DIpil Das

What’s the Story?

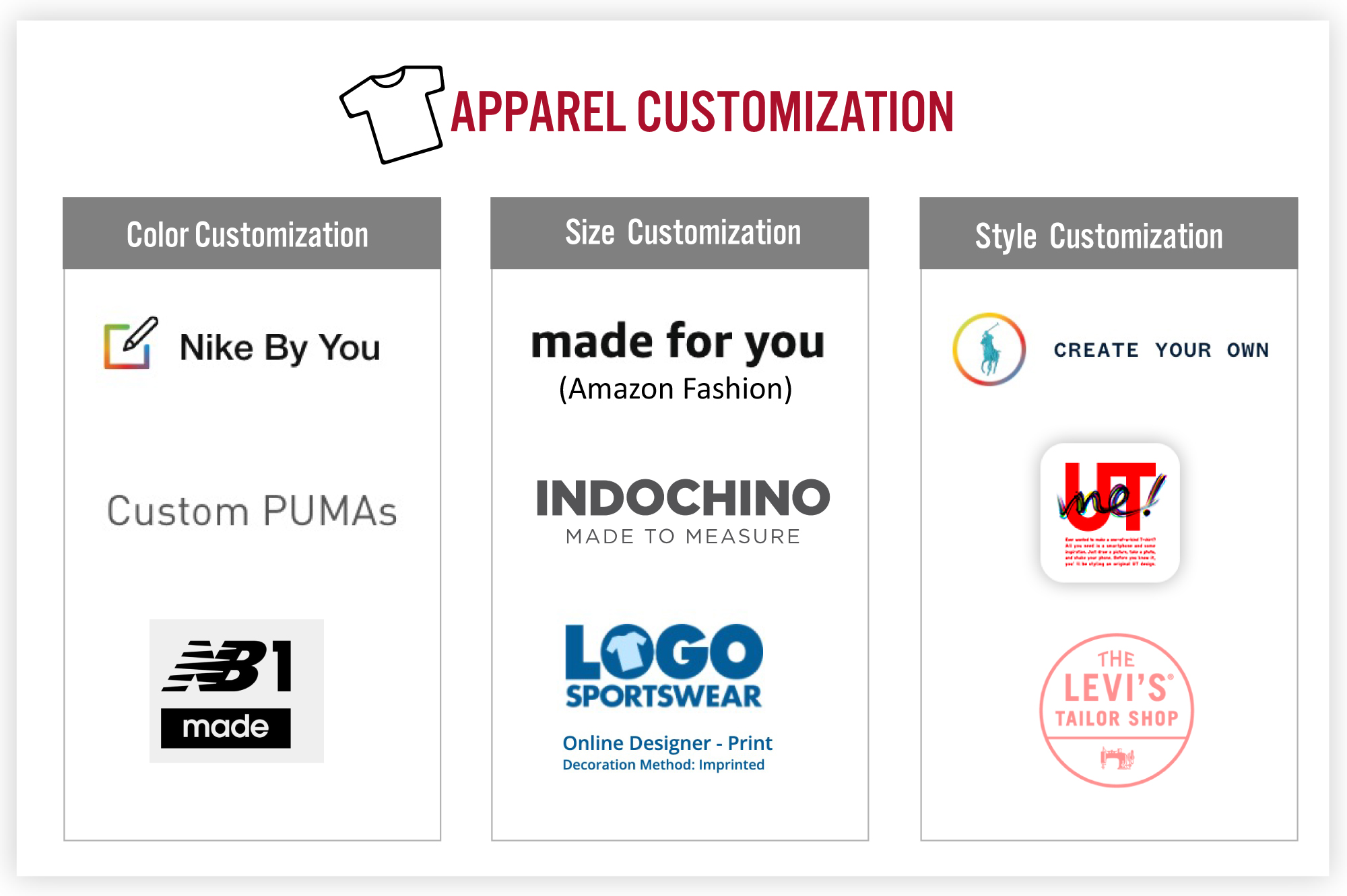

We discuss five key insights into the custom clothing and footwear market and identify opportunities for brands and retailers. Our coverage of apparel customization includes clothing and footwear with customizable colors, sizes and styles (including decorations, patterns and fabrics). We exclude custom apparel in the luxury and wedding sectors.- Color customization services enable consumers to select their own product color combinations, with services including the NIKE By You Shoe Customizer, the New Balance Custom Shoes service and PUMA’s Custom offering.

- Size customization includes made-to-measure and made-to-order items, with offerings includingAmazon’sMade for You, Indochino’s custom suits services and LogoSportswear’s custom plus-size clothing. We exclude services offered by dedicated tailors as opposed to apparel brands and retailers.

- Style customization services include Ralph Lauren’s Create Your Own service, Levi’s Tailor Shop and UNIQLO’s UTme! app.

