Nitheesh NH

What’s the Story?

In our monthly countdown to Singles’ Day, also known as the 11.11 Global Shopping Festival, we will help brands and retailers to prepare for the event and make the most of the huge opportunities it represents. In this report, we discuss popular marketing tools and notable platforms in China that brands and retailers can use to build brand awareness and drive sales during Singles’ Day. We break these down into two categories—livestreaming and content marketing—and offer examples of brands that have used these tools effectively in the past.Why It Matters

Brands and retailers that want to achieve success during the 11.11 festival need to familiarize themselves with popular Chinese social media apps—including livestreaming and short-video platforms—as consumers have increasingly turned to the digital channel to engage with brands since the Covid-19 outbreak in early 2020. By the end of last year, the number of Internet users in China jumped to almost 1 billion, from 802 million in 2019, according to the Cyberspace Administration of China. Although livestreaming is not new in China, it is revolutionizing digital retail: Coresight Research estimates that China’s livestreaming e-commerce market will see huge growth this year, totaling $300 billion—doubling in size from $150 billion in 2020. As Singles’ Day and social commerce are both high-growth segments within Chinese retail, we expect the combination to drive significant sales growth for brands and retailers.Five Months to Singles’ Day: In Detail

In each of the categories of livestreaming and content marketing, there are three tools that brands and retailers should look to leverage this year to raise brand awareness and increase sales. We summarize these in Figure 1 and explore each category in further detail below. Figure 1. Marketing Tools and Platforms That Retailers Should Leverage for Singles’ Day 2021 [caption id="attachment_128446" align="aligncenter" width="720"] Source: Coresight Research[/caption]

Livestreaming

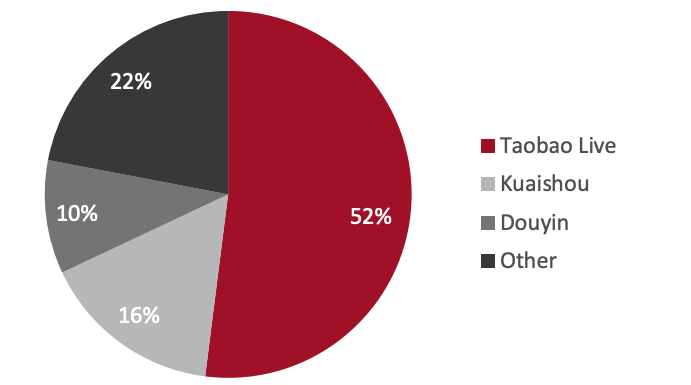

Coresight Research estimates that in 2020, Taobao Live, the dedicated livestreaming channel owned by Alibaba Group, held a majority share in China’s livestreaming e-commerce market, while short-video apps Douyin and Kuaishou held a 10% and 16% market share, respectively (see Figure 2).

Figure 2. China’s Livestreaming E-Commerce Market: Share Held by Major Players, 2020

[caption id="attachment_128447" align="aligncenter" width="580"]

Source: Coresight Research[/caption]

Livestreaming

Coresight Research estimates that in 2020, Taobao Live, the dedicated livestreaming channel owned by Alibaba Group, held a majority share in China’s livestreaming e-commerce market, while short-video apps Douyin and Kuaishou held a 10% and 16% market share, respectively (see Figure 2).

Figure 2. China’s Livestreaming E-Commerce Market: Share Held by Major Players, 2020

[caption id="attachment_128447" align="aligncenter" width="580"] Source: Coresight Research[/caption]

Taobao Live

Alibaba launched Taobao Live in 2016. During Singles’ Day 2020, nearly 300 million users watched livestreaming through Taobao Live, with GMV more than doubling year over year. The 33 livestreaming channels featured on Taobao Live each generated more than ¥100 million ($15 million) in GMV, according to Alibaba.

