Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

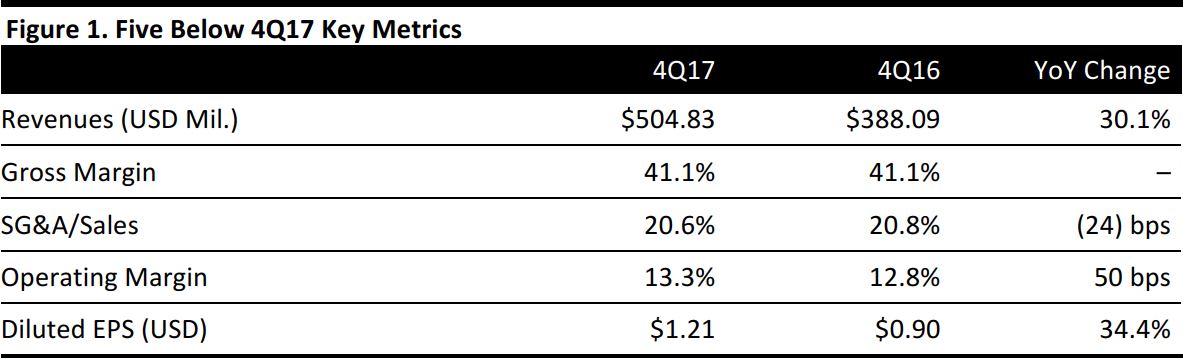

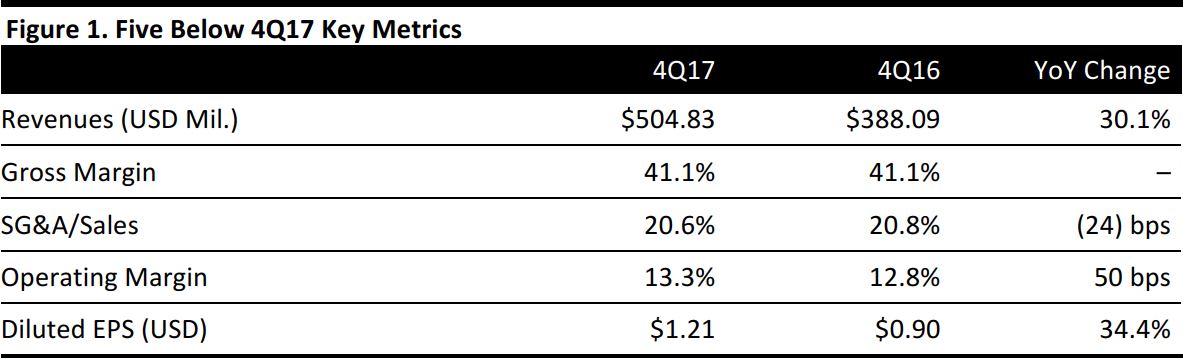

4Q17 Results

Five Below reported 4Q17 revenues of $504.8 million, up 30.1% year over year and beating the consensus estimate of $502.7 million. Diluted EPS was $1.21, beating the $1.16 consensus estimate. Comparable sales were up 5.9%, which was at the higher end of the company’s 4%–6% guidance range and slightly below the consensus estimate of 6.0%.

At the end of the quarter, Five Below operated 625 stores in 32 states, which represented a 19.7% year-over-year increase. Management was pleased with the top-line and bottom-line results and announced its first-ever share repurchase, for $100 million.

At quarter-end, inventory was $187 million, up from $154 million in the year-ago period. Quarter-end inventory on a per-store basis increased by 1%.

The company has accelerated its point-of-sale system upgrade, which is expected to be completed in 2018, a year earlier than originally planned. The new system will help ease future technology integrations, such as customer loyalty programs, self-checkout and omnichannel initiatives.

FY17 Results

Net sales increased by 27.8% year over year, to $1.28 billion. Excluding the impact of the 53rd week of 2017, sales were up 26.2% year over year and comps were up 6.5%.Diluted EPS was $1.84, up 41.5% from $1.30 in the prior year.

Outlook

For 1Q18, the company expects net sales of $290–$294 million, based on expected comp growth of 3%–4%. Five Below expects net income to grow by 17.4%, to $18.8 million. The company expects EPS of $0.31–$0.34 for the quarter, based on 55.9 million diluted shares.

For FY18, the company expects net sales of $1.49–$1.51 billion, based on the plan to open about 125 new stores in the year and expected comp growth of 1%–2%. Five Below expects net income of $132.7–$136.3 million and EPS of $2.36–$2.42 on 56.2 million diluted shares.

Management is confident that it will achieve a store count of 2,500 and 20% growth in both the top and bottom lines through 2020. The company also announced the transition of Tom Vellios, co-founder and Executive Chairman, to the role of Chairman of the Board.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research