DIpil Das

The AAFA Executive Think Tank 2019 drew leaders from brands and retailers across the world, including Levi Strauss and VF Corporation. We discuss five key takeaways from the leading apparel and footwear industry conference:

1. Digitalization of supply chain helps manufacturers and retailers to increase efficiency.

This digitalization process includes three major elements:

Edwin Keh, CEO of Hong Kong Research Institute of Textiles and Apparel

Edwin Keh, CEO of Hong Kong Research Institute of Textiles and Apparel

Source: Coresight Research [/caption] 3. Brands are collectively coming together to combat climate change. Adidas and VF Corporation have signed the Fashion Industry Charter for Climate Action, which sets out a vision to achieve net-zero emissions by 2050. The signatories will address issues that impact the environment across the supply chain by working toward a number of strategies: decarbonization of the production phase; selection of climate-friendly and sustainable materials; use of low-carbon transport; improving consumer dialogue and awareness; and working with the financing community and policymakers to catalyze scalable solutions. [caption id="attachment_99501" align="aligncenter" width="700"] From left to right: Sean Cady, Vice President, Global Sustainability and Responsible Sourcing, VF Corporation; Gary Simmons, AAFA Chairman; Tracy Nilsson, Senior Director Global Environment (Supply Chain), Social & Environmental Affairs, Adidas Group

From left to right: Sean Cady, Vice President, Global Sustainability and Responsible Sourcing, VF Corporation; Gary Simmons, AAFA Chairman; Tracy Nilsson, Senior Director Global Environment (Supply Chain), Social & Environmental Affairs, Adidas Group

Source: Coresight Research [/caption] 4. To succeed in China, brands must be ready to invest a high sum of money in the first five years of their entry into the market. According to Willie Tan, CEO of Luen Thai, brands that achieve around $1 billion in annual sales in the US need to be ready to spend $25 million in the first five years of their entry to China. Luen Thai is a leading consumer goods supply chain group that successfully helped Skechers to enter China, and Skechers achieved six years of double-digit sales growth in the market by 2018. Willie explained that during the first two years of a brand entering the China market, it would need to focus on testing products with consumers. This would include opening around 30 stores across the nation to observe product performance. For the remainder of the five-year timeline, brands should look to adjust quickly to the market based on their observations. Willie said that Skechers was at loss during its first three years, as the brand could not effectively adapt to Chinese consumers’ taste. [caption id="attachment_99502" align="aligncenter" width="700"] Willie Tan, CEO of Luen Thai