As of 2020, more than 90% of the product categories on Taobao have been displayed through livestreaming, including automobile, home appliances and pet supplies. According to the platform, as a proportion of total GMV generated on Taobao, livestreaming gradually increased its penetration through the year and reached its peak during the Singles’ Day sales period in November.

Ordinarily, merchants with more than 30,000 followers on Taobao’s social media platform Weitao automatically gain the right to livestream via Taobao Live. Merchants can log into Alibaba’s digital marketing platforms, Alimama and V Task, to look for livestreaming talent (social influencers) to collaborate with on marketing and promotion activities. Social influencers normally charge service fees based on the number of clicks and sales. Merchants can also consult professional KOL (key opinion leader) agencies to identify suitable influencers.

However, to earn the right to livestream during the Singles’ Day, merchants on Taobao and Tmall have to compete in advance of the festival to gain the most new followers, the highest average length of viewership and the highest conversion rate. The platforms that achieve the best results during this competition are included in the list of top merchants that qualify to livestream during Singles’ Day and gain better resources from Taobao Live to draw users to their virtual livestreaming rooms.

For Singles’ Day 2020, Chinese fashion brand Peacebird increased its efforts in livestreaming by adding staff and extending its sessions—providing uninterrupted livestreaming throughout the day. The brand ranked fourth in both menswear and womenswear sales rankings on Tmall during the festival.

Douyin and Kuaishou

Douyin (the Chinese version of TikTok), is currently the hottest short-video app in China, with more than 600 million daily active users on average. Kuaishou is another popular platform, with 264.6 million daily active users on average. Both apps have made aggressive moves in the nation's e-commerce market and support livestreaming functions for brands and retailers.

On Douyin, merchants need to activate the function of the merchandise window that enables them to showcase and sell products, in order to let viewers access a shopping cart during a livestreaming session. To activate the function, merchants’ Douyin account must have at least 10 short-video posts and 1,000 followers.

Merchants need to open stores on Kuaishou’s marketplace to enable livestream viewers to access a shopping cart. To do this, merchants must submit information to Kuaishou and pay a deposit, which varies according to the product category; the minimum deposit is ¥500 ($77).

Content Marketing

Although e-commerce platforms are the primary source of information about products, brands and deals on Singles’ Day, short-video platforms and social media platforms also play an important role. According to a survey conducted by Kantar, 50% of Chinese consumers reported that they learned information about Singles’ Day sales in 2020 from short-video platforms, while 44% learned from social media platforms and 25% learned from content platforms such as Little Red Book.

Below, we discuss how brands and retailers can use Taobao’s dedicated content feature Guangguang, content platform Little Red Book and social media channel Weibo to increase brand awareness during Singles’ Day.

Taobao Guangguang

At the beginning of March 2021, Alibaba upgraded its Taobao app with the launch of a content community feature named “Gaungguang,” through which users can share their purchases and shopping experiences. Guangguang also includes features similar to those offered by Little Red Book, enabling consumers to browse pictures and short videos with product reviews published by KOLs.

To have a presence on Guangguang, merchants on Taobao simply need to submit an application online. In addition to Taobao users, more than 40,000 content creators and 15,000 merchants have used Guangguang for community engagement as of April 2021.

