DIpil Das

What’s the Story?

With apparel brands increasingly shifting away from wholesale channels, we see the rise of DTC sales as a key retail trend for 2021 and beyond. To help apparel brands to get ahead in the sector, we present five key DTC strategies in this report.Why It Matters

Alongside surging demand for e-commerce amid the pandemic, consumers are increasingly looking for more direct and more authentic brand engagement—placing new focus on DTC business strategies. Among the 10 apparel brands featured in the Coresight 100 (our focus list of the largest and most influential companies in the global retail ecosystem), seven reported increased exposure in their DTC business in their most recent fiscal year compared to the previous fiscal year—mainly driven by increasing e-commerce sales. We expect to see more apparel brands reduce their exposure to wholesale and third-party retail stores and increasingly transition to DTC in 2021 and beyond, as it is more profitable when apparel brands sell through their own channels.Figure 1. Selected Apparel Brands: DTC Sales Share (%) [wpdatatable id=1274 table_view=regular]

Only eight of 10 apparel brands featured in the Coresight 100 are listed here, as the remaining two (Guess? and Fanatics) do not disclose DTC sales shares. Fiscal year ends: Adidas (December 31), Hanesbrands (December 31), Levi’s (November 30), NIKE (May 31), PVH (January 31), Ralph Lauren (March 31), Under Armour (December 31) and VF Corporation (March 31) Source: Company reports

