DIpil Das

What’s the Story?

CBD has surged in popularity in the US since the passing of the Farm Bill in December 2018, which legalized the production of hemp and sales of products derived from hemp, and is increasingly being used in a wide variety of products. With heightened consumer focus on health and wellness in response to the Covid-19 pandemic, interest in the therapeutic benefits attributed to CBD has also spiked. In this report, we discuss five key trends in the US CBD market.Why It Matters

CBD is one of the fastest-growing consumer goods industries despite still being considered a niche segment in the US consumer market. In December 2018, the Farm Bill was signed into law in the US. The bill legalized the production and sale of hemp products at the federal level, but preserved the FDA’s regulatory authority over hemp products. Therefore, all hemp products should meet applicable FDA requirements and standards, just like any other FDA-regulated product. Despite the absence of FDA approval and limited regulatory frameworks on CBD products, the US CBD market has skyrocketed—reaching $4.2 billion in 2019 and witnessing 600% year-over-year sales growth in the year following the Farm Bill’s enactment in law, according to cannabis data and research firm Brightfield Group. The market still saw 12% year-over-year growth, following the initial spike in sales after the passing of the Farm Bill in 2018. Moreover, we have seen increased use of CBD in relation to the coronavirus pandemic, as consumers seek out products with the relaxing properties often credited to CBD. Insights from Coresight Research’s 2019 CBD survey and our weekly US consumer survey from February 15, 2021 indicate that consumers’ top reasons for using CBD products are pain relief, relaxation and stress relief. The American Psychological Association reported in October 2020 that almost 80% of Americans found Covid-19 to be a significant source of stress in their life in 2020. Correspondingly, cannabis research agency High Yield Insights found that one in four consumers who use CBD products began using CBD in the six months preceding their October 2020 survey. One-quarter of consumers surveyed reported that they bought a CBD product to cope with Covid-induced anxiety or stress.Five Trends in the US CBD Market: In Detail

