Nitheesh NH

Six Key Steps for How To Prepare for Singles’ Day 2020

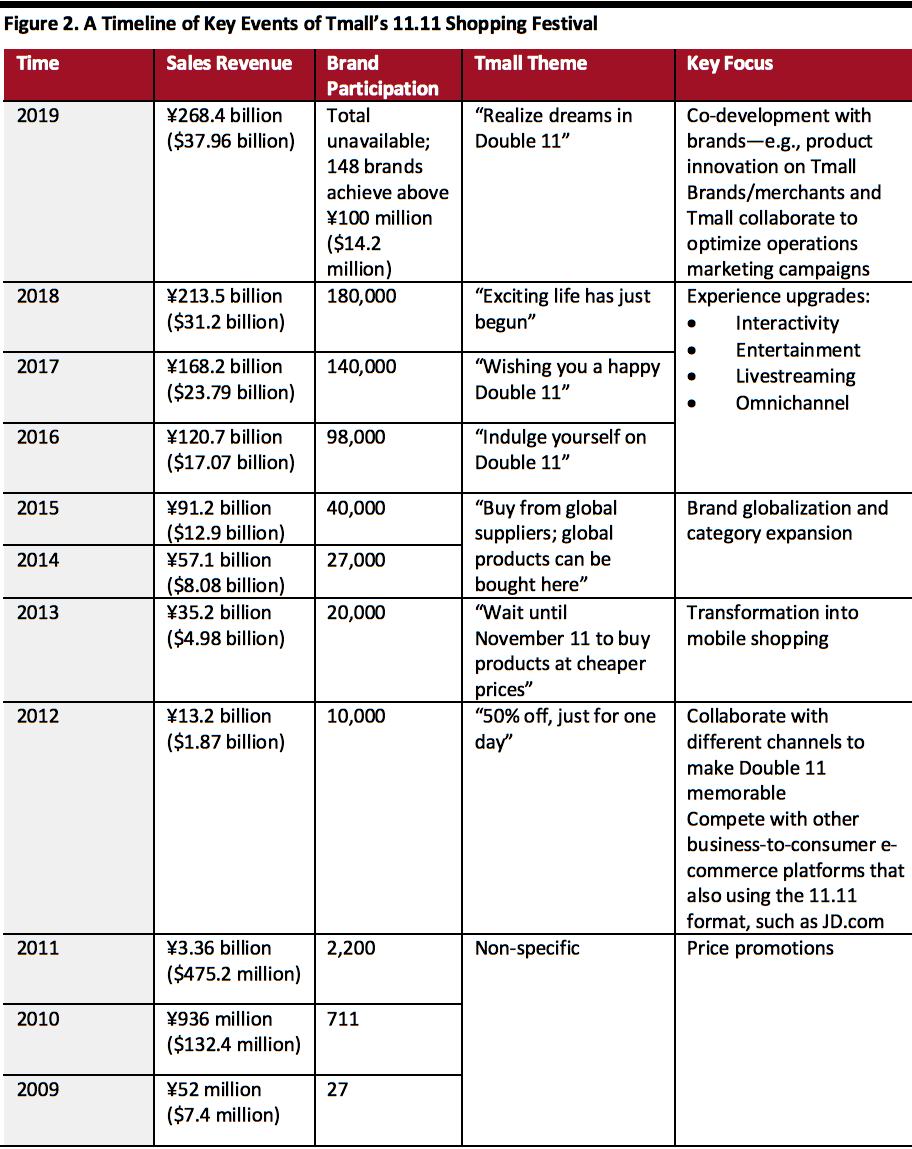

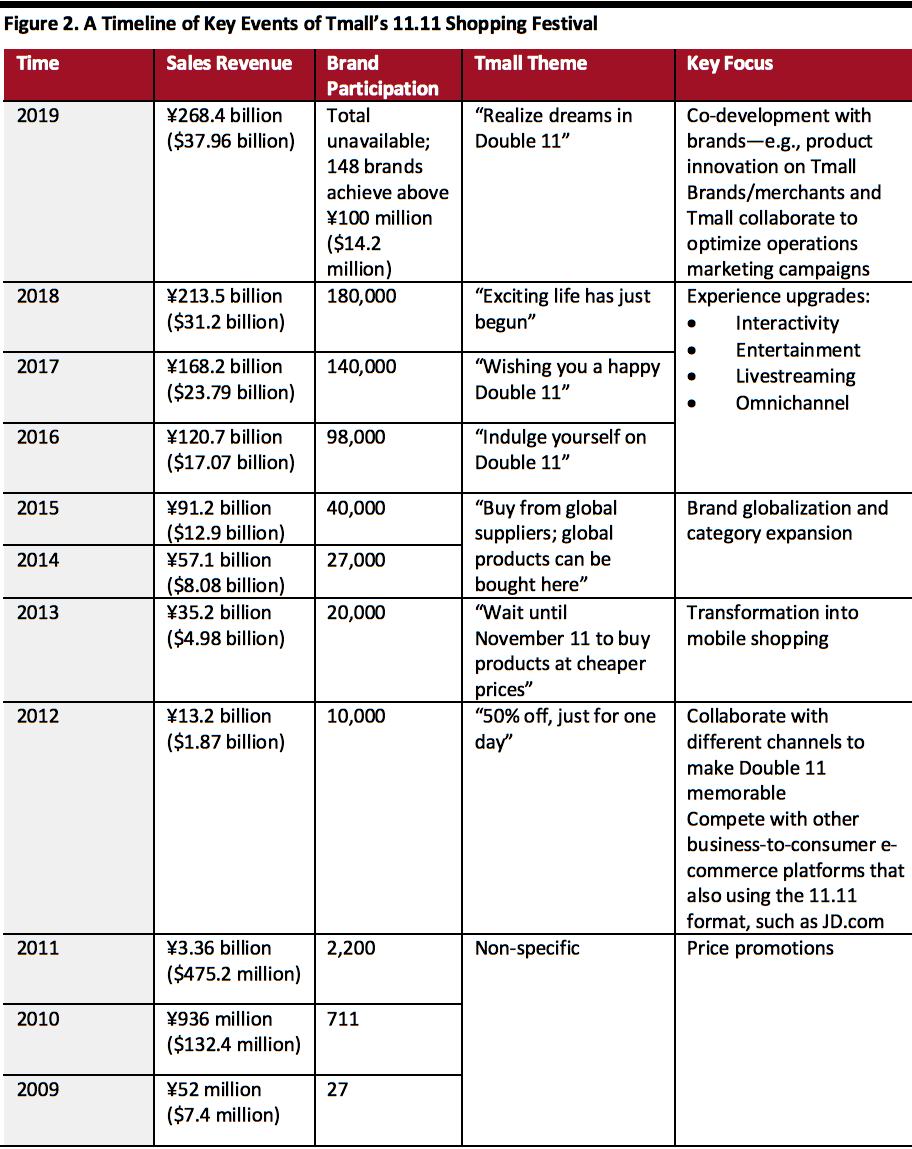

With the coronavirus pandemic having caused temporary store closures and depressed consumer demand in the West, we believe that Singles’ Day will represent a key opportunity for brands and retailers this year to clear some of their inventory of discretionary products in non-Western markets and boost sales. The Coresight Research tactical guide to Singles’ Day preparation comprises six key steps that can brands and retailers can begin to action now, taking them right up to the festival on November 11. We outline the guide in Figure 1, before detailing each step later in this report.

Figure 1. The Coresight Research Tactical Guide to Preparing for Singles’ Day: Six Key Steps and Action Points [wpdatatable id=242 table_view=regular]

Source: Coresight Research Step 1: Goal Setting Before joining the Singles’ Day event, first on the checklist for brands and retailers is to get an overall picture of what they want to achieve, what resources will be required and how much of their budget will need to be reserved for marketing, customer service and logistics. For merchants that participated in Double 11 last year, there are several factors to consider: Listerine Double 11 offline activities—letting consumers smell the essential oils added into the new products and giving consumers free samples, November 11, 2018

Listerine Double 11 offline activities—letting consumers smell the essential oils added into the new products and giving consumers free samples, November 11, 2018

Source: Coresight Research[/caption] [caption id="attachment_111340" align="aligncenter" width="700"] Maybelline Double 11 offline activities on November 11, 2019

