Source: Company reports

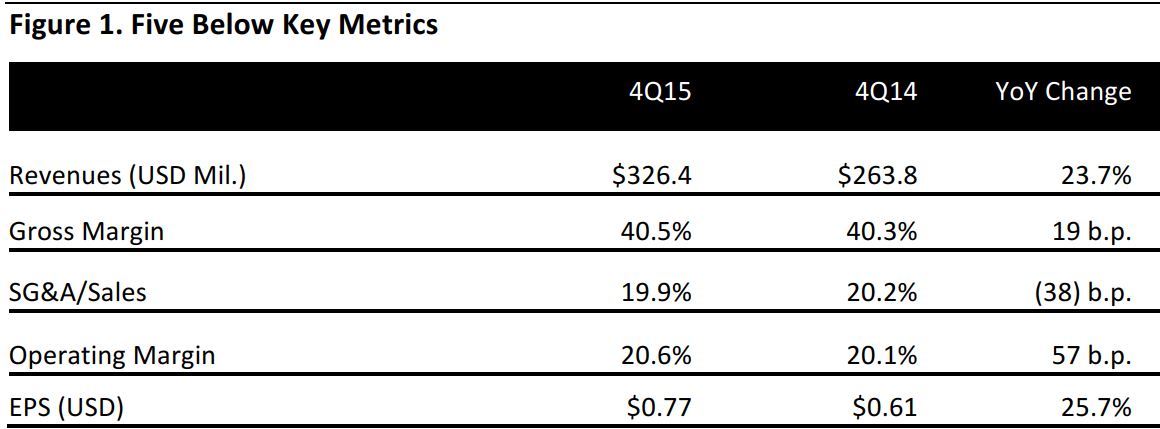

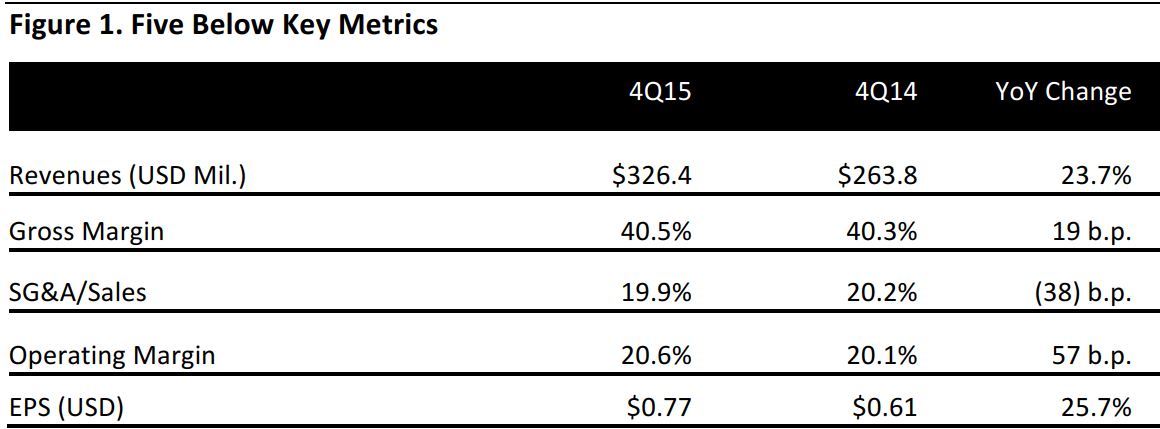

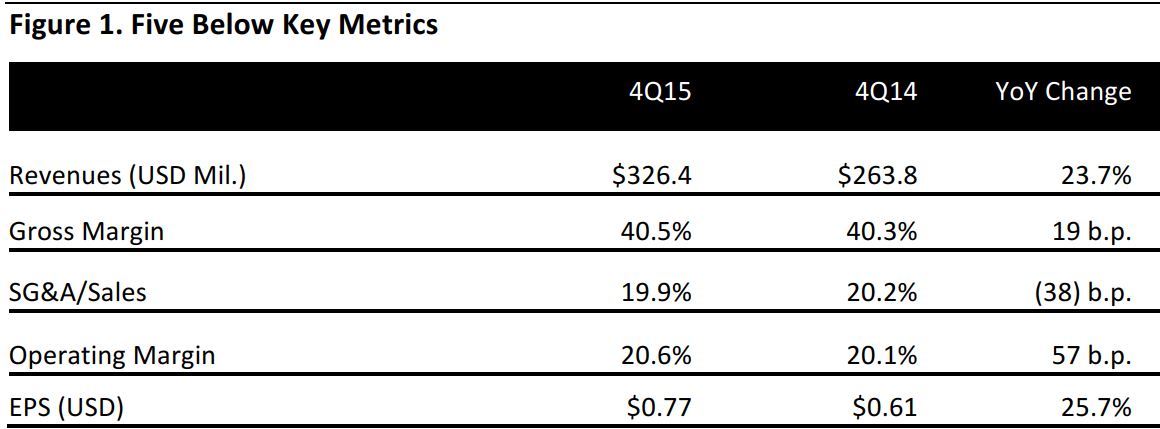

Five Below reported 4Q EPS of $0.77 versus consensus of $0.76 and guidance of $0.75 to $0.76.

Total revenues were $326.4 million, up 23.7%, versus consensus of $323.6 million and guidance of $323 to $326 million. Comps were up 3.6% versus consensus of 3.7% and guidance of 2% to 3%. Results were driven by compelling assortments, exciting marketing campaigns, the successful opening of a new East Coast distribution center and opening highly productive new stores that generate a less than one year payback on investment.

The company opened three new stores during the period ending the year with 437 stores in 27 states.

Management provided 1Q guidance calling for EPS of $0.09 to $0.10 versus consensus of $0.10. This is based on comps up 4% (versus consensus of 3.7%) and total revenues of $186 to $189 million versus the consensus estimate of $188.6 million. Twenty stores are expected to be opened in 1Q.

Full-year guidance calls for EPS of $1.27 to $1.31 versus the consensus estimate of $1.31. Comps are expected to be up 3% and total revenues are expected to be $995 million to $1.0 billion versus the consensus estimate of $1.0 billion. In 2016, the company expects to open 85 new stores, and management will focus on its strategic priorities of new stores, merchandising, marketing, and systems and infrastructure.

The company reiterated its long term goal of growing revenues at least 20% along with growing EPS at least 20% annually through 2020.