Willie Tan, CEO of Luen Thai

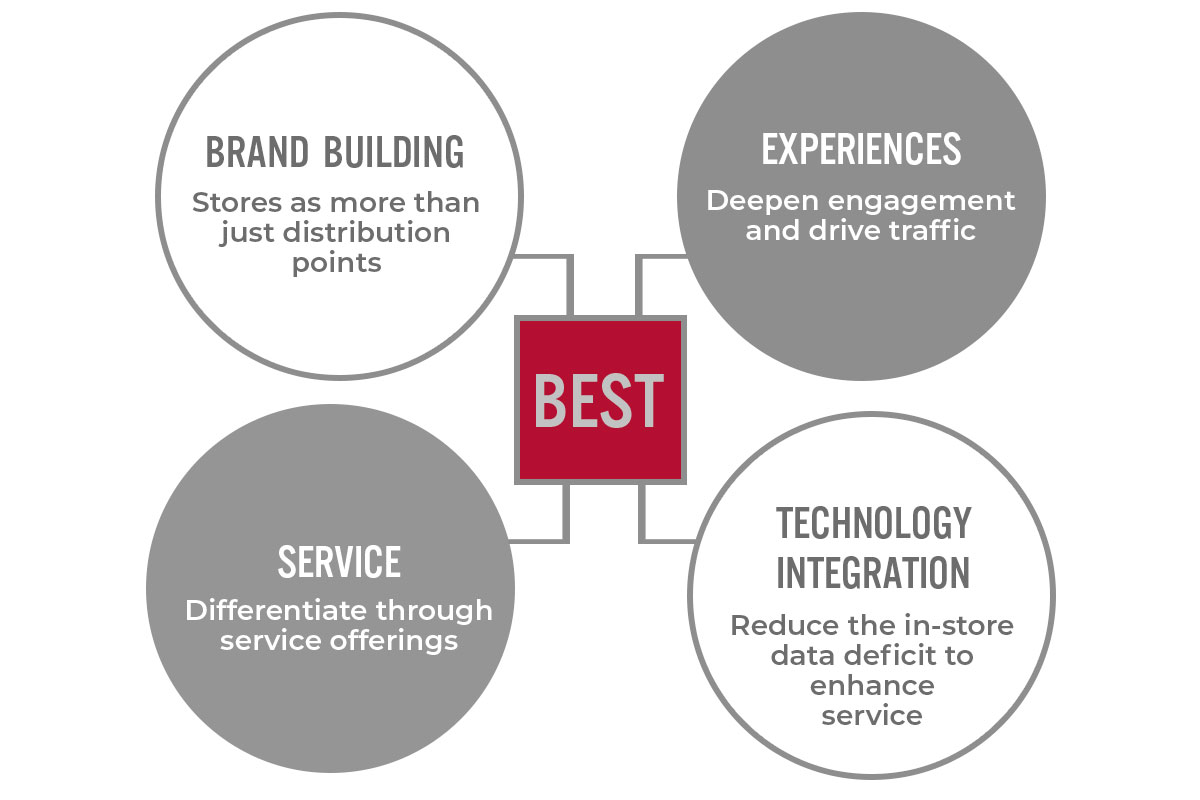

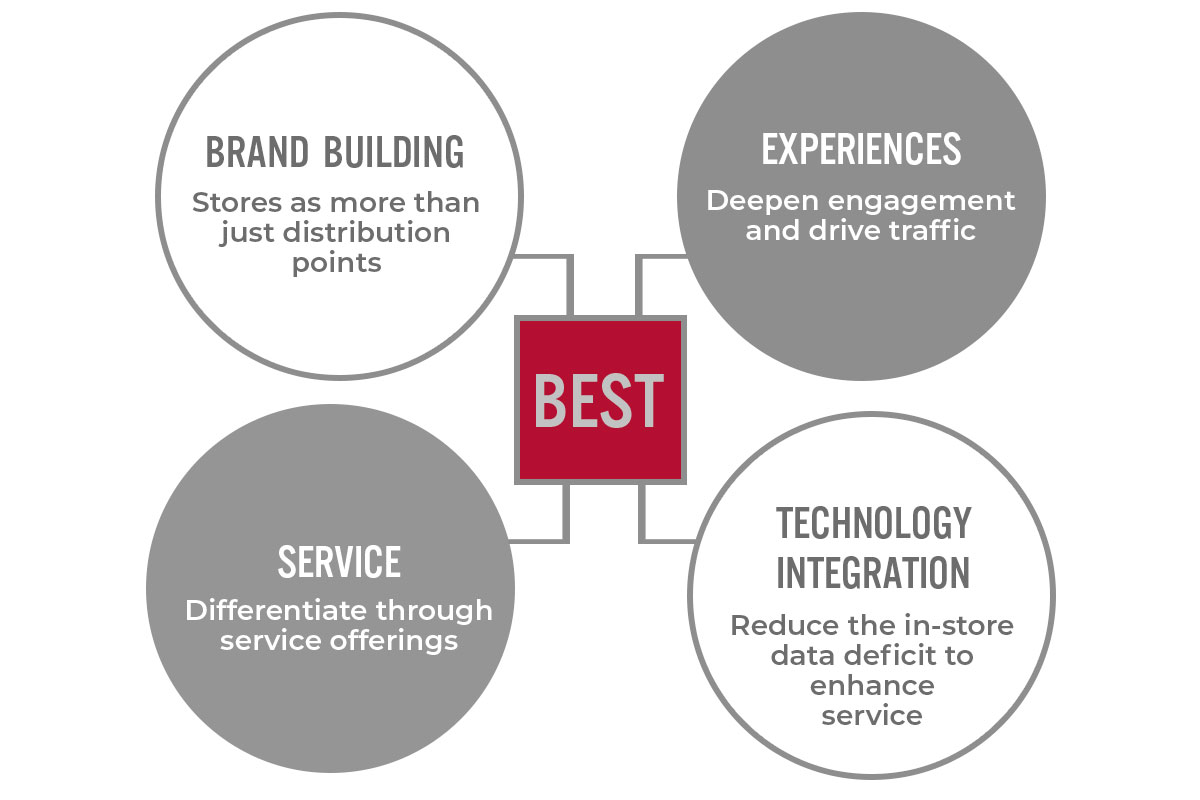

Source: Coresight Research [/caption] 5. Coresight Research’s BEST framework helps retailers to transform their brick-and-mortar stores. Max Kahn, President at Coresight Research, highlighted the importance of brick-and-mortar stores to retailers globally. The BEST framework outlines four components that are critical to the transformation of physical retail: [caption id="attachment_99504" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Brand building: Stores function as more than just distribution points, but also as touchpoints to educate customers on company values, history and product offerings. For example, Nu Skin’s Nu Xtore in Shenzhen, China, helps customers to better understand its brand by displaying information on its LED curtain walls and digital screens.

