Source: Company reports/Fung Global Retail & Technology

1Q17 Results

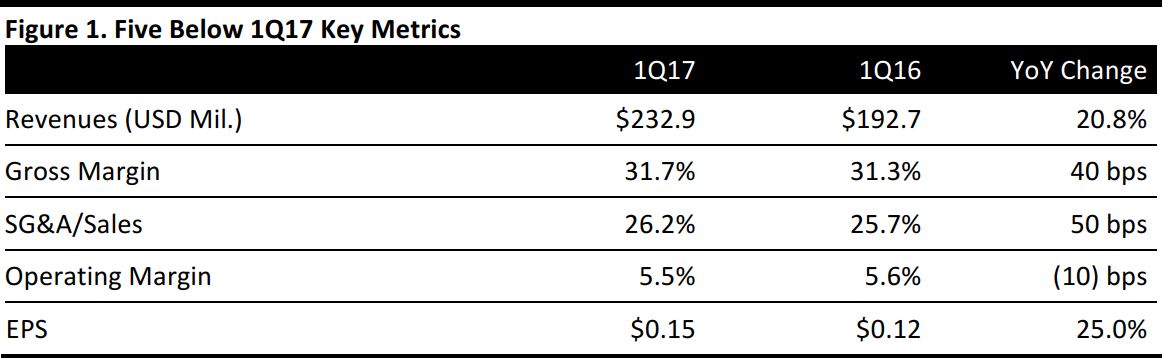

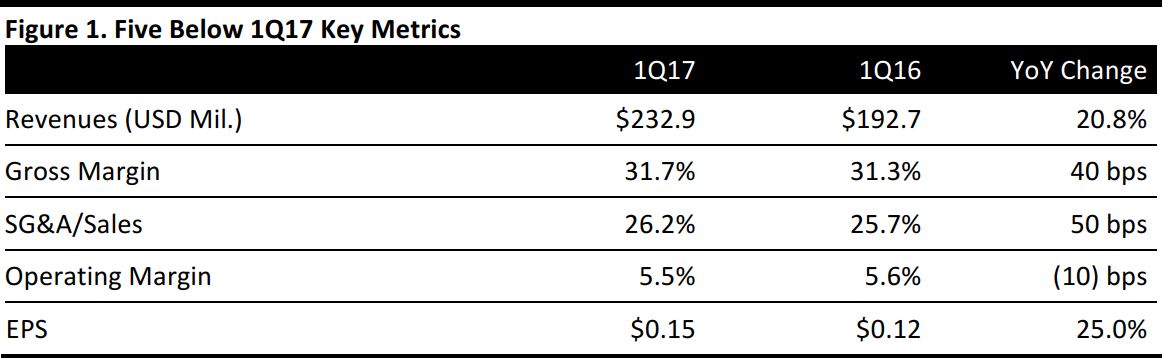

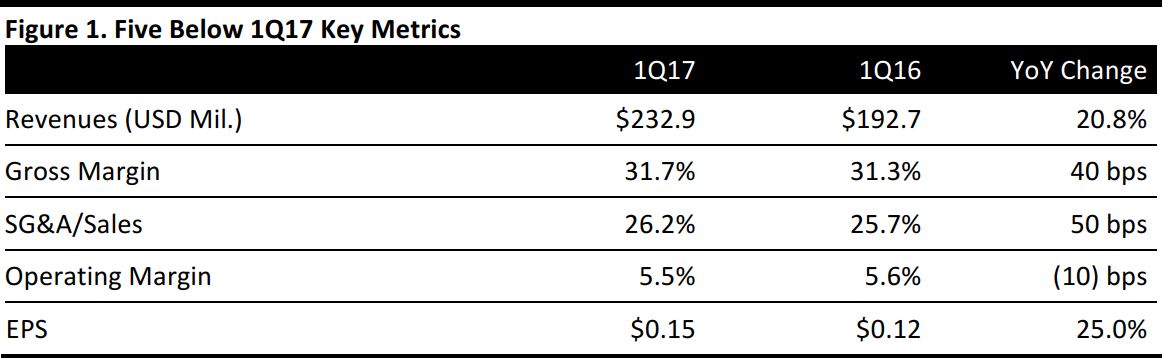

Five Below reported 1Q17 EPS of $0.15, up 25% from the year-ago quarter and slightly above the $0.14 consensus estimate. The company reported revenues of $232.9 million, up 20.8% from $192.7 million in the year-ago quarter and slightly above the consensus estimate of $230.6 million.

Comparable sales increased by 2.6%, beating the consensus estimate of 1.4%. The company attributed its comp performance to newness, better assortment and its ability to capitalize on emerging trends such as the spinner trend, which drove the comp outperformance versus the company’s guidance of 2%. In merchandising, the tech, room and candy categories were strong performers in the first quarter. Bluetooth, sequence pillows, mermaid blankets and emoji-related items were highlighted as being particularly popular with customers.

The company opened 31 new stores during the quarter and entered the new market of California with nine stores in the Los Angeles area. Five Below ended the first quarter with 553 stores in 32 states, representing a 20.7% increase year over year.

Outlook

For 2Q17, Five Below expects net sales of $273–$280 million, based on the assumption that the company will open approximately 27 new stores and see a 5%–8% increase in comparable sales.

For FY17, the company expects sales of $1.23–$1.24 billion, based on opening 100 new stores and assuming a low-single-digit increase in comparable sales. The company expects full-year EPS to increase by 24%, to $1.55–$1.61.