Nitheesh NH

[caption id="attachment_90033" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

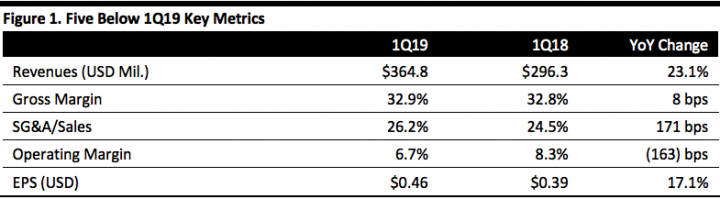

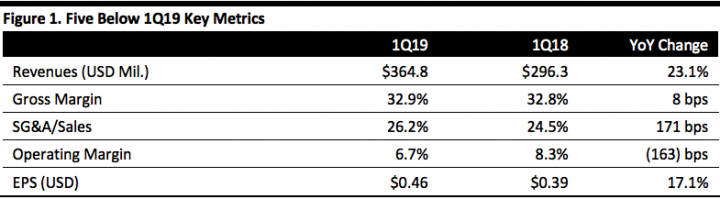

Five Below reported 1Q19 revenues of $364.8 million, up 23.1% year over year and beating the $364.2 million consensus estimate.

Comps increased 3.1%, missing the 3.7% consensus estimate and down from 3.2% in the year-ago quarter.

EPS was $0.46, up 17.1% year over year, beating the consensus estimate by 12 cents. A tax benefit from share-based accounting contributed 11 cents to EPS in the quarter as against four cents in the year-ago quarter.

Details from the Quarter

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Five Below reported 1Q19 revenues of $364.8 million, up 23.1% year over year and beating the $364.2 million consensus estimate.

Comps increased 3.1%, missing the 3.7% consensus estimate and down from 3.2% in the year-ago quarter.

EPS was $0.46, up 17.1% year over year, beating the consensus estimate by 12 cents. A tax benefit from share-based accounting contributed 11 cents to EPS in the quarter as against four cents in the year-ago quarter.

Details from the Quarter

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Five Below reported 1Q19 revenues of $364.8 million, up 23.1% year over year and beating the $364.2 million consensus estimate.

Comps increased 3.1%, missing the 3.7% consensus estimate and down from 3.2% in the year-ago quarter.

EPS was $0.46, up 17.1% year over year, beating the consensus estimate by 12 cents. A tax benefit from share-based accounting contributed 11 cents to EPS in the quarter as against four cents in the year-ago quarter.

Details from the Quarter

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Five Below reported 1Q19 revenues of $364.8 million, up 23.1% year over year and beating the $364.2 million consensus estimate.

Comps increased 3.1%, missing the 3.7% consensus estimate and down from 3.2% in the year-ago quarter.

EPS was $0.46, up 17.1% year over year, beating the consensus estimate by 12 cents. A tax benefit from share-based accounting contributed 11 cents to EPS in the quarter as against four cents in the year-ago quarter.

Details from the Quarter

- The company opened 39 stores in the quarter and ended the quarter with 789 stores in 36 states.

- Operating income declined 1% to $24.5 million owing to unanniversaried tax reform-related investments, costs related to opening the new Southeast distribution center and adoption of the new lease accounting standard.

- The company opened its Southeast distribution center at the end of the first quarter and intends to open a Southwest distribution center next year.

- Gross margin grew eight basis points to 32.9%, primarily driven by occupancy cost leverage, offset by start-up costs of the new Southeast distribution center.

- Effective tax rate for the quarter was 1.9% as against 15.4% in 1Q18, driven by the favorable impact of share-based accounting.

- Inventory was $268.4 million at the end of the first quarter as against $215.4 million at the end of the year-ago quarter. On a per-store basis, average inventory was around 4% higher than the year-ago quarter, driven mainly by a growth in import penetration and the timing of other receipts.

- Net sales of $1.86-1.88 billion, up 20-21% and below the $1.89 billion consensus.

- Opening approximately 145 to 150 new stores.

- An approximate 3% increase in comparable sales.

- EPS of $3.11-3.18, up 17-19% and above the $3.09 consensus.

- Net sales of $417-422 million, up 20-21% and in line with consensus.

- Opening approximately 40 new stores.

- An approximate 2-3% increase in comparable sales.

- EPS of $0.48-0.51, up 7-13% and in line with the $0.49 consensus.