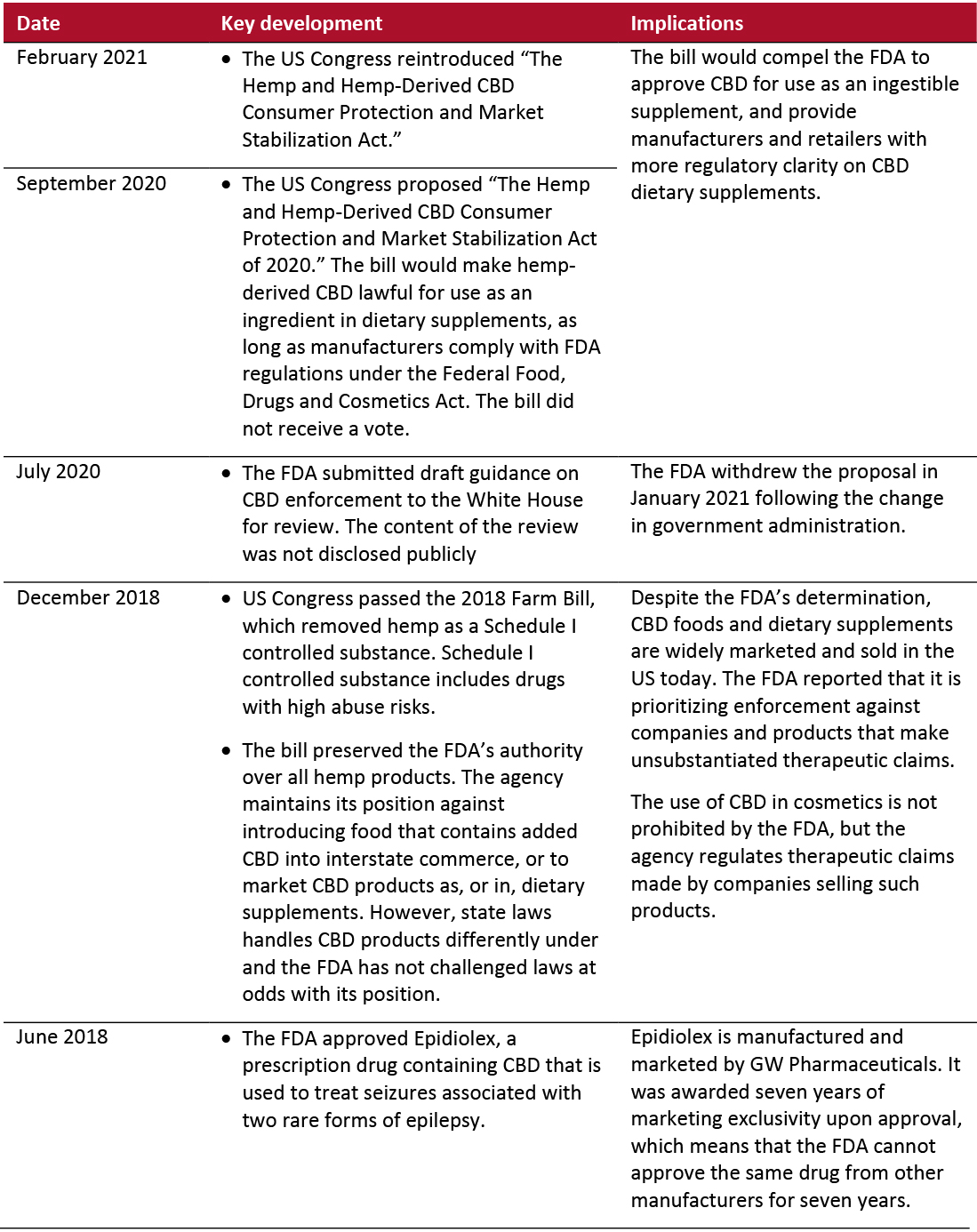

1. Increased Regulation: Building Credibility and Consumer Confidence While the CBD market in the US has grown exponentially, a lack of clear regulation from the FDA hampers the market’s growth. According to market research firm Nielsen’s 2020 study, a lack of regulation by the FDA is among consumers’ top barriers to using CBD products. In its role of overseeing the safety of cosmetics, food and drugs, the FDA does not currently approve CBD ingestible items, such as dietary supplements, drugs, and human and animal foods. Nevertheless, as the FDA has not taken legal action to regulate the market—instead, exercising enforcement discretion with warning letters to companies making unsubstantiated claims about CBD products—companies are pressing ahead with selling non-FDA-approved CBD products to meet increasing consumer demand. Following the 2018 Farm Bill, the FDA has stated that it is reviewing its position on CBD products and we expect to see an outcome soon. The only FDA-approved product is Epidiolex, a prescription drug containing CBD that is used to treat seizures, which was approved in 2018. The DFA has not expressed a position against CBD use in other FDA-regulated products, such as cosmetics and tobacco products—which are not designated as ingestible—although there is a lack of clear regulation. As well as the FDA’s position, CBD product manufacturers and consumers face inconsistent legal requirements across individual states, creating confusion and issues for product manufacturers and retailers in selling their products across state lines. For instance, while most states allow the use of hemp-derived CBD (except Idaho and Nebraska) marijuana-derived CBD products are banned in 11 states. Moreover, Colorado, Florida, Illinois, Indiana and Texas allow CBD in food, despite the FDA’s stance against ingestible CBD. In February 2021, the US Congress reproposed “The Hemp and Hemp-Derived CBD Consumer Protection and Market Stabilization Act,” which was first proposed in September 2020. If passed, hemp-derived CBD would be legal as an ingestible supplement. Upon enactment, which could take an extended period of time, we would expect this bill to clarify the pathway for CBD manufacturers to market CBD supplements and food products and to proliferate the sale of such products by mainstream retailers.Figure 1. US CBD Regulations: Key Developments [caption id="attachment_124115" align="aligncenter" width="725"]

Source: FDA/Hemp Industry Daily[/caption]