Maybelline Double 11 offline activities on November 11, 2019

Source: Tmall App[/caption] Step 4: Customer Service Preparation Tmall has been putting more emphasis on upgrading the customer experience for Singles’ Day. As such, it has stated that for the 2020 event, merchants (except for those selling large items such as home furniture) will ship products to all four of China’s tier-1 cities (Beijing, Shanghai, Guangzhou, Shenzhen) plus Hangzhou (where Alibaba is headquartered) within 48 hours and to the other locations within seven days. This commitment to meet consumer demand will be facilitated by Alibaba’s Cainiao Logistics Network. Merchants need to understand and plan shipping and logistics timelines and resources in order to ensure a smooth experience for customers. Customer service resources should be compatible and familiar with the Tmall platform. Coresight Research provides advisory work on how brands and retailers can select a trade partner in China so that their customer service personnel on Tmall or Tmall Global can bring the best professional knowledge and service to shoppers. Merchants could also consider applying to use the Tmall AI customer service offering, training their after-sales team in pre-sales or recruiting temporary support. Merchants should also test the compatibility and stability of their IT system well in advance of Singles’ Day. Step 5: Close Communication with Tmall After a merchant outlines their marketing and merchandise plans, it is important for them to communicate with Tmall category managers and ask for support and resources. We suggest three questions that merchants should bear in mind when planning Singles’ Day marketing strategies: Brands can apply to join the front-page promotions on the Tmall platform during Double 11

Brands can apply to join the front-page promotions on the Tmall platform during Double 11

