Source: Company reports/Coresight Research

3Q18 Results

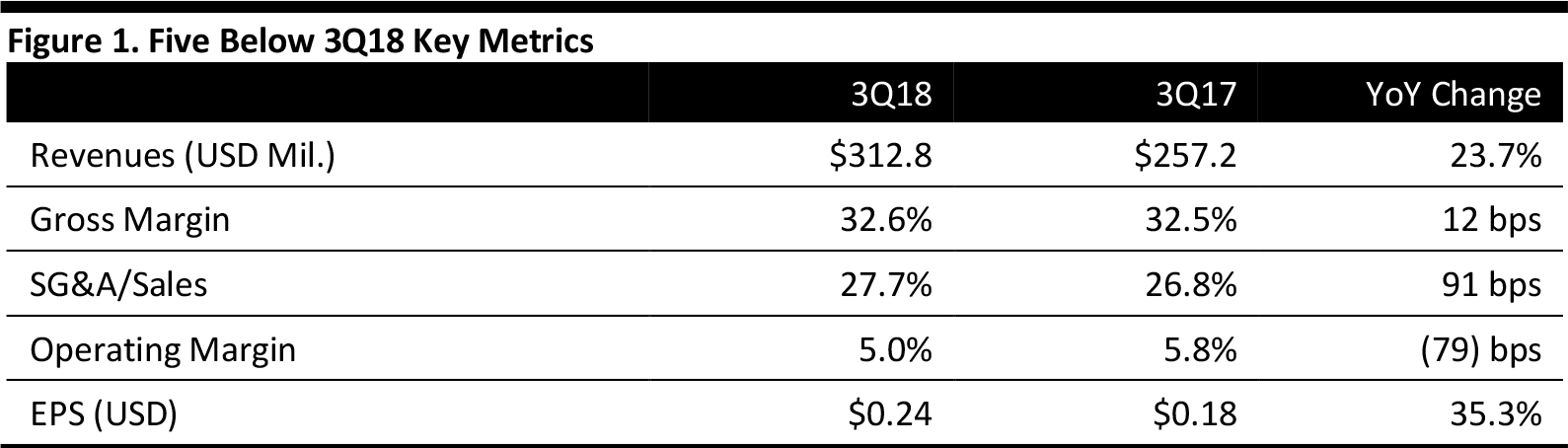

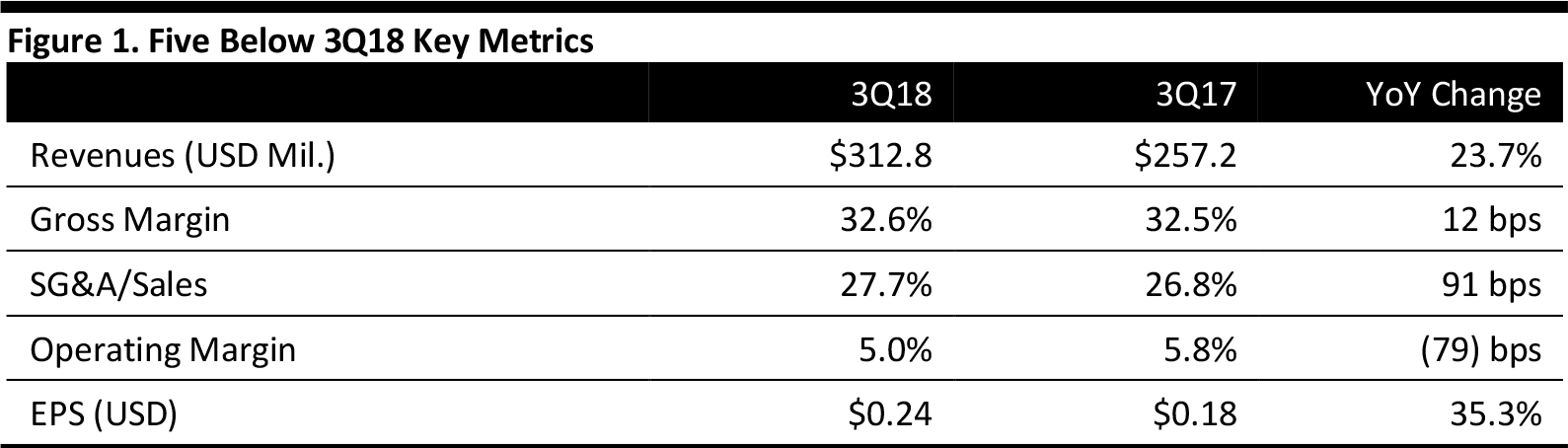

Five Below reported 3Q18 revenues of $312.8 million, up 23.7% year over year and beating the $304.1 million consensus estimate.

EPS was $0.24 (including a $0.02 accounting benefit), up 35.3% year over year and beating the $0.19 consensus estimate.

