Source: Company reports/FGRT

3Q17 Results

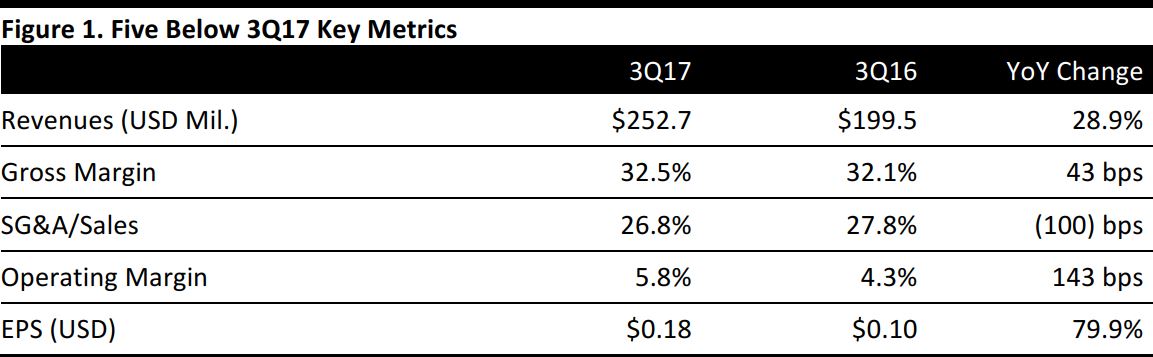

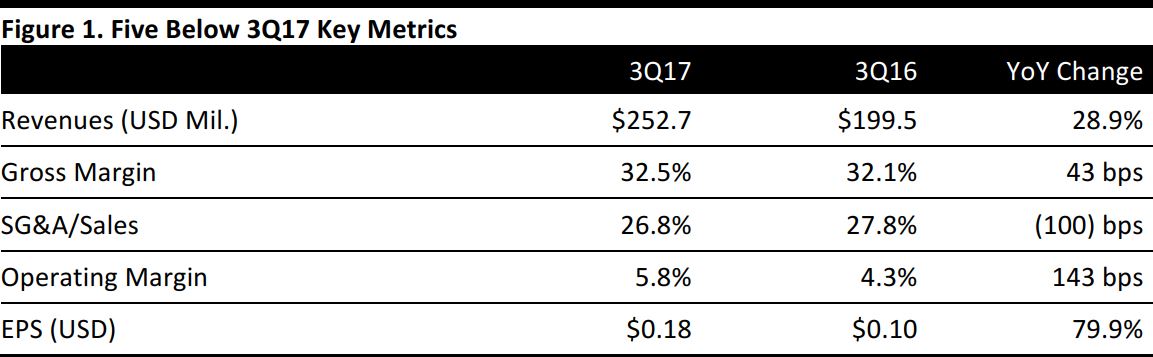

Five Below reported 3Q17 revenues of $252.7 million, up 28.9% year over year and beating the consensus estimate of $246.0 million. Guidance called for revenues of $241–$246 million.

Comps increased by 8.5% year over year, compared with guidance of 3%–5% growth.

EPS was $0.18, up 79.9% from $0.10 in the year-ago quarter and beating the consensus estimate of $0.13. Guidance called for EPS of $0.11–$0.13.

Details from the Quarter

- Management commented that the quarterly performance reflects a strong customer response to the WOW product, incredible price points, a differentiated in-store experience, and increasingly targeted marketing efforts.

- New stores typically account for more than80% of annual growth, and growing the store base remains the company’s highest priority.

- During the quarter, Five Below opened a record 41 new stores in diverse markets across 24 states, including its 600th store, located in Augusta, Maine, and its15th store in Southern California.

- The company ended the quarter with 625 stores, an increase of 21% versus the end of the third quarter last year.

- The majority of next year’s new stores already have leases in progress, and management is beginning to work on locations for its 2019 class of stores.

- In terms of merchandising, the strong third-quarter results reflected broad-based performance throughout the core business, led by the Room, Tech, Candy, Sports and Create segments. Trends such as slime, smileys, and mermaids contributed to sales, while the spinner craze continued to slow, as expected.

- Management made positive comments regarding performance during the back-to-school and Halloween periods.

- In terms of marketing, management is working on its store densification strategy, optimizing its media mix to increase brand awareness, traffic and loyalty.

- While e-commerce remains a very small piece of the company’s business, management views it as an important contributor to its growing brand awareness. Management also noted that e-commerce provides the benefit of being an easy-to-use preshopping tool for customers before they make in-store purchases.

- The company kicked off the fourth quarter and the holiday season with a $5 drone purchase-with-purchase offer, which was extremely popular. The featured Black Friday deal was Guitar Hero for $5, and other featured products included remote-controlled cars, boats and helicopters; an assortment of spa bath bombs; and the company’s first wireless charger.

- Management remains confident that Five Below will achieve its 2,000-plus store potential, as well as 20% top-line growth with 20%-plus bottom-line growth through 2020 as it focuses on delivering in the all-important fourth quarter.

Outlook

For FY17, the company expects:

- Net sales in the range of $1.264–$1.276 billion, based on opening 103 net new stores and a 5.7%–6.5% increase in comparable sales.

- EPS of $1.72–$1.79, in line with the consensus estimate of $1.76.

For 4Q17, the company expects:

- Net sales in the range of $491–$503 million, assuming a 4%–6% increase in comparable sales.

- EPS of $1.09–$1.16, in line with the consensus estimate of $1.13.