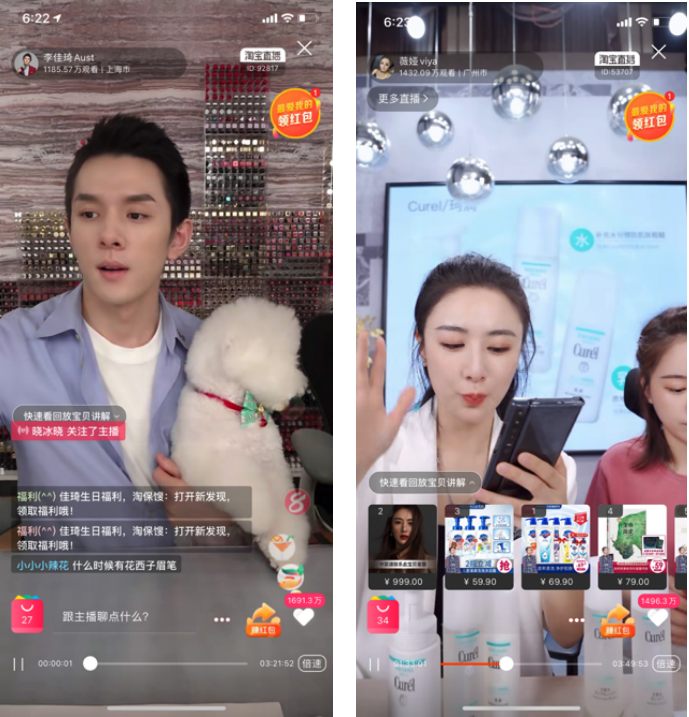

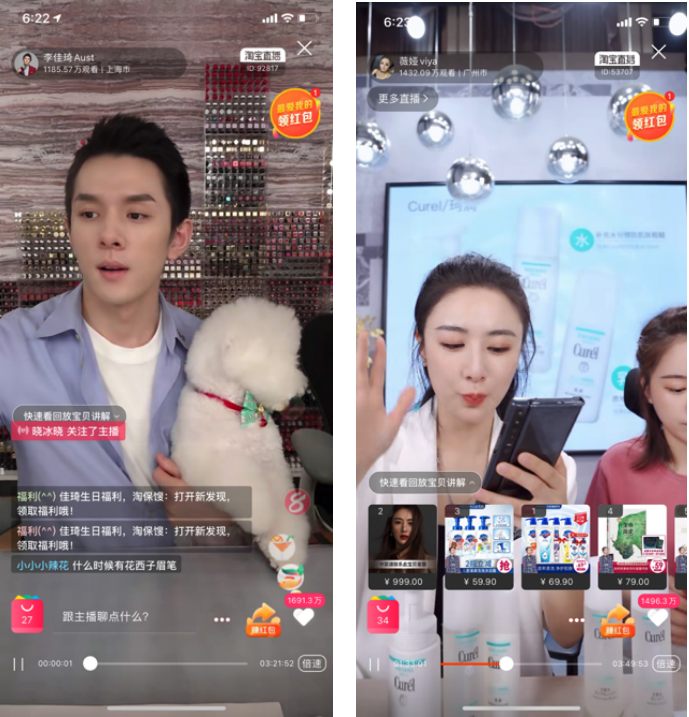

Source: Tmall App[/caption] [caption id="attachment_111342" align="aligncenter" width="400"] Key opinion leaders host livestreaming sessions: Austin Li (left) and Viya (right)

Key opinion leaders host livestreaming sessions: Austin Li (left) and Viya (right)

Source: Tmall App[/caption] Step 6: Store Operation and Management When a merchant has put plans in place through Steps 1–5 of this guide, the final course of action is to set up an internal “command center” for Singles’ Day operations. This involves working with trade partners, internal teams or outsourcing companies to comprehensively execute five phases of the shopping festival: Note: Currency conversions from RMB to USD are at exchange rates as of June 8, 2020

Note: Currency conversions from RMB to USD are at exchange rates as of June 8, 2020

Source: Baidu.com/Coresight Research[/caption] Key Insights Singles’ Day is the world’s largest 24-hour online shopping event in terms of gross merchandise volume—bigger than both Black Friday and Amazon Prime Day. Brands and retailers have a significant opportunity to break or expand into the Chinese market by participating in the festival this year. Detailed planning and close collaboration with Tmall should help merchants to achieve results on Double 11 that could somewhat mitigate the impacts of the coronavirus crisis.

Figure 1. The Coresight Research Tactical Guide to Preparing for Singles’ Day: Six Key Steps and Action Points [wpdatatable id=242 table_view=regular]

Source: Coresight Research Step 1: Goal Setting Before joining the Singles’ Day event, first on the checklist for brands and retailers is to get an overall picture of what they want to achieve, what resources will be required and how much of their budget will need to be reserved for marketing, customer service and logistics. For merchants that participated in Double 11 last year, there are several factors to consider:

- The sales performance of their Tmall store on Singles’ Day last year

- The overall growth rate of Tmall’s sales revenue during Singles’ Day last year

- Marketing budget and personnel involvement for their Tmall store

- Whether direct competitors in the same product category have launched a store on Tmall since Singles’ Day last year

- The base/lower target can be calculated by multiplying the merchant’s 2019 Singles’ Day sales revenue by Tmall’s growth rate for the festival last year. For instance, if a merchant’s revenue from last year’s Double 11 was $10 million and Tmall’s sales growth rate during the 2019 event was 25.7%, then the merchant should set a base goal of $12.57 million in revenue for the 2020 festival.

- When calculating a high target, merchants should consider their marketing budget and Tmall store customer service capabilities; High revenues cannot be achieved if there is insufficient marketing ahead of the shopping festival or if customer service is ill-equipped to communicate with shoppers in a responsive and productive manner, which may lead to lost sales. The high target may also be adjusted based on Step 2 of this guide, as merchants must factor in realistic expectations for merchandise availability. In addition, if there are new competitors on Tmall for this year’s Singles’ Day, merchants may need to lower their high sales target to account for decreased market share—as well as increasing their marketing budget to boost brand and product awareness among consumers in a more competitive environment.

- Leveraging alternative consumer-engagement channels—livestreaming, interactive games, product-ranking lists (e.g., “Top Five Must-Buy Skincare Products”), Tmall Double 11 Gala on November 10

- Taking an omnichannel approach—online channels including social media (Weibo, WeChat); other lifestyle apps (Dianping); short-video apps (Douyin, Kuaishou); and offline channels such as shopping malls, retail stores, supermarket/convenience stores and food-service businesses

- Upgrading and utilizing technology—augmented- and virtual-reality gaming and interaction (e.g. virtual makeup try-on, furniture retail)

- Optimizing CRM—loyalty membership programs, Tmall fan group interactions

- Capturing trends—for example, sales of health supplements and healthcare products significant increased during and after the coronavirus lockdowns. According to JD.com, the transaction volume in the sports and cycling category increased by over 150%, the sales of overall nutritional supplements increased by 135% and cross-border nutritional supplements increased by 210% on June 1, 2020, at the beginning of JD.com’s 6.18 Shopping Festival.