2. Consolidation in the CBD Space

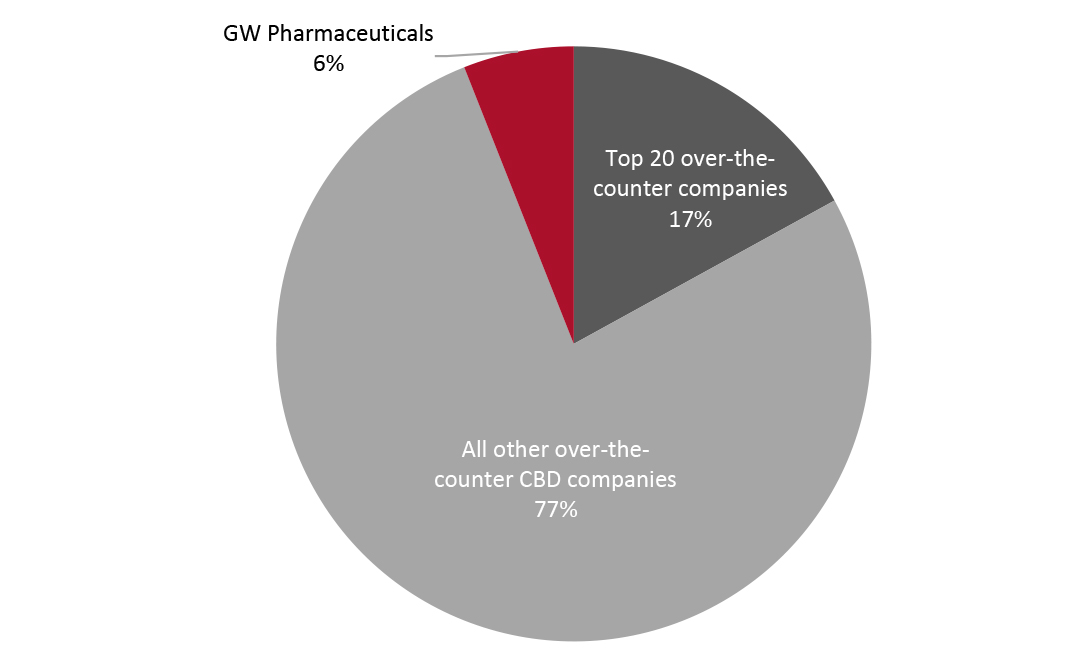

The US CBD market is highly fragmented, as a large number of companies entered the space following the passing of the Farm Bill in 2018. The largest single market player is GW Pharmaceuticals, the manufacturer of the only FDA-approved prescription CBD drug in the US, as discussed in Figure 1.

As of July 2020, the market’s top 20 over-the-counter CBD companies accounted for just 17% of the overall US CBD market, with some 3,000 players accounting for 77% of the market, as of July 2020, according to Brightfield Group.

Source: FDA/Hemp Industry Daily[/caption]

2. Consolidation in the CBD Space

The US CBD market is highly fragmented, as a large number of companies entered the space following the passing of the Farm Bill in 2018. The largest single market player is GW Pharmaceuticals, the manufacturer of the only FDA-approved prescription CBD drug in the US, as discussed in Figure 1.

As of July 2020, the market’s top 20 over-the-counter CBD companies accounted for just 17% of the overall US CBD market, with some 3,000 players accounting for 77% of the market, as of July 2020, according to Brightfield Group.

Figure 2. Market Share of US CBD Companies [caption id="attachment_124116" align="aligncenter" width="725"]

Source: Brightfield Group[/caption]

We expect to see renewed consolidation in the US cannabis and CBD market in 2021 and beyond, driven by several factors:

Source: Brightfield Group[/caption]

We expect to see renewed consolidation in the US cannabis and CBD market in 2021 and beyond, driven by several factors:

