Source: Company reports

2Q16 RESULTS

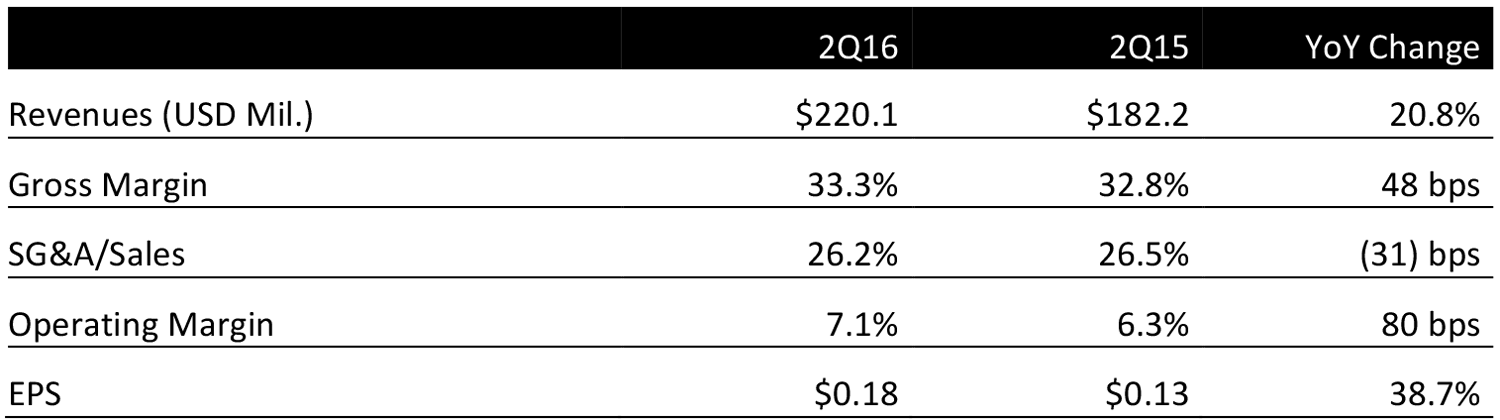

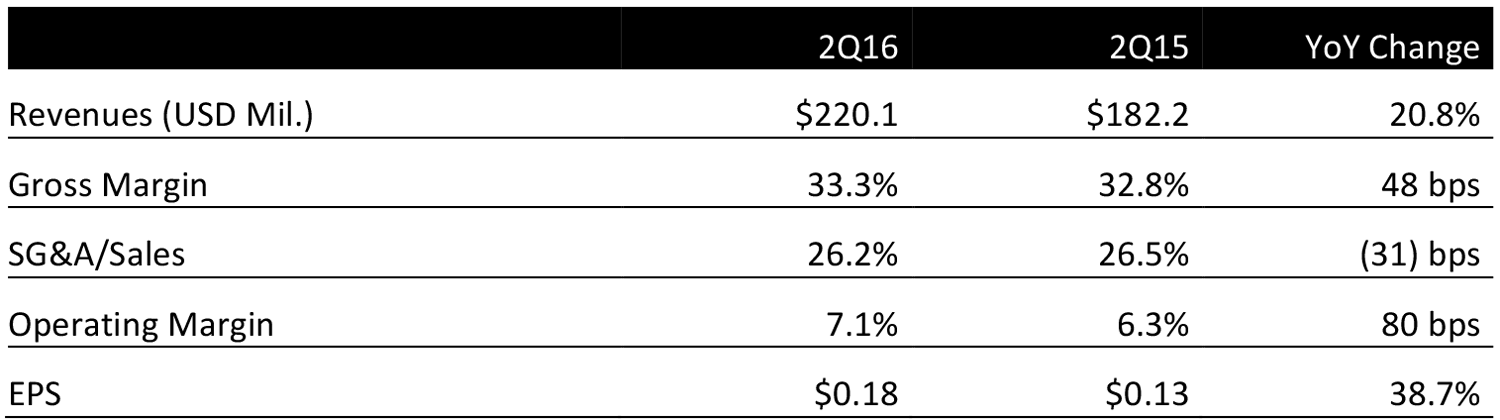

Five Below reported 2Q16 EPS of $0.18, up 38.7% year over year. The result beat the consensus estimate by a penny and was ahead of guidance of $0.16–$0.17.