Details from the Quarter

Management commented that continued robust performance from new stores, driven by new store openings during the quarter, and above-plan comp results were driven by positive customer response to the company’s assortment.

Other details:

-

- The biggest growth driver continues to be new store openings. The company opened a record 53 new stores in the quarter, exiting the quarter with 745 stores in 33 states, a 19.2% increase year over year. Management comment that there still exists substantial room for growth, estimating the total US store potential at 2,500 stores.

- The company has achieved its store-opening target this year, with the highlight being the recent opening of a new store on Fifth Avenue in New York City.

- Results were broad-based, with the 4.8% comp following on a strong 8.5% comp in the year-ago quarter, which was driven by sales of fidget spinners. Strong categories include Tech, Room, Sports, Create and Candy worlds.

- Back-to-school and Halloween merchandise resonated with customers, as did core basic programs, slime, squishy and toys.

- The company is seeking to benefit from the Toys “R” Us store closures with its Mega Toy island and is advertising toys, games and crafts across digital marketing channels.

- On the marketing front, the company is expanding TV advertising in 4Q18 to into regions that cover about half of its stores, compared to 40% last year. The company continues to shift marketing dollars to digital, including YouTube and other social media. The company has recently added Influencers to the social media program, with visibility both in stores and online. Print circulars are also expected to play an important role in 4Q18.

- Management believes e-commerce is helpng increase brand awareness among new customers and serves as a preshopping tool to drive traffic to the stores, where customers enjoy a treasure-hunt experience.

- Looking at infrastructure, the point-of-sale terminal (POS) expansion that was accelerated in the year is now complete, on time and on budget. It serves as the basis for a future loyalty program and buy online, pickup in store.

- The company has launched Ten Below and Just Wow concepts in in six stores, with items prices up to $10, and is analyzing customer behavior and reactions, with the testing expected to continue throughout 2019. Management has been pleased with the response thus far.

- Under a potential 10% China tariff scenario, the company expects to fully mitigate the tariff impact, or make selective price increases, if necessary. Management is also exploring sourcing from other countries as a medium- to longer-term solution.

Outlook

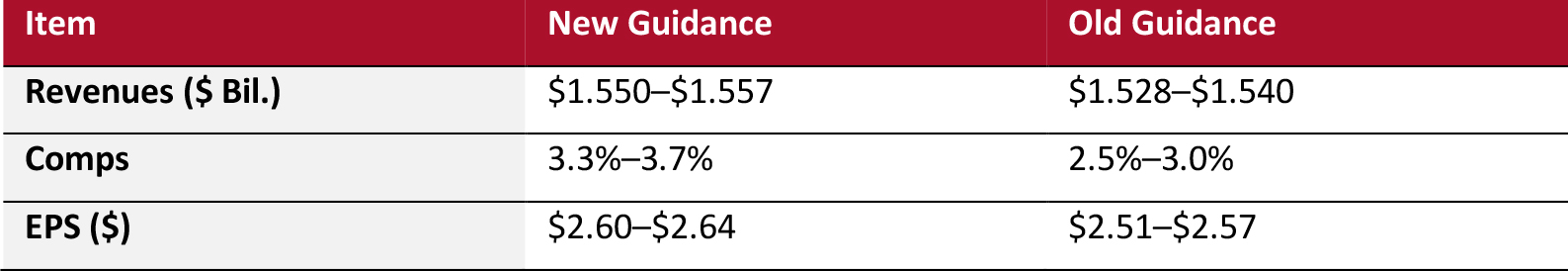

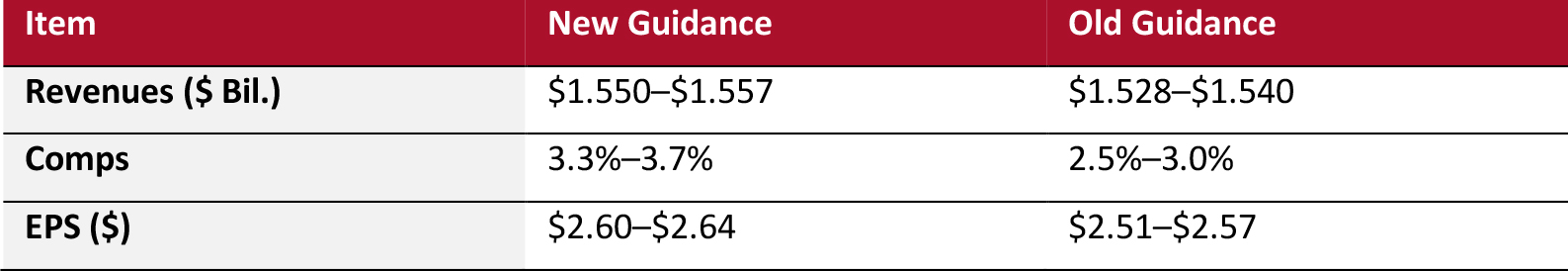

The company raised 2018 guidance across the board, as detailed below.