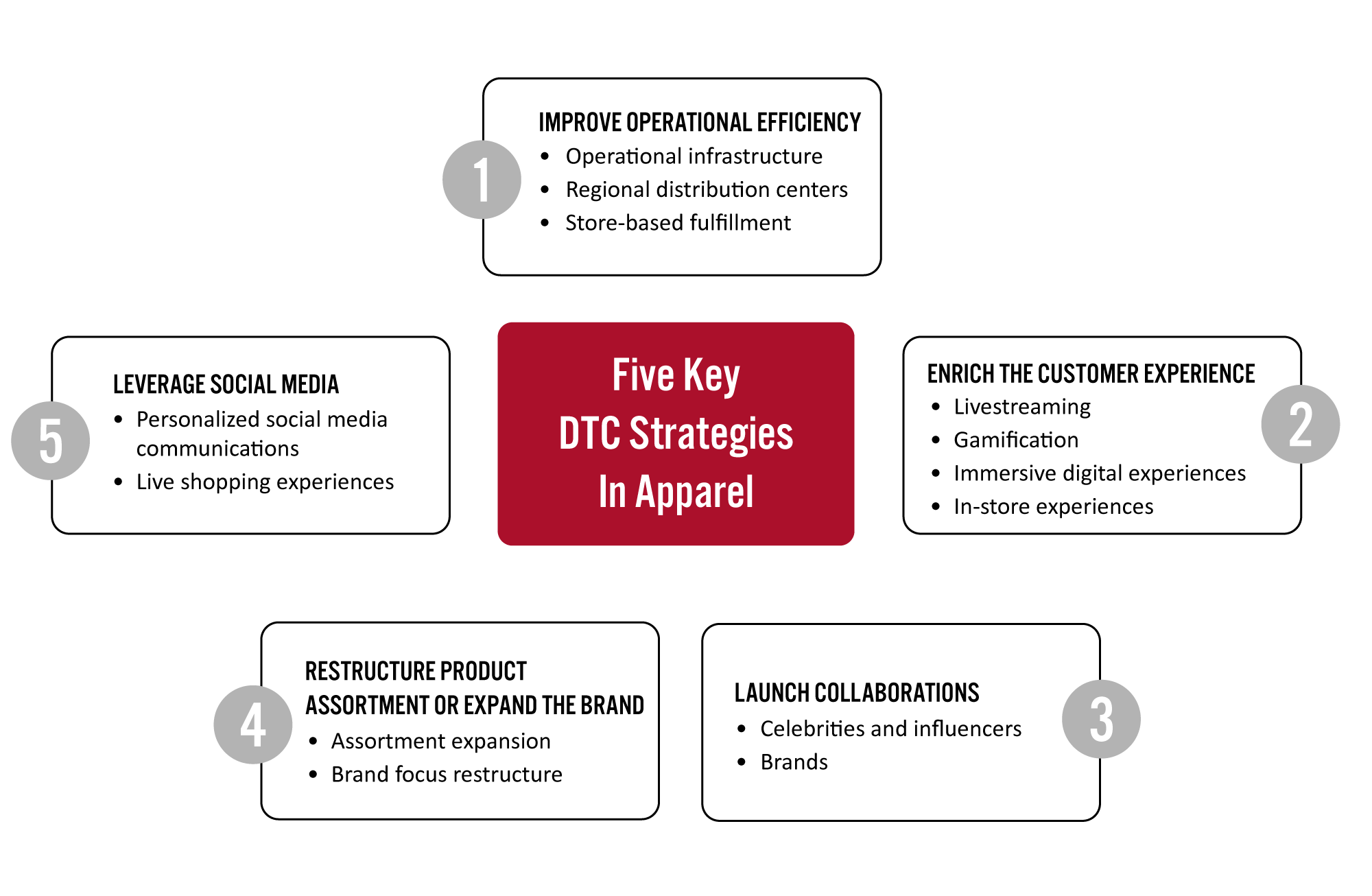

Five Key DTC Strategies in Apparel: Coresight Research Analysis

Figure 2. Five Key DTC Strategies in Apparel [caption id="attachment_133077" align="aligncenter" width="724"]

Source: Coresight Research[/caption]

1. Improve Operational Efficiency

Apparel brands transitioning from wholesale channels to DTC face challenges including ensuring fast delivery, generating in-store traffic and improving inventory management capabilities—especially amid the pandemic. We discuss three key ways apparel brands can improve operational efficiency while selling DTC to remain more resilient during crises, and we discuss initiatives that select brands have undertaken:

Source: Coresight Research[/caption]

1. Improve Operational Efficiency

Apparel brands transitioning from wholesale channels to DTC face challenges including ensuring fast delivery, generating in-store traffic and improving inventory management capabilities—especially amid the pandemic. We discuss three key ways apparel brands can improve operational efficiency while selling DTC to remain more resilient during crises, and we discuss initiatives that select brands have undertaken:

- Upgrade operational infrastructure: Apparel brands should offer convenience, seamless customer service and better understand customer preferences while selling DTC. To do so, it will be necessary for brands to upgrade websites, enterprise risk management (ERM) and data analytics. Sportwear and athleisure brand Under Armour has upgraded its US e-commerce site during the pandemic to bolster its online business and plans to do the same in Europe. Additionally, its multiyear investment in its enterprise resource planning (ERP) system has provided the firm with the necessary flexibility to meet increased digital demand, according to the company.

- Add regional distribution centers for faster fulfillment: As consumers demand faster fulfillment for online orders, apparel brands need to strike a fine balance in their use of inventory, space and staff. We see regional distribution centers as an essential approach for apparel brands to ensure that sufficient inventory is located in the right place at the right time. Additionally, regional distribution centers could help mitigate pressures caused by shipping carriers levying higher costs for delivery—although shipping carriers would remain as major delivery partners, the overall costs of shipping and transportation would be lower. Apparel retailer American Eagle Outfitters stated that it was able to offset some pandemic-driven shipping cost increases by leveraging regional distribution centers, sending products from locations nearer the customer. It also stated that it employed regional carriers and used fewer shipments per order.

- Use stores for fulfillment: Apparel brands and retailers should rethink their physical footprint and leverage stores to cope with increased online demand. We believe apparel stores could be upgraded to include more capabilities: stores can also function as warehouses, distribution and fulfillment centers. Stores with added fulfillment capabilities could be used to cater to localized demand, stocking merchandise in high demand in specific areas to increase shipping speed. Stores could also elevate BOPIS (buy online, pick up in store) and curbside-pickup capabilities, and could connect with warehouses to adjust inventories based on local needs. Additionally, we believe that apparel brands should use stores to upgrade their omnichannel capabilities, including introducing curbside returns and offering same-day shipping.

- Read our E-Commerce Outlook: US Apparel and Footwear report for more detail on omnichannel capabilities among apparel brands and retailers.

- Use livestreaming to create engaging experiences: Livestreaming provides a new, digital channel for apparel brands to connect with consumers and influence purchasing decisions. Livestreaming can enrich the shopping experience by facilitating direct communication between brands and their communities, enabling retailers to respond to consumer queries in real time, provide exclusive discounts and offer detailed product information. Brands such as Adidas, NIKE, Tommy Hilfiger and Uniqlo have turned to livestreaming e-commerce, hosting events on Tmall in 2020 and into 2021. Apparel brands can also work with technology partners such as Bambuser, Lisa, Livescale or Omnyway to set up livestreaming infrastructure and improve digital commerce.

