Source: Company reports/Coresight Research

2Q18 Results

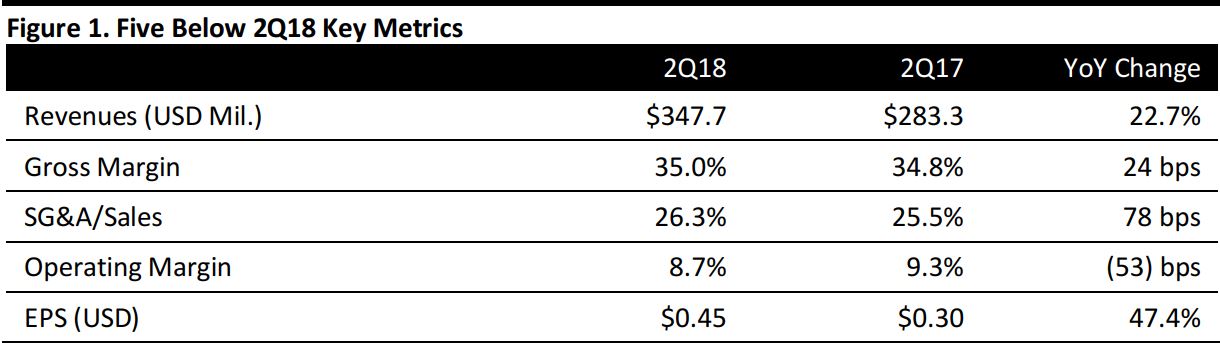

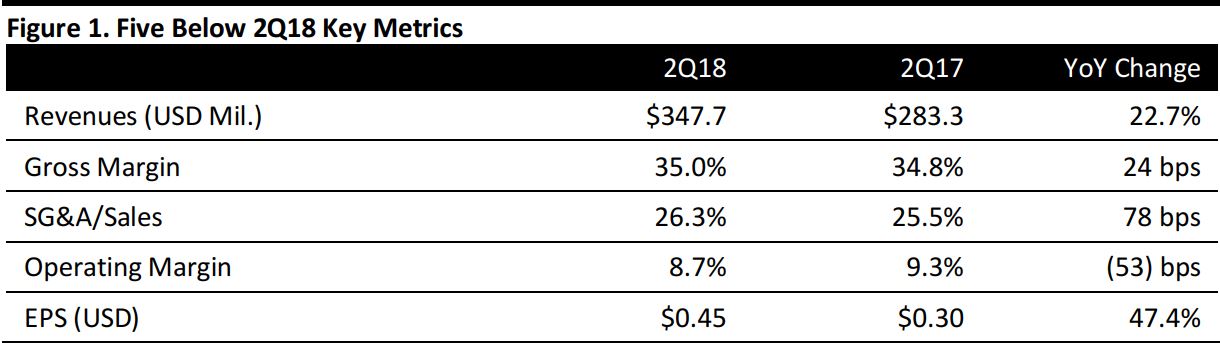

Five Below’s revenues of $347.7 million were up 22.7% year over year, beating the $334.8 consensus estimate.

Comps were increased 2.7%, beating the consensus estimate of up 0.1%.

EPS was $0.45, up 47.4% year over year and beating the $0.42 consensus estimate. The figure includes a $0.03 benefit for share-based payments.

Details from the Quarter

Management commented that it was pleased with the results, which exceeded its expectations. Sales growth stemmed from both new and existing stores. Strength was across the board, as customers responded to what management described as high-quality, trend-right products at significant value.

The company’s focus on increasing scale, digital marketing and store densification has increased brand awareness, and there are opportunities for product, real estate and talent, according to management.

Further points:

- The biggest growth driver remains new stores, and the performance of new stores remained strong. During the quarter, the company opened 34 new stores in diverse markets across 17 states. Nine of these stores made it to the top 25 on the all-time summer grand-opening list. Five Below also entered Arkansas, its 33rd state.

- In 3Q18, the company plans to open 50 stores, a record, and it has already opened 17 stores thus far. Two weeks ago, the company opened its 700th store in Glendale, California, its 25th store in the state.

- On the heels of last quarter’s 9.3% comp, Five Below experienced broad-based performance across the quarter, led by Tech, Candy, Create, Style and Room.

- Current trends include: crazes such as spinners, brands and licenses including Frozen and Star Wars, and core Five Below relevancy. Still, the company embraces all types of trends for driving transactions in sales, increasing brand awareness and building its customer base.

- The company is also seeing the emergence of a toy trend, resulting from the displacement of Toys"R"Us. Five Below plans to deploy an expanded toy selection in stores this month and will provide updates throughout the remaining part of the year.

- In terms of marketing, the company continues to optimize both marketing dollars and media mix to increase brand awareness and drive traffic, engagement and repeat visits. In the quarter, the company ran a successful summer TV ad campaign in markets which covered around 40% of its stores, a significant increase from the approximately 25% covered a year ago.

- Five Below also continues to test mobile and social media campaigns and expand its digital capabilities. This, management believes, is increasing the effectiveness of overall marketing programs, as brand awareness measured in the same 56 markets over several years continues to grow year over year.

- The two initiatives discussed in the last quarter—the acceleration of the POS implementation to be completed before the holiday season and plans for a Southeastern DC to be completed in the spring of 2019—remain on track.

- Rob Feuerman recently joined the company as CIO. Prior to this, he was a senior executive at Gap and comes with many years of retail and consulting experience.

Outlook

Raised Full-Year Guidance

The company raised full-year guidance as follows:

- Revenues to $1.528–$1.540 billion from $1.502–$1.517 billion previously.

- Comps to +2.5%–3.0% from +1%–2% previously.

- EPS to $2.51–$2.57 from $2.42–$2.48 previously.

Q3 Guidance

For 3Q18, the company expects:

-

- Net sales of $301–$304 million based on opening approximately 50 new stores and a 3%–4% increase in comps.

- EPS of $0.17–$0.19.