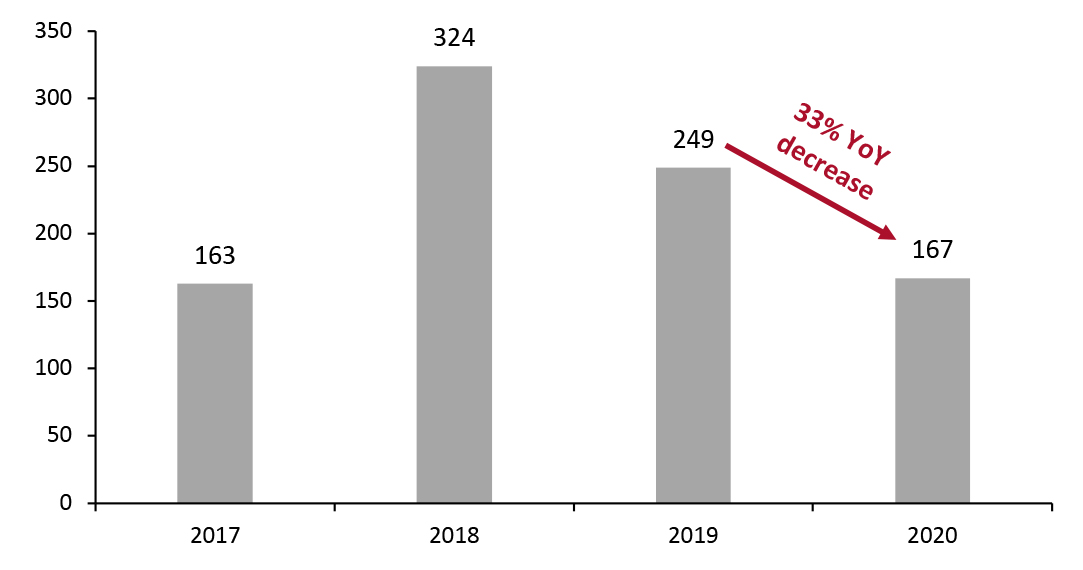

- The number of M&A deals in the North American cannabis and CBD market was high in 2018 and 2019. Last year, the industry took a step back on M&A activity, due to the pandemic-induced recession that constricted cash flow and investments for many. The number of M&A deals dropped by 33% from 249 in 2019 to 167 in 2020, according to S&P Capital IQ. Specialist cannabis law attorneys at law firm Fox Rothschild stated that M&A activity in the industry started recovering at the end of 2020, with expectations for the trend to pick up in 2021.

- The negative impact of Covid-19 is likely to force many small CBD brands out of business, as smaller brands rely on in-person events such as local farmer markets and trade expos to market their products to retailers and they mostly don’t have a strong direct-to-consumer presence. Moreover, in our US consumer survey conducted on February 15, 2021, 40% of respondents stated that they prefer to buy CBD/hemp products from trusted brands, which often equates to large established companies. We expect to see these established CBD companies grow their market share in 2021.

- In addition, clear regulations on CBD products would likely help foster the credibility of CBD products and crack down on CBD companies that make unsubstantiated claims.

Figure 3. Completed or Announced Cannabis M&A Deals in North America [caption id="attachment_124117" align="aligncenter" width="725"]

Source: S&P Capital IQ[/caption]

3. CBD Pet Products: The Market’s New Rising Star

Previously marketed primarily to humans, CBD products are becoming a popular phenomenon in the pet product market. The high household pet ownership rate in the US is driving a booming pet market—according to the American Pet Products Association, 67% of US households own a pet as of 2019, equating to 84.9 million homes. Moreover, the penetration rate continues to rise with the surge in pet ownership during the pandemic: Pet retailer, Petco, reported that more than 3.3 million new pets joined US households in 2020.

With many treating their pets akin to family members, pet owners are willing to spend a substantial amount on pet products. Our 2019 CBD survey found that those who use CBD pet products are more affluent than average CBD users, with over half of those that purchase CBD pet products reporting annual incomes of $75,000 or above—the highest proportion among the CBD product categories we included. This reflects a significant opportunity to entice affluent pet owners to increase their basket size with CBD pet products.

The most common reason for purchasing CBD pet products for dogs and cats is to reduce overall levels of stress or anxiety, according to a January 2020 US survey conducted by Brightfield Group. The same survey also indicated that those who have purchased CBD pet products agreed that CBD improved their pet’s wellbeing.

