DIpil Das

Introduction

What’s the Story? In our monthly countdown to Singles’ Day, also known by Alibaba as the 11.11 Global Shopping Festival, we will help brands and retailers to prepare for the event. Brands and retailers seeking to maximize their Singles’ Day sales must implement a multichannel marketing approach that incorporates a mix of platforms and digital media that is most likely to reach their target consumers. We discuss key opportunities, with a focus on livestreaming e-commerce and social marketing. Why It Matters This year’s Singles’ Day is shaping up to be possibly the most challenging so far. Amid extended lockdowns and other restrictions, China retail sales have slumped—at the time of writing, the latest confirmed retail sales are for April, and those were down by almost 10% in total, with key discretionary sectors such as fashion, beauty and jewelry each down by around one-quarter, year over year. The threat of further snap lockdowns will likely impact consumers’ willingness to spend, even when current restrictions end. Meanwhile, tech giants remain under pressure to be seen to be doing good, rather than driving sales at all costs. Amid a clampdown on perceived oligopolies, Singles’ Day 2021 saw a public emphasis on sustainability by major retail platforms, and we expect a deprioritization of the pace of sales growth to remain for this year’s event. Brands selling online on Singles’ Day 2022 will therefore likely face a bigger battle than ever to capture mindshare and drive sales.Five Months to Singles’ Day: Coresight Research Analysis

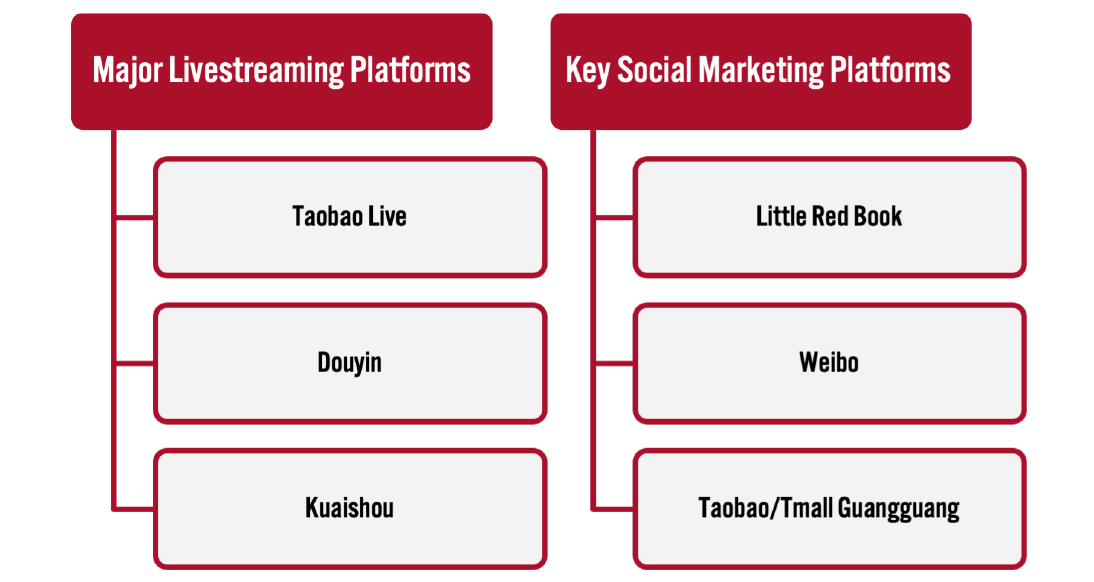

In each of the categories of livestreaming e-commerce and social marketing, there are three tools that brands and retailers should look to leverage to raise brand awareness and increase sales during Singles’ Day. We summarize these in Figure 1 and explore each category in further detail below.Figure 1. Selected Major Livestreaming and Social Marketing Platforms for Singles’ Day [caption id="attachment_149145" align="aligncenter" width="699"]

Source: Coresight Research[/caption]