Figure 1. Coresight Research’s Coverage of Apparel Customization [caption id="attachment_128689" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Why It Matters

The apparel industry is in continuous evolution and, in 2021, is experiencing a bounce back from the slump in demand in 2020. In this context, we see customization as a key way for brands and retailers to differentiate themselves with innovative and compelling product offerings. Among 24 apparel brands and retailers in the Coresight 100 (our focus list of the largest and most influential companies in the global retail ecosystem), 13 offer apparel customization services. We expect the role of customization to continue to grow and discuss five key insights to inform retail players of opportunities in the global apparel market.Five Key Insights into the Custom Apparel Market: A Deep Dive

1. Market Positioning Coresight Research estimates that the global custom apparel market captured just under 5% of the total apparel market in 2020. The market is gaining traction and is set to see year-over-year growth of 7% in 2021 according to Euromonitor International. While we don’t expect custom apparel to become mainstream in the near future, we view customization as an important part of the market—it serves a niche consumer group looking to showcase their individuality with unique purchases, as well as consumers looking for solutions to personal style or size requirements. We identify three key drivers of the global custom apparel market:- Overall apparel market recovery

- Sizing problems

- Supply chain optimization

- Denim

- T-Shirts

UNIQLO’S UTme! customized T-shirt service

UNIQLO’S UTme! customized T-shirt service Source: UNIQLO [/caption]

- Sports shoes

- Suits

- We see denim brand Levi’s Tailor Shop’s Connected Experience as an example of a shift toward integrating product customization into engaging experiences in the future. Connected Experience is a project that uses in-store technology to blur the line between digital and physical shopping experiences. The company improves consumer interaction through in-store iPads that host digital platforms with inspiration and information on the specific customization options available in the store. In addition, in Levi’s Tailor Shops, the retailer displays its tailoring equipment, custom fabrics and personalized garments to encourage customers to touch the fabrics and draw inspiration. Levi’s opened a new Next-Gen store at the Stanford Shopping Center in Palo Alto, California, in October 2020, featuring a Tailor Shop with a direct-to-garment printer and iPads interfaces that allow customers to customize T-shirts or jeans.

Levi’s Tailor Shop in Palo Alto

Levi’s Tailor Shop in Palo Alto Source: Levi’s [/caption]

- Zara offers custom online and in-store embroidery services, with its offerings still evolving and some based on seasonal demand. In March 2019, Zara launched its EDITED collection, featuring denim jackets, jeans and shorts, as well as tote bags, and sweatshirts with six embroidery color options and two different fonts. In December 2019, Zara launched a new custom capsule collection, offering custom embellishments on a range of leather bags. We expect to see more retailers trial and launch custom apparel services in the future.

- 3D Design and Printing

- Automation

Source: Adidas[/caption]

5. Price-Related Headwind

Without economies of scale, apparel brands and retailers typically charge higher prices for custom apparel products—for instance, Ralph Lauren typically charges a 15% premium on customized apparel—generatingsome uncertainty regarding consumers’ capacity and tolerance to pay a premium for custom items.Nevertheless, NIKE charges an average 20% premium on customized sneakers and receives strong feedback on the business according to the company—which it primarily attributes to consumer interest in unique customized sneakers.

We find that the majority of apparel retailers and brands still use custom apparel as one strategy to attract customers, rather than taking a mass customization approach. This is primarily due to issues with scaling in customization, whereby customization costs need to offset the added charges to the retailer and limited options for mass production keep costs high. Apparel retailers and brands must position custom products at appropriate prices and conduct trial tests with customized offerings for hero products to establish a picture of the market response.

[caption id="attachment_128693" align="aligncenter" width="725"]

Source: Adidas[/caption]