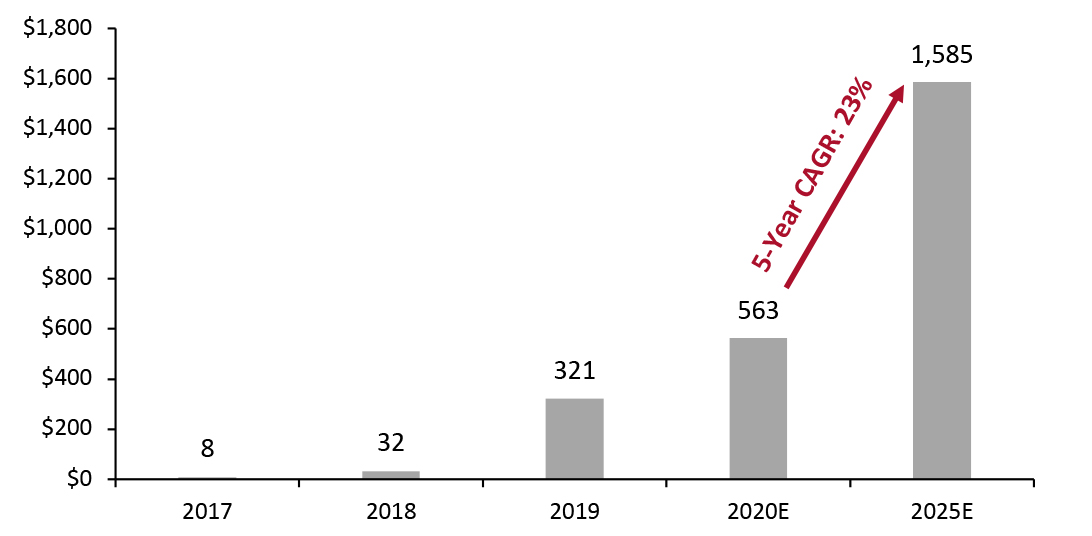

We expect to see continued significant growth in the CBD pet products market, driven by high pet ownership and consumer willingness to spend on innovative pet products. Brightfield Group estimated that the US CBD pet products market reached $563 million in 2020, with a year-over-year growth rate of 75.4%. This significantly outpaced the 3.6% year-over-year growth rate for the overall pet product market in 2020.

We project the market to reach approximately $1.6 billion in 2025, with a CAGR of 23%.

Source: S&P Capital IQ[/caption]

3. CBD Pet Products: The Market’s New Rising Star

Previously marketed primarily to humans, CBD products are becoming a popular phenomenon in the pet product market. The high household pet ownership rate in the US is driving a booming pet market—according to the American Pet Products Association, 67% of US households own a pet as of 2019, equating to 84.9 million homes. Moreover, the penetration rate continues to rise with the surge in pet ownership during the pandemic: Pet retailer, Petco, reported that more than 3.3 million new pets joined US households in 2020.

With many treating their pets akin to family members, pet owners are willing to spend a substantial amount on pet products. Our 2019 CBD survey found that those who use CBD pet products are more affluent than average CBD users, with over half of those that purchase CBD pet products reporting annual incomes of $75,000 or above—the highest proportion among the CBD product categories we included. This reflects a significant opportunity to entice affluent pet owners to increase their basket size with CBD pet products.

The most common reason for purchasing CBD pet products for dogs and cats is to reduce overall levels of stress or anxiety, according to a January 2020 US survey conducted by Brightfield Group. The same survey also indicated that those who have purchased CBD pet products agreed that CBD improved their pet’s wellbeing.

We expect to see continued significant growth in the CBD pet products market, driven by high pet ownership and consumer willingness to spend on innovative pet products. Brightfield Group estimated that the US CBD pet products market reached $563 million in 2020, with a year-over-year growth rate of 75.4%. This significantly outpaced the 3.6% year-over-year growth rate for the overall pet product market in 2020.

We project the market to reach approximately $1.6 billion in 2025, with a CAGR of 23%.

