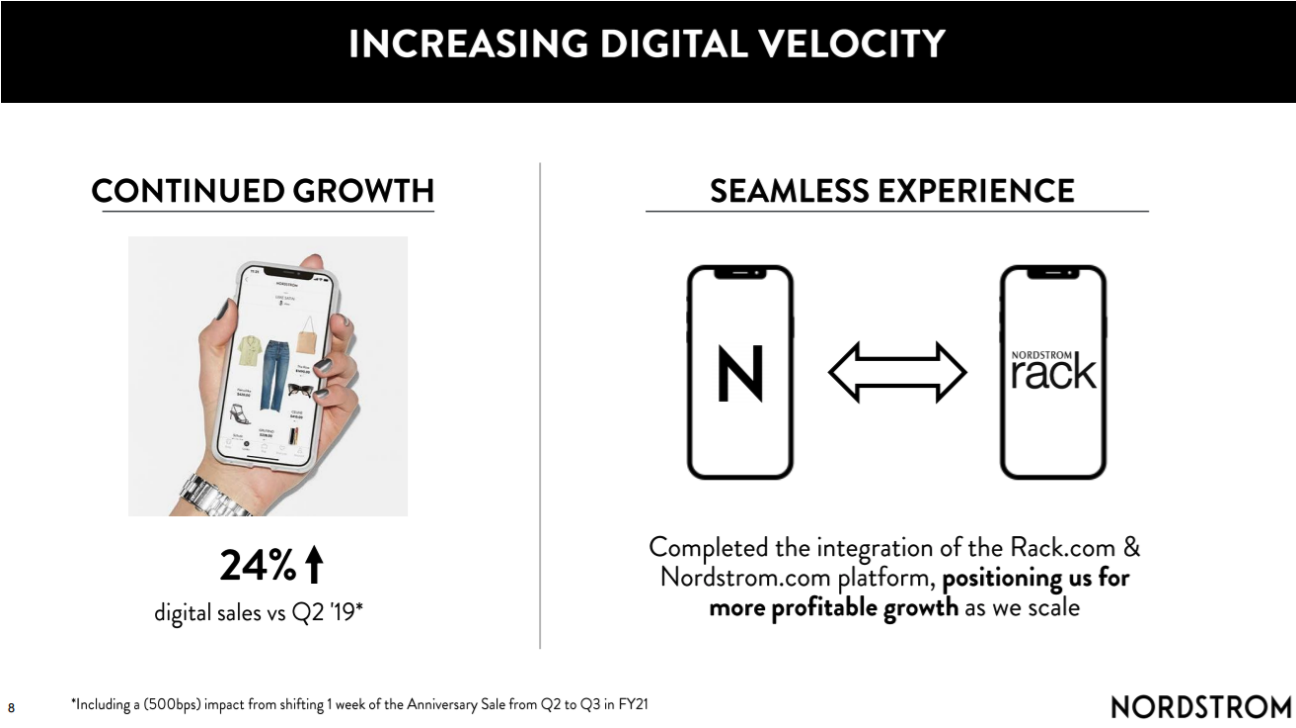

Nordstrom Rack is aggressively pursuing its digital capabilities and has been adding Nordstrom Rack assets online for over two years. Management reported on its 2Q21 earnings call on August 24, 2021, that it had completed the integration of Rack.com and Nordstrom.com.

[caption id="attachment_141160" align="aligncenter" width="700"]

Nordstrom continues to focus on its online strategy

Nordstrom continues to focus on its online strategy

Source: Company reports[/caption]

At

Nordstrom’s Investor Day presentation in February 2021, management reported that having Nordstrom Rack online provides consumers with another channel to shop as well as services such as BOPIS (buy online, pick up in-store) and ship-from-store. Not only do such services improve customer satisfaction, but they also improve Nordstrom’s supply chain capabilities and cost efficiency, according to the retailer.

