albert Chan

[caption id="attachment_95455" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

2Q19 Results

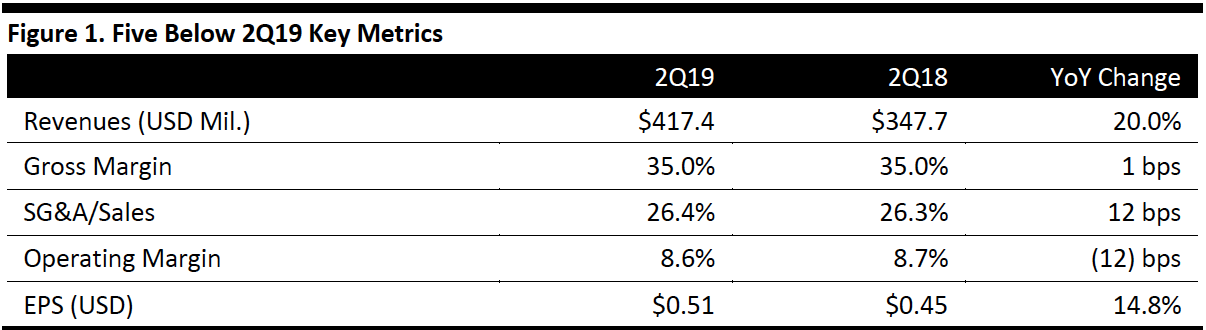

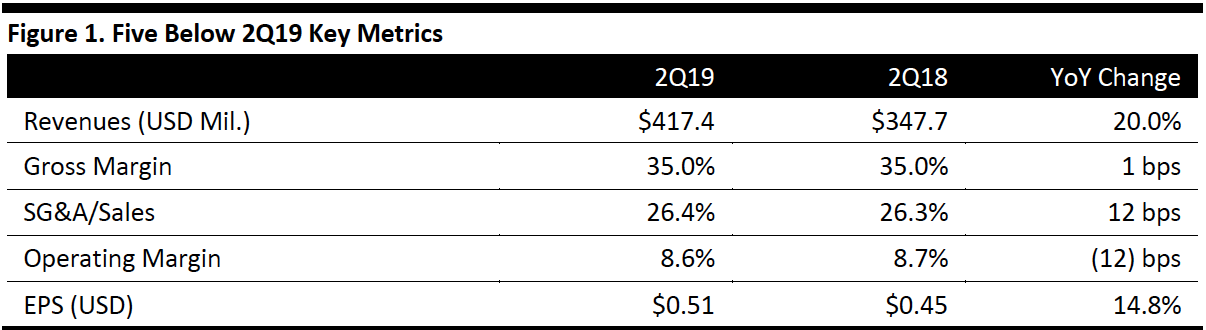

Five Below reported 2Q19 revenues of $417.4 million, up 20.0% year over year and missing the $421.1 million consensus estimate.

Comps increased 1.4%, missing the 2.7% consensus estimate and down from 2.7% in the year-ago quarter.

EPS was $0.51, up 14.8% year on year, and beating the consensus estimate by one cent. A tax benefit from share-based accounting contributed one cent to EPS in the quarter compared to three cents in the year-ago quarter.

Details from the Quarter

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Five Below reported 2Q19 revenues of $417.4 million, up 20.0% year over year and missing the $421.1 million consensus estimate.

Comps increased 1.4%, missing the 2.7% consensus estimate and down from 2.7% in the year-ago quarter.

EPS was $0.51, up 14.8% year on year, and beating the consensus estimate by one cent. A tax benefit from share-based accounting contributed one cent to EPS in the quarter compared to three cents in the year-ago quarter.

Details from the Quarter

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Five Below reported 2Q19 revenues of $417.4 million, up 20.0% year over year and missing the $421.1 million consensus estimate.

Comps increased 1.4%, missing the 2.7% consensus estimate and down from 2.7% in the year-ago quarter.

EPS was $0.51, up 14.8% year on year, and beating the consensus estimate by one cent. A tax benefit from share-based accounting contributed one cent to EPS in the quarter compared to three cents in the year-ago quarter.

Details from the Quarter

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Five Below reported 2Q19 revenues of $417.4 million, up 20.0% year over year and missing the $421.1 million consensus estimate.

Comps increased 1.4%, missing the 2.7% consensus estimate and down from 2.7% in the year-ago quarter.

EPS was $0.51, up 14.8% year on year, and beating the consensus estimate by one cent. A tax benefit from share-based accounting contributed one cent to EPS in the quarter compared to three cents in the year-ago quarter.

Details from the Quarter

- The company opened 44 stores in the quarter and ended the quarter with 833 stores in 36 states. Management said plans are on track to open 150 new stores over the course of the year.

- SG&A as a percentage of sales increased 12 basis points (bps) versus the year-ago quarter, due mainly to depreciation costs related to the opening of the company’s new southeast distribution center and the adoption of a new lease accounting standard, partly offset by lower corporate expenses.

- Operating income grew 18.4% to $36 million while net income increased 15% to $28.8 million in the quarter.

- The effective tax rate for the quarter was 23.2%, up from 20.2% in 2Q18.

- The company repurchased 146,185 shares for an approximate cost of $16.6 million during the quarter.

- Inventory was $273 million at the end of the first quarter, versus $228 million at the end of the year-ago quarter. On a per-store basis, average inventory was approximately flat against the year-ago quarter, driven by an improvement in inventory management.

- Net sales of $1.87-1.89 billion, up 20-21% and in line with the $1.89 billion consensus.

- Opening approximately 150 new stores.

- An approximate 3% increase in comparable sales.

- EPS of $3.08-3.19, up 16-20% and in line with the $3.16 consensus.

- Net sales of $369-374 million, up 18-20% and below the $377 million consensus.

- Opening approximately 55 new stores.

- An approximate 2-3% increase in comparable sales.

- EPS of $0.14-0.17, below the $0.24 consensus.