Figure 4. US CBD Pet Products Market (USD Mil.) [caption id="attachment_124118" align="aligncenter" width="725"]

Source: Brightfield Group/Coresight Research[/caption]

US CBD firms are introducing new CBD products for pets:

Source: Brightfield Group/Coresight Research[/caption]

US CBD firms are introducing new CBD products for pets:

- Canopy Growth launched SurityPro, a new line of science-backed CBD products for dogs, in February 2021, citing benefits including calm behavior, joint health, and overall physical and mental wellbeing. The cannabis company recently partnered with TV personality Martha Stewart to release a new dog product line including flavored CBD drops and gourmet soft-baked chews with CBD.

Source: Medterra/Shop Canopy[/caption]

Source: Medterra/Shop Canopy[/caption]

- Medterra, one of the largest CBD firms in the US, unveiled a new collection of CBD pet products in November 2020, including all-natural CBD-infused chews and tinctures for cats and dogs, which claim to support joints, help digestion and provide anxiety relief. Medterra stated that its pet products have witnessed the highest re-order rates among its CBD product portfolio. The company expects its pet division to grow by at least 150% in 2021.

- Cannabinol (CBN) is produced when THC is exposed to heat and light. It has primarily been used to help with sleep issues, but also shows potential in appetite stimulation, reducing inflammation, neuroprotection and as pain relief.

- Cannabigerol (CBG) is found early in the growth cycle of the cannabis plants and is typically the most expensive cannabinoid. CBG is attributed with potentially improving conditions such as bladder dysfunction, glaucoma and inflammatory bowel disease.

- CBDistillery launched CBD + CBN sleep tincture—its first CBN product—in August 2020. The company states that the product serves as a natural support for improved sleep and relaxation.

- Medterra offers a CBD + CBG tincture, which is a 1:1 blend of CBD and CBG. Under the company’s new extraction technology, it can produce products with a high concentration of CBG at an affordable price.

Source: CBDistillery/Medterra[/caption]

5. Celebrity Endorsements Will Continue To Drive CBD Sales

The passing of the Farm Bill in 2018 led to an explosion in popularity of CBD, which was also fueled by a wave of celebrity endorsements. We expect celebrities to play an increasingly integral role in driving consumers’ interests and purchasing decisions in CBD products in the future, with many partnering with CBD companies to launch their own lines.