Revenues were $220.1 million, up 20.8% year over year and slightly above the consensus estimate of $219.6 million.

A combination of comp growth and operating margin expansion of 80 basis points drove EPS growth.

OTHER DETAILS IN THE QUARTER

Comparable-store sales increased by 3.1%, which was ahead of guidance of “about 3%” but below the consensus estimate of 3.4%. The company receives 85% of its top-line growth from non-comp stores. Management sees strong and consistent performance from each class of stores across geographies with various market sizes.

The company opened 33 new stores in the quarter, exiting the quarter with 491 stores in 30 states, an increase of 17.7% year over year. In the quarter, the company entered three new markets—Wisconsin, Oklahoma and the Rio Grande Valley in Texas—and management commented that all three are off to a very strong start.

Management had previously mentioned that one of its goals for 2Q16 was to be the destination for all things summer, and the company stayed on trend with seasonal merchandise in all categories. Assortments included pool floats that look like ice cream cones and water mounts, in addition to flamingo-shaped lights, allowing the company to create elements of fun and “wow” with even basic items such as lights. Continuing with the trend seen in 1Q16, the room category remained strong, so it appears that the newness of the product assortment is resonating with customers.

The quarter represented the 41st consecutive quarter of positive comp growth, which was accompanied by operating margin expansion.

Inventory was $154.8 million, up 25.0% year over year.

Management commented that it had made good progress toward its strategic initiatives, including the initial launch of the company’s e-commerce platform and the hiring of key team members. The management team is looking forward to the all-important holiday season and remains focused on continued execution.

In addition, management outlined initiatives that should enable it to achieve its long-term plan through 2020:

- Store growth: The company celebrated the opening of its 500th store in August and has doubled its US store count in less than four years.

- Digital: Five Below launched its digital strategy just two weeks ago, ahead of plan and on budget. Management reminded investors that it was a soft launch and that the company does not expect digital to be as meaningful for Five Below as it is for other retailers.

- Infrastructure: The company has located a new headquarters in the same city as its current headquarters, Center City Philadelphia. The company had outgrown its current space primarily because it had added merchandising headcount, and it plans to move into the new space in 2018. The new space should enable the company to grow for the next 10 years, as well as move the Markland Plaza store on-site for its merchants.

- Talent: To strengthen its foundation for future growth, the company has hired two senior vice presidents. The SVP of Planning and Allocation will oversee merchandise planning, inventory allocation and replenishment. She has over 20 years of experience leading planning and allocation teams at several retailers, including Sports Authority.

The SVP of Business Optimization and Innovation will oversee business process reengineering and innovation. The company also announced that it has hired a new VP of Investor Relations.

OUTLOOK

For FY16, the company expects revenues of $1–$1.009 billion, based on the unchanged plan to open 85 stores in the full year and unchanged guidance of 3% revenue growth. Prior guidance called for revenues of $995 million–$1.005 billion.

The company expects net income of $70.4–$72.2 million, which represents EPS of $1.28–$1.32. Pre-earnings guidance was for net income of $69.9–$72.2 million, or EPS of $1.27–$1.31. The pre-earnings consensus estimate called for revenues of $1.01 billion and EPS of $1.31.

For 3Q16, the company expects revenues of $199–$202 million based on the opening of 25 new stores and a 1%–2% increase in comps. Moreover, the company expects EPS of $0.09–$0.10. The pre-earnings consensus estimates were for comps of 2.5%, revenues of $203.9 million and EPS of $0.10.