Nitheesh NH

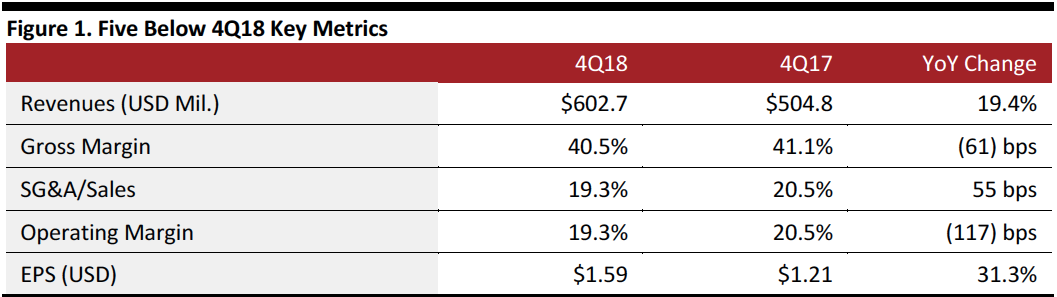

[caption id="attachment_81948" align="aligncenter" width="640"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

Five Below reported 4Q18 revenues of $602.7 million, up 19.4% year over year and beating the $601.4 million consensus estimate. Sales increased 23.2% excluding the impact of the 53rd week in the year-ago quarter.

Comps increased 4.4%, beating the 4.2% consensus but down from 6.5% in the year-ago quarter.

EPS was $1.59, up 31.3% year over year, beating the consensus estimates by two cents. EPS increased 34.7% excluding the impact of the 53rd week in the year-ago quarter. A tax benefit from share-based accounting contributed a penny to EPS.

FY18 Results

FY18 revenues were $1.56 billion, up 22.0%. Sales increased 23.5% excluding the impact of the 53rd week in the year-ago quarter.

The company opened 125 new stores in the year, compared to 103 net new stores in the prior year.

Comps increased 3.9%, down from 6.5% the prior year.

EPS was $2.66, up 44.4% from $1.84 in the prior year. EPS increased 47.0% excluding the impact of the 53rd week in the year-ago quarter. A tax benefit from share-based accounting contributed a $0.09 to EPS.

Details from the Quarter

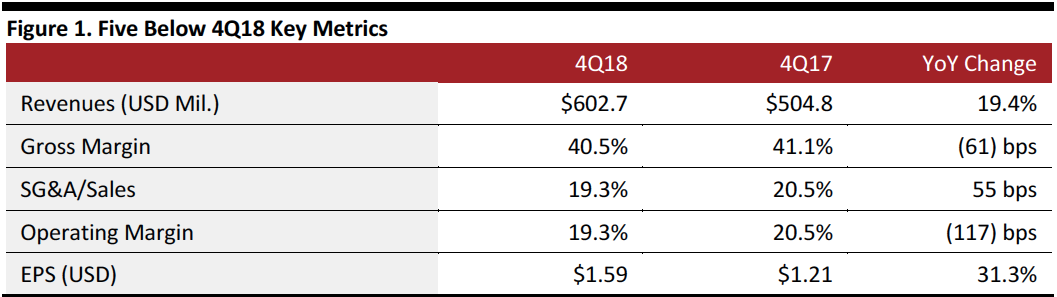

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Five Below reported 4Q18 revenues of $602.7 million, up 19.4% year over year and beating the $601.4 million consensus estimate. Sales increased 23.2% excluding the impact of the 53rd week in the year-ago quarter.

Comps increased 4.4%, beating the 4.2% consensus but down from 6.5% in the year-ago quarter.

EPS was $1.59, up 31.3% year over year, beating the consensus estimates by two cents. EPS increased 34.7% excluding the impact of the 53rd week in the year-ago quarter. A tax benefit from share-based accounting contributed a penny to EPS.

FY18 Results

FY18 revenues were $1.56 billion, up 22.0%. Sales increased 23.5% excluding the impact of the 53rd week in the year-ago quarter.

The company opened 125 new stores in the year, compared to 103 net new stores in the prior year.

Comps increased 3.9%, down from 6.5% the prior year.

EPS was $2.66, up 44.4% from $1.84 in the prior year. EPS increased 47.0% excluding the impact of the 53rd week in the year-ago quarter. A tax benefit from share-based accounting contributed a $0.09 to EPS.

Details from the Quarter

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Five Below reported 4Q18 revenues of $602.7 million, up 19.4% year over year and beating the $601.4 million consensus estimate. Sales increased 23.2% excluding the impact of the 53rd week in the year-ago quarter.