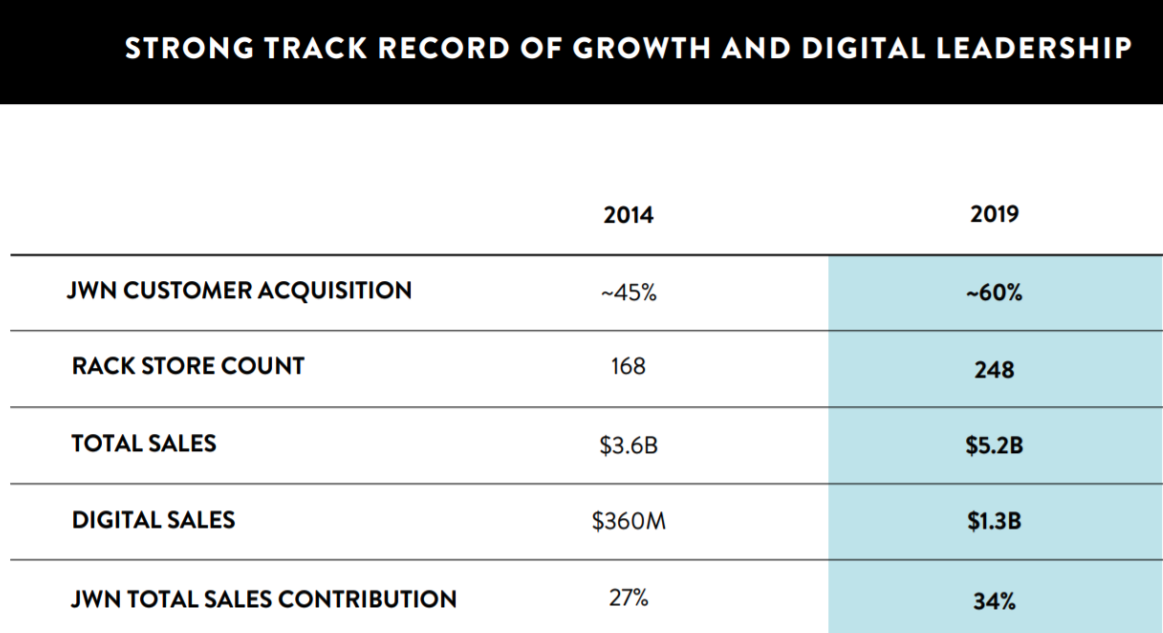

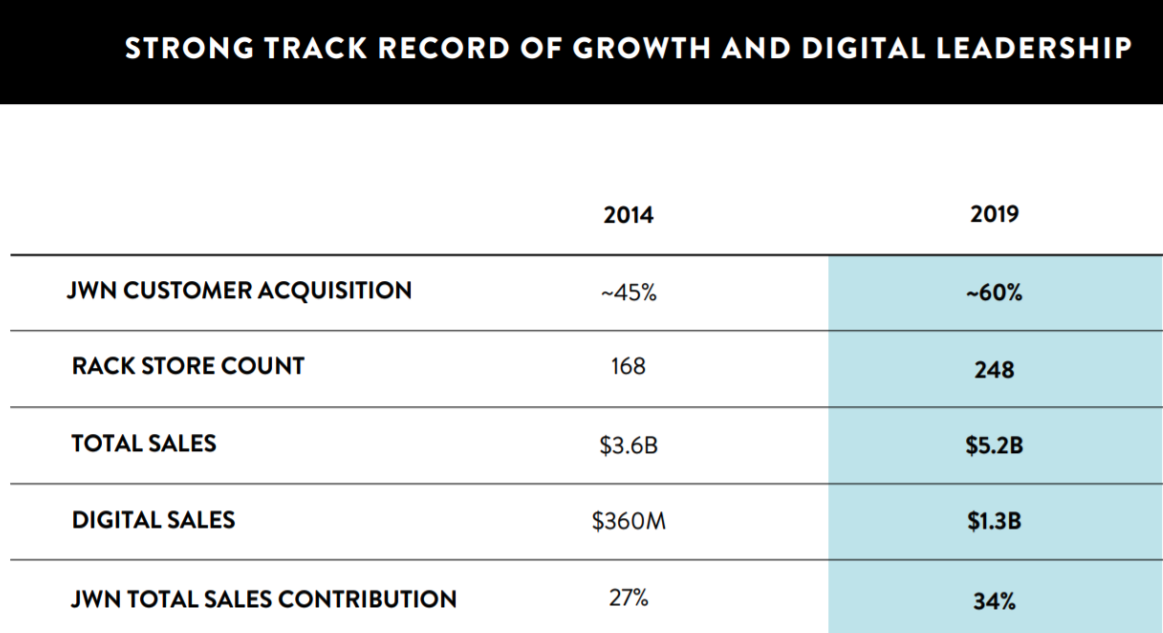

Nordstrom also reported that in FY19, Nordstrom Rack’s digital sales totaled $1.3 billion, representing 24.5% of the banner’s total sales. In November 2020, Nordstrom reported that online represented 40% of Nordstrom Rack sales in 3Q20 and that nearly 3.5 million consumers had downloaded its Nordstrom Rack app to date.

[caption id="attachment_141161" align="aligncenter" width="700"]

Nordstrom Rack digital overview

Nordstrom Rack digital overview

Source: Company reports[/caption]

The TJX Companies launched HomeGoods.com in September 2021, when management stated that it believes the company can capture a greater share of the home market by having an online presence. TJX expressed confidence in taking the business online, due to how consumers are shopping and discovering products, and wanting products delivered. On its 3Q21 earnings call on November 17, 2021, management said that it plans to add more home categories to homegoods.com. The company reported that sales comps and average unit retail are very strong at its home banners—and its Homesense business is even stronger than its HomeGoods business.