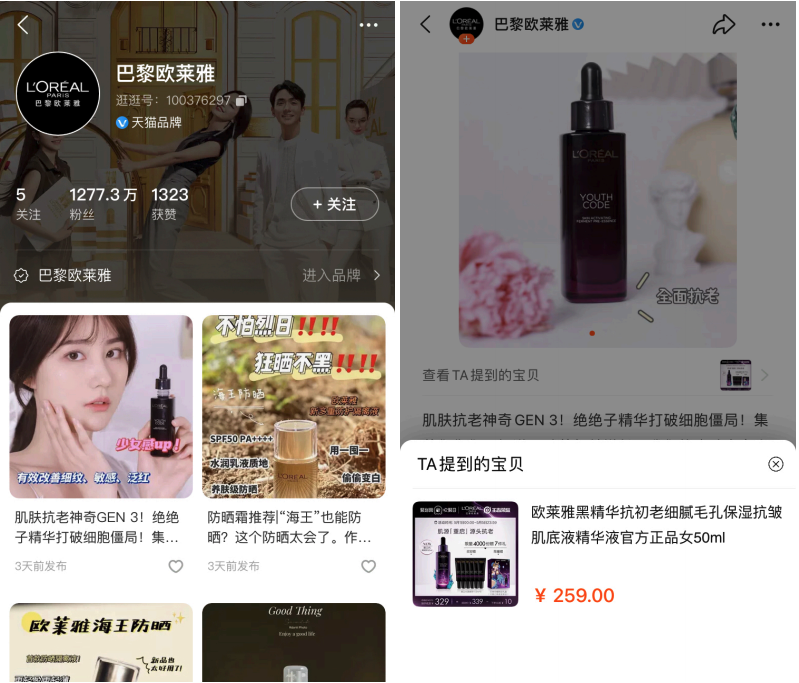

For the 3.8 Festival (International Women’s Day) in March this year, L’Oréal promoted new products on Guangguang by posting new topics and inviting KOLs to engage with its content. During the festival, more than 10,000 posts related to L’Oréal topics drove 64% of readers to visit the brand’s store, according to the company.

[caption id="attachment_128448" align="aligncenter" width="580"]

Source: Coresight Research[/caption]

Taobao Live

Alibaba launched Taobao Live in 2016. During Singles’ Day 2020, nearly 300 million users watched livestreaming through Taobao Live, with GMV more than doubling year over year. The 33 livestreaming channels featured on Taobao Live each generated more than ¥100 million ($15 million) in GMV, according to Alibaba.

As of 2020, more than 90% of the product categories on Taobao have been displayed through livestreaming, including automobile, home appliances and pet supplies. According to the platform, as a proportion of total GMV generated on Taobao, livestreaming gradually increased its penetration through the year and reached its peak during the Singles’ Day sales period in November.

Ordinarily, merchants with more than 30,000 followers on Taobao’s social media platform Weitao automatically gain the right to livestream via Taobao Live. Merchants can log into Alibaba’s digital marketing platforms, Alimama and V Task, to look for livestreaming talent (social influencers) to collaborate with on marketing and promotion activities. Social influencers normally charge service fees based on the number of clicks and sales. Merchants can also consult professional KOL (key opinion leader) agencies to identify suitable influencers.

However, to earn the right to livestream during the Singles’ Day, merchants on Taobao and Tmall have to compete in advance of the festival to gain the most new followers, the highest average length of viewership and the highest conversion rate. The platforms that achieve the best results during this competition are included in the list of top merchants that qualify to livestream during Singles’ Day and gain better resources from Taobao Live to draw users to their virtual livestreaming rooms.

For Singles’ Day 2020, Chinese fashion brand Peacebird increased its efforts in livestreaming by adding staff and extending its sessions—providing uninterrupted livestreaming throughout the day. The brand ranked fourth in both menswear and womenswear sales rankings on Tmall during the festival.

Douyin and Kuaishou

Douyin (the Chinese version of TikTok), is currently the hottest short-video app in China, with more than 600 million daily active users on average. Kuaishou is another popular platform, with 264.6 million daily active users on average. Both apps have made aggressive moves in the nation's e-commerce market and support livestreaming functions for brands and retailers.

On Douyin, merchants need to activate the function of the merchandise window that enables them to showcase and sell products, in order to let viewers access a shopping cart during a livestreaming session. To activate the function, merchants’ Douyin account must have at least 10 short-video posts and 1,000 followers.

Merchants need to open stores on Kuaishou’s marketplace to enable livestream viewers to access a shopping cart. To do this, merchants must submit information to Kuaishou and pay a deposit, which varies according to the product category; the minimum deposit is ¥500 ($77).