- Add gamification to drive consumer engagement: We believe that gamification is a rising trend; it attracts consumer attention and builds loyalty by offering rewards for engagement—while also offering intangible benefits such exclusivity, status and visibility within one’s community. Apparel brands that have made inroads in this area include luxury brand Kenzo, which launched a gamified online shopping platform in July 2019 to promote the release of its Sonic sneaker. Players had to virtually “defeat” other opponents in the game in order to gain access to buy the sneakers. Brands can also offer coupons, discounts or points as rewards.

- Build immersive digital experiences: Immersive digital experiences are typically driven by augmented reality (AR) technology, which allows brands to run interactive online stores or launch virtual try-on facilities. Augmented shopping experiences are picking up traction more rapidly than many previously expected, accelerated by the pandemic. During the 2020 holiday season, Ralph Lauren launched virtual flagship stores (including Beverly Hills, Paris and New York), enabling customers worldwide to digitally view and purchase the stores’ assortments. AR developments such as virtual shopping and virtual try-on technologies will provide opportunities for apparel brands and technology platforms to optimize consumers’ omnichannel shopping journeys and create immersive retail experiences.

- Enhance in-store experiences: Apparel brands can drive consumer engagement in stores by introducing innovative concepts. For example, Levi’s NextGen format offers services to sort inventory in real time, a tailoring service featuring a direct-to-garment printer and an interactive Tailor Shop app—alongside larger fitting rooms and digital in-store tools that educate customers on the various fits offered. Retailers can also offer upgraded in-store experiences to attract brands and engage customers. In September 2021, Dick’s Sporting Goods opened its first outdoor concept store—Public Lands. Located approximately 20 miles north of Pittsburgh, the 50,000 square foot store carries a premium assortment of outdoor and lifestyle apparel, equipment and footwear brands. The store also features a 30-foot climbing wall, an in-store gear repair and rental department and specialized shops dedicated to various outdoor activities including biking, camping, climbing, fishing, hiking, paddling, running and skiing.

- Collaborate with celebrities and influencers: Celebrities and social media influencers play an increasingly important role in driving consumer purchasing decisions. They have a real impact, exerting a particular influence over social media shoppers: 33% of consumers that use social media as part of the shopping process stated that their shopping is largely affected by influencers, according to Coresight Research’s 2021 social commerce survey. Younger consumers generally reported being affected more than older consumers, with those aged 25–34 registering the highest percentage, at 36.1%. Celebrity or influencer endorsement is therefore one of the most coveted forms of collaboration in retail—and we expect to see a growing number of brands look to this kind of collaboration to refresh their brand images and attract younger shoppers.

A pair of “24k” Curry Flow 8 custom-designed sneakers

A pair of “24k” Curry Flow 8 custom-designed sneakers Source: Under Armour [/caption]

- Collaborate with other brands: Cross-brand collaboration can also generate customer interest. The strategic mix provides a novelty that often attracts younger consumers and provides shoppers with a more affordable way to access two brands simultaneously. In February 2021, Adidas partnered with Stella McCartney to debut a new sustainable collection, “Futureplayground.” Additionally, e-commerce platform eBay teamed up with women’s T-shirt brand Playa Society to celebrate Women’s History Month in March 2021, and H&M and jeans brand Lee launched a sustainable and size-inclusive collection together in January 2021.

From left to right: Adidas and Stella McCartney’s Futureplayground collection; eBay and Playa Society’s collaboration celebrating Women’s History Month; H&M and Lee’s sustainable and size-inclusive collection.

From left to right: Adidas and Stella McCartney’s Futureplayground collection; eBay and Playa Society’s collaboration celebrating Women’s History Month; H&M and Lee’s sustainable and size-inclusive collection. Source: Company websites [/caption] 4. Expand Product Assortments or Restructure the Brand With the consumer shift to casualization, more companies are extending their product offerings into activewear and athleisure to capture the market trend. We discuss two strategic product assortment approaches for brands to engage customers and stay competitive:

- Expand product assortment: We expect that the ongoing casualization trend will drive more apparel brands that sell DTC to enter the casualwear space, as they seek to gain market share. Apparel retailers and brands such as Allbirds, Gap and Kohl’s have focused on expanding categories such as athleisure, intimates, sleepwear and sportswear during the pandemic and we expect these categories to continue trending throughout 2021, driving sales. We recommend that apparel brands focused on business wear, formal wear and occasion-specific clothing should adjust assortments in order to find new growth opportunities. Indeed, we are already seeing examples of product assortment expansion among dresswear brands. Everlane launched a new sport collection in March 2021 and Capri Holdings expanded its active and casual classifications in early 2021—both of which are gaining traction, according to the companies. Additionally, Brooks Brother is including more sportswear and casualwear in its assortment.