The launch of its home banners online builds on The TJX Companies’ existing digital presence. The retailers first launched an e-commerce site, tjmaxx.com, in 2013, followed by marshalls.com in 2019. TJX also acquired Sierra Trading Post in 2012, which has operated an e-commerce site, sierra.com, since 1999. TJX reported in its 10-K for the fiscal year ended January 30, 2021, that its US e-commerce businesses represented approximately 3% of Marmaxx’s net sales in FY19 (totaling an estimated $2.4 billion) and FY20 (estimated $1.4 billion). Marmaxx includes Marshalls, T.J. Maxx and Sierra stores.

5. Off-Price Is Seeing Continued Growth Momentum

We calculate that total revenue in the US off-price sector grew by a CAGR of 8.4% from $29.3 billion in FY10 to $60.5 billion in FY19, with every banner across major off-price retailers seeing positive growth every year (see Figure 2 earlier in the report). Although revenues were impacted by the Covid-19 pandemic in FY20, we saw consumers prioritize value, resulting in a positive CAGR of 4.9% from FY10 to FY20—compared to overall declines in other sectors.

We expect that the off-price market will rebound quickly to pre-pandemic growth levels for several reasons:

Retailers across the retail industry are reporting that consumers are prioritizing both value and luxury in their consumption patterns—at either ends of the price spectrum. This is a trend worth noting as consumers are shopping “mass market” retailers (in the middle of that spectrum) less, creating more competition in the value and luxury retail spaces.

- Off-price retailers have noted on earnings calls that during past recessionary times or times of economic downturns, the sector has traditionally outperformed. We therefore expect that, given the economic uncertainty amid the Covid-19 pandemic and the end of government stimulus payments, consumers will continue to shop value assortments.

- Due to the vast, global network of suppliers in the US off-price sector, those retailers may be able to better mitigate some inventory shortages that retailers in other sectors are currently citing as challenges. Major off-price retailers have recently reported that the buying environment has been strong.

What We Think

We expect that major US off-price players will continue to expand their physical footprints with smaller stores, taking the lead from Burlington and discount retailers’ moves in the off-price space, such as Dollar General’s PopShelf concept store. Along those same lines, we expect that off-price stores will become more specialized and localized—a trend that TJX started early on with its HomeGoods and Homesense stores. We see retailers specializing in price and category to meet consumer needs, across beauty, home and apparel, for example—with a key example being Nordstrom Rack’s specialization of its store portfolio.

Consumers’ prioritization of value is likely to be a lasting trend, particularly following the impacts of the pandemic on spending habits and preferences—though the consumer spending shift away from mass market retail had been ongoing for several years, resulting in a series of bankruptcies and declining sales at major mass retailers in the middle market. However, we do see increasing competition in off-price retail as companies such as Amazon, Target and Walmart launch design collaborations and private-label brands to attract off-price shoppers.

Only some off-price retailers are venturing into the digital channel. Coresight Research expects that the online presence of the TJX HomeGoods and Homesense banners will advance the retailer’s advantage in the home category and provide further competition to Burlington and Ross. We expect that Nordstrom Rack’s e-commerce capabilities will provide competition for T.J. Maxx (TJX) in particular, as both banners are known for offering consumers unique and trending fashion apparel and accessories. Operating online will provide retailers with a data advantage to enable personalized offers, as well as supporting omnichannel services such as BOPIS, which could be a key differentiator in the crowded off-price space.

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Nordstrom’s repositioning of its Rack store fleet: New York example

Nordstrom’s repositioning of its Rack store fleet: New York example *TJX Marmaxx banners includes Marshalls, T.J. Maxx and Sierra

*TJX Marmaxx banners includes Marshalls, T.J. Maxx and Sierra Source: Company reports/Coresight Research[/caption]

As the sector continues to expand its brick-and-mortar footprint, we are seeing leading players announce new, smaller store formats (see detail on Burlington below), as well as external competition launch into the sector through small physical stores, such as Dollar General’s PopShelf concept store.

Source: Company reports/Coresight Research[/caption]

As the sector continues to expand its brick-and-mortar footprint, we are seeing leading players announce new, smaller store formats (see detail on Burlington below), as well as external competition launch into the sector through small physical stores, such as Dollar General’s PopShelf concept store.

Nordstrom continues to focus on its online strategy

Nordstrom continues to focus on its online strategy Nordstrom Rack digital overview

Nordstrom Rack digital overview