Content Marketing

Although e-commerce platforms are the primary source of information about products, brands and deals on Singles’ Day, short-video platforms and social media platforms also play an important role. According to a survey conducted by Kantar, 50% of Chinese consumers reported that they learned information about Singles’ Day sales in 2020 from short-video platforms, while 44% learned from social media platforms and 25% learned from content platforms such as Little Red Book.

Below, we discuss how brands and retailers can use Taobao’s dedicated content feature Guangguang, content platform Little Red Book and social media channel Weibo to increase brand awareness during Singles’ Day.

Taobao Guangguang

At the beginning of March 2021, Alibaba upgraded its Taobao app with the launch of a content community feature named “Gaungguang,” through which users can share their purchases and shopping experiences. Guangguang also includes features similar to those offered by Little Red Book, enabling consumers to browse pictures and short videos with product reviews published by KOLs.

To have a presence on Guangguang, merchants on Taobao simply need to submit an application online. In addition to Taobao users, more than 40,000 content creators and 15,000 merchants have used Guangguang for community engagement as of April 2021.

For the 3.8 Festival (International Women’s Day) in March this year, L’Oréal promoted new products on Guangguang by posting new topics and inviting KOLs to engage with its content. During the festival, more than 10,000 posts related to L’Oréal topics drove 64% of readers to visit the brand’s store, according to the company.

[caption id="attachment_128448" align="aligncenter" width="580"] The homepage of L’Oréal in Guangguang (left) and a post through which users can access the brand’s store to purchase related products (right)