- Targeting the right consumer segments—Tmall has identified eight primary segments that shop on the platform during Double 11: Gen-Z, elegant moms, modern white collar, senior middle class, small town youth, small town elder, urban blue collar, urban silver hair.

Listerine Double 11 offline activities—letting consumers smell the essential oils added into the new products and giving consumers free samples, November 11, 2018

Listerine Double 11 offline activities—letting consumers smell the essential oils added into the new products and giving consumers free samples, November 11, 2018Source: Coresight Research[/caption] [caption id="attachment_111340" align="aligncenter" width="700"]

Maybelline Double 11 offline activities on November 11, 2019

Maybelline Double 11 offline activities on November 11, 2019Source: Tmall App[/caption] Step 4: Customer Service Preparation Tmall has been putting more emphasis on upgrading the customer experience for Singles’ Day. As such, it has stated that for the 2020 event, merchants (except for those selling large items such as home furniture) will ship products to all four of China’s tier-1 cities (Beijing, Shanghai, Guangzhou, Shenzhen) plus Hangzhou (where Alibaba is headquartered) within 48 hours and to the other locations within seven days. This commitment to meet consumer demand will be facilitated by Alibaba’s Cainiao Logistics Network. Merchants need to understand and plan shipping and logistics timelines and resources in order to ensure a smooth experience for customers. Customer service resources should be compatible and familiar with the Tmall platform. Coresight Research provides advisory work on how brands and retailers can select a trade partner in China so that their customer service personnel on Tmall or Tmall Global can bring the best professional knowledge and service to shoppers. Merchants could also consider applying to use the Tmall AI customer service offering, training their after-sales team in pre-sales or recruiting temporary support. Merchants should also test the compatibility and stability of their IT system well in advance of Singles’ Day. Step 5: Close Communication with Tmall After a merchant outlines their marketing and merchandise plans, it is important for them to communicate with Tmall category managers and ask for support and resources. We suggest three questions that merchants should bear in mind when planning Singles’ Day marketing strategies:

- What is the goal you want to achieve?

- How do you want to make that happen through marketing?

- How will you plan the store merchandise mix?

- Logo design for Double 11

- Opportunity to appear in the front page of a category on Tmall

- Applying to join Tmall’s marketing or gaming activities

- Applying to join Tmall’s Double 11 offline events or activities

- Booking time slots for livestreaming sessions

- Booking to use top key opinion leaders to host livestreaming sessions—it is difficult to do this without going through Tmall category managers, who have specific time slots reserved or can offer special recommendations.

Brands can apply to join the front-page promotions on the Tmall platform during Double 11

Brands can apply to join the front-page promotions on the Tmall platform during Double 11Source: Tmall App[/caption] [caption id="attachment_111342" align="aligncenter" width="400"]

Key opinion leaders host livestreaming sessions: Austin Li (left) and Viya (right)

Key opinion leaders host livestreaming sessions: Austin Li (left) and Viya (right)Source: Tmall App[/caption] Step 6: Store Operation and Management When a merchant has put plans in place through Steps 1–5 of this guide, the final course of action is to set up an internal “command center” for Singles’ Day operations. This involves working with trade partners, internal teams or outsourcing companies to comprehensively execute five phases of the shopping festival:

- Pre-event marketing push: Mid-September to October

- Pre-sale period: End of October to November 10

- Singles’ Day: November 11

- Returns sale: November 12 or several days within the week of November 12

- After-sale period: November 12–20

Note: Currency conversions from RMB to USD are at exchange rates as of June 8, 2020

Note: Currency conversions from RMB to USD are at exchange rates as of June 8, 2020Source: Baidu.com/Coresight Research[/caption] Key Insights Singles’ Day is the world’s largest 24-hour online shopping event in terms of gross merchandise volume—bigger than both Black Friday and Amazon Prime Day. Brands and retailers have a significant opportunity to break or expand into the Chinese market by participating in the festival this year. Detailed planning and close collaboration with Tmall should help merchants to achieve results on Double 11 that could somewhat mitigate the impacts of the coronavirus crisis.