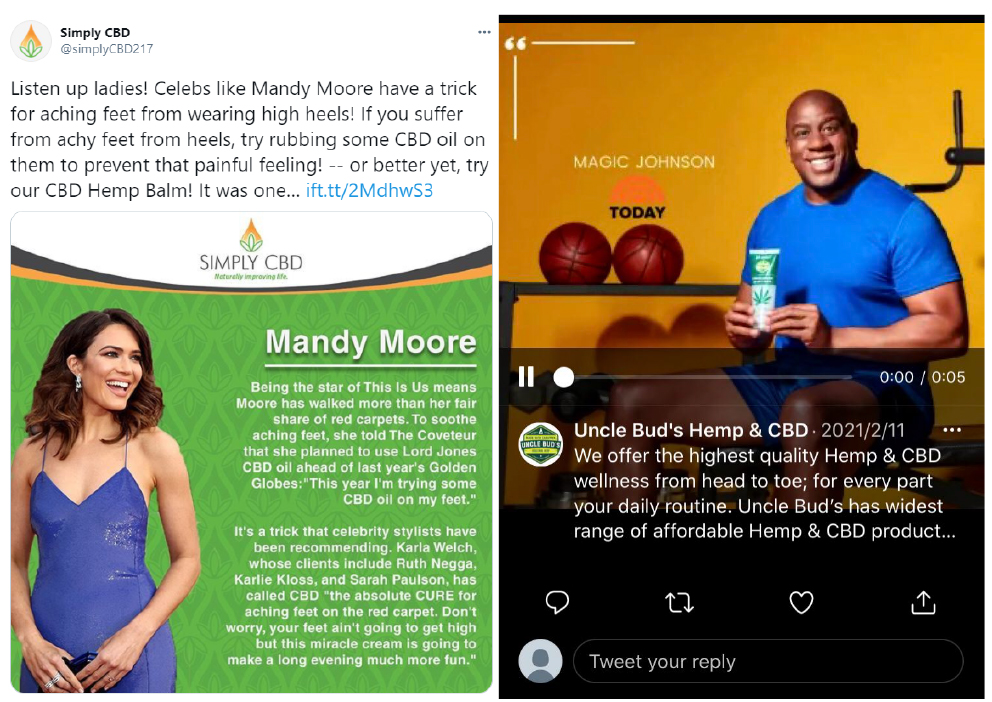

To overcome negative perceptions of CBD, which is sometimes confused with its intoxicating and illegal cannabis counterparts, celebrity endorsements play a significant role in spreading awareness and enhancing products’ mainstream credibility. In a survey by Coresight Research in November 2019, one-fifth of US respondents who use social media for shopping stated that their shopping is “often or always” affected by social media influencers and celebrities.

[caption id="attachment_124121" align="aligncenter" width="725"]

Source: CBDistillery/Medterra[/caption]

5. Celebrity Endorsements Will Continue To Drive CBD Sales

The passing of the Farm Bill in 2018 led to an explosion in popularity of CBD, which was also fueled by a wave of celebrity endorsements. We expect celebrities to play an increasingly integral role in driving consumers’ interests and purchasing decisions in CBD products in the future, with many partnering with CBD companies to launch their own lines.

To overcome negative perceptions of CBD, which is sometimes confused with its intoxicating and illegal cannabis counterparts, celebrity endorsements play a significant role in spreading awareness and enhancing products’ mainstream credibility. In a survey by Coresight Research in November 2019, one-fifth of US respondents who use social media for shopping stated that their shopping is “often or always” affected by social media influencers and celebrities.

[caption id="attachment_124121" align="aligncenter" width="725"] Actress Mandy Moore and athlete Magic Johnson have featured in Twitter posts by CBD companies Simply CBD and Uncle Bud’s

Actress Mandy Moore and athlete Magic Johnson have featured in Twitter posts by CBD companies Simply CBD and Uncle Bud’s Source: Twitter [/caption] According to analytics firm Synthesio, Twitter saw the most CBD-related conversations among all social channels in 2019, making it the primary platform for promoting CBD products. Celebrities should consider advertising regulations imposed by the Federal Trade Commission (FTC) and the FDA to avoid facing legal issues with endorsements. For example, under FDA regulations CBD products should not be promoted for preventing or treating serious diseases.

- TV personality Martha Stewart has played an advisory role at Canopy Growth since 2019, launching partnership lines of CBD gummies, soft gels, oil drops and, most recently, pet products—as discussed earlier in the report. The co-branded line scored its first retail deal in December 2020, and is now also sold by The Vitamin Shoppe. Previously, Canopy Growth has worked with multiple celebrities including Snoop Dog, Seth Rogen and Evan Goldberg. David Klein, CEO of Canopy Growth stated that associating its brands with celebrities such as Martha Stewart helps the company to go mainstream.

- Actress Kristen Bell started her own CBD line, Happy Dance, with cannabinoid company Cronos Group in October 2020. The brand features clean, cruelty-free and vegan CBD bath and body care products including bath bombs and moisturizers.

What We Think

Despite the challenges and disruptions caused by the health crisis, increased consumer focus on health and wellbeing amidst the pandemic has increased demand for CBD products—given the associated health and wellness features. While the pandemic has led to an approximate increase of 9 million new CBD consumers in the US, according to High Yield Insights, uncertainty remains regarding regulation and product credibility in this emerging retail market. Implications for Brands/Retailers- We expect the FDA to issue more formal regulations on CBD products in 2021, but for now, companies should monitor state-specific regulations as well as federal developments to avoid breaches in interstate commerce.

- Our 2019 CBD survey found that consumers who purchase CBD pet products are significantly more affluent than the average CBD user. CBD brands and retailers should consider opportunities in CBD pet products to gain a foothold in the lucrative market.

- Unique product offerings, such as secondary cannabinoids could help to distinguish product offerings and expand product margins. With more innovative products, brands can reach a wider consumer base with varying needs.

- Celebrity endorsements on a relatively new retail category such as CBD can increase consumer awareness and confidence. Brands and retailers can work with suitable celebrities to generate interest and build credibility among consumers.