5. Price-Related Headwind

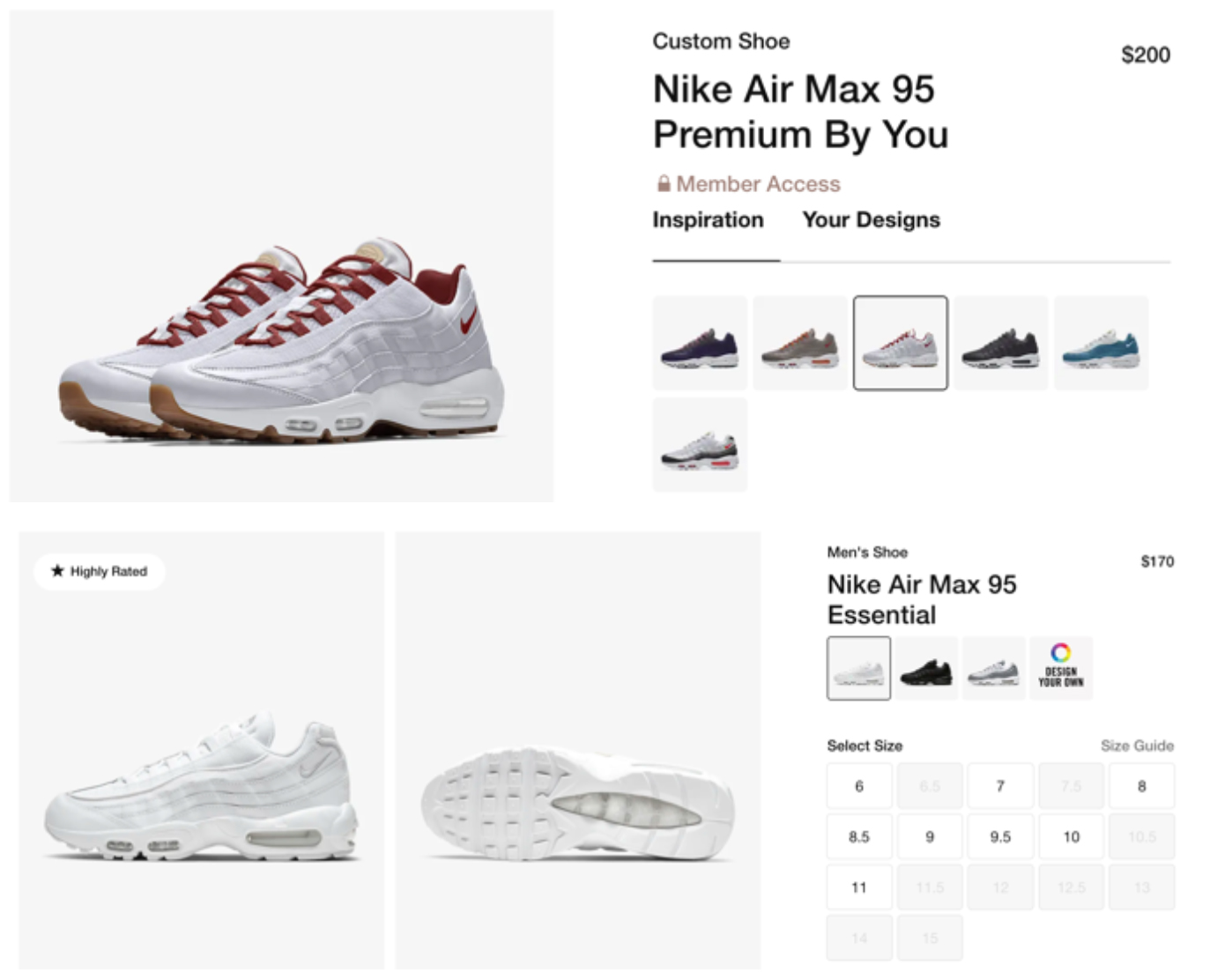

Without economies of scale, apparel brands and retailers typically charge higher prices for custom apparel products—for instance, Ralph Lauren typically charges a 15% premium on customized apparel—generatingsome uncertainty regarding consumers’ capacity and tolerance to pay a premium for custom items.Nevertheless, NIKE charges an average 20% premium on customized sneakers and receives strong feedback on the business according to the company—which it primarily attributes to consumer interest in unique customized sneakers.

We find that the majority of apparel retailers and brands still use custom apparel as one strategy to attract customers, rather than taking a mass customization approach. This is primarily due to issues with scaling in customization, whereby customization costs need to offset the added charges to the retailer and limited options for mass production keep costs high. Apparel retailers and brands must position custom products at appropriate prices and conduct trial tests with customized offerings for hero products to establish a picture of the market response.

[caption id="attachment_128693" align="aligncenter" width="725"] Premium By You Nike Air Max 95 sneakers with custom design options at $200 (Top) compared to Essential Nike Air Max 95 sneakers at $170 (bottom)

Premium By You Nike Air Max 95 sneakers with custom design options at $200 (Top) compared to Essential Nike Air Max 95 sneakers at $170 (bottom) Source: NIKE [/caption]

What We Think

Implications for Retailers and Brands- We see customization as an important part of the apparel market as it serves a growing consumer group that seek to showcase their individuality with personalized and unique apparel items. We expect custom apparel to gain traction in 2021 but remain outside of the mainstream.

- We identified four apparel categories at the forefront of apparel customization: denim, T-shirts, sports shoes and suits. Brands and retailers should look to capitalize on customization demand in these categories.

- We recommend that apparel retailers and brands with custom apparel businesses adopt automation and 3D design and printing techniques to facilitate faster production processes. We believe that the future of apparel customization for the retail industry will be consumer-centric, demand-driven and fueled by advances in technology.

- Apparel retailers and brands must position custom products at appropriate prices and conduct trial tests with customized offerings for hero products to establish a picture of the market response.

- Technology vendors with automation and 3D design and printing solutions should seek opportunities to help apparel retailers and brands facilitate faster and more efficient production processes to drive down costs and lead times.