Source: Company reports/FGRT

2Q17 Results

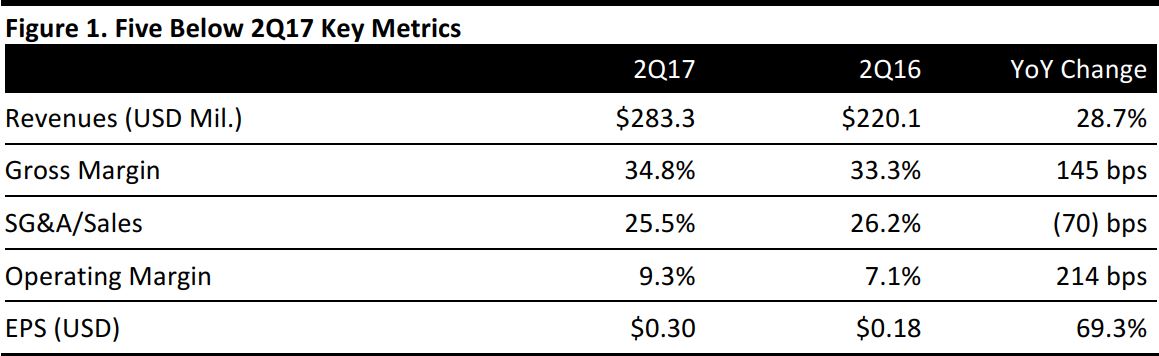

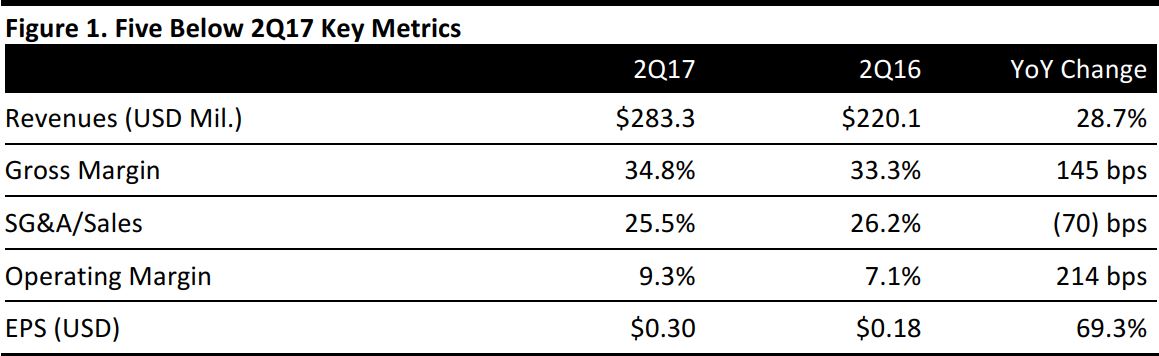

Five Below reported 2Q17 revenues of $283.3 million, up 28.7% year over year and beating the consensus estimate of $276.6 million.

Comps increased by 9.3% year over year.

EPS was $0.30, up 69.3% from $0.18 in the year-ago quarter and beating the consensus estimate of $0.26.

Details from the Quarter

- Management said that the company saw solid, broad-based performance of the core business, led by Room, Tech, Create and Candy, with a strong contribution from trends, primarily spinners, with slime and smiley-related products also contributing.

- For example, the company introduced a Bluetooth spinner and a pen with a spinner top during the quarter and noted that these trends build brand awareness, introduce new customers, drive incremental transactions and increase sales.

- Stores in California performed well in the quarter, given the state’s population density and number of trend-conscious consumers.

- Stores opened in 2017 feature a refreshed store experience with more visual appeal, brighter lighting and signage, better-defined worlds, and several new interactive displays.

- E-commerce remains a very small piece of the company’s business, and store growth and in-store experience remain management’s primary focus.

- In terms of marketing, the company continues to use a mix of traditional and digital media to increase brand awareness, traffic and loyalty. In the quarter, Five Below distributed print circulars during peak summer weeks and conducted successful TV tests in markets covering about 25% of its stores.

- The company ended the quarter with 584 stores in 32 states, an increase of 31 stores, or 18.9%, from a year earlier.

- Stores are set for the back-to-school season, featuring trend-right, “wow” products and room, style and tech items, as well as cool, fun backpacks, all at $5 or below. Management believes the stores are stocked with what the company’s customers will want to have.

Management commented that the healthy, 29% sales growth was led by strong new-store performance and that the transaction-driven comps were the highest since the company’s IPO. Topline results were also accompanied by strong margin expansion, resulting in net income growth of more than 70%.

Looking toward the second half, management is focused on the important fourth quarter and executing its strategic initiatives, including continuing to provide a differentiated in-store experience; offering compelling, trend-right, quality merchandise at value prices;introducing new customers to its brand; and increasing awareness while building out its infrastructure to support its market opportunity of operating more than 2,000 stores.

Outlook

For FY17, the company expects:

- Net sales in the range of $1.236–$1.248 billion, based on expectations of opening approximately 100 new stores and a 3.5%–4.5% increase in comps, in line with the consensus estimate of $1.24 billion.

- EPS of $1.62–$1.66, in line with the consensus estimate of $1.64.

- The 53rd week of the business year to contribute approximately $15 million in sales and $0.02 in EPS.

For 3Q17, the company expects:

- Net sales in the range of $241–$246 million, based on expectations of opening 35 new stores and a 3%–5% increase in comps, in line with the consensus estimate of $242.8 million.

- EPS of $0.11–$0.13, in line with the consensus estimate of $0.12.