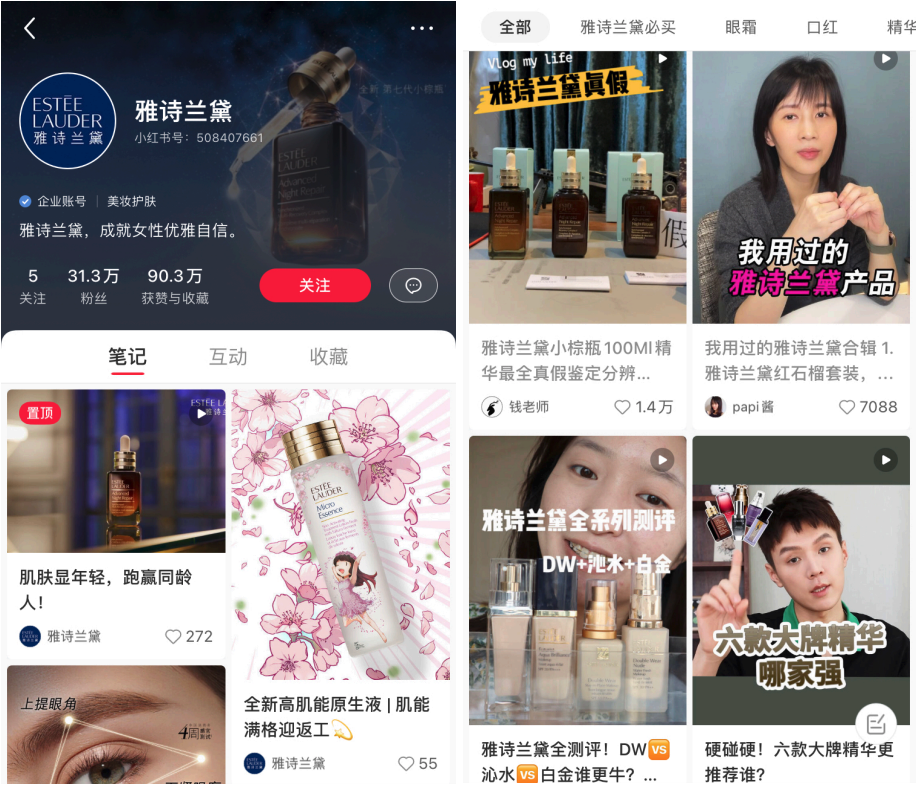

The homepage of L’Oréal in Guangguang (left) and a post through which users can access the brand’s store to purchase related products (right)Source: Taobao[/caption] Little Red Book Little Red Book (or “Xiaohongshu” in Chinese) was launched in 2013 as a social site on which Chinese tourists could share their experiences of discovering and buying products from overseas. Today, it has evolved into a social lifestyle platform that blends user-generated content and e-commerce—often described as a combination of Instagram and Pinterest. In addition to fashion and beauty products, users are increasingly sharing content about travel, fitness, home products and restaurant dining experiences. Little Red Book enables brands and retailers to set up an official account for organic marketing. To register on the platform, foreign companies need to submit documents for verification. Separately, brands can also choose to open an account on Little Red Book’s e-commerce store to fully leverage the platform’s social commerce capability, allowing users to shop seamlessly without having to exit the app. Little Red Book takes commission of about 15–20% on each sale. During last year’s Singles’ Day, 39% of the top 100 brands on Little Red Book (by the number of posts that were marked as sponsored by brands) were domestic brands and 61% were foreign brands from Australia, Germany, the UK and the US, according to data firm Qianuga. During the period October 20–November 11, 2020, the number of average daily posts that were marked as sponsored by Estée Lauder exceeded 30, and the number of total posts mentioning the brand reached 14,800—an increase of nearly three times from 5,542 posts in 2019, indicating a significant rise in user engagement through Little Red Book. [caption id="attachment_128449" align="aligncenter" width="580"]

The homepage of Estée Lauder on Little Red Book (left) and the user-generated posts that mentioned the brand (right)

The homepage of Estée Lauder on Little Red Book (left) and the user-generated posts that mentioned the brand (right)Source: Little Red Book[/caption] Weibo Launched in 2009, Weibo was one of the first social media platforms in China, and it is one of the largest today, with 521 million monthly active users. Weibo has been expanding its features since its launch to incorporate short videos, e-commerce and livestreaming capabilities— making it a comprehensive social platform that brands can use to increase brand awareness, attract and engage with followers and ultimately drive sales. Once brands register for an official account they can create engaging posts to attract followers, such as content about new product launches, promotional campaigns and events. Brands could partner with celebrities and social media influencers as part of their campaigns to reach a wider audience. Last year, Weibo launched its ranking of Singles’ Day trending goods, based on data from the platform. Brands that posted graphics and short videos on their products would get the chance to have their products feature in the ranking. Chinese dairy brand Adopt A Cow had one of its products debut on the list for eight consecutive days, with its Weibo account seeing a sixfold increase in followers. [caption id="attachment_128450" align="aligncenter" width="580"]

Weibo’s ranking of Singles’ Day 2020 trending goods (left) and the user-generated posts that mentioned Adopt A Cow (right)

Weibo’s ranking of Singles’ Day 2020 trending goods (left) and the user-generated posts that mentioned Adopt A Cow (right)Source: Weibo[/caption]

What We Think

Brands and retailers that want to achieve success during Singles’ Day should familiarize themselves with Chinese social media apps and establish a presence on popular platforms. There are two primary areas of focus: livestreaming, which is a sales channel that is gaining traction among consumers in China; and content marketing, which offer opportunities for brands and retailers to increase brand awareness, engage with consumers and ultimately drive sales. Implications for Brands/Retailers- Brands and retailers should set up accounts on popular platforms and explore the functionality that they offer to be well prepared for promoting Singles’ Day-related content.

- Brands can gain experience and build up their follower base on social platforms prior to the event in November, including by leveraging livestreaming and content marketing tools for the 6.18 Shopping Festival.

- Brands and retailers should create varied forms of content that integrate their products and current hot topics to drive traffic to their online stores.

- Brands and retailers can consider partnering with KOLs or celebrities to widen their audience reach.