Source: Company reports/Fung Global Retail & Technology

3Q16 RESULTS

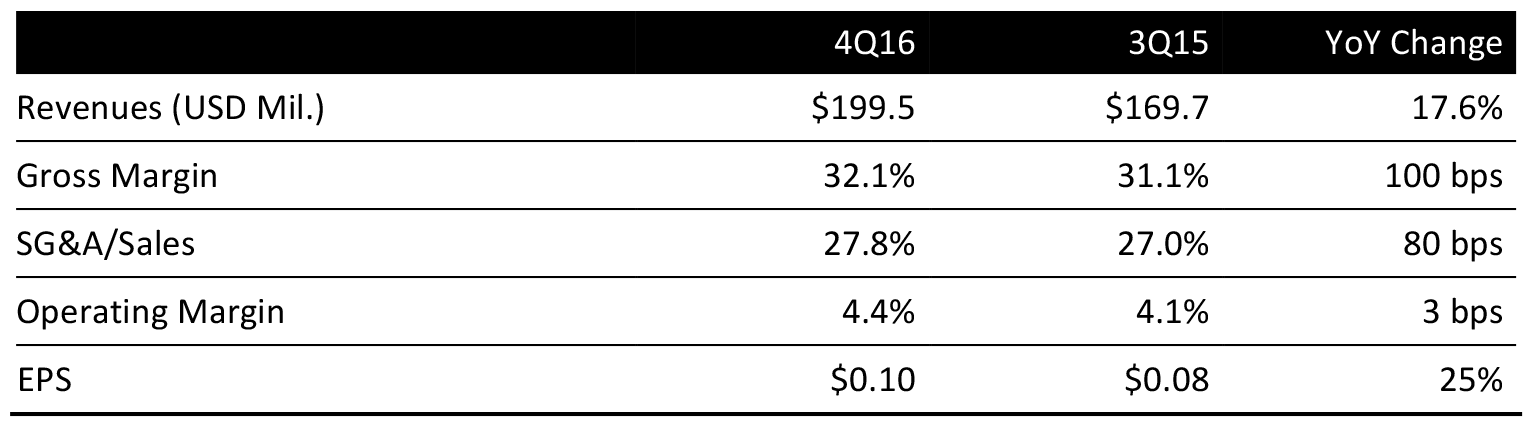

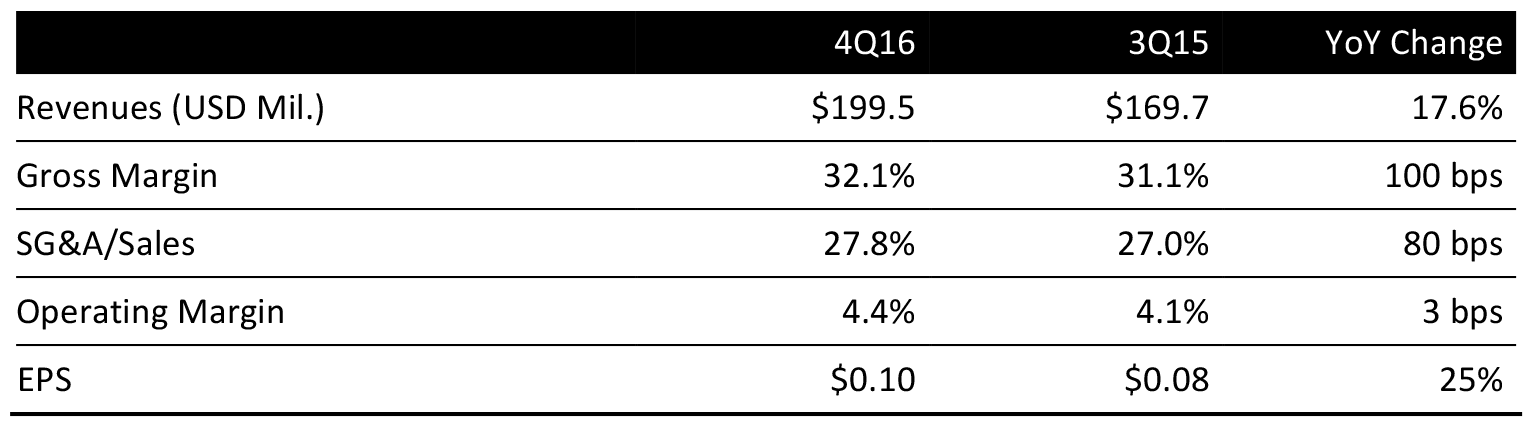

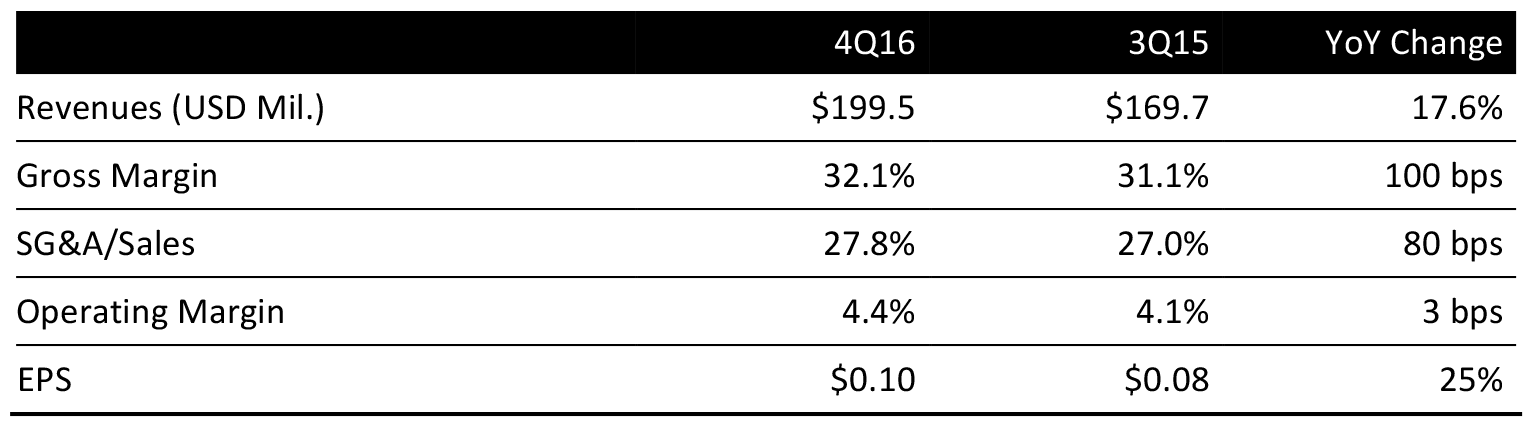

Five Below reported 3Q16 revenues of $199.5 million, up 17.6% from last year’s $169.7 million, and slightly below the consensus estimate of $200.7 million. EPS was $0.10, ahead of the $0.09 consensus estimate, and up 25% year over year.

Comps sales declined 0.2%, below consensus of 1.1%, driven by decreased transactions. The earnings were at the high end of the company’s guidance for the quarter. Five Below attributed the comp decline to tough comparisons to last year, driven by strong licenses such as Shopkins and Minions. Moreover, the election this year was a distraction for shoppers. By category, the license category’s strong performance decelerated this quarter. Its room category was strong driven by several new hot décor items.

Five Below has opened 26 new stores, including seven stores in Texas during the past quarter. It now operates 517 stores in 31 states, which represents a 19.1% increase in stores year over year. As of the first week of November, the company completed its 2016 new store opening plan. Management was pleased with the strong quarter and felt it was a good start to the holiday season. The company aims to expand its marketing plans, including an expanded TV campaign. Its upcoming holiday campaign will touch 40% of its store base.

OUTLOOK

For 4Q, Five Below raised the low end of its sales guidance while keeping the high end unchanged. The company is expecting total sales in the range of $391 million to $397 million, based on opening five net new stores and a 2%–3% expected increase in comps sales. Net income is expected to be between $49.2 million and $50.6 million, with EPS of $0.89–$0.92. The company is committed to adding a compelling holiday assortment. For Black Friday, Five Below offered merchandise such as a Bluetooth Headset and a sewing machine for under $5.

For fiscal year 2016, net sales are expected to be between $1,003 million and $1,009 million, based on the planned 85 new store openings and an expected 2.3%–2.7% increase in comparable sales. Net income is expected to be in the range of $1.29–$1.32.

In 2017, the company plans to enter the California market. The first batch of stores will be opened in Southern California in the first half of the year.