Livestreaming E-Commerce

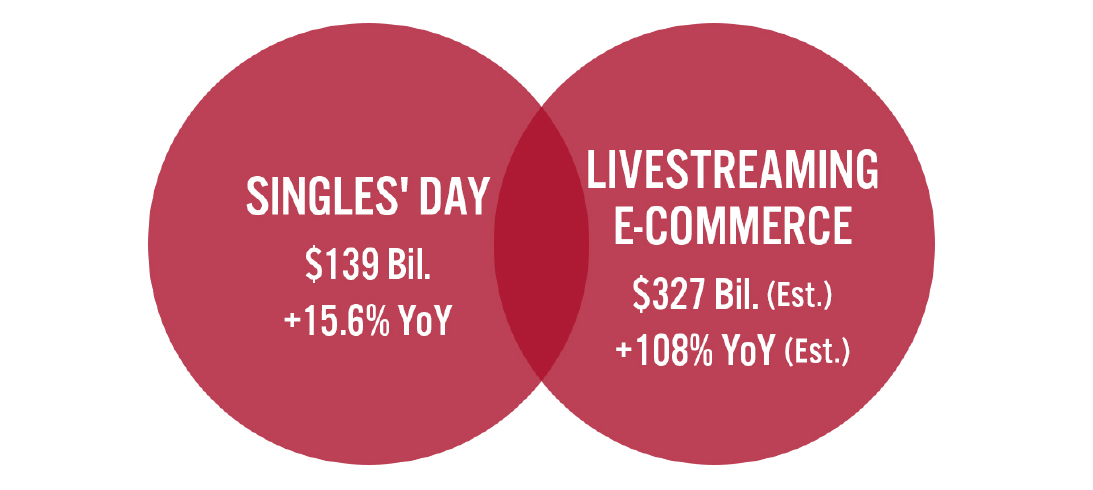

Singles’ Day and livestreaming each represent opportunities measured in tens of billions of dollars. While total growth for Singles’ Day may well prove sluggish amid a tough context this year, Coresight Research expects total livestreaming e-commerce sales to grow by around 52% to $497 billion in 2022 overall, up from $327 billion last year. This compares to just 15.6% aggregate growth in Singles’ Day 2021 sales reported by Alibaba and JD.com. The livestreaming momentum suggests real opportunities for brands and retailers to support growth in Singles’ Day sales.

Source: Coresight Research[/caption]

Livestreaming E-Commerce

Singles’ Day and livestreaming each represent opportunities measured in tens of billions of dollars. While total growth for Singles’ Day may well prove sluggish amid a tough context this year, Coresight Research expects total livestreaming e-commerce sales to grow by around 52% to $497 billion in 2022 overall, up from $327 billion last year. This compares to just 15.6% aggregate growth in Singles’ Day 2021 sales reported by Alibaba and JD.com. The livestreaming momentum suggests real opportunities for brands and retailers to support growth in Singles’ Day sales.

Figure 2. China: Selected Sales Metrics, 2021 [caption id="attachment_149146" align="aligncenter" width="700"]

Singles’ Day sales are for Alibaba and JD.com

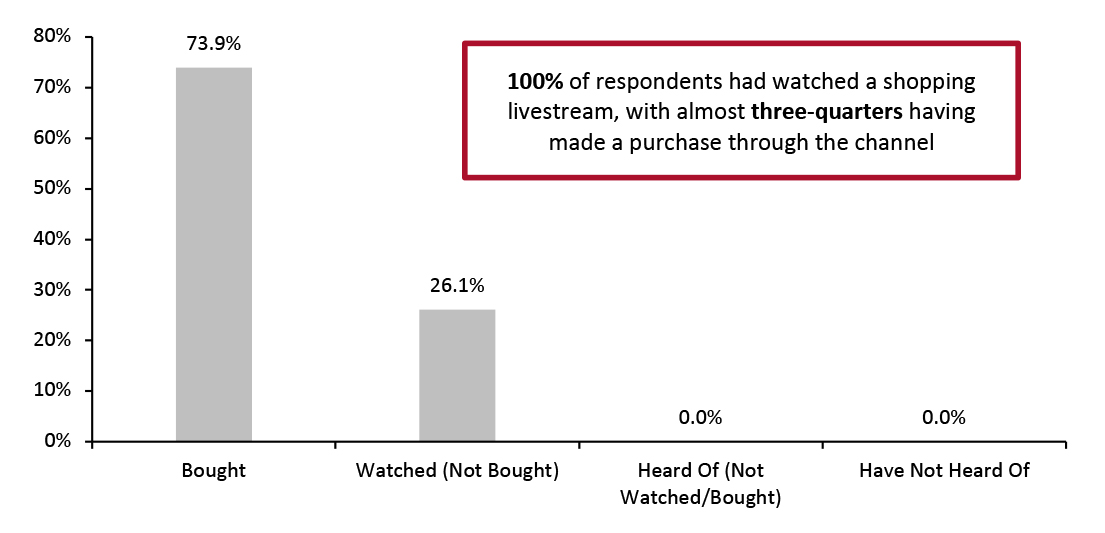

Singles’ Day sales are for Alibaba and JD.com Source: Company reports/Coresight Research [/caption] Livestream shopping sees extremely high levels of adoption in China. According to a new Coresight Research survey of Chinese consumers online, in May 2022, 100% of respondents had watched and/or bought from a shoppable livestream (see Figure 3).