Experiences: Stores can blend retail and entertainment to deepen customer engagement and drive traffic. For instance, Lancôme’s store in Sanya, China, features a game zone where shoppers can use photo booths or play interactive games to win product samples.

Service: Stores can differentiate themselves through service offerings. US toy company FAO Schwarz offers greeting and escorting services to store visitors, with staff at the entrance of the store wearing soldiers’ uniforms from Grimm’s Fairy Tales.

Technology integration: Stores should take advantage of technology to increase efficiency. For example, Chinese department store and mall operator Intime adopted a cloud-based retail model, enabling a processing capacity of more than 1 million orders per day. The new cloud-based point-of-sale machines also allow consumers to pay at specific brands’ counters instead of at cashiers’ checkouts, thus lowering the average transaction time to 58 seconds from two to three minutes.

With e-commerce developing rapidly, retailers must look to transform their brick-and-mortar stores to provide rich experiences and services that drive customer engagement. Brands can also use physical stores as opportunities to educate customers about their culture and history.

[caption id="attachment_99503" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Brand building: Stores function as more than just distribution points, but also as touchpoints to educate customers on company values, history and product offerings. For example, Nu Skin’s Nu Xtore in Shenzhen, China, helps customers to better understand its brand by displaying information on its LED curtain walls and digital screens.

Experiences: Stores can blend retail and entertainment to deepen customer engagement and drive traffic. For instance, Lancôme’s store in Sanya, China, features a game zone where shoppers can use photo booths or play interactive games to win product samples.

Service: Stores can differentiate themselves through service offerings. US toy company FAO Schwarz offers greeting and escorting services to store visitors, with staff at the entrance of the store wearing soldiers’ uniforms from Grimm’s Fairy Tales.

Technology integration: Stores should take advantage of technology to increase efficiency. For example, Chinese department store and mall operator Intime adopted a cloud-based retail model, enabling a processing capacity of more than 1 million orders per day. The new cloud-based point-of-sale machines also allow consumers to pay at specific brands’ counters instead of at cashiers’ checkouts, thus lowering the average transaction time to 58 seconds from two to three minutes.

With e-commerce developing rapidly, retailers must look to transform their brick-and-mortar stores to provide rich experiences and services that drive customer engagement. Brands can also use physical stores as opportunities to educate customers about their culture and history.

[caption id="attachment_99503" align="aligncenter" width="700"] Max Kahn, President of Coresight Research

Max Kahn, President of Coresight Research

Source: Coresight Research [/caption]

- The application of the Internet of Things (IoT)—Manufacturers can use radio-frequency identification sensors to track products and gather data about them, such as storage temperature. Retailers can also implement IoT solutions to improve traceability and follow goods in transit from warehouses to delivery.

- The use of advanced robotics—Autonomous robots will have a growing presence in manufacturing, final assembly and warehousing, etc.

- The application of advanced big data analytics—For instance, visibility of point-of-sale data, inventory data and production volumes can be analyzed in real time to identify mismatches between supply and demand. This information can then drive price changes, the timing of promotions or the addition of new product lines. Brands and retailers can also use big data analytics to inform product recommendations to customers, effectively steering demand towards items that are available in stock.

Edwin Keh, CEO of Hong Kong Research Institute of Textiles and Apparel

Edwin Keh, CEO of Hong Kong Research Institute of Textiles and ApparelSource: Coresight Research [/caption] 3. Brands are collectively coming together to combat climate change. Adidas and VF Corporation have signed the Fashion Industry Charter for Climate Action, which sets out a vision to achieve net-zero emissions by 2050. The signatories will address issues that impact the environment across the supply chain by working toward a number of strategies: decarbonization of the production phase; selection of climate-friendly and sustainable materials; use of low-carbon transport; improving consumer dialogue and awareness; and working with the financing community and policymakers to catalyze scalable solutions. [caption id="attachment_99501" align="aligncenter" width="700"]