- Restructure the brand: Brand restructuring is increasingly employed by apparel brands to clearly distinguish their coverage and strategic focus—and we believe it is especially important for brands that are moving from wholesale to DTC. Ralph Lauren is shifting its brand positioning toward a focus on lifestyle, aiming to meet consumer demand for comfort and timeless core items, according to the company. After selling Club Monaco in May 2021, Ralph Lauren’s brand mix now comprises apparel brands with typically mid-to-high price ranges, focusing on men’s and women’s lifestyle wear and performance wear. PVH has also changed brand focus: In July 2020, it announced the sale of its Heritage Brands retail business (Arrow, Geoffrey Beene, Izod, Olga, Van Heusen and Warner’s—which were mainly sold through wholesale channels) to strategically focus on Calvin Klein and Tommy Hilfiger over the coming years.

- Personalize social media campaigns: Social media platforms, such as Instagram, use machine learning to customize the advertisements that populates the user’s feed. Apparel brands should leverage this algorithm to enrich customers’ feeds—for example, by adding information on apparel products that customers have looked at but not yet purchased.

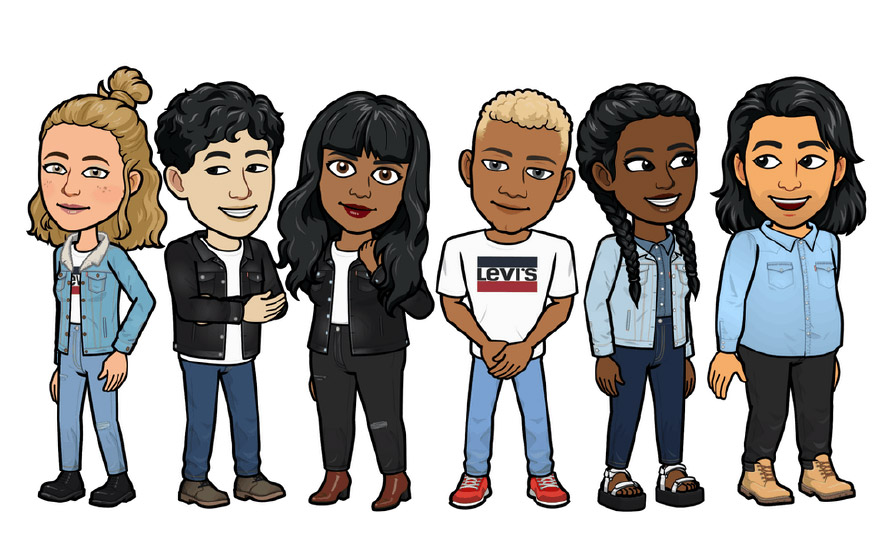

- Incorporate live shopping experiences: Apparel brands can use social media to build brand connections via new methods of social shopping. For example, Levi’s launched its first Instagram Live shopping experience in October 2020, allowing the audience to directly purchase products displayed by its stylist on Instagram, without leaving the page. The company also joined forces with Snapchat to launch a Levi’s bitmoji collection in December 2020, which saw strong engagement, especially among younger consumers.

Levi’s and Snapchat enabled users to dress virtual avatars and buy items from links embedded in the platform.

Levi’s and Snapchat enabled users to dress virtual avatars and buy items from links embedded in the platform. Source: Snapchat/Levi’s [/caption]

What We Think

Implications for Apparel Brands- Operational infrastructure is important in building seamless, convenient and efficient DTC ecosystems. Although apparel and footwear brands have already begun investing inregional distribution centers for faster fulfillment and leveraging store-based fulfillment to offer more convenience, they would benefit from expanding these capabilities to more stores and more channels. We see opportunity in BOPIS and curbside collections as methods of driving e-commerce growth—we also expect that distribution center delivery costs will increase in the future, owing to rising demand. Apparel retailers will therefore benefit from store-based fulfillment solutions.

- With heightened competition in the apparel landscape, it will be beneficial for apparel and footwear brands to increase consumer engagement, by launching livestreams, adding gamification, building immersive digital experiences and enhancing in-store environments.

- Collaborations and partnerships will continue to be an important theme for apparel brands, to increase their reach and create interesting and iconic products, by sharing resources and ideas. We expect to continue to see brands embracing collaborations to create special collections to be sold alongside their regular offerings.