Comps increased 4.4%, beating the 4.2% consensus but down from 6.5% in the year-ago quarter.

EPS was $1.59, up 31.3% year over year, beating the consensus estimates by two cents. EPS increased 34.7% excluding the impact of the 53rd week in the year-ago quarter. A tax benefit from share-based accounting contributed a penny to EPS.

FY18 Results

FY18 revenues were $1.56 billion, up 22.0%. Sales increased 23.5% excluding the impact of the 53rd week in the year-ago quarter.

The company opened 125 new stores in the year, compared to 103 net new stores in the prior year.

Comps increased 3.9%, down from 6.5% the prior year.

EPS was $2.66, up 44.4% from $1.84 in the prior year. EPS increased 47.0% excluding the impact of the 53rd week in the year-ago quarter. A tax benefit from share-based accounting contributed a $0.09 to EPS.

Details from the Quarter

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Five Below reported 4Q18 revenues of $602.7 million, up 19.4% year over year and beating the $601.4 million consensus estimate. Sales increased 23.2% excluding the impact of the 53rd week in the year-ago quarter.

Comps increased 4.4%, beating the 4.2% consensus but down from 6.5% in the year-ago quarter.

EPS was $1.59, up 31.3% year over year, beating the consensus estimates by two cents. EPS increased 34.7% excluding the impact of the 53rd week in the year-ago quarter. A tax benefit from share-based accounting contributed a penny to EPS.

FY18 Results

FY18 revenues were $1.56 billion, up 22.0%. Sales increased 23.5% excluding the impact of the 53rd week in the year-ago quarter.

The company opened 125 new stores in the year, compared to 103 net new stores in the prior year.

Comps increased 3.9%, down from 6.5% the prior year.

EPS was $2.66, up 44.4% from $1.84 in the prior year. EPS increased 47.0% excluding the impact of the 53rd week in the year-ago quarter. A tax benefit from share-based accounting contributed a $0.09 to EPS.

Details from the Quarter

- 2018 marks the 13th consecutive year of positive comps for Five Below.

- The company opened five stores in the quarter and ended the quarter and year with 750 stores in 33 states.

- First-year average unit volumes (for stores opened in 2018) are expected to exceed $2 million each.

- Performance was broad-based, led by tech, sports, create and candy. Toy performance was better than expected during the holiday season, and continuing trends such as slime, squishy and unicorn drove store traffic.

- Holiday merchandise included desktop diffusers, rock salt lamps, loungewear and facemasks, wireless earbuds, action figures, board games and craft kits.

- The company continues to shift marketing efforts into TV and digital advertising, while utilizing e-commerce and e-mail to dynamically feature its holiday campaigns and gift assortments. 2018 marked the fifth year of holiday TV campaigns. The company also expanded its reach to include markets covering approximately 50% of its stores, the highest percentage of stores ever covered.

- In digital advertising, Five Below tested social media influencers in Q4, with fun video content on Instagram and YouTube, and management is pleased with the results in customer engagement and plans to build upon its influencer testing throughout 2019.

- Five Below saw continued growth in e-commerce in the year. Mid-year the company brought e-commerce fulfillment in-house. While still a small contributor to sales, e-commerce is an important marketing tool to connect with customers, create brand awareness and drive traffic to stores.

- Other significant milestones in 2018:

- The first full year at Wowtown, the new home office.

- The completion of a store remodel test and plans for a formal roll-out.

- The test of stores offering a limited assortment of higher price point items up to $10.

- Commencing construction on the first owned DC near Atlanta, to open in the spring.

- The completion of an accelerated rollout of a new POS system, on time and on budget.

- Enhancement of the technology team, increasing talent and hiring a CIO.

- Reinvesting a portion of tax reform-related proceeds into employees to improve wages, benefits, training and development.

- Partnerships with both local and national organizations for charitable causes.

- Net sales of $1.86-1.88 billion, up 20-21% and below the $1.90 billion consensus.

- Opening approximately 145 to 150 new stores, reaching a total of 895-900 stores.

- An approximate 3% increase in comparable sales.

- EPS of $3.00-3.07, up 13-15% and below the $3.13 consensus.

- Net sales of $361-366 million, up 22-24% and in line with consensus.

- Opening approximately 35 new stores.

- An approximate 3-4% increase in comparable sales.

- EPS of $0.32-0.35, down 10-18% and below the $0.39 consensus.