From left to right: Sean Cady, Vice President, Global Sustainability and Responsible Sourcing, VF Corporation; Gary Simmons, AAFA Chairman; Tracy Nilsson, Senior Director Global Environment (Supply Chain), Social & Environmental Affairs, Adidas Group

From left to right: Sean Cady, Vice President, Global Sustainability and Responsible Sourcing, VF Corporation; Gary Simmons, AAFA Chairman; Tracy Nilsson, Senior Director Global Environment (Supply Chain), Social & Environmental Affairs, Adidas Group Source: Coresight Research [/caption] 4. To succeed in China, brands must be ready to invest a high sum of money in the first five years of their entry into the market. According to Willie Tan, CEO of Luen Thai, brands that achieve around $1 billion in annual sales in the US need to be ready to spend $25 million in the first five years of their entry to China. Luen Thai is a leading consumer goods supply chain group that successfully helped Skechers to enter China, and Skechers achieved six years of double-digit sales growth in the market by 2018. Willie explained that during the first two years of a brand entering the China market, it would need to focus on testing products with consumers. This would include opening around 30 stores across the nation to observe product performance. For the remainder of the five-year timeline, brands should look to adjust quickly to the market based on their observations. Willie said that Skechers was at loss during its first three years, as the brand could not effectively adapt to Chinese consumers’ taste. [caption id="attachment_99502" align="aligncenter" width="700"]

Willie Tan, CEO of Luen Thai

Willie Tan, CEO of Luen Thai Source: Coresight Research [/caption] 5. Coresight Research’s BEST framework helps retailers to transform their brick-and-mortar stores. Max Kahn, President at Coresight Research, highlighted the importance of brick-and-mortar stores to retailers globally. The BEST framework outlines four components that are critical to the transformation of physical retail: [caption id="attachment_99504" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Brand building: Stores function as more than just distribution points, but also as touchpoints to educate customers on company values, history and product offerings. For example, Nu Skin’s Nu Xtore in Shenzhen, China, helps customers to better understand its brand by displaying information on its LED curtain walls and digital screens.

Experiences: Stores can blend retail and entertainment to deepen customer engagement and drive traffic. For instance, Lancôme’s store in Sanya, China, features a game zone where shoppers can use photo booths or play interactive games to win product samples.

Service: Stores can differentiate themselves through service offerings. US toy company FAO Schwarz offers greeting and escorting services to store visitors, with staff at the entrance of the store wearing soldiers’ uniforms from Grimm’s Fairy Tales.

Technology integration: Stores should take advantage of technology to increase efficiency. For example, Chinese department store and mall operator Intime adopted a cloud-based retail model, enabling a processing capacity of more than 1 million orders per day. The new cloud-based point-of-sale machines also allow consumers to pay at specific brands’ counters instead of at cashiers’ checkouts, thus lowering the average transaction time to 58 seconds from two to three minutes.

With e-commerce developing rapidly, retailers must look to transform their brick-and-mortar stores to provide rich experiences and services that drive customer engagement. Brands can also use physical stores as opportunities to educate customers about their culture and history.

[caption id="attachment_99503" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Brand building: Stores function as more than just distribution points, but also as touchpoints to educate customers on company values, history and product offerings. For example, Nu Skin’s Nu Xtore in Shenzhen, China, helps customers to better understand its brand by displaying information on its LED curtain walls and digital screens.

Experiences: Stores can blend retail and entertainment to deepen customer engagement and drive traffic. For instance, Lancôme’s store in Sanya, China, features a game zone where shoppers can use photo booths or play interactive games to win product samples.

Service: Stores can differentiate themselves through service offerings. US toy company FAO Schwarz offers greeting and escorting services to store visitors, with staff at the entrance of the store wearing soldiers’ uniforms from Grimm’s Fairy Tales.

Technology integration: Stores should take advantage of technology to increase efficiency. For example, Chinese department store and mall operator Intime adopted a cloud-based retail model, enabling a processing capacity of more than 1 million orders per day. The new cloud-based point-of-sale machines also allow consumers to pay at specific brands’ counters instead of at cashiers’ checkouts, thus lowering the average transaction time to 58 seconds from two to three minutes.

With e-commerce developing rapidly, retailers must look to transform their brick-and-mortar stores to provide rich experiences and services that drive customer engagement. Brands can also use physical stores as opportunities to educate customers about their culture and history.

[caption id="attachment_99503" align="aligncenter" width="700"] Max Kahn, President of Coresight Research

Max Kahn, President of Coresight Research Source: Coresight Research [/caption]