Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

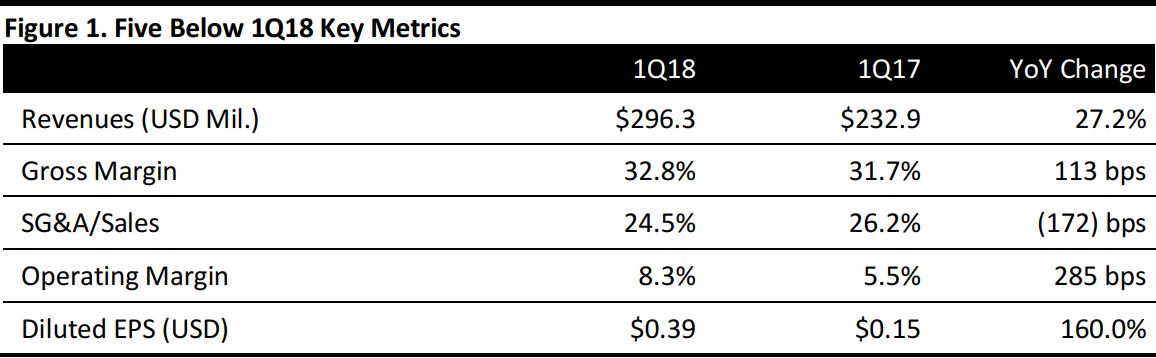

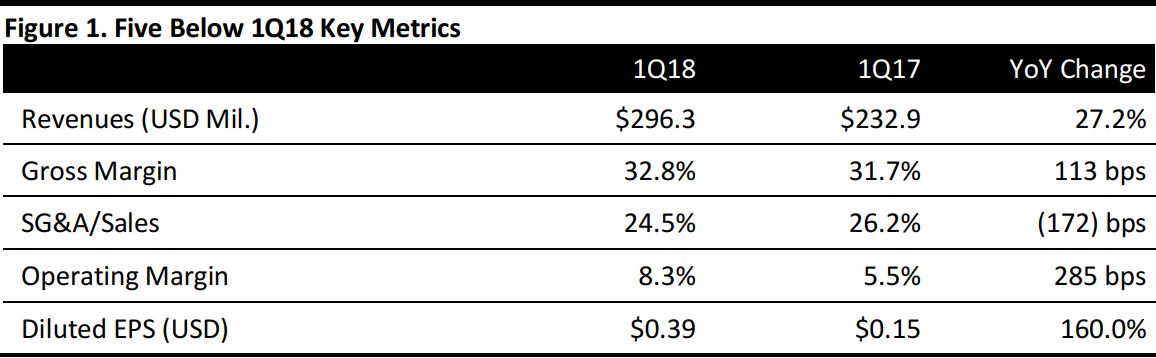

1Q18 Results

Value variety-store retailer Five Below reported continued strong growth in 1Q18, ended May 5:

- Net sales were up 27.2% year over year, to $296 million, coming in slightly above the consensus estimate of $291 million. Top-line growth slowed a little from the prior quarter, when the company reported a 30.1% increase in net sales.

- Sales growth was supported by the opening of 33 stores in the quarter, which equated to a 19% year-over-year increase in store numbers. The company ended the quarter with 658 stores.

- The company grew comparable sales by 3.2%, versus analysts’ expectations of 3.7% growth.

- Gross profit climbed by 31.8%, resulting in a solid uplift to the gross margin.

- Operating expenses were up 19.0%, equating to a substantial fall in the SG&A ratio as the company benefited from the leveraging of costs on the back of strong sales growth. Operating profit jumped by 93.3% as a result.

- Diluted EPS more than doubled year over year, to $0.39, and was comfortably ahead of the consensus estimate of $0.32.

Five Below President and CEO Joel Anderson said, “We are very pleased with the strong start to fiscal 2018, as we delivered both sales and earnings above our guidance ranges for the first quarter. Continued out performance from our new stores and healthy comparable sales were accompanied by strong gross margin performance, SG&A leverage and tax rate favorability.”

Outlook

For 2Q18, management expects net sales of $332–$335 million, supported by the opening of around 33 new stores and assuming broadly flat comparable sales. The company expects net income of $20.0–$21.2 million, equating to diluted EPS of $0.36–$0.38.

For FY18, management expects net sales of $1,502–$1,517 million, underpinned by the opening of approximately 125 new stores and assuming a 1%–2% increase in comparable sales. At the midpoint of guidance, this implies FY18 sales growth of around 18.2%. The company expects net income of $136.5–$139.9 million and diluted EPS of $2.42–$2.48.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research