Figure 3. China Respondents: Usage/Awareness of Shoppable Livestreams (% of Respondents) [caption id="attachment_149147" align="aligncenter" width="701"]

Base: 1,724 China respondents aged 18+, surveyed in May 2022

Base: 1,724 China respondents aged 18+, surveyed in May 2022 Source: C2/Coresight Research [/caption] The top categories for livestreaming in China, based on the proportion of livestream shoppers that have purchased via shoppable videos are clothing, footwear or accessories (50.9% of livestream purchasers); food or drink (39.5%); and beauty, grooming or personal care (37.7%). Taobao Live Taobao Live, the dedicated livestreaming channel owned by Alibaba Group, held the greatest share in China’s livestreaming e-commerce market in 2021, according to Coresight Research analysis. Alibaba launched Taobao Live in 2016. Some 61.8% of livestream users have used (watched or bought on) Taobao Live, according to Coresight Research’s May 2022 China consumer survey. During last year’s Singles’ Day shopping festival, more than 100,000 brands held livestream sessions, and 43 merchants topped ¥100 million ($15.0 million, using an exchange rate as of June 3, 2022) in sales on Taobao Live, according to Alibaba. In the year ended March 2021, Taobao Live sold more than $76.3 billion of goods, equivalent to 6.7% of Alibaba’s consumer marketplaces’ GMV in the year (Tmall and Taobao). Alibaba did not disclose a similar number for its latest year or quarter, both of which ended March 2022. Brands and retailers can tap Alibaba’s digital marketing platforms, Alimama and V Task, to find livestreaming and social influencers that they can collaborate with. As with other livestreaming platforms, merchants can also consult professional KOL (key opinion leader) agencies to identify suitable influencers. Douyin and Kuaishou Douyin (the Chinese version of TikTok) is a micro-video service owned by privately held ByteDance. Douyin hit 600 million daily active users (DAUs) in August 2020, according to ByteDance. However, according to a November 2021 report by news website 36kr, which cited a 640 million DAU figure for September 2021, user growth “almost stagnated” in 2021, from previous “ultra-high growth.” Some 74.0% of livestream users in China have used (watched and/or bought on) Douyin, according to Coresight Research’s May 2022 consumer survey. This makes the platform more popular, by number of users, than Taobao Live. Kuaishou underwent an IPO (initial public offering) in early 2021 and continues to grow apace, according to its reported metrics. In the first quarter of 2022, the company reported the following:

- Average monthly active users (MAUs) on the Kuaishou app were 597.9 million, up 15.0% year over year. DAUs were up 17.0% to 345.5 million.

- Average daily time spent per DAU was 128.1 minutes, up of 29.0% year over year.

- Total GMV of e-commerce transactions was ¥1 billion ($26.3 billion), up 47.7% year over year.

- Revenue (not GMV) from livestreaming increased by 8.2% to ¥8 billion ($1.2 billion).

- For guidance and best practices on successfully implementing livestreaming e-commerce, brands and retailers can consult our separate report, Playbook: Livestreaming E-Commerce—A Guide for Global Brands and Retailers.

- Re-post campaigns—Companies can leverage the re-post function in Weibo, getting users to share the post within their social circle.

- Content creation—Companies can encourage users to contribute original content related to the brand or product, such as pictures, videos or product reviews. The brand can frame this a competition with incentives for higher engagement.

- Lucky draws—These reward randomly selected users that meet the requirements of entry (rather than rewarding users for the quality of their content, as in content creation, above). Weibo offers a platform for lucky draws that helps brands to fairly select winners for this type of campaign.

What We Think

Based on trends in China’s economy, and retail and digital commerce landscapes so far in 2022, this year’s Singles’ Day looks likely to occur in a much more challenging context. Brands and retailers must be ready to pull all levers that provide them with a competitive advantage, and that includes livestreaming and social commerce platforms. Implications for Brands/Retailers- Last year, total China livestreaming e-commerce sales grew faster than total Singles’ Day sales. We think a meaningful divergence will remain this year, meaning that it will be even more important for brands and retailers to leverage the momentum of livestreaming to power their Singles’ Day sales.

- China e-commerce is a highly social and networked affair. Driving social sharing and engagement can be key to driving sales. Social media, social commerce and livestreaming converge to become a powerful marketing component. Brands and retailers must implement a nuanced channel mix that is tailored to their target consumer—such as by city tier, gender and income.

- Similarly, brands and retailers deploying campaigns must consider which KOLs—if any—they should partner with. Platform tools and influencer agencies can help companies refine their selections. However, some brands may prefer to eschew big-name influencers in favor of KOCs (key opinion consumers) or by deploying in-house representatives on livestreaming—see our Playbook for more on the choices in implementing livestreaming programs.